Bitcoin (BTC) reached its highest degree in additional than two months with only a few days remaining earlier than the July inflation report.

The highest cryptocurrency climbed 1.65% to $45,363 on Aug.8, persevering with the upside momentum that has already seen it leaping 21.62% from its August 5 low of $37,300.

Momentum was sturdy among the many Bitcoin rivals as properly. Ether (ETH), the second-largest crypto by market cap, elevated 29.78% from its Aug. 3 low of $2,630, crossing over $3,100 on Sunday. Its good points got here after Ethereum’s London exhausting fork went dwell on Aug. 5, which ought to add deflationary stress to the availability of ETH.

July inflation report, on-chain

On Wednesday, Aug.11, america Bureau of Labor Statistics will launch July’s inflation report, with markets forecasting a 0.5% spike. The projections seem after the buyer worth index (CPI) jumped to five.4% year-over-year in June to log its greatest enhance in 13 years.

Bitcoin bulls have responded positively to the latest inflation experiences. They successfully guarded the cryptocurrency towards falling beneath $30,000 after the Might 19 crash. In the meantime, their latest efforts to push the costs above $40,000, ultimately main right into a gradual upside break above $45,000, signifies sturdy demand for Bitcoin, which seems to be breaking out of its summer season hunch.

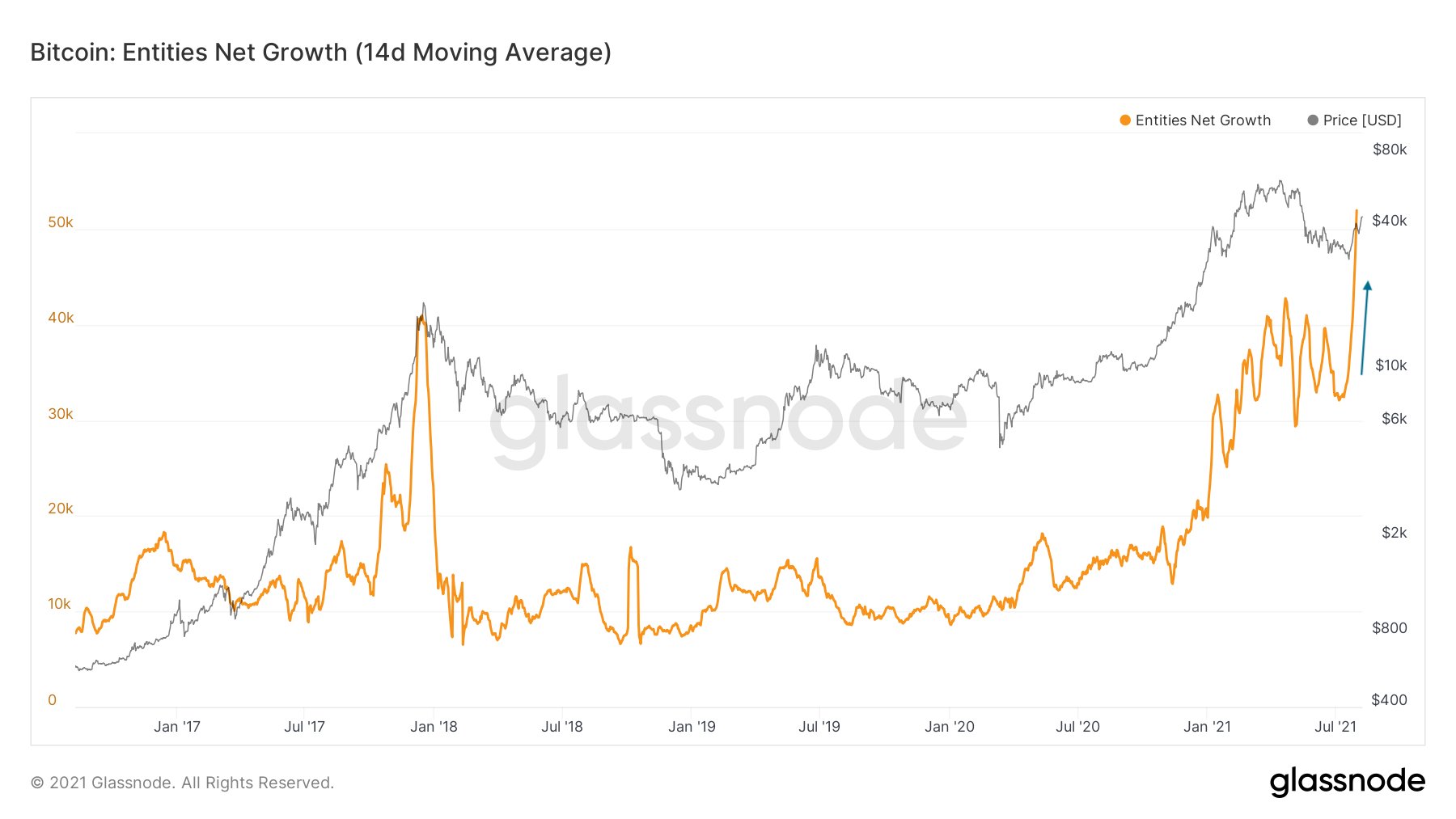

Lex Moskovski, chief funding officer at Moskovski Capital, highlighted a Glassnode chart that confirmed dramatic spikes in entities getting into the Bitcoin community, matching the expansion with the rising BTC/USD charges.

“Quantity of latest Bitcoin entities continues to hit all-time excessive,” Moskovski tweeted.

