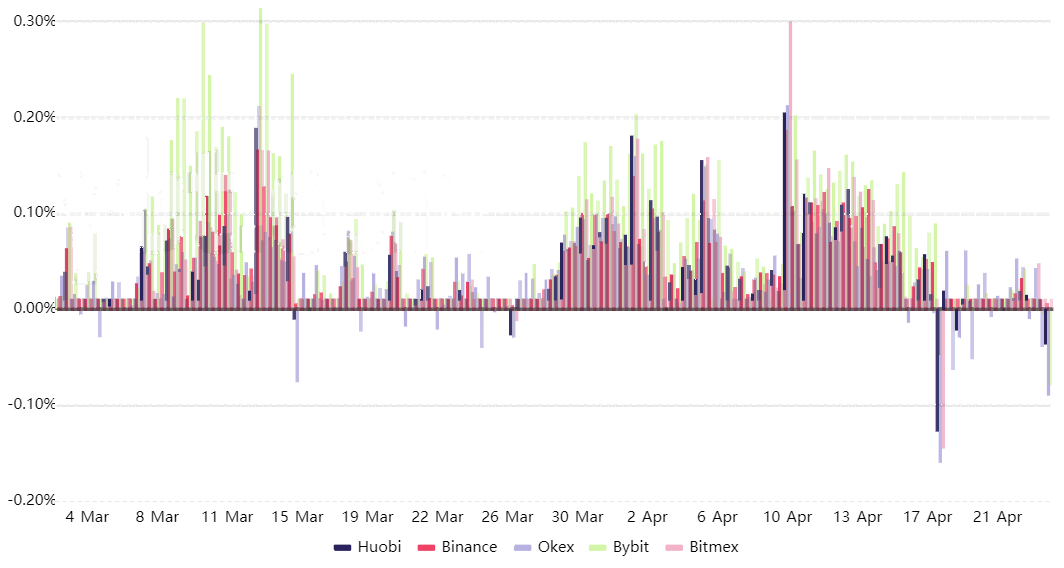

As Bitcoin (BTC) misplaced the $52,000 assist on April 22, the futures contracts funding price entered destructive terrain. This unusual scenario causes the shorts, traders betting on worth draw back, to pay charges each eight hours.

Whereas the speed itself is mildly damaging, this case creates incentives for arbitrage desks and market makers to purchase perpetual contracts (inverse swaps) whereas concurrently promoting the long run month-to-month contracts. The cheaper it’s for long-term leverage, the upper the incentives for bulls to open positions, creating an ideal “bear lure.”

The above chart reveals how uncommon a destructive funding price is, and sometimes it would not final for lengthy. Because the latest April 18 information reveals, this indicator shouldn’t be used to foretell market bottoms, no less than not in isolation.

Month-to-month futures contracts are higher suited to longer-term methods

Futures contracts are likely to commerce at a premium — no less than they do in neutral-to-bullish markets u2014 and this occurs for each asset, together with commodities, equities, indexes and currencies.

