Might was a testing time for cryptocurrencies like Bitcoin (BTC). The flagship digital asset was already wobbling after rallying to just about $65,000 in mid April, owing to profit-taking sentiment amongst merchants.

Elon Musk accelerated the sell-off by reversing his firm’s plans to just accept Bitcoin as cost for Tesla’s electrical vehicles.

Later within the month, the Individuals’s Financial institution of China reiterated to the nation’s monetary establishments towards using digital currencies for funds. Chinese language authorities are additionally beginning to maintain an in depth eye on crypto mining — the method by which computer systems mine cryptocurrencies like Bitcoin.

Extra blows to the cryptocurrency sector got here from the U.S. tax and financial authorities, together with Federal Reserve Chairman Jerome Powell, who recommended that extra laws are wanted.

All and all, the flurry of destructive updates prompted the cryptocurrency market to lose greater than $500 billion in Might. Being the benchmark digital asset, Bitcoin additionally suffered the brunt of aggressive draw back stress, falling 35.50% within the month.

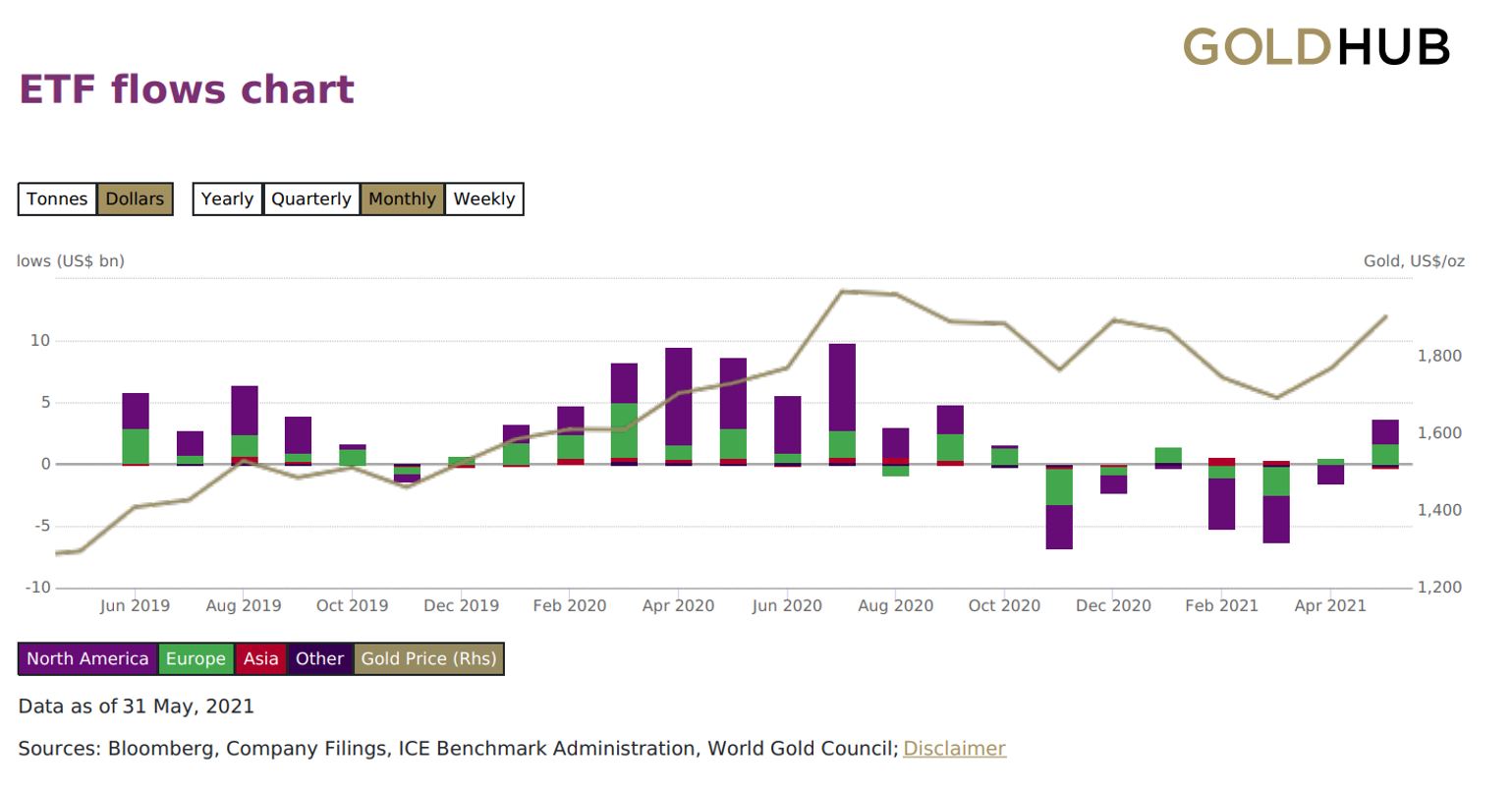

In the meantime, bodily gold exchange-traded funds (ETFs) recorded its strongest months in Might 2021 since September 2020. The funds throughout the globe attracted a mixed whole of $3.4 billion in comparison with September’s $4.8 billion, in keeping with information offered by the World Gold Council (WGC).

Intimately, U.S.-based gold ETFs skilled an influx price $2.1 billion. The European gold ETFs reported $1.6 billion price of deposits. Nonetheless, Asian funds monitoring the dear metallic’s costs famous an outflow of about $300 million.

Sturdy demand for gold ETFs additionally contributed to the rise of its spot costs. Consequently, the XAU/USD change fee jumped 7.6% in Might to $1,912.785 an oz.

