The ghost of inventory market crash is again once more to hang-out Bitcoin (BTC).

It occurred final in March 2020. Again then, the prospect of the fast-spreading coronavirus pandemic led to lockdowns throughout developed and rising economies. In flip, world shares crashed in tandem, and Bitcoin misplaced half of its worth in simply two days.

In the meantime, the U.S .greenback index, or DXY, which represents the buck’s power in opposition to a basket of prime foreign currency, has now climbed by 8.78% to 102.992, its highest degree since January 2017.

The large inverse correlation confirmed that traders dumped their shares and Bitcoin holdings and sought security in what they thought was a greater haven: the buck.

Greater than a yr later, Bitcoin and inventory markets once more wrestle with an identical bearish sentiment, this time led by a renewed demand for the U.S. greenback following the Federal Reserve’s hawkish tone.

Specifically, the U.S. central financial institution introduced Wednesday it is going to begin climbing its benchmark rates of interest by the tip of 2023, a yr sooner than deliberate.

Decrease rates of interest helped to drag Bitcoin and the U.S. inventory market out of their bearish slumber. The benchmark cryptocurrency jumped from $3,858 in March 2020 to nearly $65,000 in April 2021 because the Fed pushed lending charges to the 0%-0.25% vary.

In the meantime, the S&P 500 index rose greater than 95% to 4,257.16 from its mid-March 2020 peak. Dow Jones and Nasdaq rallied equally, as proven within the chart beneath.

And that is what occurred after the Federal Reserve’s rate-hike announcement on Wednesday…

In the meantime, the U.S. greenback index jumped to its two-month excessive, hinting at a renewed urge for food for the buck in world markets.

Common on-chain analyst Willy Woo said on Friday {that a} inventory market crash coupled with a rising greenback might enhance Bitcoin’s bearish outlook.

“Some draw back danger if stonks tank, a number of rallying within the DXY (USD power) which is typical of cash transferring to security,” he defined.

Michael Burry, the pinnacle of Scion Asset Administration, additionally sounded the alarm on an imminent Bitcoin and inventory market crash, including that when crypto markets fall from trillions, or when meme shares fall from billions, the Important Road losses will strategy the dimensions of nations.

“The issue with crypto, as in most issues, is the leverage,” he tweeted. “If you do not know how a lot leverage is in crypto, you do not know something about crypto.”

Burry deleted his tweets later.

Some bullish hopes

Away from the worth motion, Bitcoin’s adoption continues to develop, an upside catalyst that was lacking in the course of the March 2020 crash.

On Friday, CNBC reported that Goldman Sachs has began buying and selling Bitcoin Futures with Galaxy Digital, a crypto service provider financial institution headed by former hedge fund tycoon Mike Novogratz. The monetary information service claimed that Goldman’s name to rent Galaxy as its liquidity supplier got here in response to rising strain from its rich shoppers.

Associated: Hawkish Fed feedback push Bitcoin worth and shares decrease once more

Damien Vanderwilt, co-president of Galaxy Digital, added that the mainstream adoption would assist Bitcoin decrease its notorious worth volatility, paving the best way for institutional gamers to affix the crypto bandwagon. Excerpts from his interview with CNBC:

“As soon as one financial institution is on the market doing this, the opposite banks may have [fear of missing out] and so they’ll get on-boarded as a result of their shoppers have been asking for it.”

Earlier, different main monetary and banking companies, together with Morgan Stanley, PayPal, and Financial institution of New York Mellon, additionally launched crypto-enabled companies for his or her shoppers.

Is Bitcoin in a bear market?

Referring to the query “are we in a bear market?” Woo stated that Bitcoin adoption continues to look wholesome regardless of the latest worth drop. The analyst cited on-chain indicators to point out an rising consumer progress and capital injection within the Bitcoin market.

Of major curiosity is capital rotation from stablecoins again into the crypto markets (I will say that is primarily BTC since alt cash are lowering in dominance).

