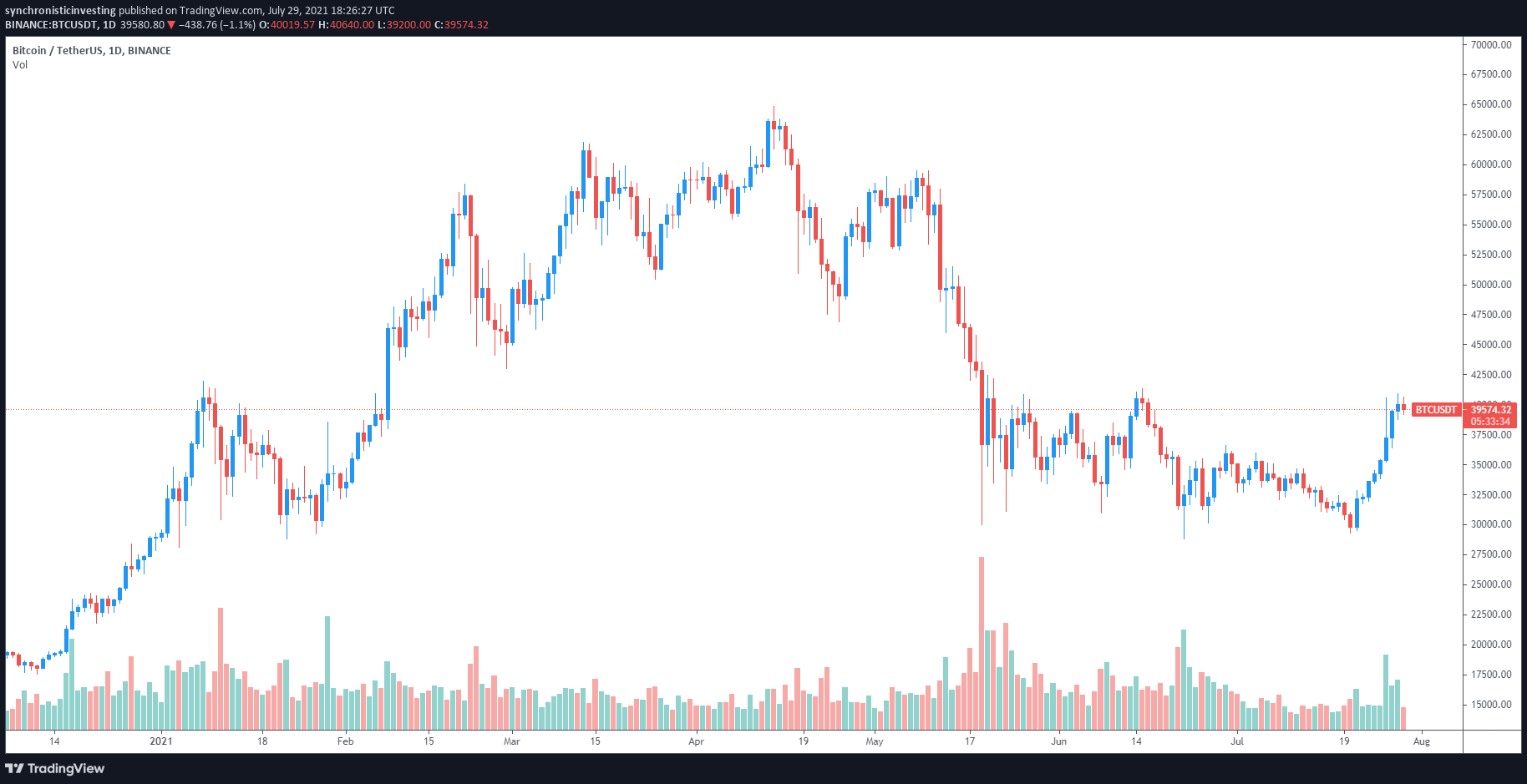

The rumor that Amazon would settle for cryptocurrency funds sparked a wave of bullish enthusiasm throughout the crypto market earlier within the week however now this sentiment has begun to wane as Bitcoin (BTC) bulls face stiff resistance on the $40,000 stage.

