Bitcoin (BTC) traded worryingly close to $30,000 help on June 8 amid contemporary predictions of incoming lows.

BTC worth hints at “sub $30,000” transfer

Information from Cointelegraph Markets Professional and TradingView adopted BTC/USD because the pair misplaced 9% in a single day on Monday.

No quantity of excellent information was capable of assist bulls, with potential adoption breakthroughs in Latin America conspicuously doing nothing to spice up lackluster worth motion.

U.S. Treasury Secretary Janet Yellen likewise didn’t raise the temper when she voiced help for greater inflation.

As a substitute, Bitcoin dropped to $32,000, on the time of writing coming off a rebound to $33,000.

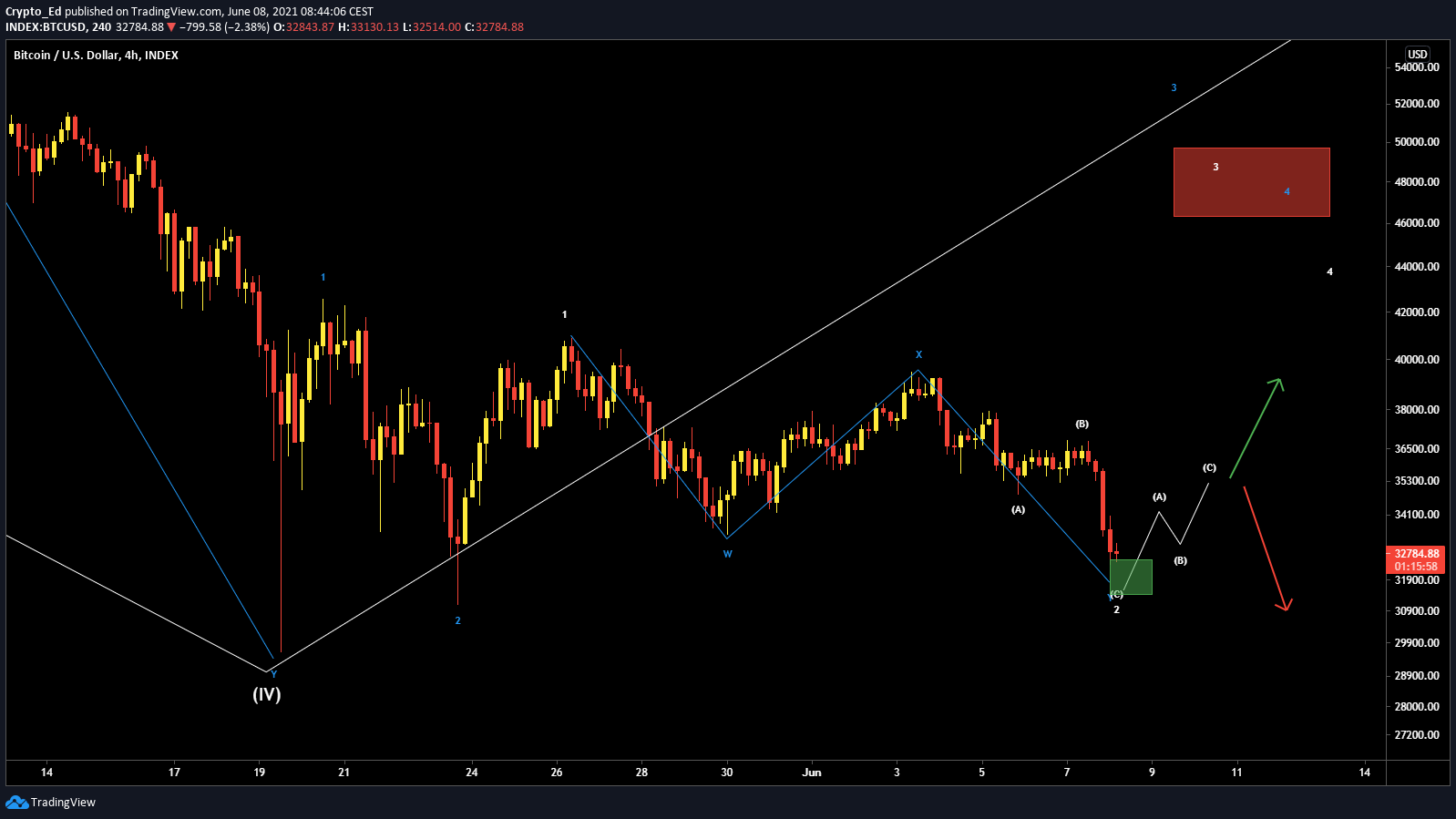

For common dealer Crypto Ed, the outlook was uninspiring — and even included a visit under the $30,000 mark.

