Bull market optimism returned to the cryptocurrency market on July 26 after Bitcoin (BTC) worth rallied above the $40,000 stage for the primary time in over six weeks.

At this time’s rally to $40,581 was a continuation of the July 25 breakout which noticed BTC worth rocket to $48,110 at Binance af a brief squeeze resulted in almost $500 million in shorts being liquidated in simply two minutes.

Knowledge from Cointelegraph Markets Professional and TradingView reveals that BTC spiked to an intraday excessive at $40,581 on Monday earlier than pulling again to $37,500 as bulls look to flip this resistance zone again to help in preparation for an extra transfer increased.

Whereas the transfer increased has the mark of a development change and has prompted some analysts to proclaim the bull market is again on monitor, on-chain information and the perpetual funding charges don’t totally concur with this perspective. Particularly when one considers that the present breakout might have solely been the results of an enormous brief squeeze.

Elements that might reignite the bull market

Based on Élie Le Relaxation, accomplice at digital asset administration agency ExoAlpha, the just lately denied rumor that Amazon would settle for cryptocurrency funds have the potential to have the same impact because the 2020 revelation from PayPal that it could combine cryptocurrencies. Le Relaxation stated that if the Amazon information seems to be true, this “could possibly be the catalyst to ignite a bull run in H2 of 2021.”

As Bitcoin worth pushed above the $35,000 stage on July 25, “greater than a billion {dollars} of shorts obtained liquidated prior to now 24 hours, with the majority of the liquidation occurring in lower than 1 hour” in accordance with Le Relaxation, who additionally stated, “the present market transfer could possibly be sustained in the course of the week by volumes coming from gamers having waited for a extra directional development on Bitcoin because the finish of Could.”

Le Relaxation stated:

“To validate this directional development, Bitcoin has to interrupt out of the $30,000-$40,000 vary it has been caught into for two months. Sustaining Bitcoin over the $40,000 stage would sign that the “bear market” is over and the bull-run might resume.”

If Bitcoin is ready to keep its present momentum, Le Relaxation stated “as many anticipate, Bitcoin might get again on monitor with the Inventory to Circulation mannequin and attain the $100,000 mark by year-end.”

On-chain information will not be so bullish

Warning is warranted in opposition to being overly bullish and information from Glassnode means that a number of bearish threats stay legitimate.

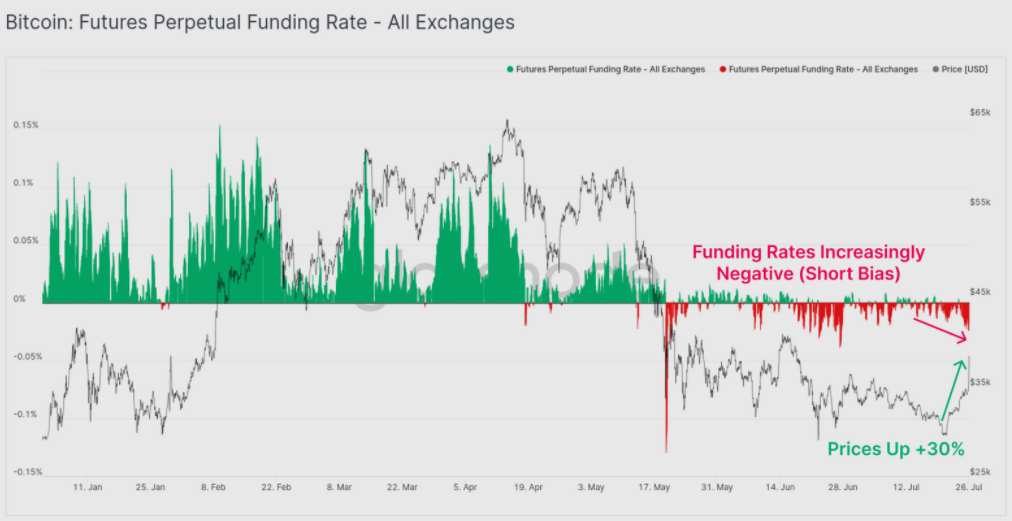

When analyzing the directional bias of the futures markets, Glassnode discovered that “perpetual funding charges have continued to commerce destructive,” which “signifies the online bias stays brief Bitcoin.”

Glassnode stated:

“This metric particularly helps us establish that Monday’s worth rally is probably going related to an general brief squeeze, with funding charges persevering with to commerce at much more destructive ranges regardless of worth rallying +30%.”