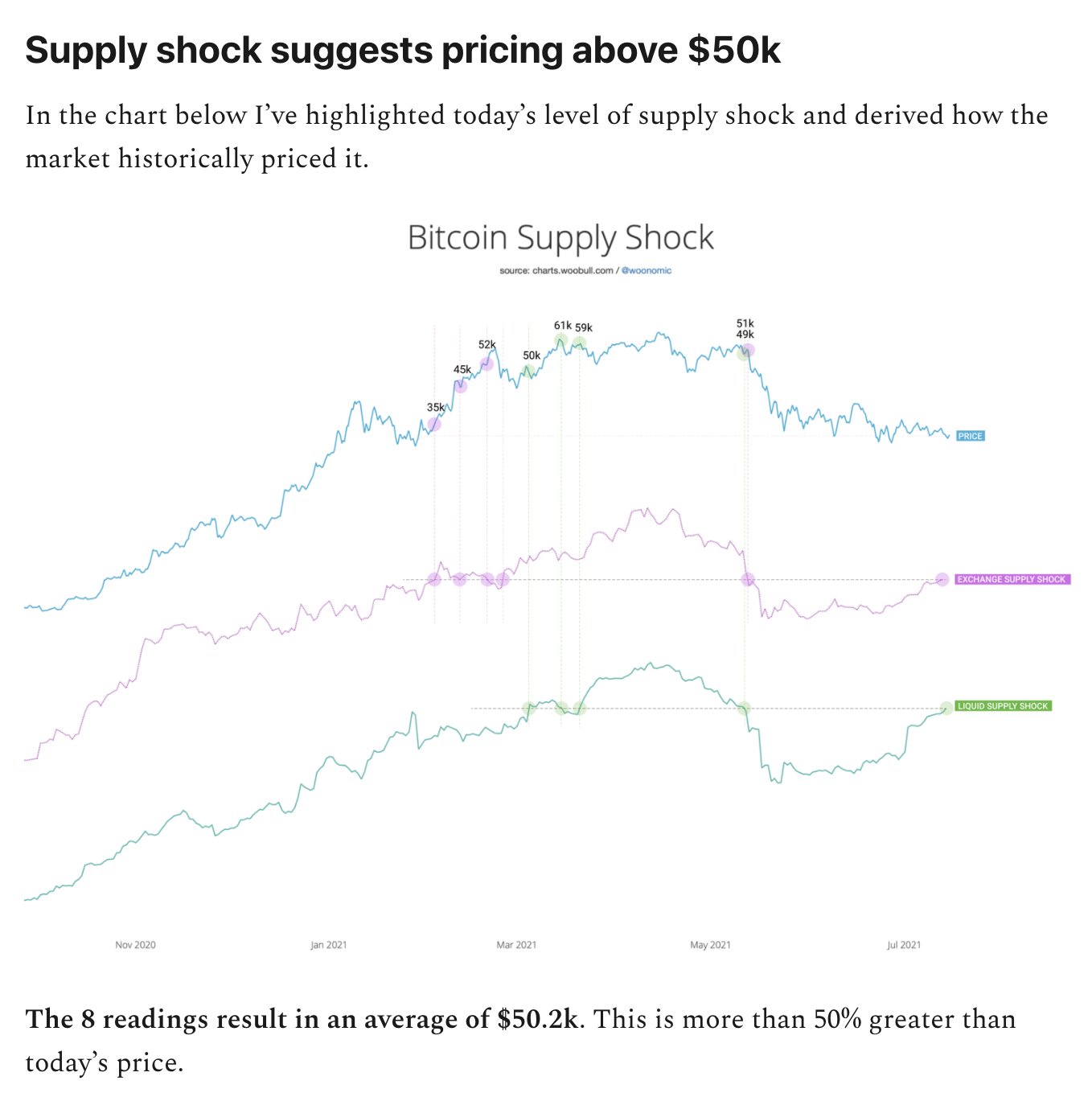

Moreover, on-chain analyst Willy Woo mentioned the continuing Bitcoin momentum ought to push its costs above $50,000, citing supply-demand imbalance available in the market. He mentioned that each one investor cohorts have been shopping for Bitcoin, which led to produce shock.

Associated: Right here’s what merchants anticipate now that Ethereum worth is over $3,000

Woo referred to a chart he posted on July 15 when Bitcoin market was correcting decrease after peaking out sessional at $36,675. The graph, as proven beneath, highlighted occasions of Bitcoin liquidity shock throughout all of the exchanges and their relation to the costs.

Woo defined:

“Fundamentals don’t predict short-term worth, however given sufficient time worth discovery reverts to fundamentals. [The] precise worth is $53.2k as we speak, with an ordinary deviation band between $39.6k - $66.8k (68.5% confidence).”

