Generally all Bitcoin (BTC) must pump 10% is a optimistic comment from somebody like Elon Musk.

The Tesla CEO has been pointed to because the wrongdoer for the current downturn after the corporate’s Could 12 announcement explaining that it will now not settle for Bitcoin funds attributable to environmental issues. Musk adopted up by saying that he was trying into different cryptocurrencies that required 99% much less vitality consumption.

Nevertheless, on June 13, the scenario reversed as Musk reassured the general public that Tesla didn’t promote any further Bitcoin. The submit additionally mentioned that the electric-car producer would resume taking BTC funds as quickly as its Bitcoin mining relied on a minimal of fifty% clear vitality.

In bear markets, high merchants act with warning

Whereas retail traders and algorithmic buying and selling bots bounce into motion as quickly as bullish or bearish alerts and information flash, high merchants are likely to act extra with extra warning. Those that have been across the crypto markets lengthy sufficient know that optimistic information may find yourself being ignored or severely downplayed in bear markets.

Alternatively, even doubtlessly adverse information appears to have little to no impression throughout bull runs. For instance, on Sept. 26, 2020, Kucoin was hacked for $150 million. The next week, on Oct. 1, america Commodity Futures Buying and selling Fee charged BitMEX for working an unregistered buying and selling platform and violating Anti-Cash Laundering rules.

Two weeks later, police reportedly questioned the founding father of OKEx, forcing the change to droop crypto withdrawals. Had this sequence of adverse information occurred whereas Bitcoin was flat or in a bearish section, the value would have undoubtedly have stalled throughout a bear market.

As proven above, Bitcoin barely had any adverse impression in late September and October 2020. In actual fact, by the tip of November 2020, Bitcoin was up 74% in two months. That is the primary purpose why high merchants are likely to ignore optimistic information throughout bear markets and vice-versa.

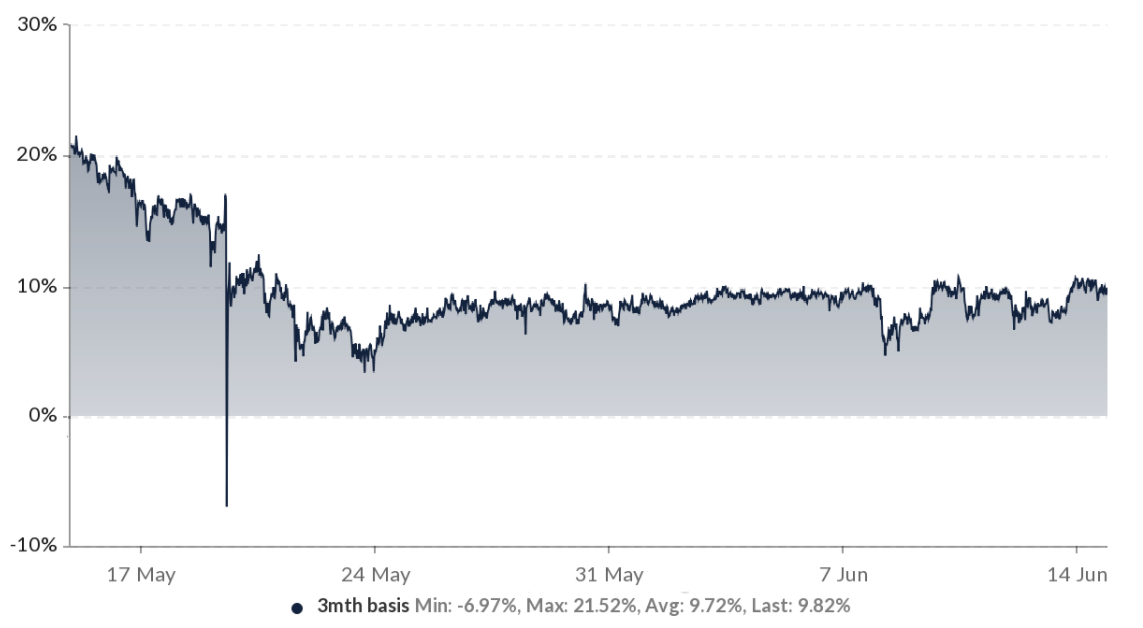

The three-month futures premium is impartial

A futures contract vendor will often demand a worth premium to common spot exchanges. This case just isn’t unique to crypto markets and occurs in each derivatives market as a result of along with the change liquidity danger, the vendor is suspending settlement and this ends in the next worth.