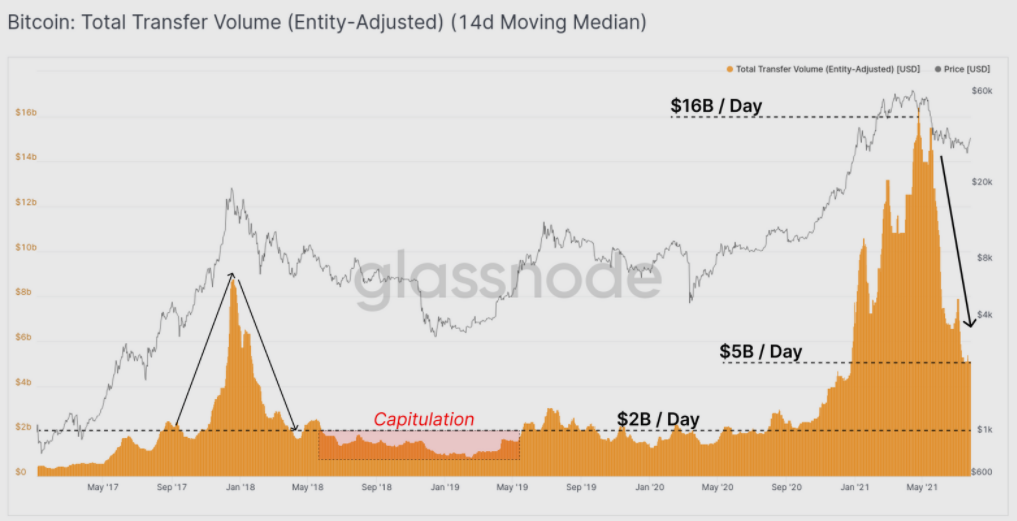

Glassnode additionally pointed to Bitcoin on-chain exercise and highlighted that “in direct distinction to the volatility in spot and derivatives markets, the transaction quantity and on-chain exercise stays extraordinarily quiet.”

General, how on-chain switch quantity responds to the latest worth motion in Bitcoin will present higher perception into the place the market is headed, however as famous by Glassnode, “it stays to be seen whether or not on-chain volumes begin to choose up in response to latest risky price-action.”

Associated: DeFi tokens e-book double-digit features after Bitcoin rallies above $39,000

Altcoins comply with Bitcoin’s lead

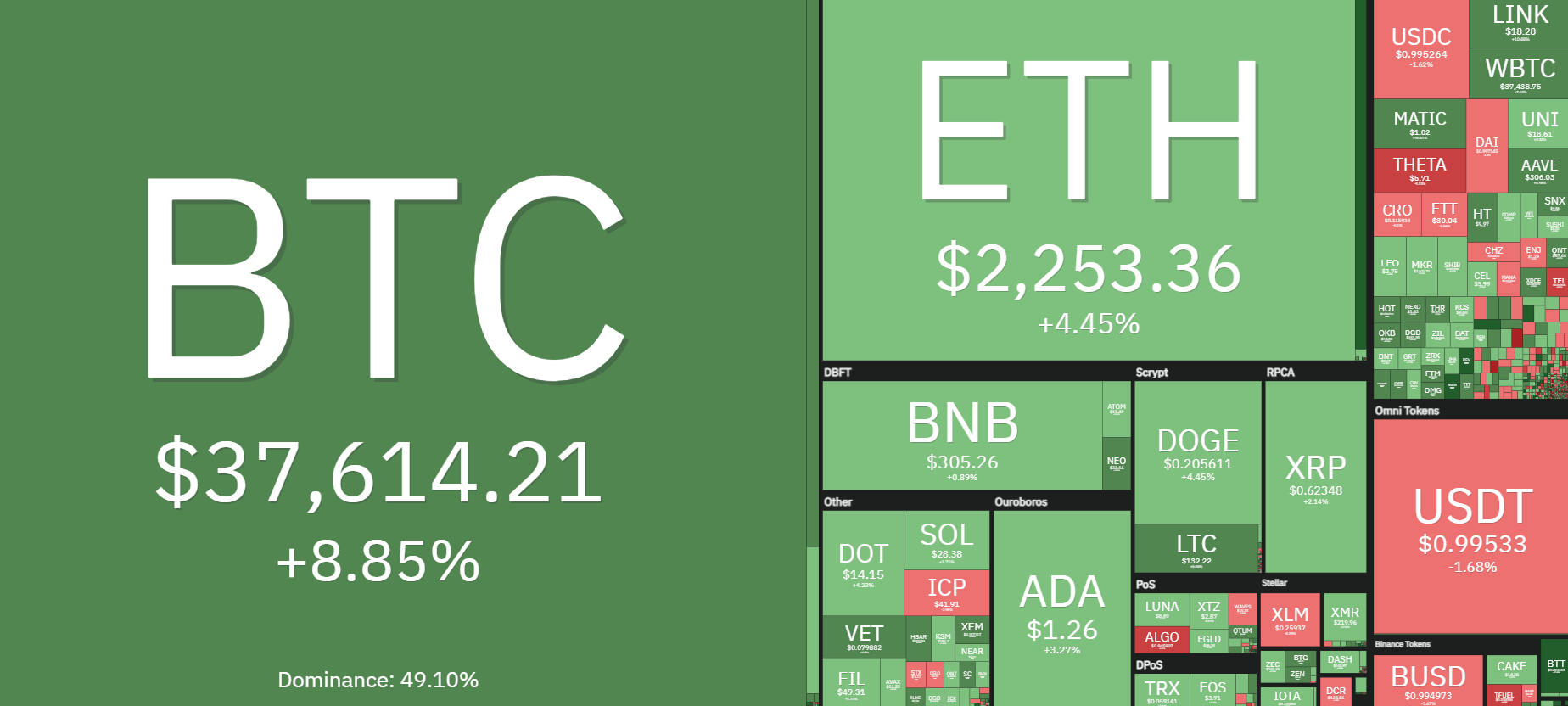

Bitcoin’s restoration above $40,000 additionally helped spark robust rallies in most altcoins.

Ether (ETH) gained of 11% to hit a each day excessive at $2,433, whereas Dogecoin (DOGE) posted a 7% acquire and trades at $0.208.

Different notable gainers embrace a 64% acquire for Strike (STRK), a 55% rally in Venus (XVS) and a 20% breakout in VeChain Thor (VTHO) and Ankr (ANKR).

The general cryptocurrency market cap now stands at $1.46 trillion and Bitcoin’s dominance price is 47.4%.

The views and opinions expressed listed here are solely these of the creator and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer entails danger, it is best to conduct your personal analysis when making a choice.

Source link