Bitcoin (BTC) value acquired a lift as information that lawmakers in Paraguay plan to current a invoice to make BTC authorized tender unfold throughout Twitter. Shortly after the unconfirmed information surfaced on Twitter, Bitcoin value rallied to $35,289 earlier than barely pulling again beneath the important thing short-term resistance stage.

Congratulations Paraguay

• a invoice has been submitted to make #BITCOIN authorized tender

• studying more likely to happen on July 14th

• they want to be a crypto hub

• promotion of inexperienced power mining

• some curiosity from Argentina & Brazil now too

— djThistle (@DJThistle01) June 24, 2021

Whereas the cryptocurrency Worry and Greed Index nonetheless signifies a sentiment of Excessive Worry, it’s price noting that the measure has risen from 14 on June 23 to 22 on June 24 as merchants start to view the drop beneath $29,000 and Bitcoin’s rising open curiosity as indicators that the present corrective section could have ended.

Whereas merchants’ sentiment could have improved barely, Cointelegraph analyst Marcel Pechman recommended that buyers could possibly be ready for the $6 billion in Bitcoin and Ether (ETH) quarterly futures and choices to run out on June 25 earlier than making a extra decisive transfer.

Shares attain new file highs, altcoins rally

The crypto market wasn’t the one market to rally at this time. Conventional markets additionally rose to new highs after U.S. President Joe Biden revealed that he had reached an settlement on a $953 billion bipartisan infrastructure spending plan with the Senate.

Following the announcement, the S&P 500 and Nasdaq every rallied to new file intraday highs and closed the day up 24.65 factors and 97.98 factors respectively, whereas the Dow gained greater than 322 factors on the day.

