Bitcoin (BTC) costs steadied on Tuesday after closing the earlier session at a 3.41% loss, supported by a weakening greenback sentiment forward of a key United States’ inflation report due later at this time.

Spot BTC/USD alternate charge rose by a modest 1.31% to $33,096 after bottoming out on Monday at $32,996 on Coinbase alternate. The CME Bitcoin Futures was up 1.64% from its earlier session’s low of $32,600.

In the meantime, the US greenback index was down about 0.03% forward of the London opening bell. The index represents the buck’s energy in opposition to a basket of high foreign exchange.

Inflation knowledge awaited

Bitcoin and the greenback moved inversely within the week of key inflation stories and an important congressional testimony from the Federal Reserve Chairman Jerome Powell.

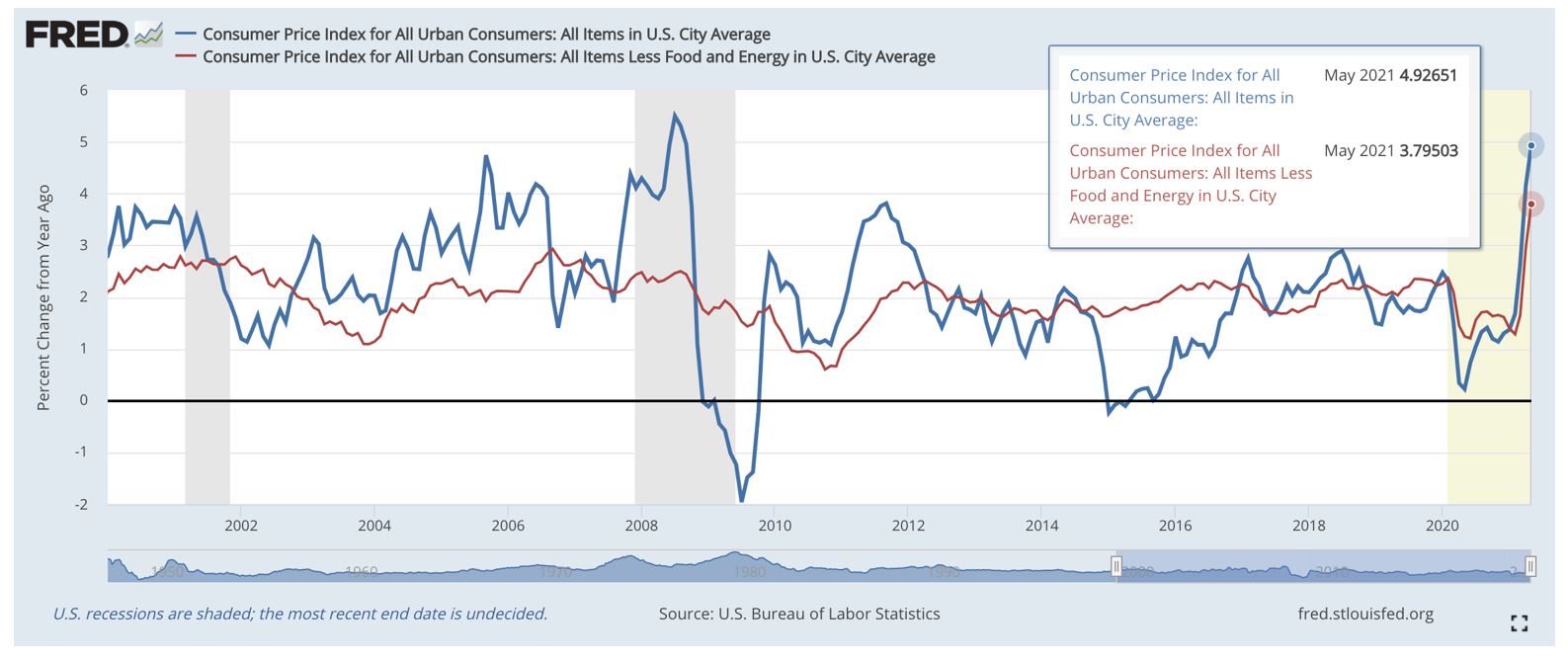

On Tuesday, the US Shopper-Worth Index (CPI) expects to submit one other important spike in June, highlighting a run-up in inflation because the financial system makes an attempt to get better from the coronavirus pandemic slowdown. A Reuters ballot of economists famous that the CPI may need elevated by 0.5% from Could and 4.9% from a yr earlier.

Many merchants guess on Bitcoin in opposition to the prospects of upper inflation, partly as a consequence of fashionable narratives that undertaking the flagship cryptocurrency as a hedge in opposition to central banks’ inflationary insurance policies that harm fiat currencies’ buying energy.

Inflation is killing your financial savings account.

Powering energy. #Bitcoin

— David Gokhshtein (@davidgokhshtein) July 11, 2021

Intimately, the Federal Reserve has been operating a $120 billion month-to-month asset buy program since March 2020 whereas preserving its benchmark lending charge close to zero. Consequently, the U.S. central financial institution’s insurance policies have doubled the scale of its stability sheet to greater than $8 trillion. In the meantime, the identical interval has witnessed Bitcoin spiking by as much as 1,528%—from $3,858 to nearly $65,000.

