Bitcoin (BTC) could be struggling to interrupt the $36,000 resistance for the previous three weeks, however bulls now have one much less factor to fret about: cascading futures contracts liquidations.

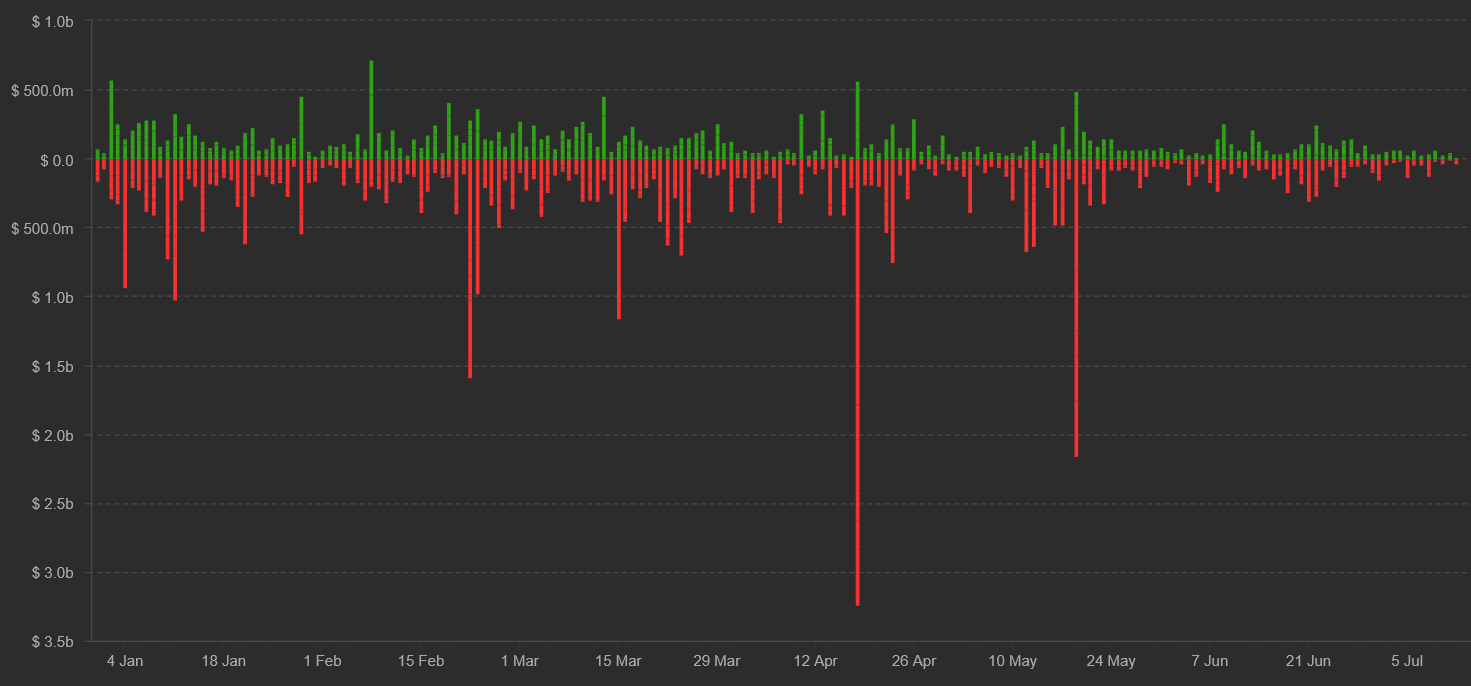

One could be underneath the impression {that a} $1 billion liquidation is common for Bitcoin. Nonetheless, merchants have a tendency to recollect the latest exaggerated actions greater than some other value shifts, particularly when the value crashes and folks lose cash.

This negativity bias signifies that even when varied value impacts with equal depth happen, the disagreeable feelings and occasions have a extra important impact on a dealer’s psychological state.

For instance, a number of research present that successful $500 from enjoying the lottery is 2 to a few occasions much less ‘impactful’ than shedding the identical quantity from the gambler’s private pockets.

At the moment, we’re six and a half months into 2021 and there have been solely 7 occasions the place a $1 billion or bigger lengthy contract liquidation has occurred. So, moderately than being the norm, these are very uncommon conditions that may solely happen when merchants are utilizing extreme leverage.

Extra importantly, there hasn’t been a $1 billion short-seller liquidation even when Bitcoin rallied 19.4% on Feb. 8. These liquidations simply present how leverage longs are typically extra reckless, leaving much less margin on derivatives exchanges.

Whereas retail merchants use excessive leverage and ultimately fall sufferer to liquidations, extra intuitive merchants that guess on a value drop are seemingly absolutely hedged and doing ‘money and carry’ trades.

This is among the three explanation why $1 billion futures liquidation shouldn’t be a priority proper now.

Money and carry trades have a low liquidation danger

The quarterly futures contracts often don’t commerce at par with common spot exchanges costs. Normally, there’s a premium when the market is impartial or bullish and it ranges from 5% to fifteen% annualized.

This fee (generally known as the premise) is usually similar to the stablecoin lending fee as a result of the choice to postpone settlement means sellers demand the next value, and this causes the value distinction.

This example creates room for arbitrage desks and whales to purchase Bitcoin at common spot exchanges and concurrently quick the futures to gather the futures contract premium.

Though these merchants will likely be displayed as ‘quick curiosity’, they’re successfully impartial. Thus, the consequence will likely be unbiased of the market shifting up or down.