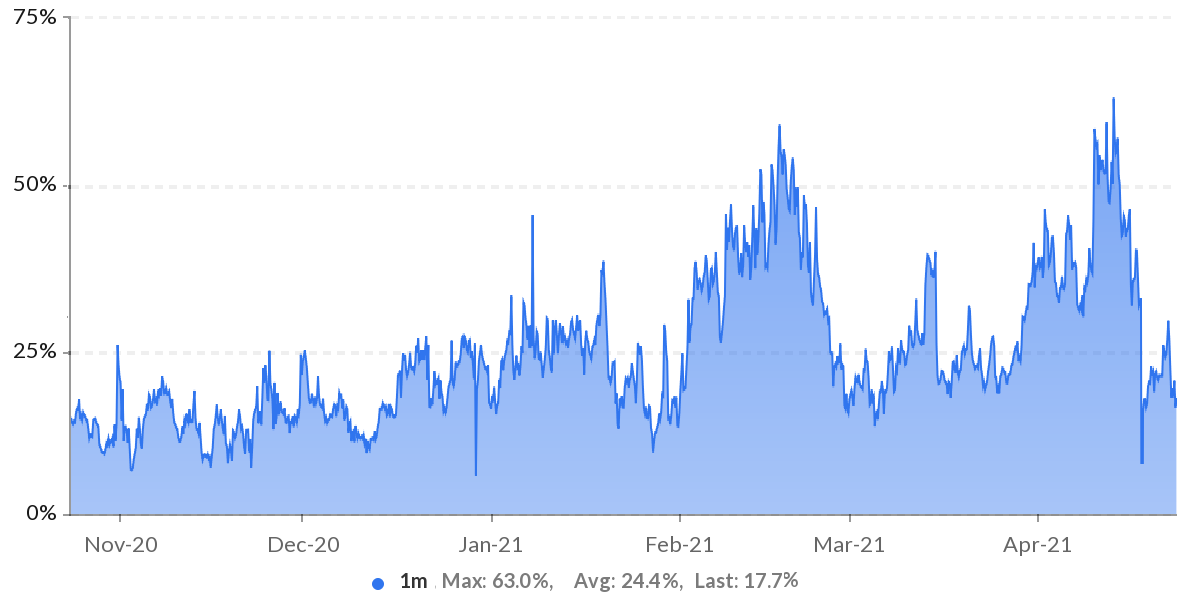

Nevertheless, cryptocurrencies have lately skilled a 60% annualized premium (foundation), which is taken into account extremely optimistic.

In contrast to the perpetual contract (inverse swap), the month-to-month futures do not need a funding price. As a consequence, their worth will vastly differ from common spot exchanges. These fixed-calendar contracts eradicate the fluctuation seen in funding charges and make the the perfect instrument for longer-term methods.

As proven within the chart above, discover how the 1-month futures premium (foundation) entered dangerously overleveraged ranges, which exhausts the chances for bullish methods.

Even those who beforehand purchased futures in expectation of an extra rally above the $64,900 all-time excessive had incentives to chop their positions.

The decrease price for bullish methods might set bear traps

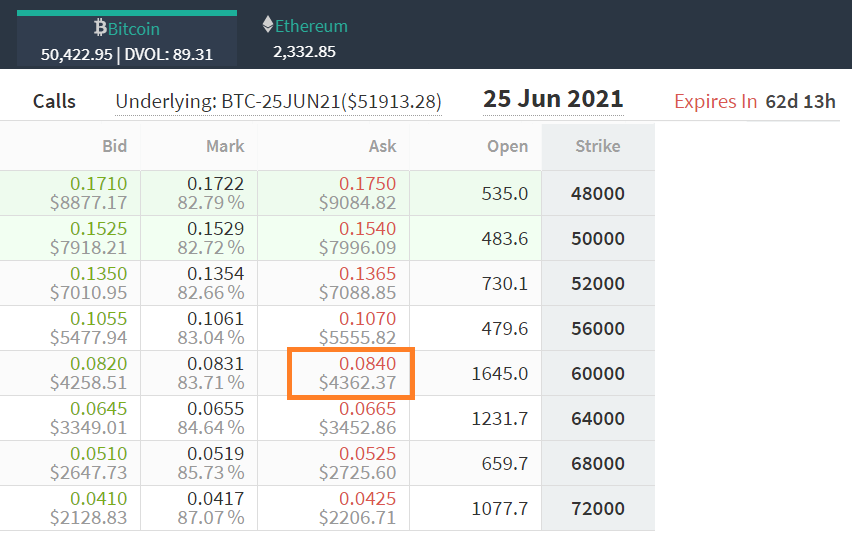

Whereas a 30% or increased price to open lengthy positions is prohibitive for many bullish methods, as the idea price slips under 18%, it often turns into cheaper to lengthy futures than purchase name choices. This $11 billion derivatives market is historically very expensive for bulls, primarily because of BTC’s attribute excessive volatility.

For instance, shopping for upside safety utilizing a $60,000 name choice for June 25 at present prices $4,362. This implies the worth must rise to $64,362 for its purchaser to revenue — a 19.7% enhance from $50,423 in two months.

Whereas the decision choice contract provides one infinite leverage over a small upfront place, it makes much less sense for bulls than the three% June futures premium. A 5x-leveraged lengthy place will return 120% beneficial properties if BTC occurs to achieve the identical $64,362. In the meantime, the $60,000 name choice purchaser would require Bitcoin’s worth to rise to $77,750 for a similar revenue.

Subsequently, whereas traders don’t have any motive to rejoice the 27% correction occurring over the previous 9 days, traders may interpret the transfer as a “glass half full.”

The decrease the prices for bullish methods, the upper the incentives for bulls to arrange an ideal “bear lure,” fueling Bitcoin to a extra comfy $55,000 assist.

The views and opinions expressed listed here are solely these of the author and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer includes threat. It’s best to conduct your individual analysis when making a choice.

Source link