The cryptocurrency declined by greater than half by the mentioned mid-April peak however sustained its total bullish bias by relentlessly holding $30,000 as its psychological value ground. The help got here extraordinarily useful following the earlier two CPI stories exhibiting that inflation jumped to 4.2% in April and 4.9% in Could.

“The uptick within the CPI readings is a sign that the financial system has not healed utterly from the pangs of the pandemic, and the crypto market is trailing the unfavourable inflation figures,” Gustavo De La Torre, director of enterprise growth at N.alternate, instructed Cointelegraph. He added that decrease Bitcoin costs mixed combined financial outlook would drive extra buyers to build up the cryptocurrency.

“Ought to the buyup intensify, a value push as much as $40,000 for Bitcoin could also be seen within the quick time period,” added De La Torre.

Moreover, Konstantin Anissimov of CEX.IO warned about Fed’s potential hawkish response to additional inflation hikes, noting that it’d immediate the central financial institution to unwind its bond-buying program and lower rates of interest sooner than anticipated.

“As issues stand, the Federal Reserve has elevated the scale of its stability sheet from early 2020 to greater than $8 trillion — a considerable rise,” Anissimov mentioned, including that decrease crypto costs would preserve serving as the best hedge in opposition to inflationary fears in the interim. He additional famous:

“Each Bitcoin and Ethereum with the renewed buy-ups are prone to retest new value ranges at $45,000, and $3,000, respectively.”

Bitcoin enters accumulation

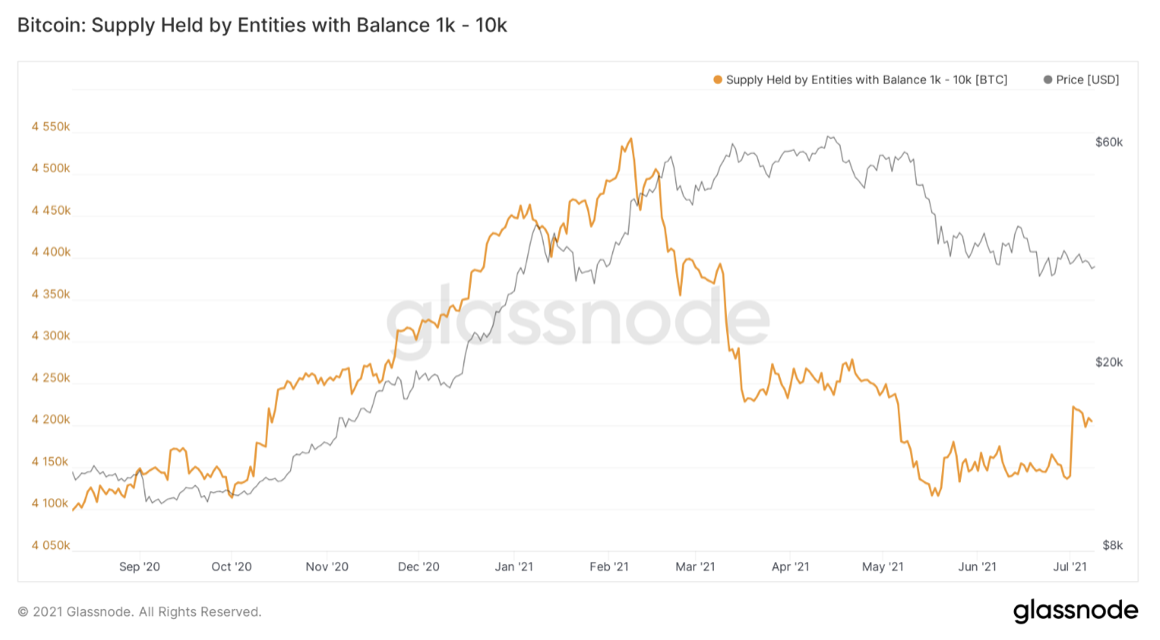

On-chain indicators continued to level in the direction of an ongoing Bitcoin accumulation. As of the final week’s shut, as per Glassnode’s knowledge, entities with little historical past of promoting continued piling up Bitcoin from weaker arms, whereas internet alternate flows dipped into unfavourable territory, suggesting that merchants have been withdrawing their Bitcoin from buying and selling platforms to carry.

“Retail has been shopping for closely for weeks now, however we lastly received the uptick in whales that we had been ready for,” famous Will Clemente, an unbiased market analyst.

“There have been 17 new whales birthed on the blockchain this week, whereas on the similar time the general holdings of whales enhance up by 65,429 BTC.”

The views and opinions expressed listed here are solely these of the writer and don’t essentially replicate the views of Cointelegraph.com. Each funding and buying and selling transfer entails threat, you need to conduct your individual analysis when making a choice.

Source link