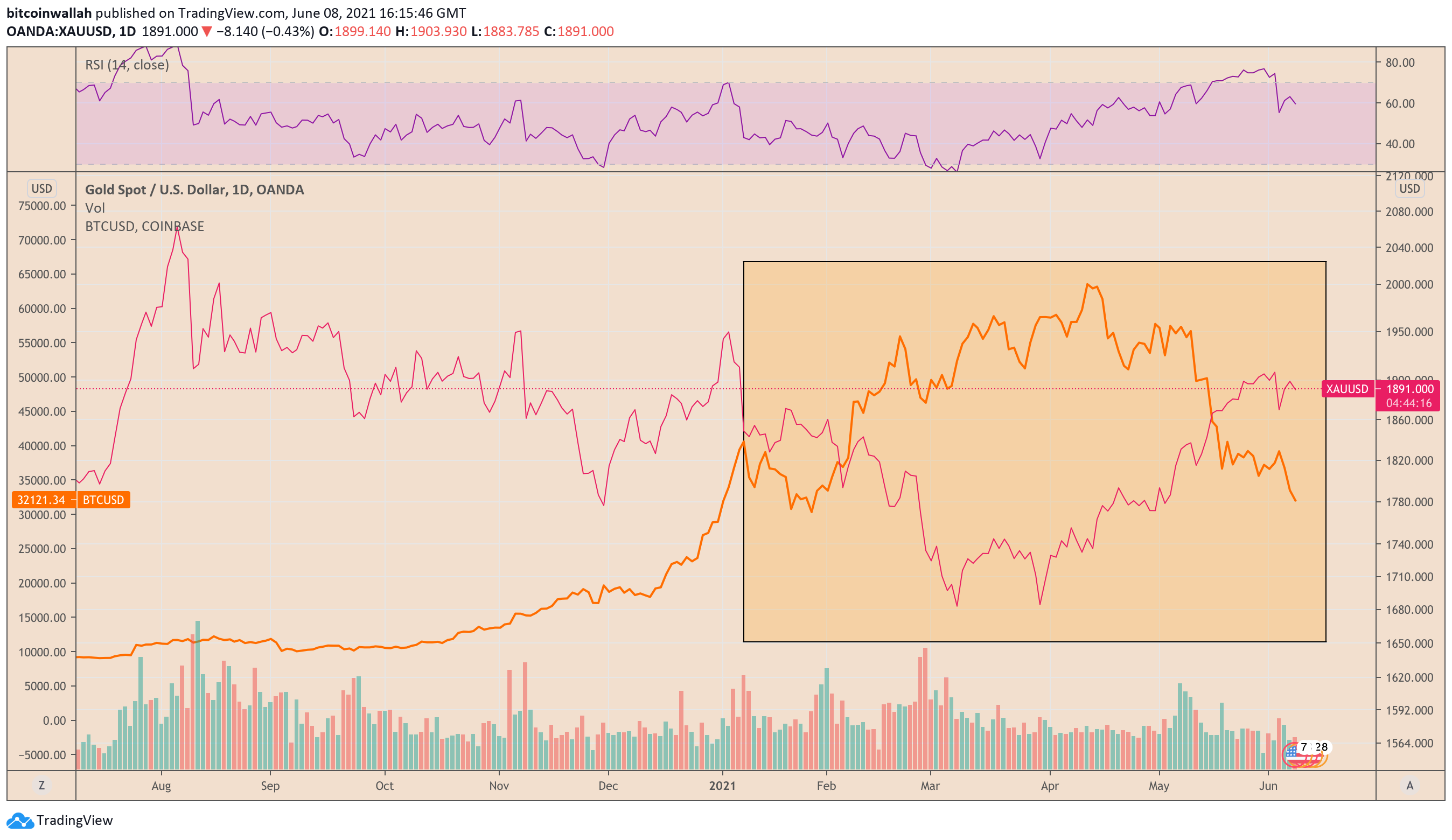

Unfavorable correlation

The polar reverse strikes in Bitcoin and Gold markets indicated {that a} short-term destructive correlation has been brewing between them. As well as, Wall Avenue veterans Nick Colas and Jessica Rabe additionally wrote of their DataTrek Analysis report that the sell-off in digital currencies might need boosted gold’s attraction amongst institutional buyers.

The market strategists projected Bitcoin as a riskier various to Gold. In the meantime, they famous that the dear metallic’s worth doesn’t decline by half in 5 weeks due to Elon Musk tweets, nor does it reply to policymakers’ ban threats.

“Gold is, relative to digital currencies, a no-drama funding. [Therefore], we proceed to advocate a 3-5 p.c place in gold for diversified portfolios.”

Bitcoin is essentially a speculative wager for rich and small retail buyers looking for fast earnings. However the fastened provide of BTC has additionally seen it profit from fears of rising inflation, just like gold. Corporates together with Tesla, Ruffer Investments, Sq., and MicroStrategy added Bitcoin to their cash-ruled stability sheets.

They did so to offset inflation dangers introduced forth by the Federal Reserve’s unprecedented expansionary insurance policies, together with near-zero rates of interest and a $120 billion month-to-month asset buying program.

The high-profile investments performed a key position in doubling Bitcoin costs within the first quarter of 2021, fueled additional greater to round $65,000 by mid-April by a rise in debt-fueled leveraged bets and inflow of latest retail merchants into the market.

