Bitcoin (BTC) is changing gold whilst United States’ regulators try and disrupt its advance, stated Mike McGlone of Bloomberg Intelligence on Aug. 16.

The senior commodity market strategist credited the “digitization of cash and finance” behind the Bitcoin market’s superior development in opposition to gold, noting that the identical components helped the U.S. greenback acquire dominance “quickly and organically” over the dear metallic.

McGlone’s feedback appeared as takeaways from a current three-day convention at New Hampshire’s Bretton Woods resort, attended by economists, macro analysts, and buyers, together with Constancy Funding’s Jurrien Timmer, Morgan Stanley’s Amy Oldenburg, amongst others.

Bretton Woods is fashionable amongst economists for internet hosting the United Nations Financial and Monetary Convention in 1944, which later led to the duty that the USA, Canada, Western European international locations, Australia, and Japan would tie their currencies to gold.

Consequently, the brand new financial institution earned itself the title of “Bretton Woods system.”

However on Aug. 15, 1971, the thirty seventh U.S. President Richard Nixon took the greenback off the gold commonplace. Many economists hailed the transfer, calling upon John Maynard Keynes’ benchmark opinion that the gold commonplace was “a barbarous relic.”

The most recent “Bretton Woods: The Realignment” convention served as a metaphorical homage to the top of the Bretton Woods system whereas specializing in rising monetary belongings like Bitcoin that threaten to displace the “greenback hegemony” to develop into the subsequent world reserve asset.

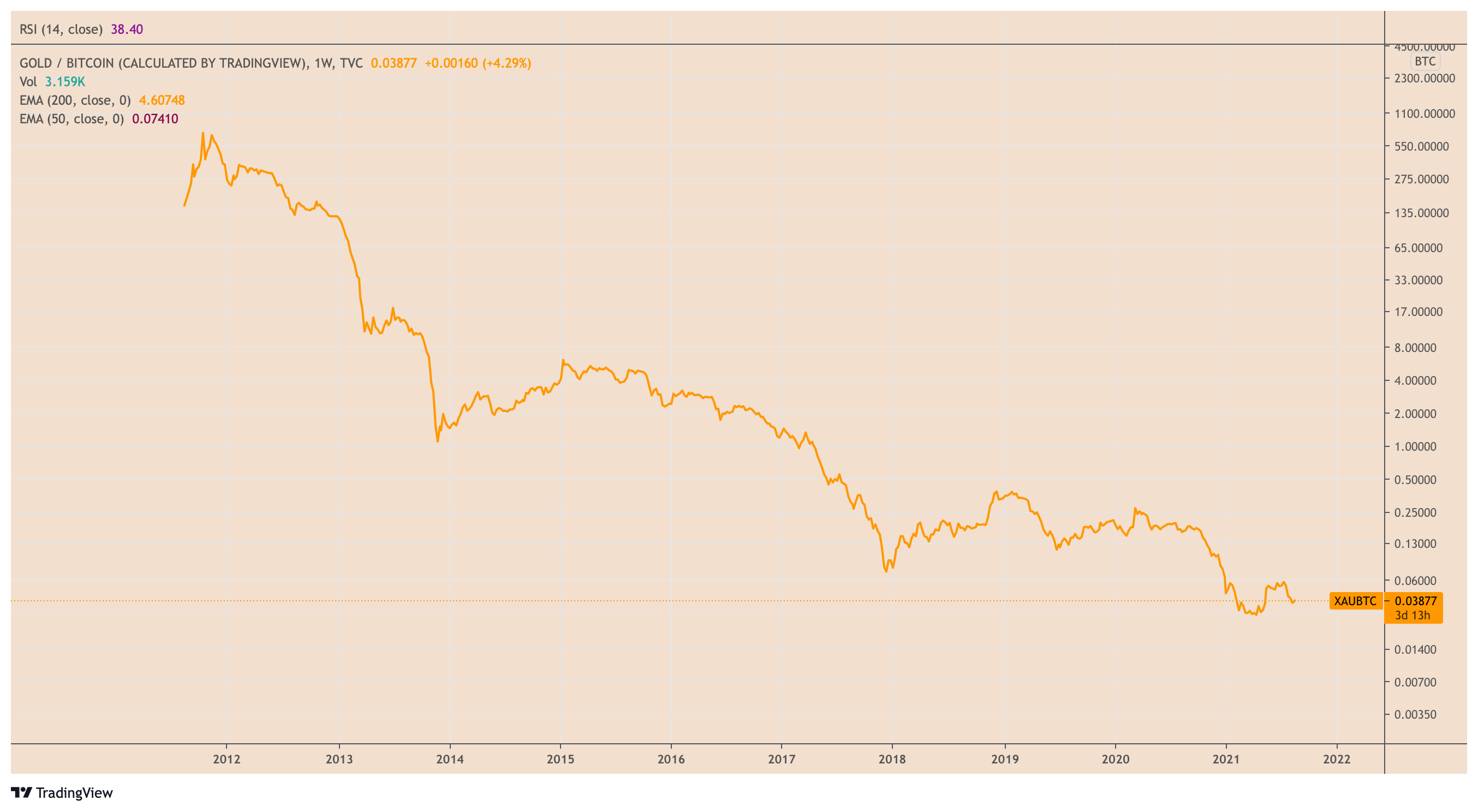

In doing so, Bitcoin straight challenged gold’s place as a standard competitor to the buck, which, as McGlone acknowledged, is already taking place.