Right now, longs are removed from over-leveraged

Merchants had been extremely bullish on Bitcoin value because it rallied to a $65,800 excessive, however this sentiment flipped to bearish after the brutal lengthy contracts liquidations between Might 11 and Might 23 as BTC crashed 53% from $58,500 to $31,000.

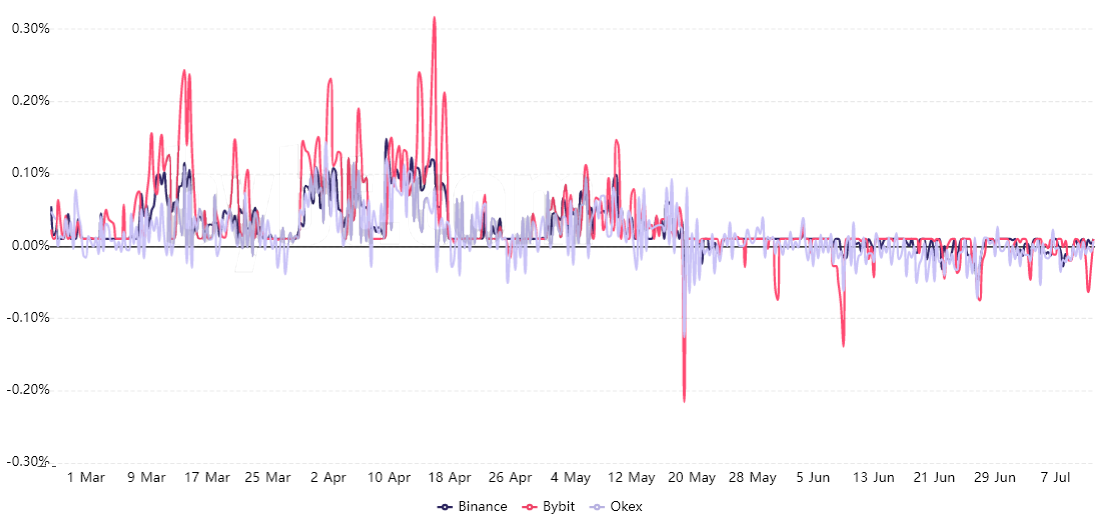

Wanting on the perpetual contracts (inverse swaps) funding fee is an effective solution to measure traders’ sentiment. Each time longs are those demanding extra leverage, the indicator will develop into constructive.

Since Might 20, there hasn’t been a single day the place the 8-hour funding fee was greater than 0.05%. This proof signifies that consumers are unwilling to make use of excessive leverage, and with out it, it is more durable to create $1 billion or greater liquidations.

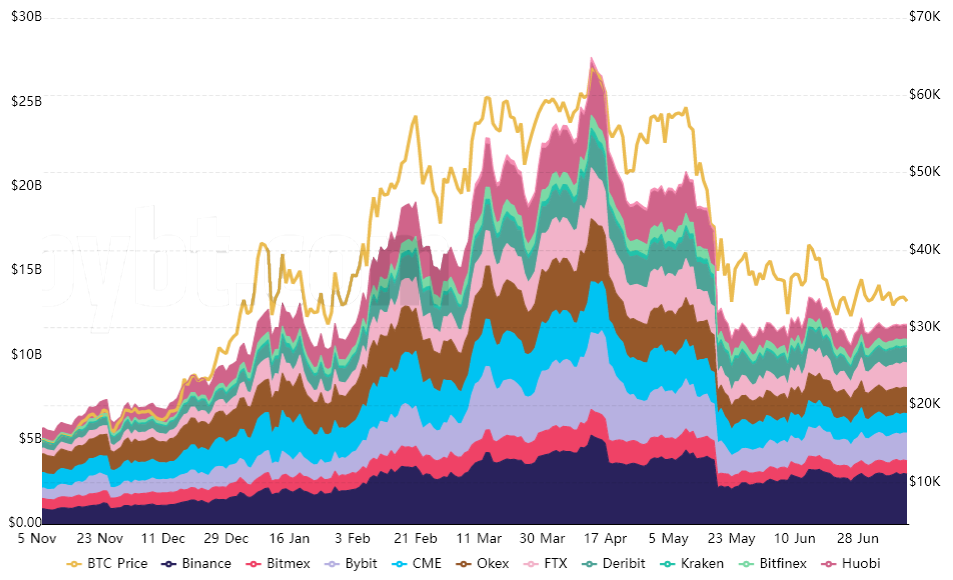

Open curiosity additionally crashed when Bitcoin value imploded

Each futures contract wants a purchaser and vendor of the very same dimension, and the open curiosity measures the mixture notional in U.S. {dollars}. Which means as Bitcoin value strikes down, so does the indicator.

The above chart reveals how the futures open curiosity surpassed $20 billion by mid-March. Throughout that interval, a $1 billion liquidation represented a mere 5% of the excellent whole.

Contemplating the present $11.8 billion open curiosity, the identical $1 billion quantity would symbolize 8.5% of the mixture variety of contracts.

In a nutshell, it’s turning into rather more tough for cascading liquidations to happen as a result of consumers will not be utilizing extreme leverage, and sellers look like absolutely hedged. Until these indicators shift considerably, bulls can stay in peace.

The views and opinions expressed listed here are solely these of the author and don’t essentially mirror the views of Cointelegraph. Each funding and buying and selling transfer includes danger. It’s best to conduct your personal analysis when making a call.

Source link