Information from Cointelegraph Markets Professional and TradingView reveals that bears have managed to fend off a number of makes an attempt to flip the $40,000 stage to assist and protection of this zone continued on July 29 as Bitcoin’s stagnant value motion and added to considerations that the value may fall again to final week’s $35,000 to $30,000 vary.

Right here’s what analysts and traders are saying in regards to the latest developments in Bitcoin’s value.

The 21-week EMA marks the road between a bull and bear market

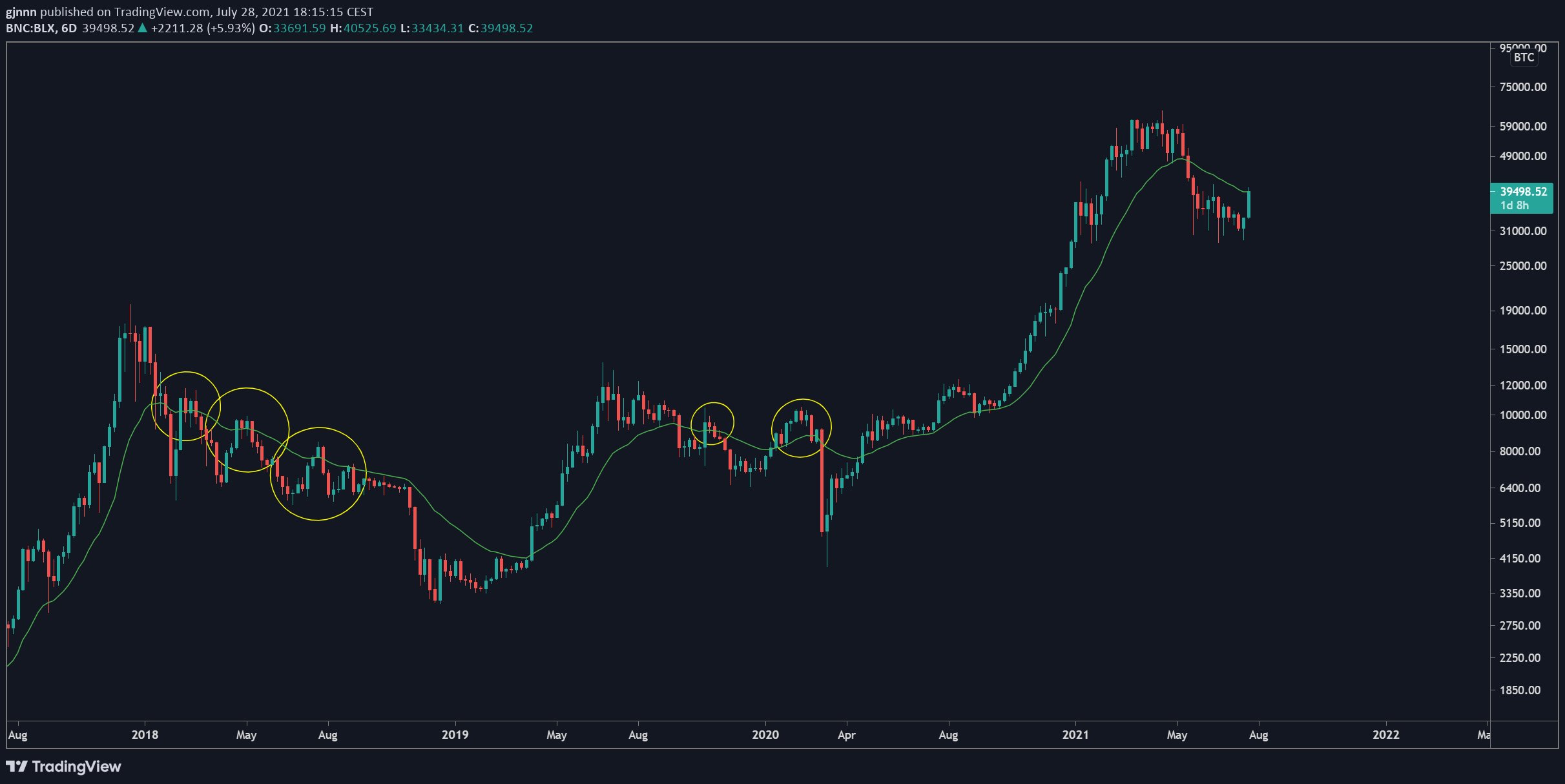

Bitcoin’s fast ascent from $31,000 to $40,925 lifted the value close to its 21-week exponential shifting common, a stage that’s broadly thought of as a bull market indicator in keeping with pseudonymous crypto Twitter analyst Rekt Capital.

The 21-week EMA is basically considered a #BTC Bull Market indicator

When $BTC is above it - BTC is considered in a Bull Market

When value is under it - BTC is considered in a Bear Market

BTC is now preventing to breakout past the 21-week EMA (inexperienced)#Bitcoin #Crypto pic.twitter.com/rMqeWzJS4i

— Rekt Capital (@rektcapital) July 28, 2021

As seen within the tweet above, the 21-week EMA is at the moment close to the $40,000 value stage, successfully turning into the ‘line within the sand’ that separates bulls and bears.

One of many responses to the above tweet affords a phrase of warning for overly bullish merchants as a result of comparable strikes up to now have been adopted by decrease lows and an extension of bear market situations.

