The worth of Bitcoin (BTC) is recovering after a robust sell-off through the weekend brought on by cascading liquidations within the futures market.

Merchants are pinpointing three ranges because the important value areas to look at within the brief time period: $51,200 as the most important assist, $60,300 because the necessary resistance, and $57,000 because the close to time period space of curiosity for sellers.

It’s important for Bitcoin to reclaim $57,000

Though the value of Bitcoin dropped to as little as round $50,000, the market construction itself doesn’t look largely regarding, in line with a pseudonymous dealer often known as TraderKoz.

Bitcoin depraved to sub-$50,000, nevertheless it recovered shortly to round $53,000 and has sustained above $56,000 since.

Referring to the chart above, the dealer said:

“You already know, if this wick wasn’t fairly as lengthy due to all of the cascading liquidations… it might truly be some actually clear PA.”

Within the close to time period, it is crucial for Bitcoin to rise and maintain above $57,000. If BTC’s value stabilizes at these ranges, it might affirm that the weekend crash was a purely technical and futures market-driven correction.

Standard pseudonymous dealer Rekt Capital additionally emphasised that the macro assist stays at $51,200. Bitcoin recovered shortly as quickly because it dropped to the low $50,000 space.

Subsequently, Bitcoin will affirm a better low construction if it continues to get well within the brief time period and doesn’t drop beneath $51,200.

A better low construction kinds when the newest Bitcoin low is increased than the earlier low level.

The dealer explained:

“Final time #BTC dipped into the low-$50000s was 4 weeks in the past Then, $BTC dipped to ~$50200 earlier than reversing Not too long ago, BTC dipped to the low-$50000s once more This time, BTC dipped to ~$51200 earlier than reversing BTC bottomed $1000 increased on this dip. That may be a Greater Low.”

Moreover, analysts at Santiment famous that BTC recovered quickly instantly after the funding charge of Bitcoin on BitMEX went destructive.

This means that important natural purchaser demand emerged when promoting strain began to amp up within the derivatives market, which might assist the argument for a short-term pattern reversal so long as Bitcoin stays above $57,000.

The analysts wrote:

“The #BitMEX funding charge for #Bitcoin went destructive (extra contracts betting in opposition to $BTC’s value rising than contracts betting in favor) this weekend for the primary time in 3 months. As is usually the case, the value bounced proper because the #FUD settled in.”

Will the reduction rally proceed?

There have been massive deposits made to exchanges when the value of Bitcoin dropped, including to the promoting strain.

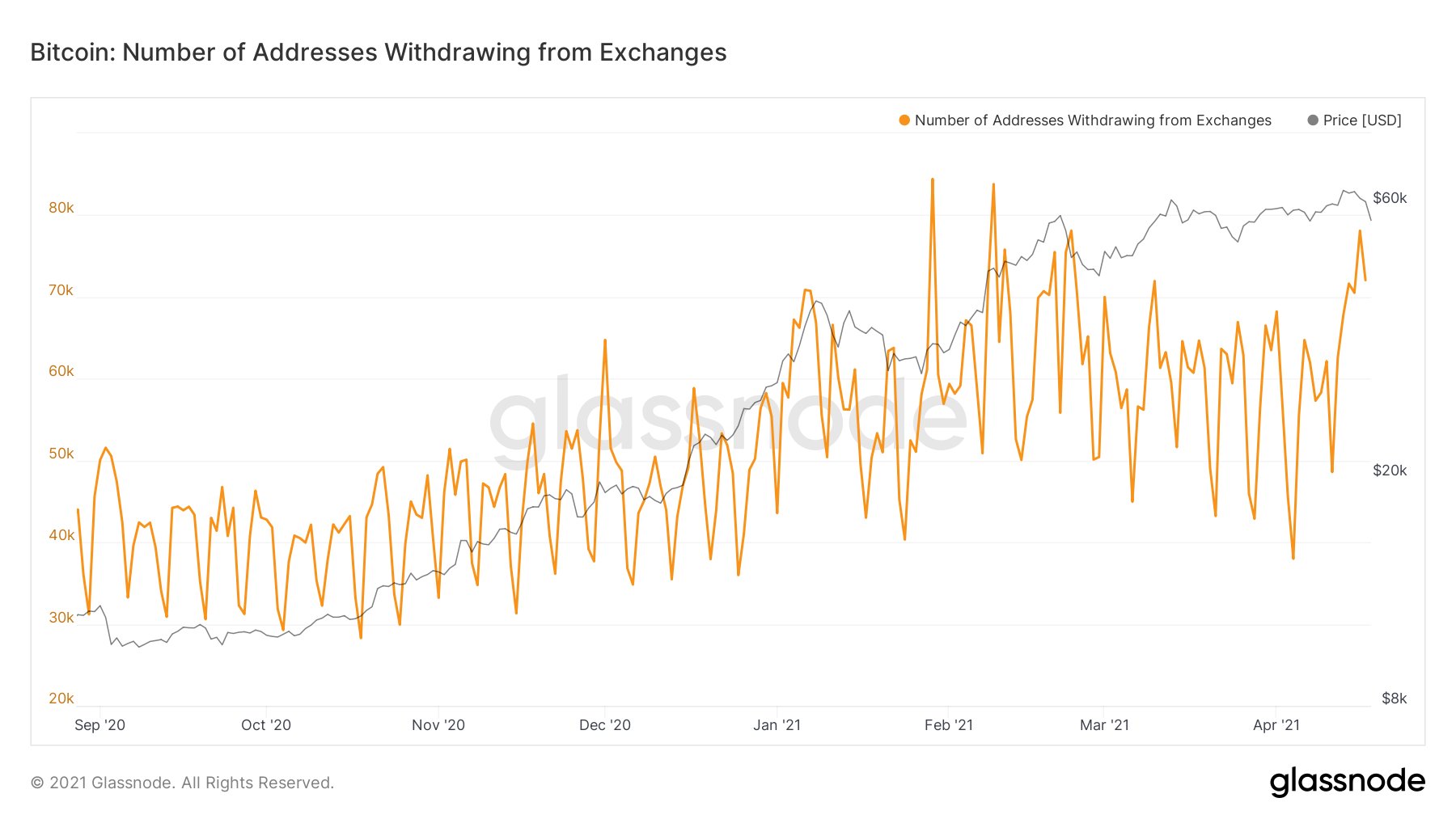

However, as identified by Bitcoin Jack, a cryptocurrency derivatives dealer, trade withdrawals or outflows exceeded the deposits however.

He said:

“April 15, 16 and seventeenth $BTC noticed ~482K addresses deposit to exchanges Identical interval ~220K addresses had been withdrawn to from exchanges & internet optimistic outflow recorded Many tiny fingers in -> fewer greater fingers out Confirmed by brief time period holder SOPR capitulation.”

So long as trade withdrawals are on par or increased than trade deposits, the technical momentum of Bitcoin isn’t prone to dropping steam within the close to time period.

Source link