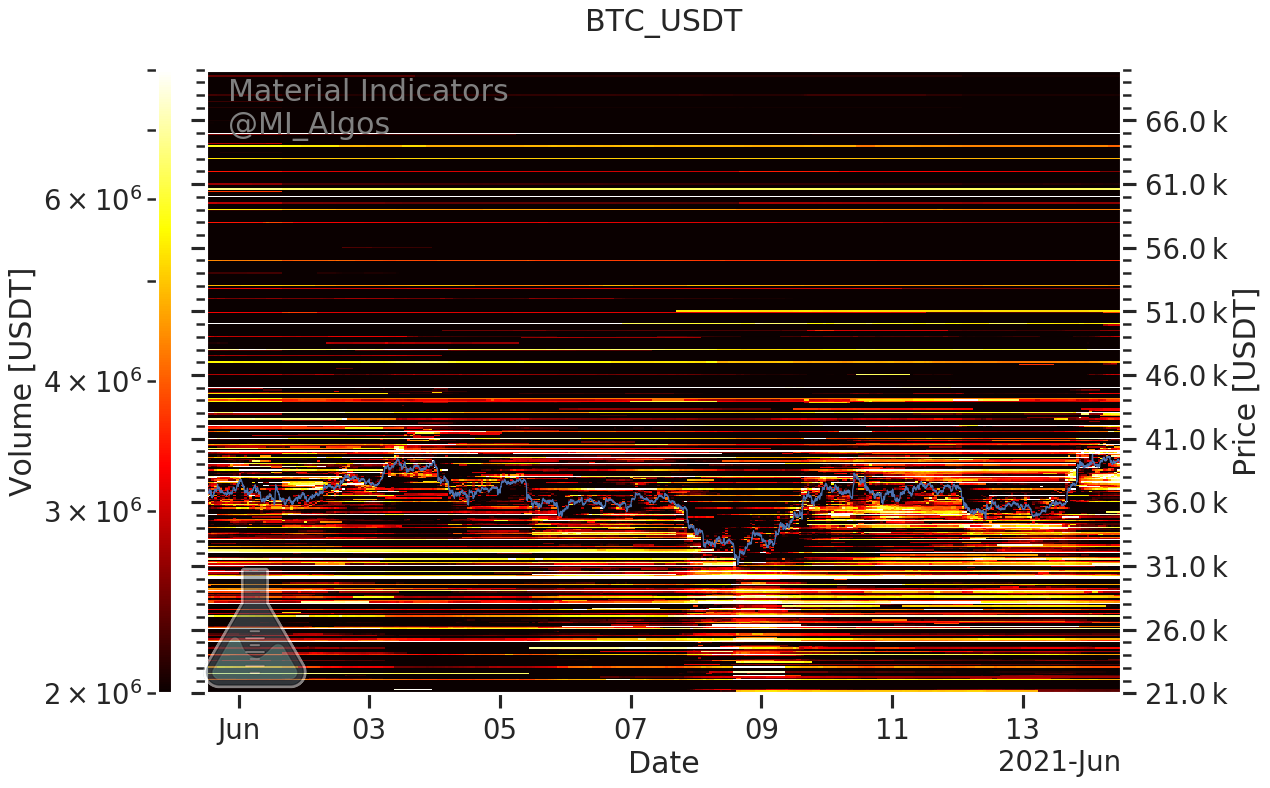

Bitcoin (BTC) handed $40,000 on June 14 as a consolidation interval snapped to unleash a stable breakout.

BTC worth breaks out previous $40,000

Information from Cointelegraph Markets Professional and TradingView confirmed BTC/USD gaining 3% in beneath an hour, reaching $40,600 on Bitstamp.

The most important cryptocurrency capitalized on the upside that resulted from a brand new optimistic tweet by Elon Musk regarding Tesla presumably accepting BTC sooner or later.

Earlier, Cointelegraph reported on merchants betting on a leg as much as round $47,000 earlier than a correction.

A take a look at purchase and promote positions on main trade Binance exhibits assist at $38,000, with resistance at $40,500 — the subsequent hurdle for bulls.

Paul Tudor Jones advocates 5% BTC allocation

Bitcoin reached a $2 trillion market capitalization due to a “dichotomy” in Federal Reserve coverage that “questions” its credibility, mentioned well-known dealer Paul Tudor Jones.

In an interview with CNBC on June 14, the founding father of Tudor Funding Company sounded the alarm over advancing inflation.

After final week’s client worth index (CPI) report confirmed that United States inflation has hit a 13-year excessive, Bitcoin’s deflationary nature has hardly ever regarded so interesting.

For Jones, the concept larger inflation is simply momentary resulting from latest occasions — as steered by the Fed and central banks basically — is a fantasy.

“It is considerably disingenuous to say that inflation is transitory — for them to say inflation is transitory,” he informed CNBC’s Squawk Field section.

At the moment’s atmosphere is completely completely different from those who noticed episodes of inflation previously, corresponding to in 2013. As such, there may be little sense within the Fed making use of the identical forecasts, Jones believes.

Jones famous that the CPI was a lot decrease then, whereas now, unemployment ranges and job provides additionally roughly equal one another.

Associated: Paul Tudor Jones says Bitcoin is ‘like investing early in Apple or Google’

In the meantime, gold and Bitcoin have supplied a refuge for a lot of. Regardless of the valuable metallic vastly underperforming Bitcoin by way of positive factors, it stays close to report highs.

“If you take a look at the Fed at present and the Fed again then, you marvel: How will you have such wildly completely different coverage views on what constitutes the correct ranges for employment, the correct ranges for inflation?” he continued.

“How will you have that with an eight-year timeframe? It is virtually like a break up character. And also you marvel why Bitcoin has a $2 trillion market cap and gold’s at $1,865 an oz. And the explanation why is as a result of you’ve this dichotomy in coverage that once more questions — questions — the institutional credibility of one thing.”

In the end, a 5% Bitcoin allocation is among the solely issues he recommends to these looking for portfolio recommendation.

“I say, ‘OK, pay attention. The one factor that I do know for sure is I need to have 5% in gold, 5% in Bitcoin, 5% in money, 5% in commodities at this cut-off date,'” he added.

Source link