Bitcoin (BTC) could get a lift to lastly clear $40,000 on the expense of the U.S. greenback as United States President Joe Biden’s new $6 trillion federal spending price range proposal is unveiled.

On Might 28, the US president will announce the huge fiscal coverage, the biggest for the reason that Second World Struggle, to make sure investments in main infrastructure, training and healthcare tasks, reported The New York Instances on Might 27.

Biden reportedly desires the federal authorities to spend $6 trillion in 2022. He additionally plans to lift the overall spending to $8.2 trillion by 2031.

Biden had earlier proposed important tax hikes on America’s richest corporations and people to fund his large spending program. However it might take the federal government at the very least till 2030 to shrink its price range deficits, the Instances reported. Meaning the US would face a monumental debt burden because it borrows cash to finance Biden’s document proposal.

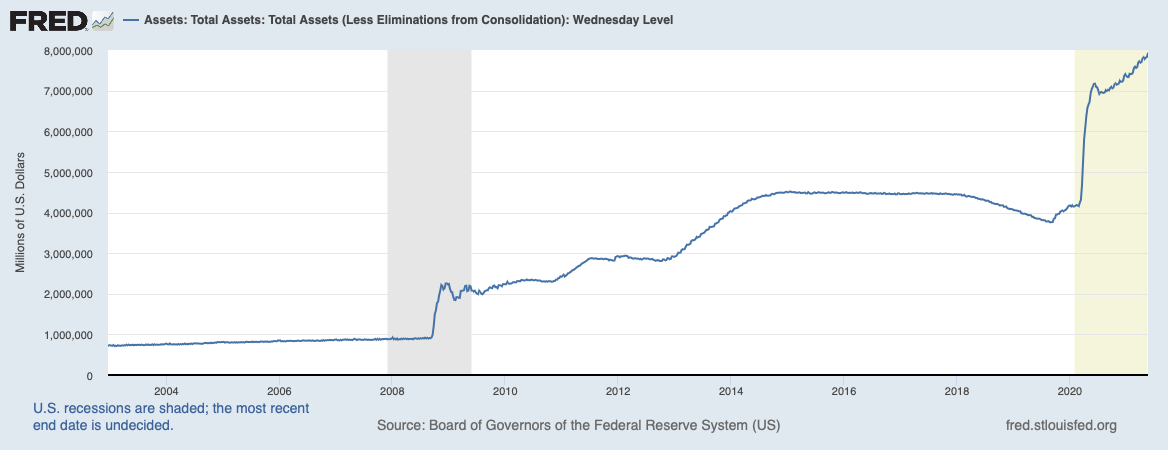

The state of affairs, per current historical past, serves as an excellent bullish backstop for Bitcoin. The decentralized cryptocurrency rallied 1,582% from its $3,858 low in March 2020 because the U.S. authorities ramped up spending to unprecedented ranges to fight the coronavirus pandemic.

Alternatively, the U.S. greenback power index (DXY), which measures the buck’s power in opposition to a basket of high foreign exchange, crashed by as much as 13.38% after topping out in March 2020 amid the worldwide market crash.

In the meantime, Anthony “Pomp” Pompliano, a well-renowned Bitcoin lobbyist and founding father of Pomp Investments, predicts additional declines in greenback bids.

“The federal government is proposing to push our nation additional into debt whereas concurrently destroying the worth of our foreign money,” Pompliano said. “Historians will write that the federal government accelerated the destruction of the world reserve foreign money because the residents cheered them on.”

Different analysts additionally jumped in to suggest Bitcoin — with its fastened provide — as a treatment in opposition to a steepening U.S. debt curve.

US President Joe Biden set to announce $6 Trillion price range.

Debt as a % of GDP will rise to highest ranges since World Struggle II.

Purchase #Bitcoin

— Bitcoin Archive (@BTC_Archive) May 27, 2021

#bitcoin has no high as a result of fiat has no backside pic.twitter.com/Zl3AygwVsB

— PlanB (@100trillionUSD) May 27, 2021

Bitcoin reclaims $40,000

The New York Instances’ protection brought about jitters throughout the early morning U.S. buying and selling session, with the DXY falling by a modest 0.01% on the New York opening bell whereas Bitcoin reclaimed $40,000.

The BTC/USD alternate fee examined its 200-day easy transferring common (the orange wave within the chart above) — which sits at round $40,756 — for a breakout transfer to the upside.

If achieved, the pair would eye an in depth above its 20-day exponential transferring common (the inexperienced wave) — close to $43,655 — to verify its short-term bullish bias.

Source link