The three-month futures premium (foundation fee) often trades at a 5% to fifteen% annualized premium in wholesome markets. When futures are buying and selling under the common spot change worth, it alerts a short-term bearish sentiment.

As proven above, the longer term foundation has been under 11% since Could 20 and flirting with bearish territory on a number of events because it examined 5%. The present stage signifies a impartial place from high merchants.

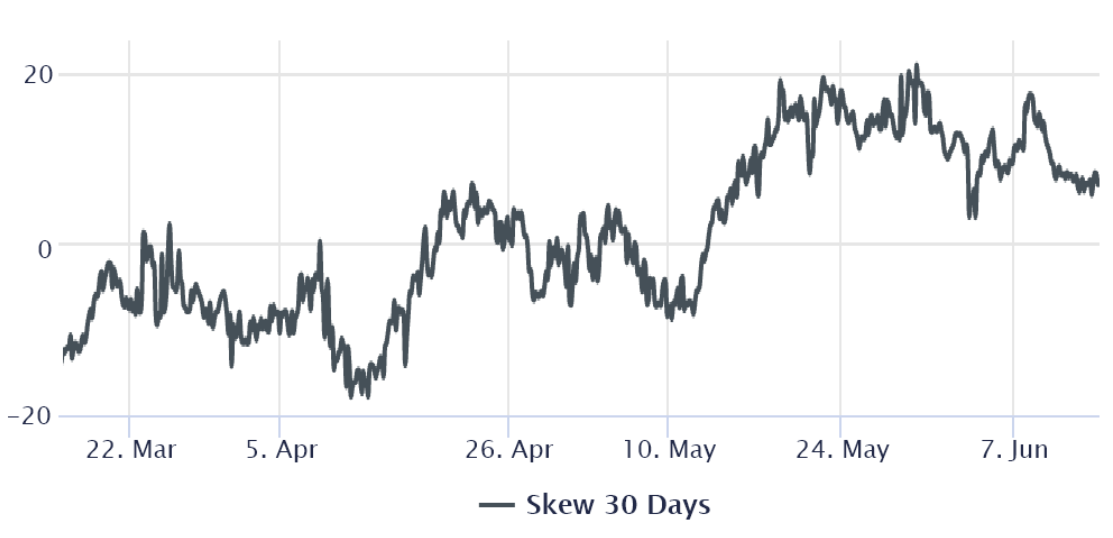

The choices skew is now not signaling concern

The 25% delta skew compares comparable name (purchase) and put (promote) choices side-by-side. It would flip optimistic when the protecting put choices premium is larger than comparable danger name choices.

The alternative holds when market makers are bullish and this causes the 25% delta skew indicator to enter the adverse vary.

The above chart confirms that high merchants, together with arbitrage desks and market markers, are presently uncomfortable with Bitcoin worth because the neutral-to-bearish put choices premium is larger. Nevertheless, the present 7% optimistic skew is much from the 20% exaggerated concern seen in late Could.

Derivatives markets present no proof of high merchants getting excited in regards to the current $40,000 hike. On the brilliant facet, there may be room for leverage consumers to mount positions. Stronger upswings often happen when traders are least anticipating, and the present situation appears to be an ideal instance.

The views and opinions expressed listed here are solely these of the writer and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer includes danger, it is best to conduct your personal analysis when making a choice.

Source link