Bitcoin (BTC) dropped to native lows of $33,750 on June 20 as fears over weak assist ranges proved to be properly based.

Knowledge from Cointelegraph Markets Professional and TradingView confirmed BTC/USD swiftly dropping beneath $34,000 on Sunday after uneven conduct at first of the weekend.

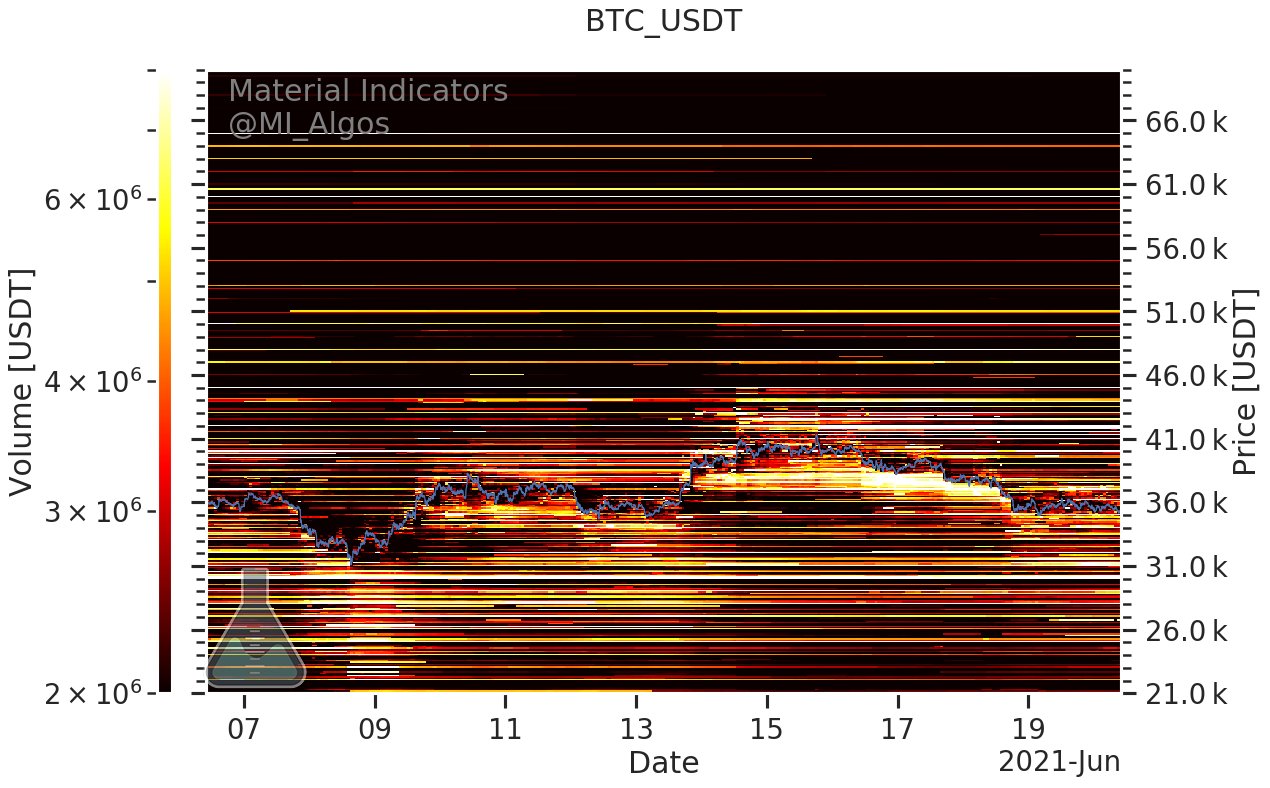

A comedown from resistance at close to $40,000 continued to unfold, with low volumes highlighting little curiosity in defending worth motion a lot above $30,000.

Orderbook knowledge from Binance confirmed this on the day, with sellers eradicating a serious purchase wall above $36,500 to go away the subsequent important assist degree at simply $31,000.

Amongst merchants, discuss principally revolved across the so-called “loss of life cross” on the BTC/USD every day and hourly charts which occurred on Friday. This refers back to the 50-day shifting common crossing over the 200-day shifting common, and is historically thought of to be a nasty omen for worth stability.

