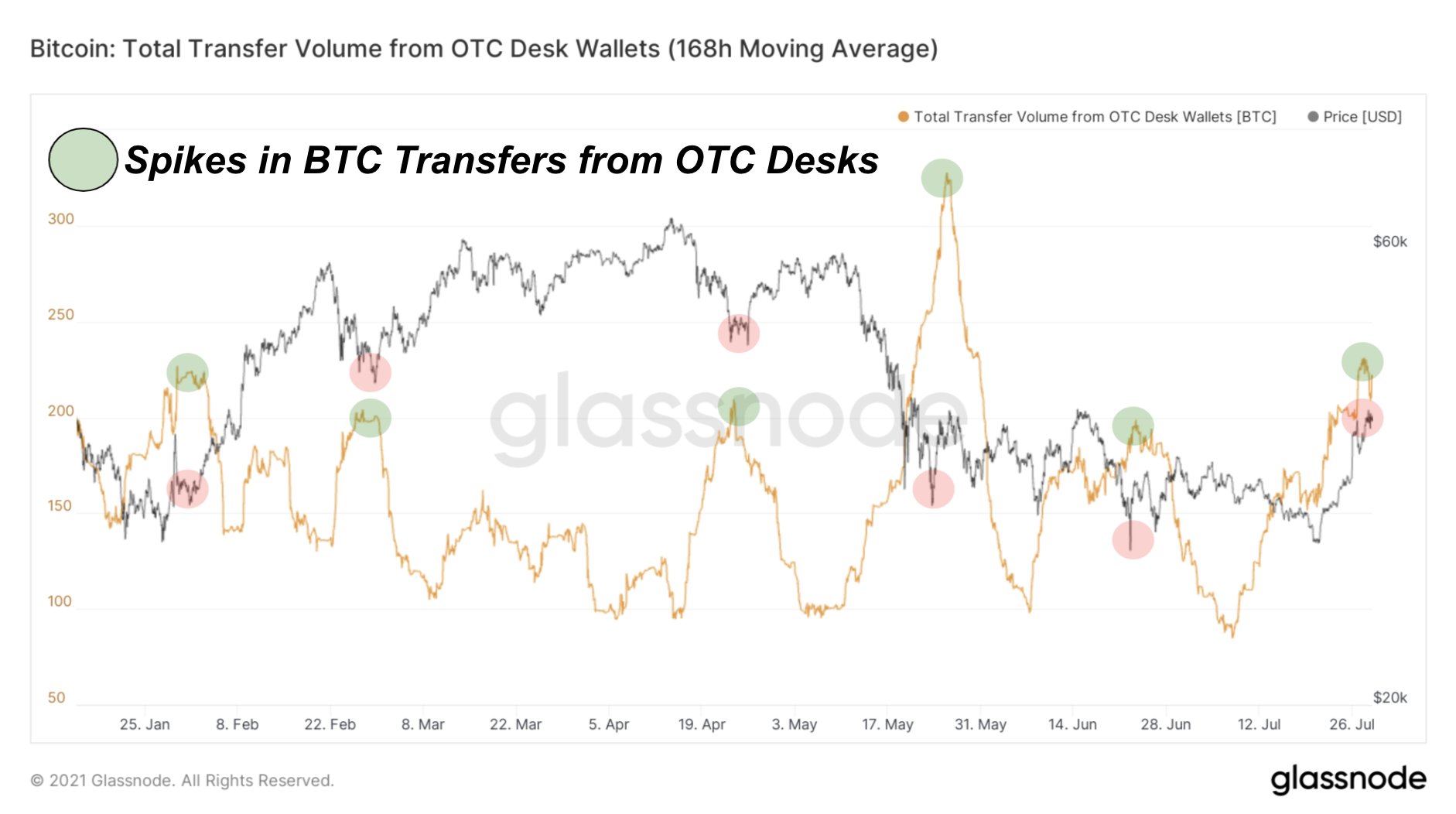

Bitcoin (BTC) is being aggressively purchased up by institutional entities this week as information reveals over-the-counter (OTC) buying and selling volumes spiking.

As noted by Dylan LeClair, co-founder of analytics and advisory agency twenty first Paradigm, excessive internet value people have clear curiosity in Bitcoin at present costs.

Traders ramp up BTC exercise

Citing information from on-chain monitoring useful resource Glassnode, LeClair eyed a sudden uptick in OTC exercise only a BTC/USD hit native highs of $40,700.

A traditional tandem occasion, OTC buying and selling will increase are inclined to accompany a BTC worth spike.

In Might and June following the comedown from these highs, OTC entities purchased on non permanent worth dips. The identical phenomenon has occurred all through the 2021 bull run, even earlier than all-time highs appeared and BTC/USD was nonetheless on the way in which up.

“Huge switch volumes from OTC Desks over the past week,” he commented.

“Excessive internet value people & establishments need your Bitcoin.”

Whereas the newest spike was not the biggest by way of quantity, information reveals spectacular flows from main exchanges.

As Cointelegraph reported, round 57,000 BTC left exchanges in a single day Wednesday, whereas Thursday noticed Kraken alone shift an enormous 98,000 BTC as buy-ins accelerated throughout the market.

Regardless of dropping over $400 million on its BTC stash in Q2, in the meantime, MicroStrategy, arguably the king of institutional Bitcoin buyers, has already pledged to purchase extra.

….However decrease costs persist

Friday’s worth efficiency could in the meantime precipitate a replay of earlier shopping for curiosity.

Associated: Bitcoin merchants specific blended feelings about what’s subsequent for BTC worth

On the time of writing, BTC/USD circled $38,600, having dived 2.7% in an hour as a streak of bearish sentiment entered the market.

Whereas nothing uncommon, the volatility highlights the problem bulls face in overcoming resistance, be it psychological at $40,000 or technical at $41,000 and above.

Patiently ready for volatility to kick in on #Bitcoin right here.

Caught in a small vary. pic.twitter.com/Xu6ZJgdNaJ

— Michaël van de Poppe (@CryptoMichNL) July 30, 2021

Given the relative lack of volatility over the previous 24 hours, nonetheless, such a transfer was broadly anticipated amongst merchants ready for the next low after the journeys above $40,000.

Source link