As proven by the yellow circles within the chart above, earlier cases of the value breaking above the 21-week EMA have resulted in a reversal that results in a retest of decrease lows within the following weeks and months.

Bitcoin whales stay grasping whereas others are fearful

One group of market individuals who’ve proven little proof of indecision are Bitcoin whales, who’ve embraced Warren Buffett’s mantra to “be fearful when others are grasping, and grasping when others are fearful,” by shopping for up low-priced BTC as weaker palms faucet out.

#Bitcoin‘s whales have been staying busy, and addresses holding between 100 and 10,000 $BTC simply reached a mixed #AllTimeHigh 9.19m cash held. They’ve added 170,000 extra $BTC since Could twenty second, and a staggering 130,000 $BTC up to now 4 weeks alone. https://t.co/qv5IbYXgGQ pic.twitter.com/PwrmUyz9Of

— Santiment (@santimentfeed) July 29, 2021

In keeping with knowledge from Santiment, an on-chain and behavioral evaluation platform, whale wallets have gathered 130,000 BTC up to now 4 weeks as the value of Bitcoin traded under $35,000.

With such heavy accumulation being seen within the decrease $30,000 to $35,000 vary, some analysts have recommended that whales could try and orchestrate one other pullback in value in order that they will proceed to build up.

Associated: Bitcoin bulls management Friday’s $1.7B month-to-month choices expiry