“It did the white ABC I posted earlier than the weekend,” he told Twitter followers, referring to a forecast worth rotation.

“Now in inexperienced field however I might count on 1 extra leg down in the present day, adopted by a bounce to ~35k From there down once more, sub 30k, or ‘up solely’ once more, however the latter feels extra like a miracle tbh.”

Transferring averages trigger alarm

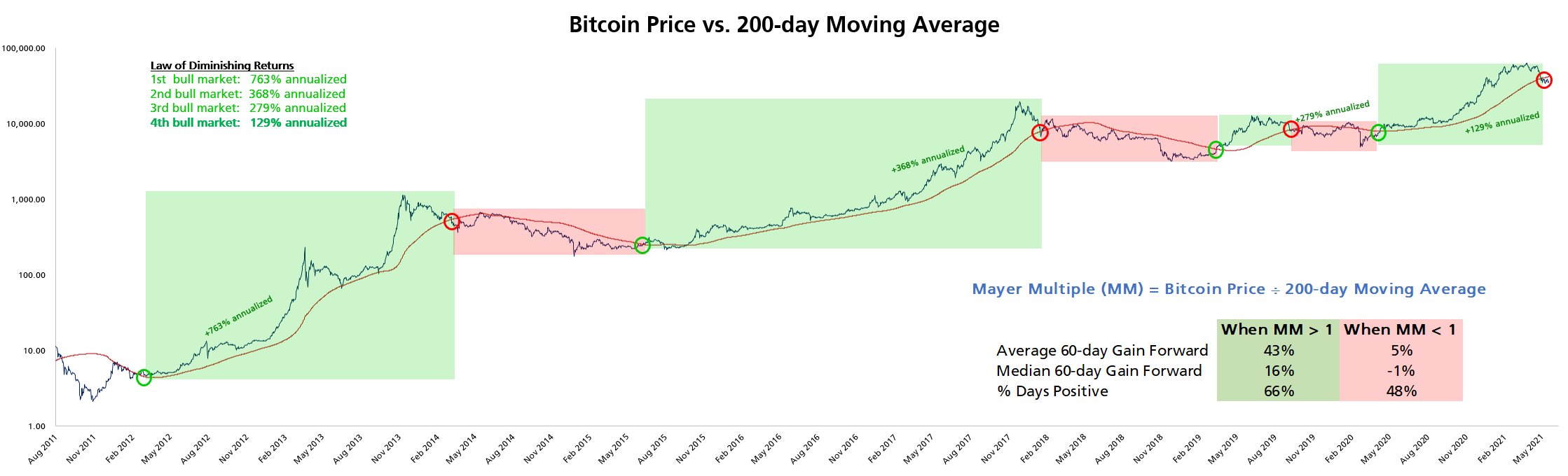

As Cointelegraph reported, merchants are already on edge over a possible “dying cross” involving two key shifting averages which may spell additional draw back.

This might lengthen past the quick time period, Cane Island Different Advisors funding supervisor Timothy Peterson noted, due to BTC/USD now lingering under its 200-day shifting common for nearly three weeks.

“This metric has *all the time* marked the tip of a bull run and the beginning of a bear market,” he added in feedback on Monday.

Source link