#Digitalization of cash and finance is occurring quickly and organically, the #dollar is gaining dominance, #Bitcoin is changing gold and U.S. regulation is unlikely to disrupt its advance — these are our key takeaways from the #BrettonWoods: The Realignment convention. pic.twitter.com/Oy11l68Oqs

— Mike McGlone (@mikemcglone11) August 16, 2021

5 many years of greenback dominance

Princeton College’s financial historian Harold James argued in his July 2021 article that “digital applied sciences are driving a brand new financial revolution that might finish the buck’s world primacy altogether,” hinting on the position of crypto-assets like Bitcoin and Ethereum might play in reshaping the worldwide financial system.

The statements appeared regardless of the greenback’s potential to outlive the worst of world financial situations previously 5 many years and emerge because the world’s reserve asset.

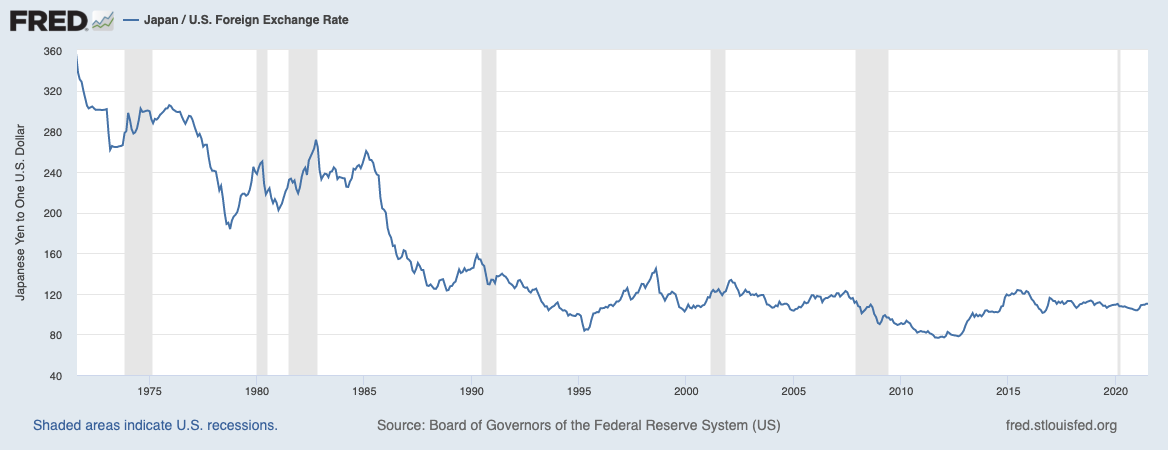

Intimately, the so-called Nixon Shock in 1971 led to double-digital inflation within the US, prompting the greenback to fall by greater than 50% in opposition to the Japanese Yen and German Deutschmark. However neither foreign money might substitute the buck within the race to world fiat hegemony.

The greenback posted sturdy restoration rallies within the first of the Nineteen Eighties. It posted related upside strikes within the second half of the Nineties—through the dot-com increase and bust. The buck additionally walked unhurt by the 2008 monetary disaster and Covid-19-led financial misery.

Greenback shock forward?

However why did the greenback survive? Bloomberg opinion columnist Niall Ferguson supplied three causes in its newest report.

First, the buck acquired backing from the Federal Reserve’s greater rate of interest insurance policies to reset expectations.

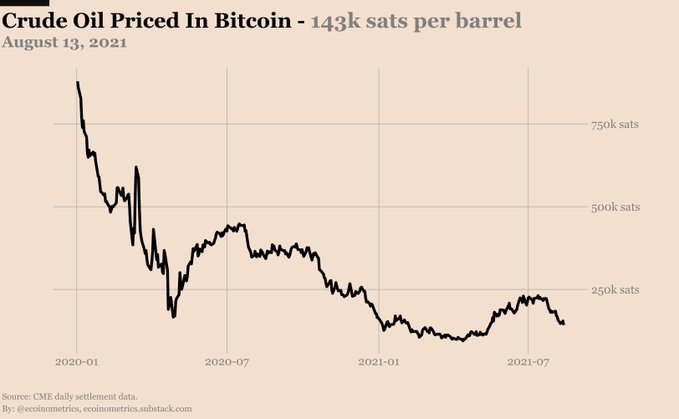

Second, liberalized capital markets, led by a increase in eurodollar and petrodollar markets, boosted the greenback’s worldwide utility, prompting international central banks to make use of it to execute worldwide trades.

