Coming each Saturday, Hodler’s Digest will enable you observe each single vital information story that occurred this week. The perfect (and worst) quotes, adoption and regulation highlights, main cash, predictions and way more — every week on Cointelegraph in a single hyperlink.

High Tales This Week

Bitcoin bulls assault $57,000, and altcoins rally as April involves an in depth

A sudden bullish surge took merchants without warning as April drew to an in depth, with Bitcoin staging a 10% rally in a matter of hours.

Highs of $58,448.34 helped to erase latest losses — however not solely.

Knowledge from Bybt exhibits that BTC’s value fell by 1.98% final month. That’s the primary time the world’s largest cryptocurrency has closed the month of April within the crimson since 2015.

A contributing issue to upbeat market exercise might have been linked to an astounding surge in revenues at MicroStrategy, an organization that owns 91,000 BTC.

MicroStrategy CEO Michael Saylor mentioned: “We’ll proceed to amass and maintain extra Bitcoin as we search to create extra worth for shareholders.”

Ethereum’s market cap exceeds platinum’s for the very first time

Whereas Bitcoin had misplaced its footing for a lot of the week, Ether has gone from power to power.

The No. 2 cryptocurrency continues to interrupt new all-time highs — with the newest document of $2,879.75 set on Saturday.

Total, 2021 guarantees to be a vital 12 months for the Ethereum blockchain because the long-awaited Eth2 improve takes form. The community is ready to half methods with its proof-of-work consensus algorithm and shift to proof-of-stake, which is ready to chop prices and protect power.

At $330 billion, Ether’s market cap has now exceeded trade giants together with Procter & Gamble and PayPal — to not point out platinum. The digital asset can be a stone’s throw away from overtaking The Walt Disney Firm and Financial institution of America.

Tesla books large revenue from Bitcoin sale in Q1

Tesla offered a portion of its Bitcoin holdings within the first quarter, pocketing a revenue of $101 million consequently.

The electrical car producer introduced that it had snapped up Bitcoin value $1.5 billion in February, and this sale quantities to about 10% of its crypto stash.

Crypto Twitter didn’t react kindly to the information, with comic Dave Portnoy accusing Elon Musk of cashing in on a pump-and-dump engineered by his public statements supporting BTC.

Musk rejected these claims and mentioned that he hasn’t offered any of his Bitcoin. He additionally defined that Tesla executed this transaction “primarily to show liquidity of Bitcoin as an alternative choice to holding money on stability sheet.”

In the meantime, Musk has continued to champion Dogecoin on his Twitter feed — forward of him internet hosting Saturday Night time Reside on Could 8.

Coinbase gives prospects a way to buy crypto utilizing PayPal

There have been a sequence of milestones this week in relation to simplifying the method of shopping for crypto… and utilizing it as a cost technique.

Coinbase introduced that customers within the U.S. will now be capable of purchase digital property utilizing debit playing cards and financial institution accounts linked to their PayPal profiles — giving them a larger selection of digital property than PayPal alone offers.

In the meantime, rival change Gemini introduced that it’s teaming up with Mastercard to launch a bank card that can permit crypto holders to spend digital property and obtain cash-back rewards within the type of Bitcoin.

Elsewhere, Binance introduced that it was launching its personal NFT market in June — full with a “Premium Occasion” class that’s designed to draw big-name signings.

And, in case you’re feeling hungry, Bubba Gump Shrimp’s seafood eating places are going to begin accepting Bitcoin and different cryptocurrencies within the subsequent 90 days.

The Giving Block launches “Crypto Giving Pledge” to ramp up donation efforts

A number one crypto donations platform has launched a brand new initiative that’s designed to assist the digital property sector turn into essentially the most charitable on this planet.

The Giving Block has launched a “Crypto Giving Pledge” that encourages buyers to pledge not less than 1% of their holdings to charities every year and asks companies on this area to contribute 1% of their income towards comparable causes.