Traditionally, not all loss of life crosses have resulted in losses — as Cointelegraph reported, some are adopted by bullish phases.

“A loss of life cross is overrated,” common dealer Crypto Ed summarized earlier within the week.

“The one factor it is telling you, is that you’re very late when opening shorts. A lot of the down strikes already occur earlier than the cross.”

In a separate commentary, Adam Again, CEO of Blockstream, likewise took Twitter customers to job over the unfavourable skew given to loss of life cross occasions.

On the time of writing, nonetheless, Bitcoin nonetheless traded down 5% on the day, whereas 3-day losses totaled over 14%.

Liquidations have been mounting on exchanges, with virtually $150 million of positions gone in only a single hour after a flash dip of round $800.

Grayscale traders get a promote alternative

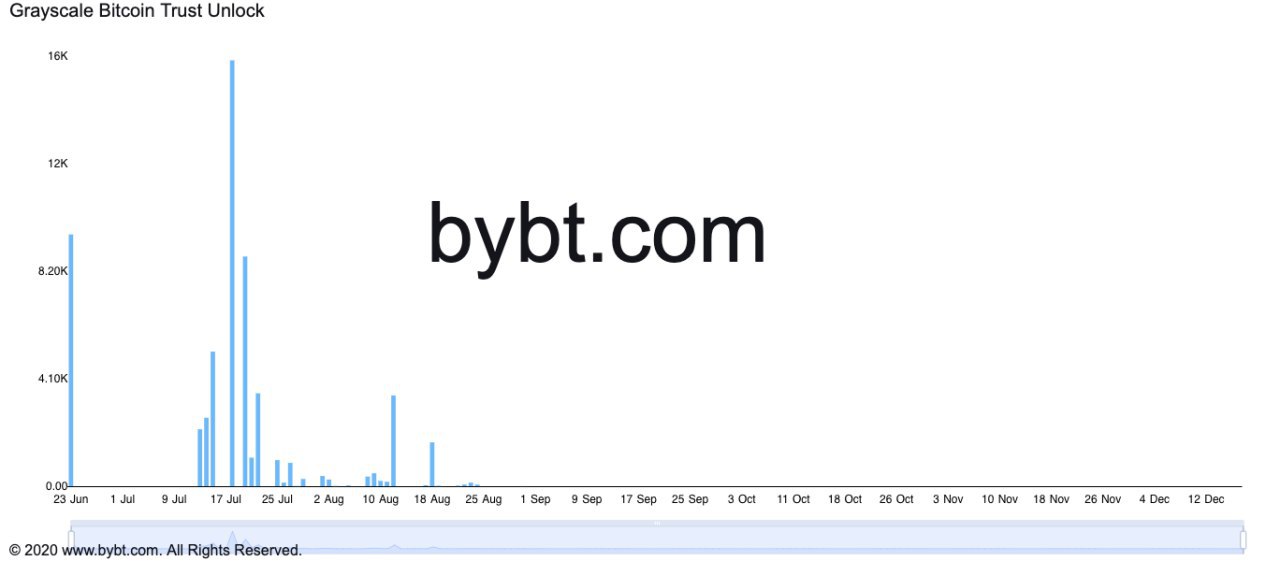

One other concept about worth course concerned an impending “unlocking” part at institutional big Grayscale.

As Cointelegraph beforehand famous, the approaching weeks will see a big chunk of investor funds launched after a 6-month lock-up interval, with the potential for promoting stress to subsequently enhance as accredited traders search to offset a few of their losses (realized after promoting their GBTC shares) by promoting BTC on the spot market.

Thereafter, against this, there needs to be a major lack of sell-side exercise.