And third, the U.S. authorities’s energy to impose monetary sanctions on international locations it deemed unruly to the White Home’s insurance policies—particularly within the wake of the World Commerce Middle assaults on Sep. 11, 2001—made the greenback a monetary weapon.

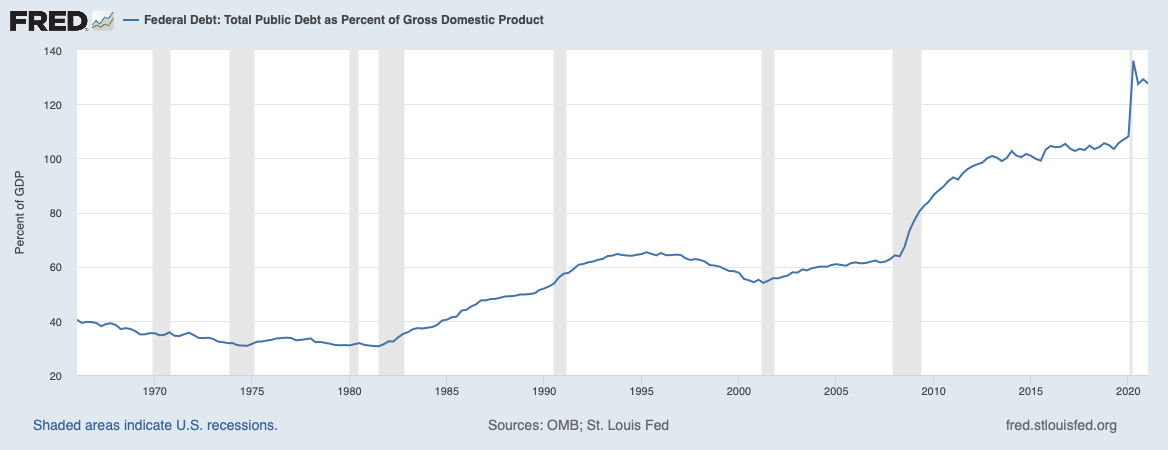

However James famous that the greenback has met unprecedented financial situations following the Covid-19 disaster. The previous 18 months have seen the U.S. deficit climbing to 13.4% of the gross home product (GDP), the second-largest for the reason that finish of World Warfare 2.

It expects to develop greater after the $1 trillion infrastructure invoice that the Senate simply handed. The Congressional Finances Workplace reported that the stimulus would develop the finances deficit by one other $256 billion inside the subsequent decade.

In the meantime, one other package deal price $3.5 trillion that focuses on anti-poverty and local weather expects to get enacted by the top of this yr. Consequently, James famous that rising deficits had decreased the greenback’s upside prospects in world markets. He wrote:

“Some risks are already seen within the Treasury market, the place there have been liquidity strains (in 2020) and a weakening of international demand […] New cash, subsequently, could also be ending the lengthy interval of greenback hegemony.”

Bitcoin battles gold as various to greenback

The Federal Reserve’s free financial insurance policies have resulted in supersonic worth rallies within the Bitcoin market, insomuch that the sturdy strikes upside has crushed gold, a standard hedging asset.

Pomp Investments’ companion Anthony Pompliano, a long-time advocate of Bitcoin, stated in a be aware to purchasers that if one holds their wealth in {dollars}, bonds, or gold, their investments will yield “unfavorable actual charges of return.”

“You primarily are left with bitcoin or equities, which leads you to think about an allocation to bitcoin given the excessive diploma of volatility that can doubtless serve to outperform equities over an extended sufficient time interval.”

Pompliano’s statements appeared regardless of potential regulatory challenges for rising digital belongings, as McGlone identified in his Monday tweet. The crypto business has confronted a wave of assaults from Treasury Secretary Janet Yellen, Democratic Senator Elizabeth Warren, and Gary Gensler, chairman of the Securities and Change Fee.

Associated: What the SEC can study from the German regulator

However McGlone famous that the arduous rules wouldn’t be capable to disrupt Bitcoin’s advance in opposition to gold. Moreover, Liam Bussell, head of company communications at crypto buying and selling service Banxa, famous that US regulators don’t want to cease Bitcoin; they wish to shield US buyers from fraud.

“Unlawful schemes resulted in about 82,135 cryptocurrency frauds instances in 2020 alone,” Bussell stated, including:.

“The US regulators that conceivably contact digital belongings (CFTC, SEC and FINRA) are open to the diversification of devices, so long as these devices are truthful and function in a clear method.”

The views and opinions expressed listed here are solely these of the creator and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer entails danger, it’s best to conduct your individual analysis when making a choice.

Source link