Customers can be a part of the initiative anonymously and with out having to reveal their contributions. If everybody in crypto donated 1% of their holdings to charities, they might collectively increase $20 billion.

In addition to elevating cash for “wonderful causes in vital want of help,” the group’s co-founder additionally says that this might erase crypto tax burdens for donors — and “put to mattress this concept that crypto is dangerous.”

Winners and Losers

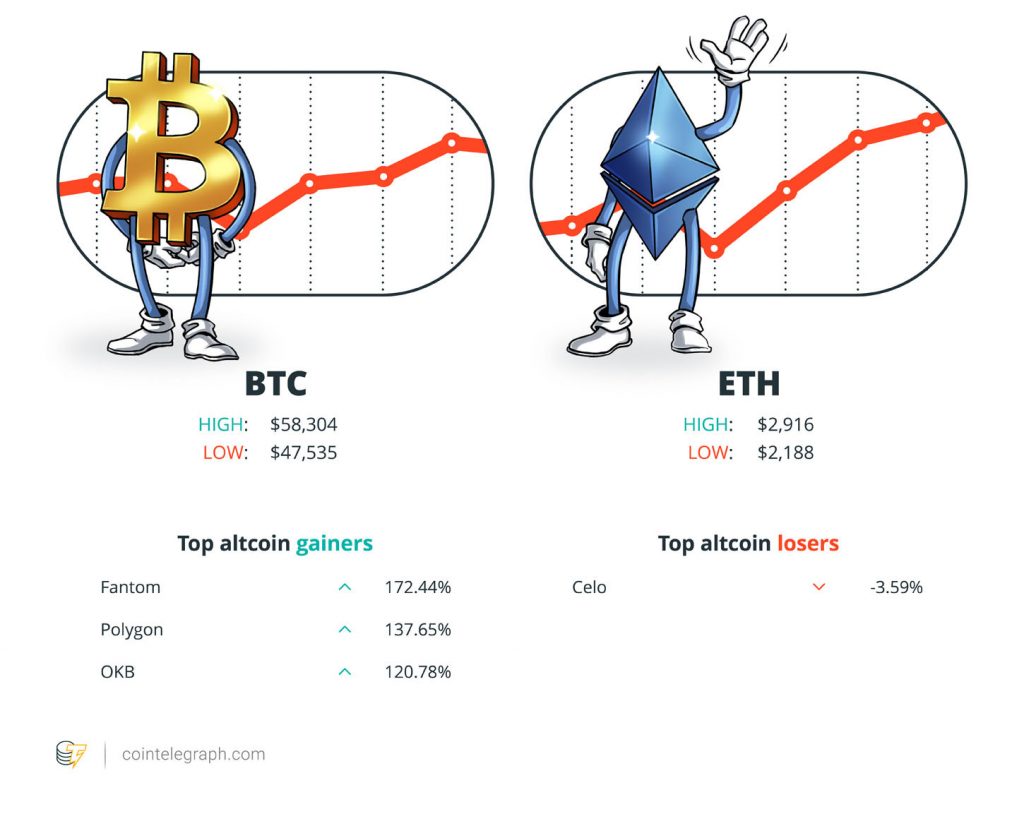

On the finish of the week, Bitcoin is at $57,380.31, Ether at $2,880.41 and XRP at $1.56. The whole market cap is at $2,212,553,216,270.

Among the many largest 100 cryptocurrencies, the highest three altcoin gainers of the week are Fantom, Polygon and OKB. The one altcoin loser is Celo.

For more information on crypto costs, ensure to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“After the present lawsuit, Ripple will go public. The present CEO needs to do this. Chris needs to do this.”

Yoshitaka Kitao, SBI Group CEO

“Fb has bought 0 bitcoin for an combination value of $0 in a strategic company transfer to have enjoyable staying poor.”

Texan Hodl

“If you happen to offered #Bitcoin as a result of Fb didn’t purchase any in Q1 and also you additionally assume you’re GMI, I’ve some unlucky information for you.”

