Bitcoin began the week off with an abrupt bullish breakout to $37,500, a degree some analysts have recognized as an important ‘line within the sand’, however the rally was short-lived as BTC met promoting close to the decrease arm of the bearish pennant that may be seen on a number of timeframes.

Whereas many merchants are involved that the 2021 bull market is now over and contemplating whether or not beneficial properties must be locked in, on-chain knowledge reveals that long-term Bitcoin (BTC) holders have been accumulating in preparation for a possible 2013-style double-pump that has the potential to raise BTC to a contemporary all-time excessive.

Ether (ETH), however, rallied 8% to $2,677 as chatter a couple of potential ‘flippening’ between Bitcoin and Ethereum continues to be a subject of dialogue. Most just lately, Bloomberg speculated that Ether may one-day surpass Bitcoin because the world’s cryptocurrency of selection.

Quick-term holders are feeding the sell-off

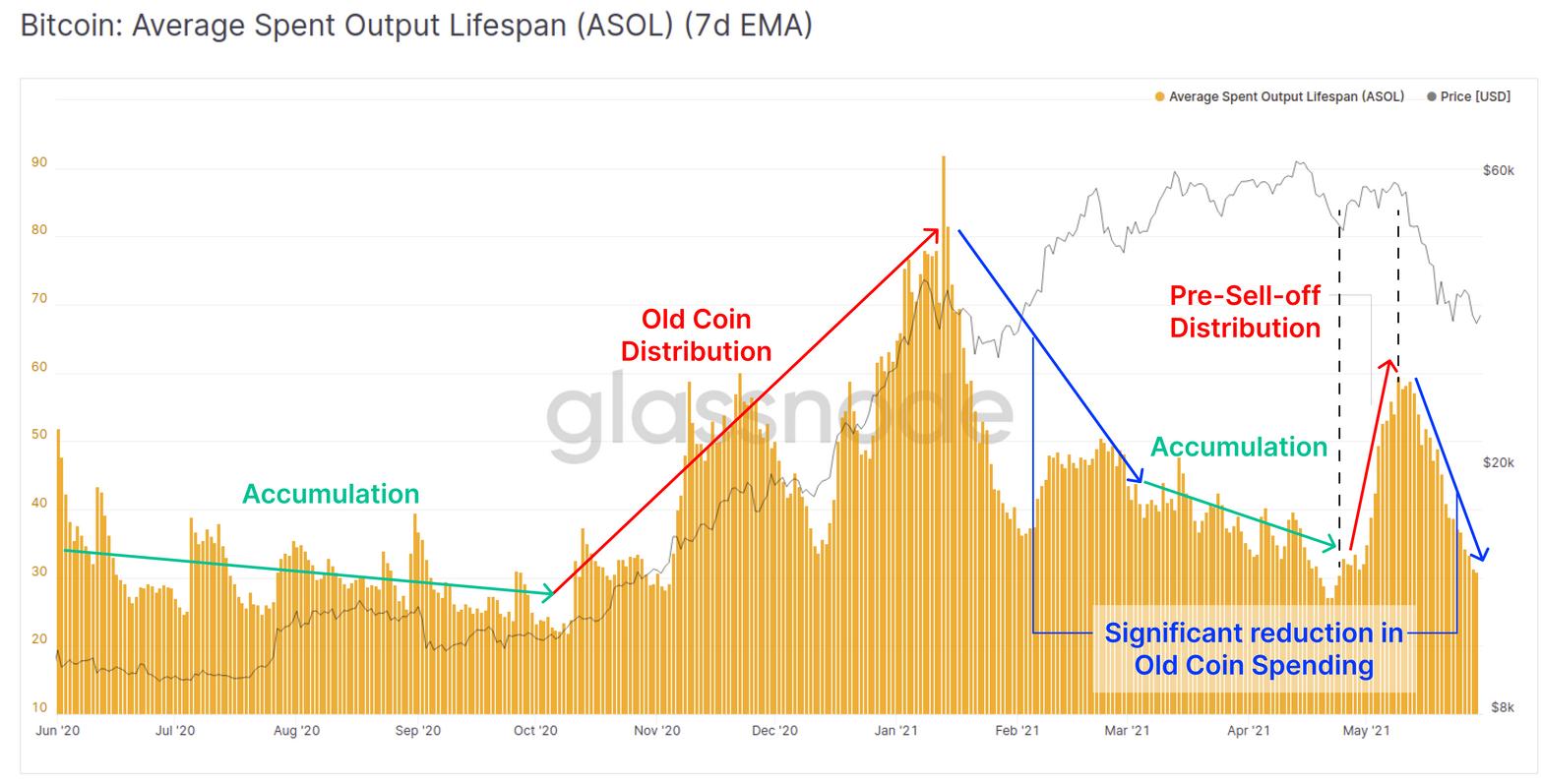

Additional insights into what’s feeding the uncertainty within the markets may be present in the latest “Week on-chain” report from Glassnode which seemed on the exercise of short-term holders (STH), who’re newer market entrants that maintain cash youthful than 155 days, and long-term holders (LTH) who maintain cash older than 155 days.

