Bitcoin (BTC) worth reacted as excessive as $44,600 on Aug. 7, the best stage since earlier than the notorious Could 19-crash. In the meantime, there are growing speculations that BTC may endure an analogous upside increase just like the one which started in October 2020.

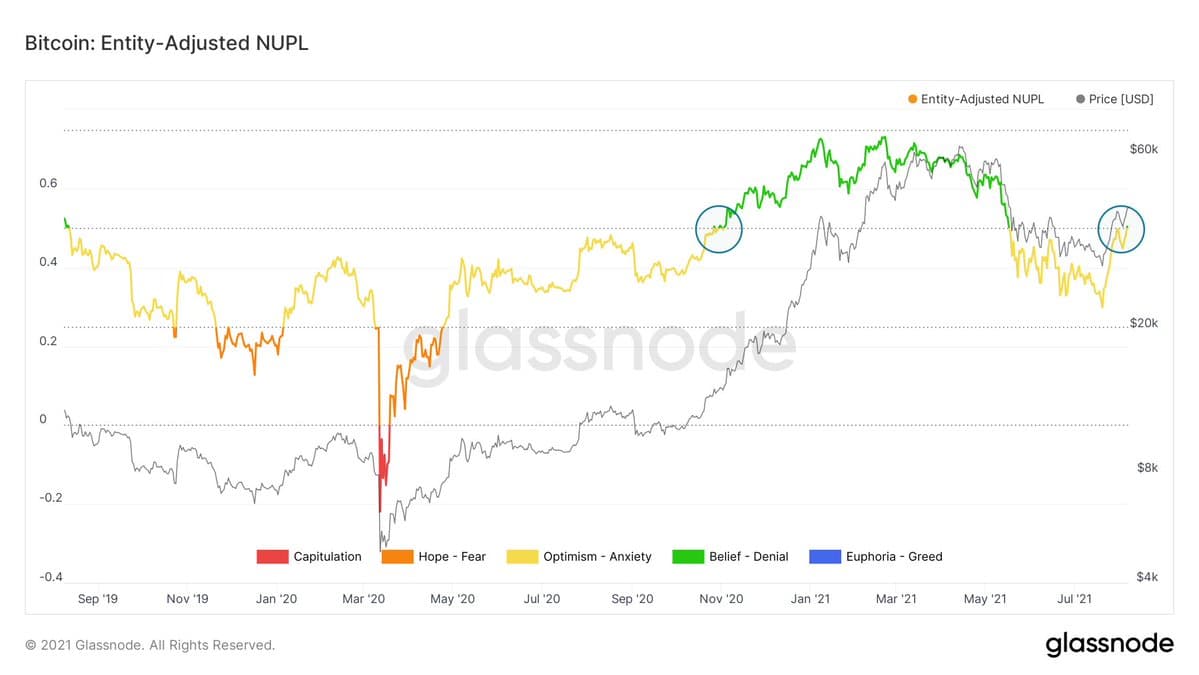

A minimum of two indicators anticipated Bitcoin to pursue large uptrends. The primary one was Glassnode’s Entry-Adjusted Internet Unrealized Revenue/Loss that assists buyers in figuring out whether or not the Bitcoin community as an entire is at present in a state of revenue or loss.

Understanding NUPL and its warmth map

A NUPL studying above zero signifies that the community is in a state of internet revenue, whereas values beneath zero point out a state of internet loss. The additional NUPL deviates from zero, the extra it helps buyers spot market tops and bottoms.

They spot the diploma of deviations from zero through a warmth map. For instance, throughout an uptrend, purple signifies “capitulation,” orange means “hope,” yellow exhibits “optimism,” inexperienced hints “perception,” and blue underscores “euphoria.”

In October 2020, the Bitcoin NUPL moved upward of zero as its warmth map modified colours from yellow to inexperienced after efficiently bouncing off the purple zone in March earlier that 12 months.

Later, the costs moved from roughly $10,000 to round $65,000.

Bitcoin dropped later to beneath $30,000, a interval that noticed its NUPL temper switching from greed to denial and later to nervousness. However a robust shopping for sentiment close to the $30,000 stage helped maintain Bitcoin’s upside sentiment intact, offsetting nervousness with optimism.