Travis Kling, Ikigai CEO

“HMRC suspects that an growing quantity of hidden wealth is slipping by way of its fingers because of the rise of cryptocurrencies.”

David Jones, UHY Hacker Younger director

“With blockchain analytics, the factor we are saying time and again is that each one this exercise is on this ledger without end, and in case you did one thing dangerous 10 years in the past you might be caught and arrested for it at present.”

Sarah Meiklejohn, laptop scientist

“Slightly than investing in cryptocurrency stuff, I wish to give attention to the acute life extension applied sciences as a result of in case you die, you’ll be able to’t take pleasure in your life anymore.”

Roger Ver, Bitcoin.com founder

“This latest restoration in Altcoin Market Cap is way sharper than the post-retrace restoration in February.”

Rekt Capital

Prediction of the Week

Ether will all the time come second to Bitcoin, says Shark Tank’s Kevin O’Leary

Regardless of ETH strengthening additional in opposition to BTC this week, Shark Tank star Kevin O’Leary nonetheless believes that Bitcoin will stay high of the crypto rankings.

Talking to CNBC, he declared: “Bitcoin will all the time be the gold, Ethereum will all the time be the silver.”

The Shark Tank star mentioned he had owned crypto since 2017, saying final month that he can be allocating 3% of his portfolio into Bitcoin.

Nonetheless, he has beforehand referred to digital property as “crypto crap” and Bitcoin as “not an actual forex.”

FUD of the Week

DeFi hacks and exploits whole $285 million since 2019, Messari reviews

Decentralized finance’s rising recognition since 2019 has seen the rising market section turn into a goal for hackers and opportunistic profiteers.

Crypto analysis firm Messari says DeFi protocols have misplaced greater than $284 million to hacks and different exploit assaults since 2019.

Nearly half of the DeFi hacks lined within the Messari report had been flash mortgage assaults, whereas others took benefit of momentary defects in value oracle feeds.

County in New Jersey makes 250% revenue from crypto seized in 2018

Prosecutors within the U.S. have offered off crypto they confiscated in 2018.

The digital property, seized throughout a drug bust, had been initially valued at $57,000. Three years on, and so they’ve generated a revenue of $141,000.

Monmouth County Prosecutor Christopher Gramiccioni mentioned that the county is the primary state-level company to finish the forfeiture and liquidation of cryptocurrency property.

“This may function an efficient template for the state regulation enforcement companies within the cryptocurrency market — a spot the place we will anticipate proceeds from crimes to proceed to be hid,” he added.

Binance may face heavy fines over inventory tokens, warns German regulator

Binance’s makes an attempt to bridge conventional markets with the cryptocurrency area by way of fractionalized inventory tokens have drawn the eye of Germany’s monetary regulator.

BaFin has warned that the world’s largest crypto change may face heavy fines for launching security-tracking tokens with out an accompanying investor prospectus.

Binance launched fractionalized inventory tokens for Apple, MicroStrategy and Microsoft on Monday, including to tokens for Coinbase and Tesla.

The change informed Cointelegraph: “Binance takes its compliance obligations very severely and is dedicated to following native regulator necessities wherever we function. We’ll work with regulators to handle any questions they could have.”

Greatest Cointelegraph Options

Roger Ver’s subsequent life: Cryonics meets crypto

With a fortune he vaguely refers to as being within the billions, the Bitcoin Money proponent intends to change his funding focus to cryonics over the following decade within the hopes of enhancing the experimental expertise.

100 fascinating info about crypto’s final 100 days

A $100 funding into DOGE 100 days in the past would now be value $2,742, whereas the identical funding into BTC can be value $130 at present.

Biden’s capital positive aspects tax plan to drag crypto right down to earth from the moon?

Extra taxes might trigger short-term volatility, “however long run, you might even see extra demand for DeFi purposes and different collateralized use circumstances.”

Source link