Over the previous seven days, Bitcoin (BTC) has failed to interrupt by means of the $48,000 resistance, however its value has remained flat at the same time as Minneapolis Federal Reserve Chairman Neel Kashkari bashed the trade.

Throughout an look on the Pacific NorthWest Financial Area Annual Summit on Aug. 17, Kashkari mentioned:

“To this point, what I’ve seen is […] 95% fraud, hype, noise and confusion.”

Furthermore, Kashkari particularly focused Bitcoin when hementioned that its solely use case has been funding illicit actions.

Even with the present pullback, Bitcoin buyers ought to be glad that the $44,000 assist held as a result of the Federal Reserve additionally signaled its intent to unwind its $120-billion month-to-month purchases of Treasury and mortgage-backed securities.

With much less stimulus to assist the markets, buyers naturally change into extra risk-averse, which may have triggered a retracement in Bitcoin’s value.

With that in thoughts, merchants ought to be much less anxious about Friday’s $600 million Bitcoin choices expiry as a result of when the markets maintain throughout probably damaging information, it may be interpreted as bullish.

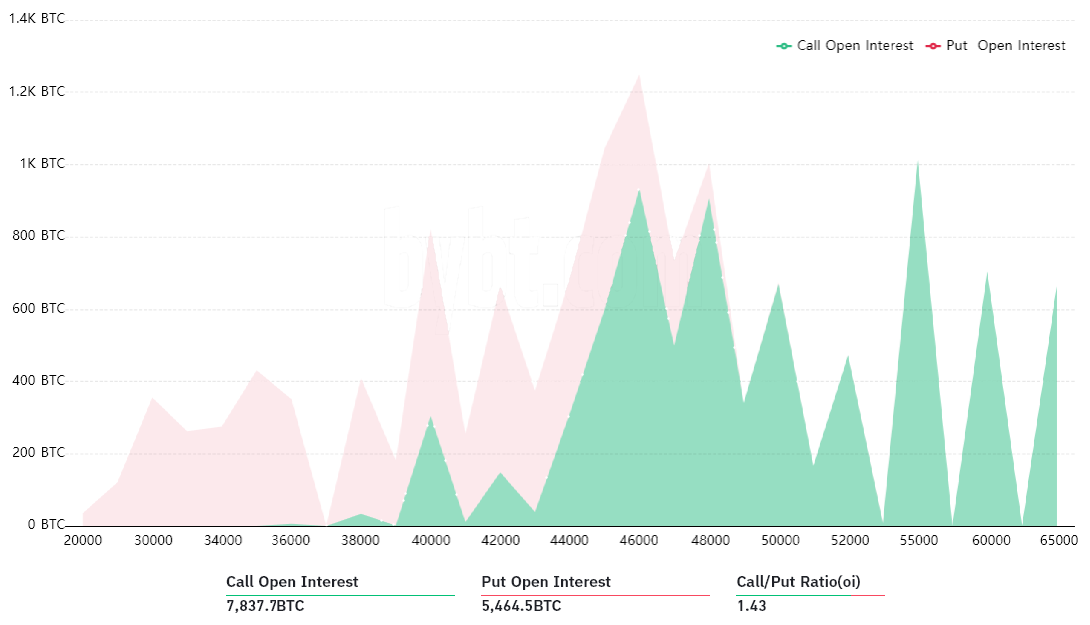

The decision-to-put ratio at present stands at 1.43 and favors the neutral-to-bullish name choices. This knowledge displays the 7,838 Bitcoin name choices stacked towards the 5,465 put choices.

Bulls appear assured within the $44,000 assist

Presently, there are lower than 17 hours till Friday’s expiry, and there’s a slim likelihood {that a} $50,000 name choice might be of any use. Which means that even when Bitcoin trades at $49,900 at 8:00 am UTC on Aug. 20, these choices change into nugatory.

Due to this fact, after excluding the three,700 ultra-bullish name choices contracts above $50,000, the adjusted open curiosity for the neutral-to-bullish devices stands at $190 million.

An expiry value beneath $48,000 reduces this determine to $138 million. If bears handle to maintain Bitcoin buying and selling beneath $46,000, solely $67 million of those name choice contracts will participate in Friday’s expiry.

Lastly, the bull’s worst-case situation occurs beneath $44,000 as a result of it wipes out 83% of the neutral-to-bullish name choices to depart a meager $24 million open curiosity of their favor.

Associated: Bitcoin slides with S&P 500 as Fed alerts tapering $120B month-to-month bond purchases

Bears want BTC value beneath $45,000 to stability the state of affairs

Bears appear to have been taken without warning as a result of 73% of the protecting put choices have been positioned beneath $44,000. Consequently, the instrument’s open curiosity could be diminished to $65 million if the Bitcoin expiry takes place above that threshold, and this could give bears a $41 million benefit.

By protecting Bitcoin value beneath $45,000, bears may hold the open curiosity nearly balanced between name choices and protecting places.

Finally, an expiry value above $46,000 will increase the bull’s benefit to $105 million, which looks as if a adequate motive to justify elevated shopping for stress forward of Friday’s expiry.

The views and opinions expressed listed here are solely these of the author and don’t essentially mirror the views of Cointelegraph. Each funding and buying and selling transfer entails threat. You must conduct your personal analysis when making a choice.

Source link