However, Gold ETFs reported six months of back-to-back outflows till Might 2021. JPMorgan analysts in January 2021 reported that gold ETFs misplaced about $7 billion in the identical interval Grayscale Bitcoin Belief (GBTC), a belief operated by New York-based Grayscale Investments, attracted $3 billion.

The dearth of capital injection into valuable metallic funds additionally lowered its spot bids; XAU/USD closed the primary 2021 quarter down 10.14% against Bitcoin’s 100% returns.

In Might 2021, one other JPMorgan report recommended that enormous institutional buyers secured their earnings in Bitcoin to hunt alternatives in gold. They cited open curiosity information in Bitcoin futures contracts on the Chicago Mercantile Alternate that skilled its greatest drop since October 2020. JPMorgan analysts mentioned:

“The bitcoin circulate image continues to deteriorate and is pointing to continued retrenchment by institutional buyers.”

The statements additionally appeared as Ruffer Investments, a U.Okay.-based fund that manages about $33.95 billion for rich people and charities, additionally introduced Tuesday that it has unloaded its total Bitcoin place and has netted $1.56 billion in earnings.

Duncan MacInnes, funding director at Ruffer, instructed the Finance Instances that that they had shifted the funds into gold, commodity shares, and inflation-protected bonds.

Macinnes added that Bitcoin remains to be “on the menu” of Ruffer’s potential investments sooner or later, noting that the world is determined for brand spanking new safe-haven towards ultra-low bond yields.

Source link