Bearish fractal

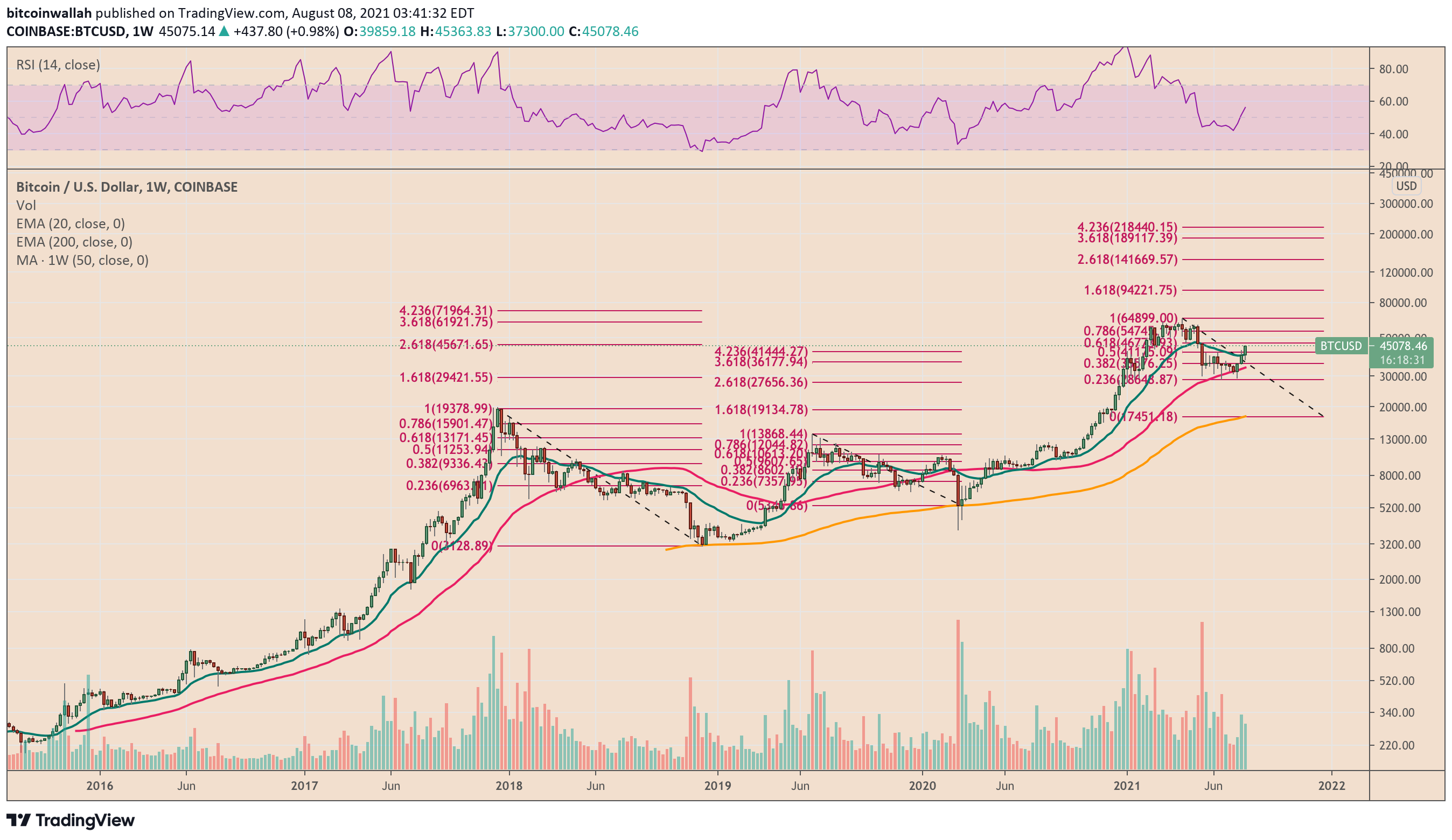

Nevertheless, the newest Bitcoin climb does carry dangers of turning into a lifeless cat bounce based mostly on earlier top-to-bottom Fibonacci retracement fractals.

After organising document highs, Bitcoin tends to right towards its 200-week exponential shifting common (200-week EMA; the yellow wave), the place it will definitely bottoms out to pursue one other bullish cycle.

Prior to now two occasions, the BTC/USD trade fee posted pretend restoration rallies after testing the 23.6 Fib line as help. These upside strikes failed wanting turning into massive bullish momentums after going through resistance at greater Fib ranges.

Associated: 3 the reason why Ethereum is unlikely to flip Bitcoin any time quickly

For example, in 2019, Bitcoin rebounded by greater than 50% after bouncing off from its 23.6 Fib line close to $7,357. However the cryptocurrency confronted excessive promoting stress close to its 61.8 Fib line of $10,613. Finally, it resumed its downtrend and crashed to as little as $3,858 in March 2020.

If the fractal repeats, Bitcoin might face excessive resistance at 61.8 Fib degree at $46,792 and proper decrease to retest its 200-day EMA, which presently sits beneath $20,000.

Unbiased market commentator and dealer Keith Wareing steered that an imminent bullish crossover between Bitcoin’s two weekly shifting averages hints in the beginning of a multi-month bull run. Dubbed as MACD, the indicator was instrumental in predicting the 2020 bull run.

“The weekly MACD is because of cross bullish on Bitcoin after tonight’s shut,” opined Wareing to his followers with the worth of Bitcoin up to now sustaining above $44,500 on the time of writing.

The views and opinions expressed listed here are solely these of the creator and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer entails threat, it’s best to conduct your personal analysis when making a call.

Source link