In response to the Common Spent Output Lifespan (ASOL) metric, which offers perception into the typical age of all UTXOs spent that day, LTHs primarily held by the current dip as evidenced by the ASOL falling dramatically “again to ranges beneath the buildup vary seen between $50,000 and $60,000.”

Additional proof that it has been STHs which are behind the sell-off may be discovered by evaluating the quantity of on-chain Bitcoin switch quantity that’s in revenue (LTHs) to the at a loss (STHs).

In response to knowledge from Glassnode, LTHs had been seen taking earnings early within the 2021 rally from $10,000 to $42,000 earlier than their spending “reached a reasonably steady baseline,” with final week’s sell-off “having little impact on their spending patterns” indicating “that LTHs are typically unwilling to liquidate cash at decreased costs.”

This compares to the habits of STHs who “elevated their spending by over 5x throughout this sell-off with the utmost spending occurring close to the present native low of the market.”

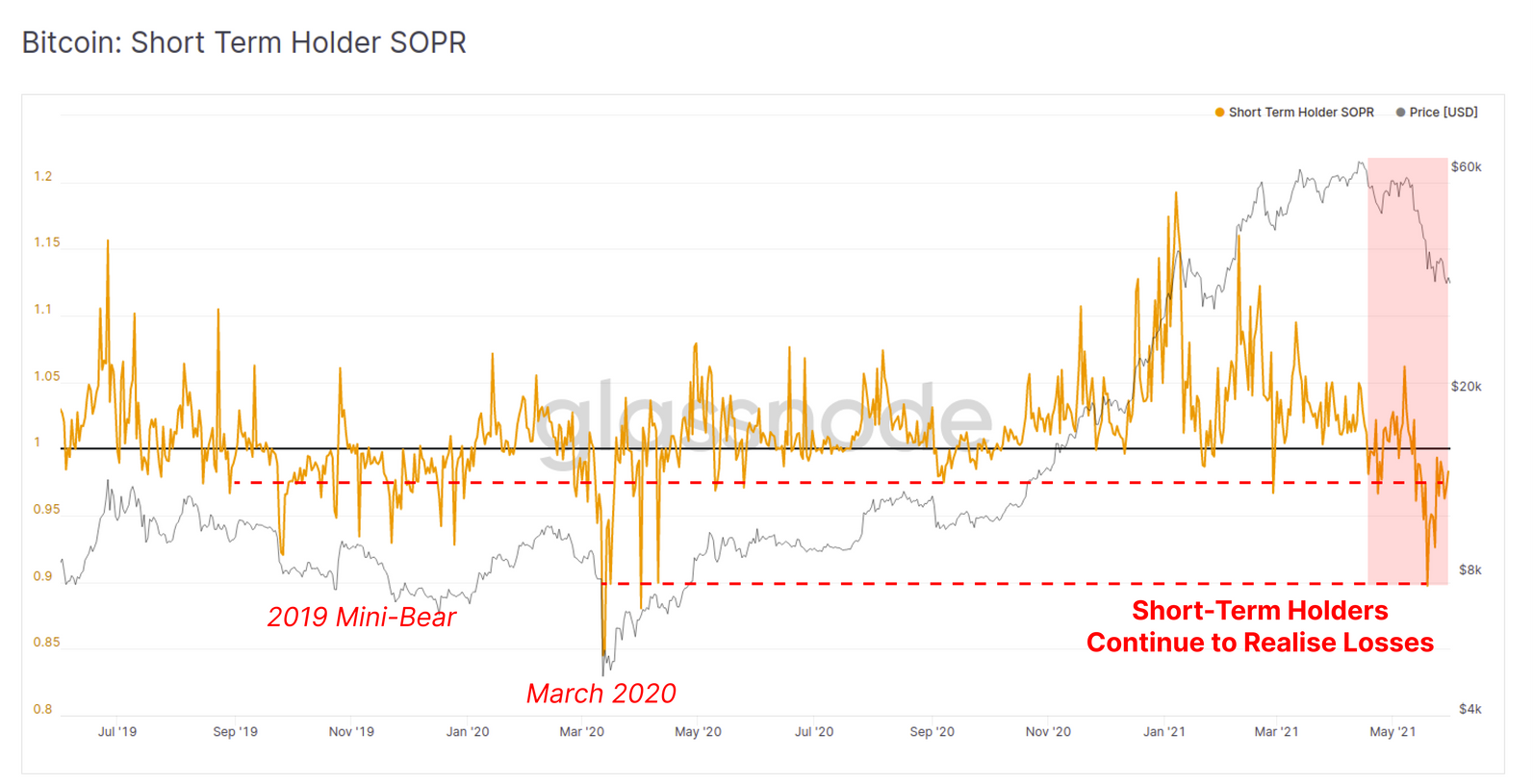

Proof of this will also be present in a evaluate of the Spent Output Revenue Ratio (SOPR) for STHs, who proceed to understand losses by spending cash that had been gathered at larger costs on the present decrease costs, indicating capitulation.

In response to Glassnode: s

“No doubt, the present market construction is finest described as a battleground between the bulls and the bears with a transparent pattern forming between long-term and short-term buyers. It is a battle of HODLer conviction and quick shopping for energy.”

The views and opinions expressed listed here are solely these of the creator and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer entails threat, it’s best to conduct your personal analysis when making a choice.

Source link