However simply as Bitcoin reclaimed $40,000 and exceeded its upside momentum, the sentiment switched again to perception for the primary time since October 2020. Lex Moskovski, Chief Funding Officer at Moskovski Capital, additionally highlighted Bitcoin’s upside prospects following the NUPL improve in a tweet, saying:

“We have entered the Perception section.”

Alternatively, the favored Concern and Greed Index additionally touched 69, a rating that signifies a sentiment of Greed, which the market additionally hasn’t seen since Could.

The second indicator

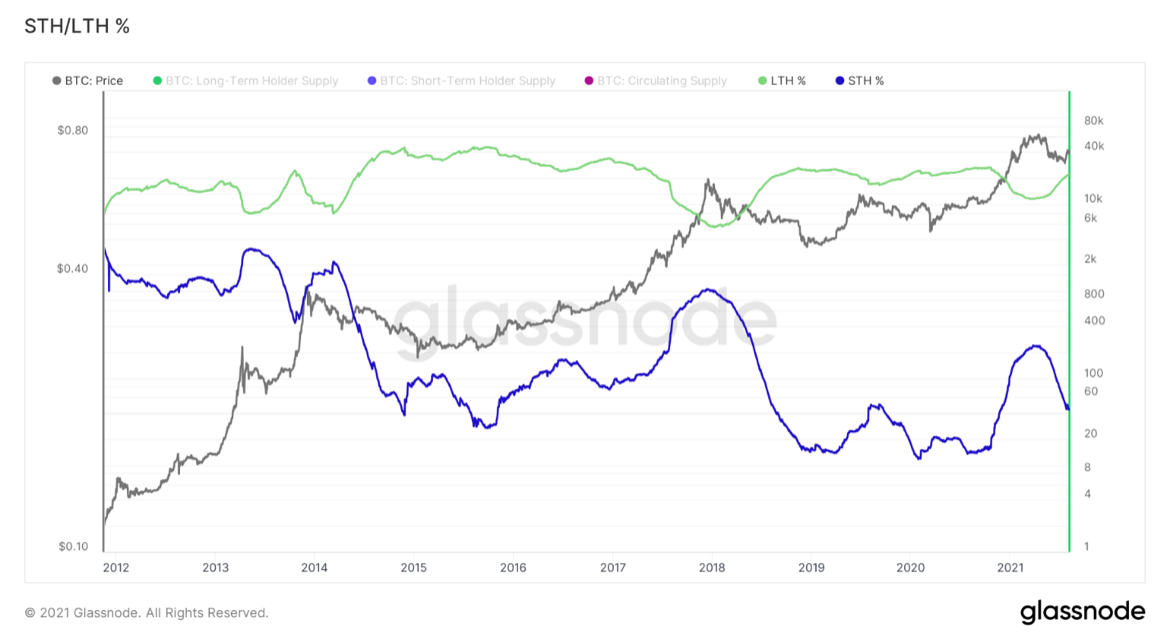

On an analogous be aware, market analyst Will Clemente additionally highlighted one other indicator that promised to repeat October 2020’s upside increase. The fractal involved the dynamic between quick and long-term Bitcoin holders.

Clemente famous that short-term holders bought off their Bitcoin holdings to long-term holders, insomuch that the previous accrued nearly as a lot because the Bitcoin provide in August 2021 that that they had again in October 2020.

Associated: Ethereum worth soars above $3K into ‘purple zone’ triggering sell-off fears

“Lengthy-term holders now have over 66% of provide, short-term is now down to just about 20%,” the analyst wrote. “Earlier than the principle bull run started in October, long-term holder provide reached simply over 68%.”

That additional indicated that the most recent worth appeared out of the demand from buyers that had no intentions of promoting Bitcoin instantly.

Bitcoin achieved an intraday excessive of $44,600 on Saturday earlier than correcting decrease on account of profit-taking sentiment. BTC was altering fingers for $43,500 on the time of writing.

The views and opinions expressed listed below are solely these of the writer and don’t essentially replicate the views of Cointelegraph.com. Each funding and buying and selling transfer entails danger, it is best to conduct your individual analysis when making a call.

Source link