All of that dry powder sitting on the sidelines has began flowing again in. pic.twitter.com/v1jRDMD1sm

— Willy Woo (@woonomic) June 18, 2021

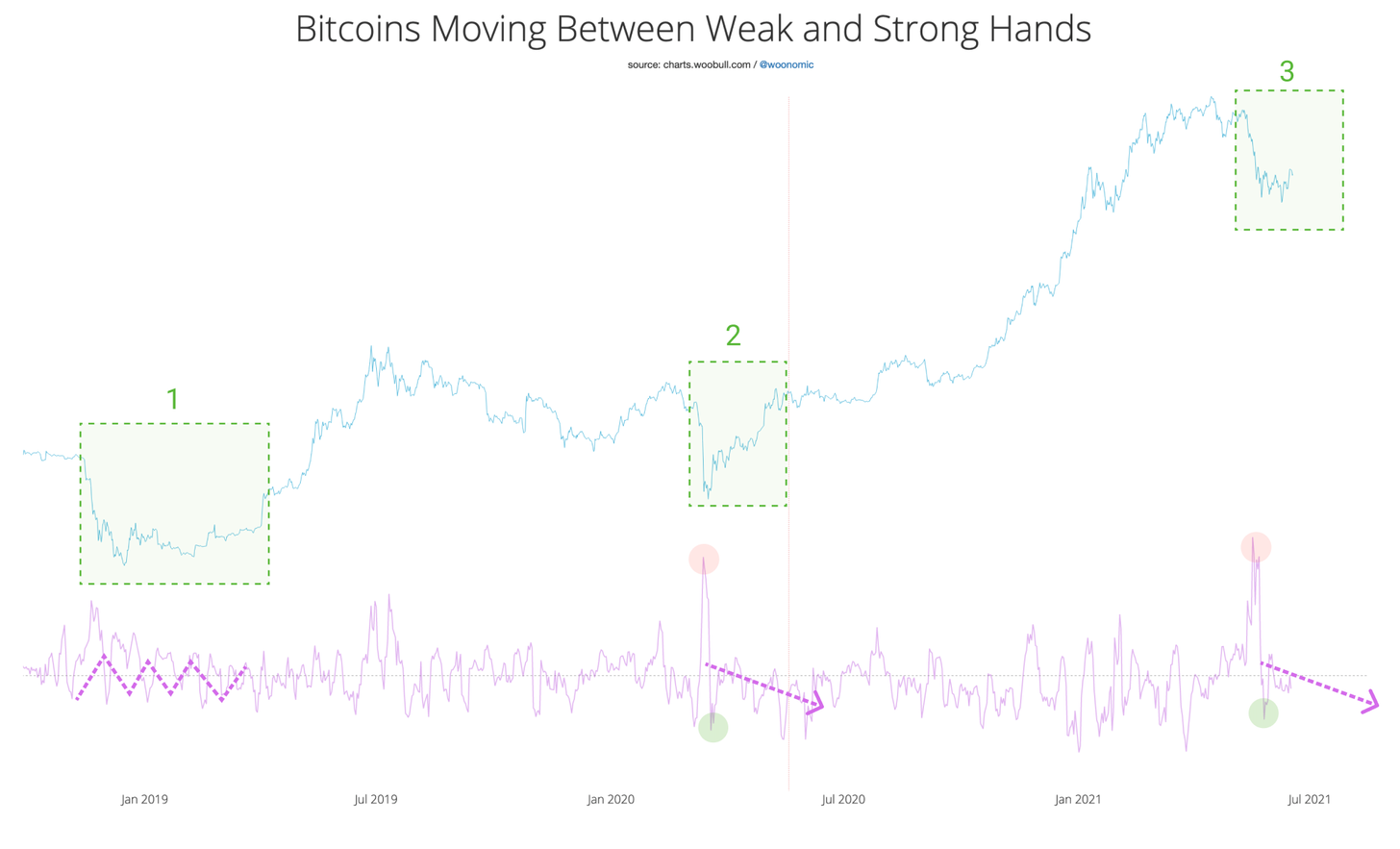

He additionally famous that the latest Bitcoin sell-off merely transported BTC from weak fingers to robust fingers.

Woo reminded:

“My solely concern for draw back danger is that if we get a significant correction in equities which can pull BTC worth downwards it doesn’t matter what the on-chain fundamentals could counsel. Noticing USD power on the DXY, which counsel some traders transferring to security within the USD.”

Source link