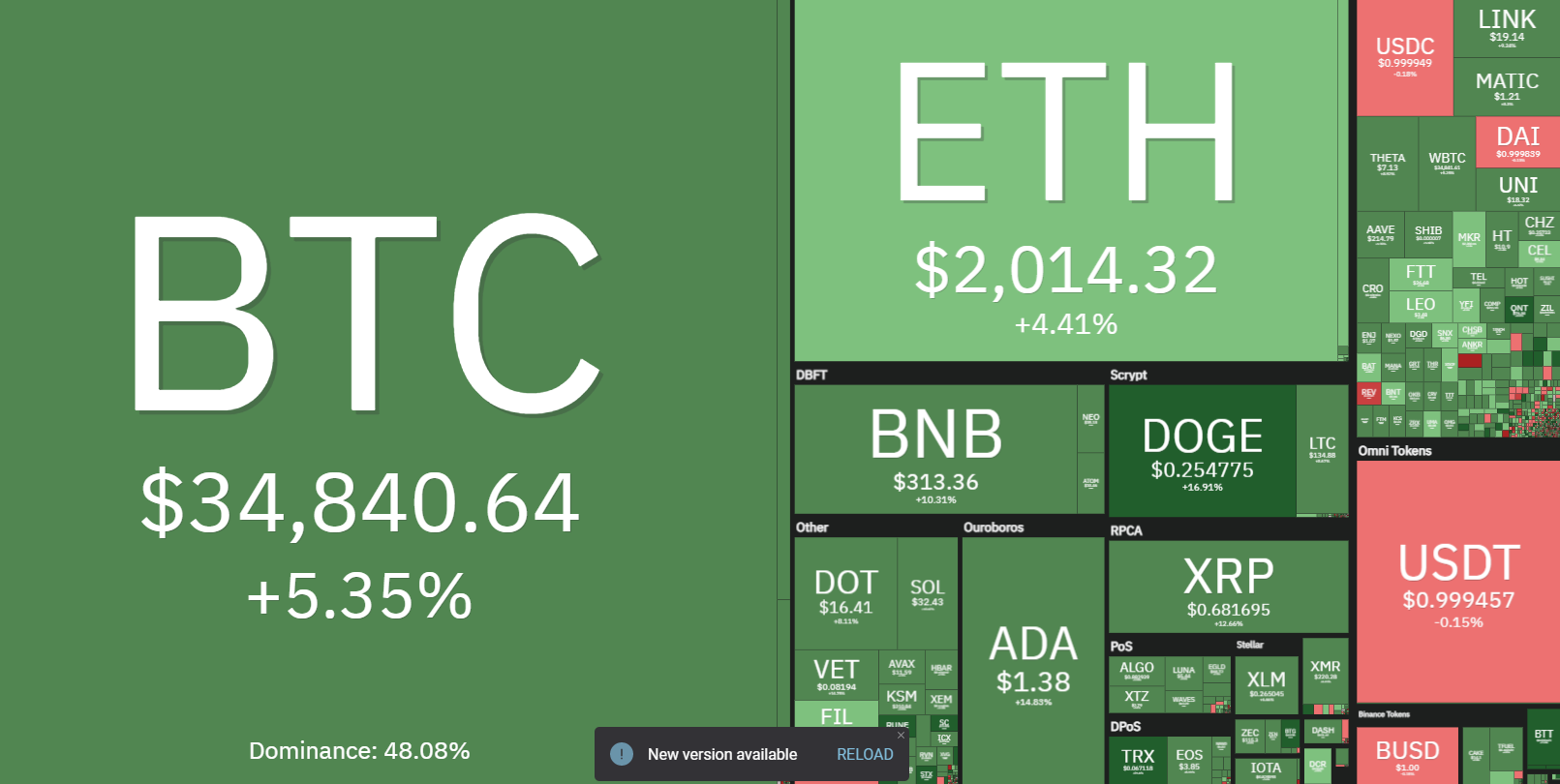

As one would count on, altcoins additionally surged greater as Bitcoin value and conventional markets moved greater. Ether (ETH) rallied again above the psychologically vital $2,000 stage, whereas Tron (TRX) and Celo gained 26% and 28% respectively. CELO’s transfer seems to be pushed by the itemizing of its Celo Euro (cEUR) stablecoin on KuCoin trade.

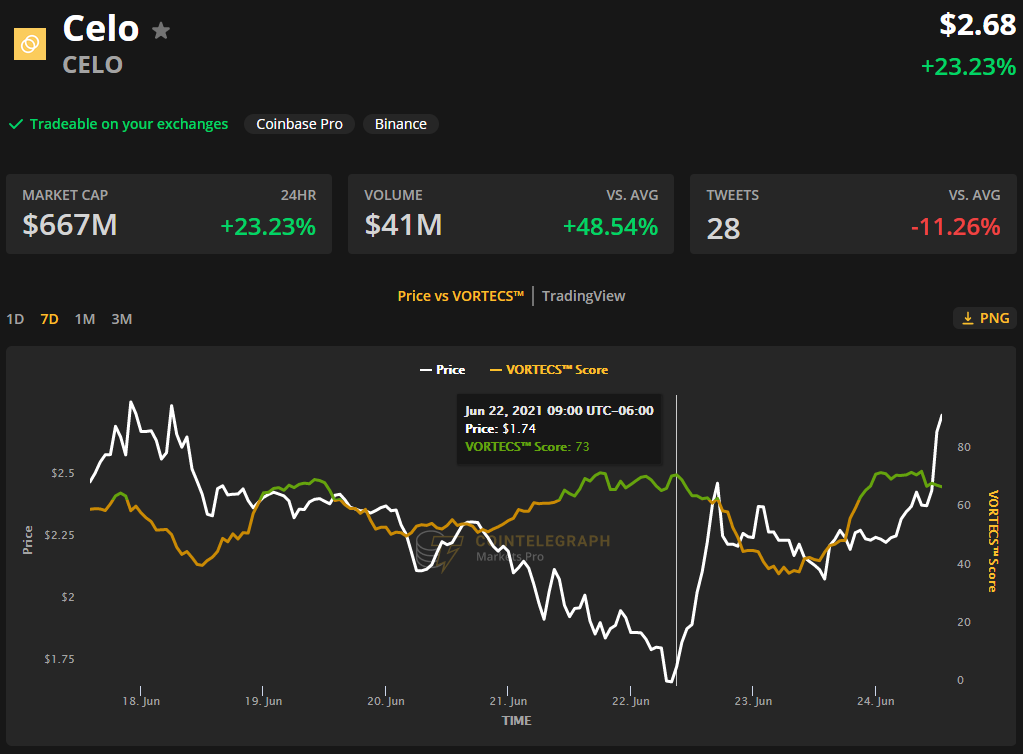

Previous to the current value rise, VORTECS™ information from Cointelegraph Markets Professional started to detect a bullish outlook for CELO on June 22.

The VORTECS™ Rating, unique to Cointelegraph, is an algorithmic comparability of historic and present market situations derived from a mix of information factors together with market sentiment, buying and selling quantity, current value actions and Twitter exercise.

As seen within the chart above, the VORTECS™ Rating for CELO climbed into the inexperienced and reached a excessive of 73 on June 22, one hour earlier than its value started to spike 56% over the following day. The VORTECS™ Rating turned inexperienced once more on June 24, reaching a excessive of 74 as CELO started to rally one other 25%.

The general cryptocurrency market cap now stands at $1.4 trillion and Bitcoin’s dominance fee is 46.6%.

The views and opinions expressed listed here are solely these of the writer and don’t essentially replicate the views of Cointelegraph.com. Each funding and buying and selling transfer includes threat, it’s best to conduct your individual analysis when making a choice.

Source link