Fundamentals see growing retracement

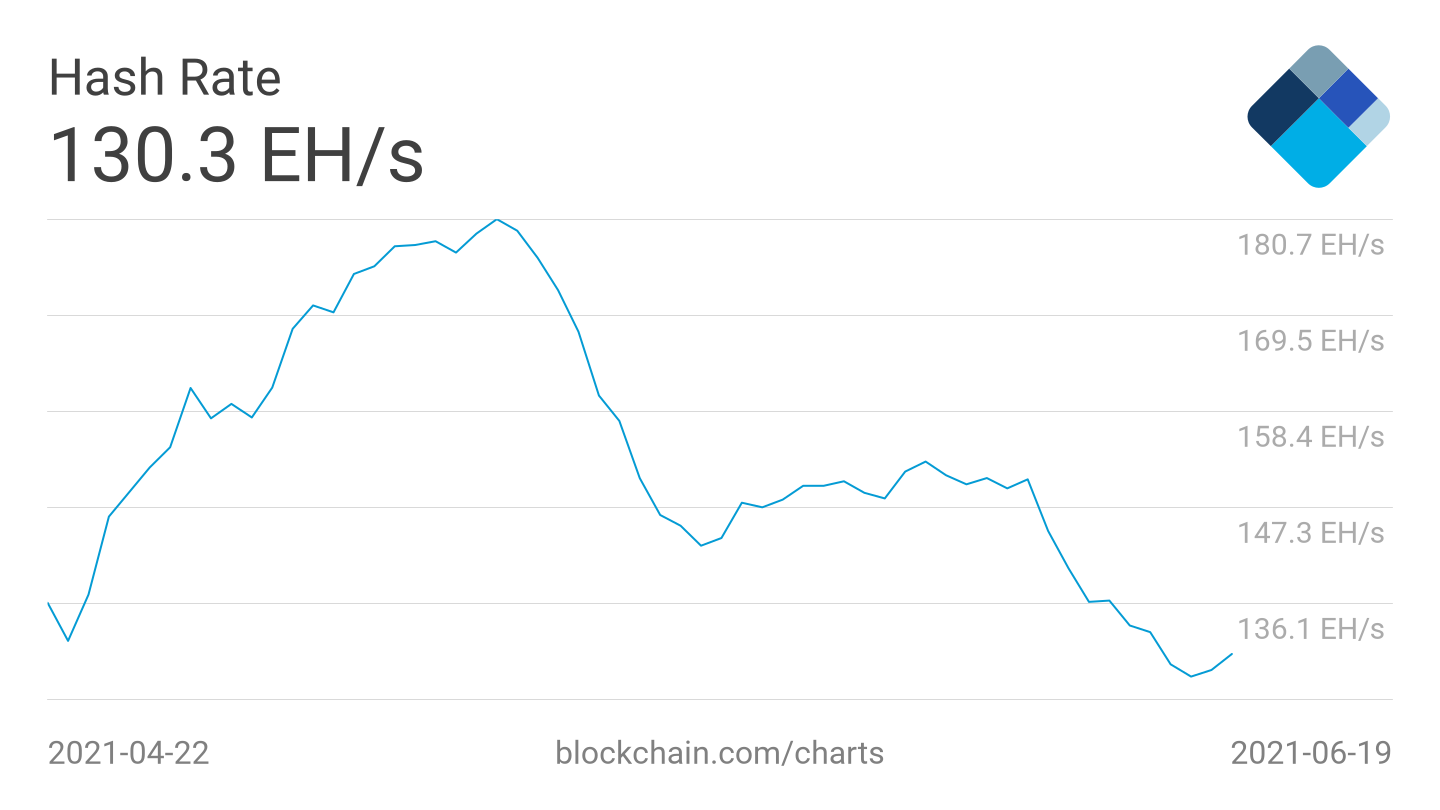

A take a look at community fundamentals in the meantime gave extra trigger for concern. Hash charge, already in flux because of shifts in miner distribution, fell beneath 100 exahashes per second (EH/s) having beforehand hit a peak of 168 EH/s.

Associated: Bitcoin might lose $30K worth degree if shares tank, analysts warn

Different estimates, whereas not actual, additionally depicted the hash charge downtrend.

Problem, recent from two consecutive downward changes, was on observe for a 3rd leg down of round 9.7% on the subsequent in round 9 days’ time.

The final time that Bitcoin noticed three downward problem changes in a row was in the course of the capitulation part of the earlier bear market in late 2018.

Source link