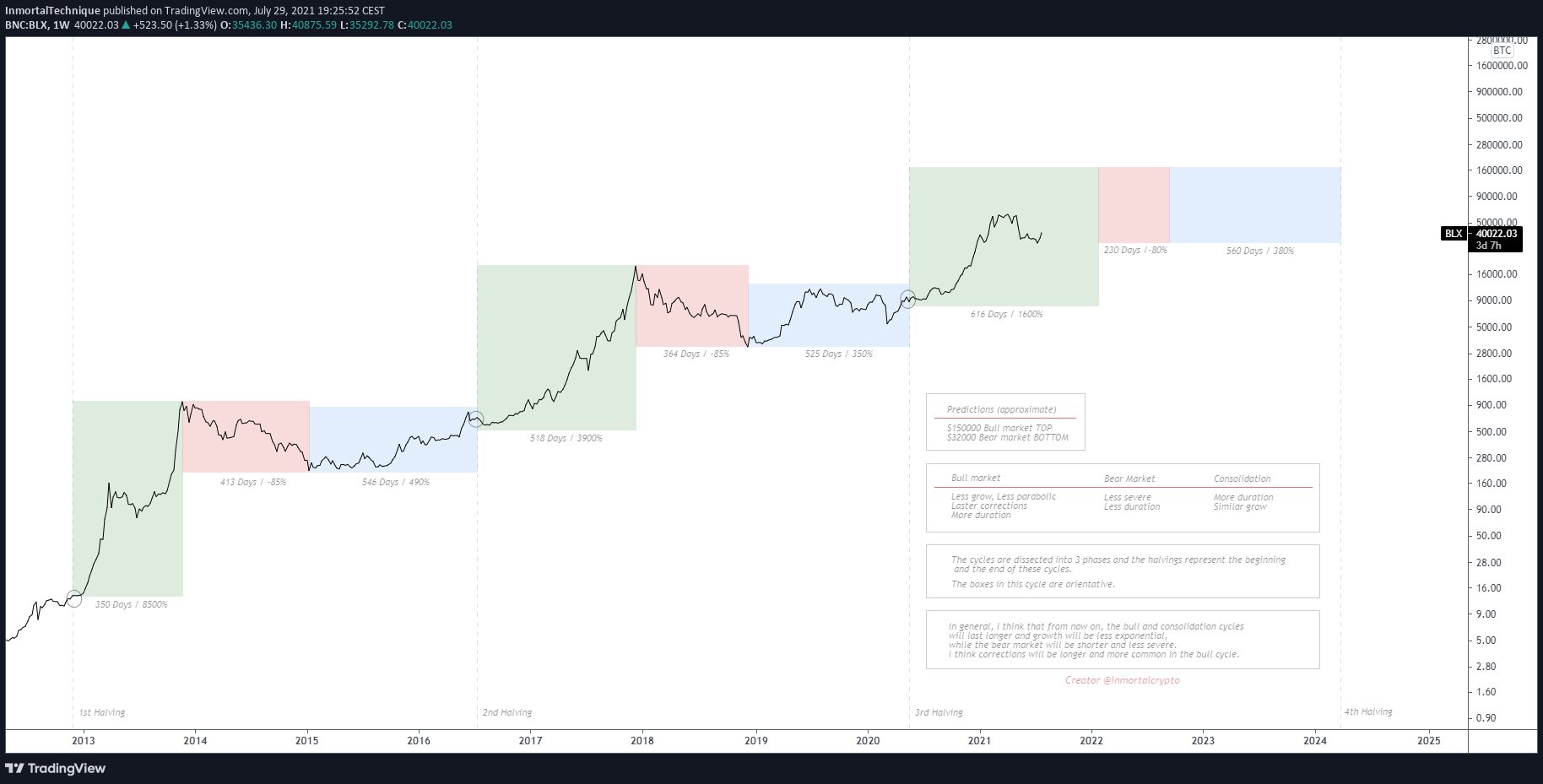

Lengthy-term cycles provide hope

When near-term confusion prevails, generally it is best to take a step again to see the larger image of the place the market is and what potentialities the long run holds.

In keeping with Inmortal UP ONLY, a pseudonymous Twitter person, Bitcoin’s four-year cycle is at the moment about 65% via its bull-market part and the dealer predicts a high at $150,000, which shall be adopted by a correction to $32,000.

For merchants and holders that desire to function on an extended time scale, there stays a lot to be optimistic about sooner or later for and skilled market individuals know the value strikes seen over the previous few months are half and parcel of the traditional development for Bitcoin.

Additional affirmation of the long-term perspective was provided by Ecoinometrics, who in contrast Bitcoin’s present post-halving value motion to performances within the earlier two halvings.

#Bitcoin after the Halving

Jul. 29, 2021443 days after the third halving#BTC at $39,973

Catching as much as the expansion trajectory of the earlier cycle would require a whole lot of juice.

However we are able to hope this transfer is the beginning of a brand new leg up.

To date so good. pic.twitter.com/a12RYAhlsn

— ecoinometrics (@ecoinometrics) July 29, 2021

As proven above, the present value of BTC is effectively under the common progress of earlier cycles, indicating that the BTC has some “catching as much as do” if it should obtain the same trajectory and attain a brand new all-time excessive above $100,000.

The views and opinions expressed listed below are solely these of the creator and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer entails danger, you must conduct your individual analysis when making a choice.

Source link