Bitcoin (BTC) closed its third crimson month-to-month candle in a row this week as a preferred analyst likened BTC value motion to January 2019.

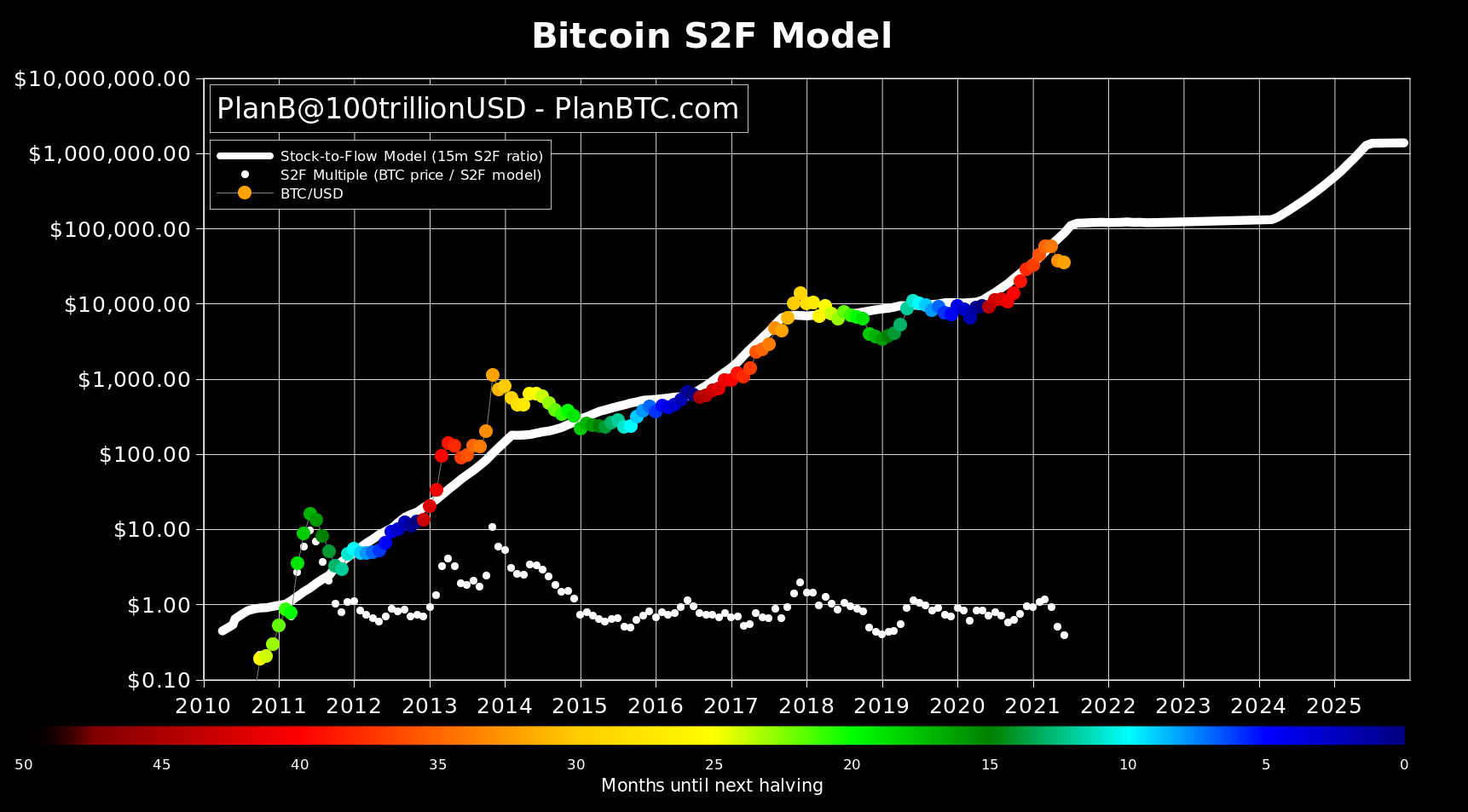

In a tweet on Thursday, PlanB mentioned that BTC/USD is now the furthest away from his stock-to-flow mannequin’s estimates in over two years.

Inventory-to-flow “make or break”

After Could’s big capitulation occasion, Bitcoin value motion has didn’t regain misplaced floor, staying round 50% beneath latest all-time highs.

Consequently, value fashions are getting a critical take a look at — whilst on-chain indicators are starting to flash bullish once more.

Within the case of stock-to-flow, which requires a mean value of no less than $100,000 this halving cycle, the scenario is getting precarious.

Well-known for its accuracy, the mannequin has accounted for each twist and switch in BTC value motion since its inception. Now, nevertheless, the spot value is nearing the bounds of what it could possibly accommodate.

“Even for me it’s all the time a bit uneasy when bitcoin value is on the decrease sure of the stock-to-flow mannequin,” PlanB admitted final week.

Nonetheless, given the adjustments that may happen in Bitcoin in a matter of months, there’s little trigger for concern about stock-to-flow changing into invalidated.

“June closing value $35,037 .. as far beneath S2F mannequin as in Jan 2019,” PlanB added on Thursday, implying that it’s nonetheless “enterprise as regular” for the mannequin’s relationship with value.

“Subsequent 6 months will likely be make or break for S2F (once more).”

Last time Bitcoin was so far from stock-to-flow, which predicts a value of $77,760 for Thursday, BTC/USD had simply emerged from the pit of the 2018 bear market, throughout which it dropped to simply $3,100.

A correction ready within the wings?

As Cointelegraph reported, value enjoying “catch-up” with on-chain indicators has change into one thing of a defining narrative in latest weeks.

Associated: Coincidence? Bitcoin noticed its highs and lows on ‘Turnaround Tuesdays’ in June

Yardsticks akin to the favored Puell A number of are hinting {that a} value backside is on the playing cards, in step with historic precedent, with an implied bounce to comply with.

appears like nonetheless monitoring -25% #bitcoin problem alter for friday. https://t.co/TuqYAFU1wU bitcoin unaffected, tick-tock subsequent block. mining profitability pic.twitter.com/yONPd88xJq

— Adam Again (@adam3us) June 29, 2021

The continuing relocation of mining energy away from China also needs to change into much less of a priority as soon as full. The mining problem is about for its biggest-ever decline this weekend on account of the upheaval, one thing that may quickly enhance income for miners and entice some new mining energy.

Source link