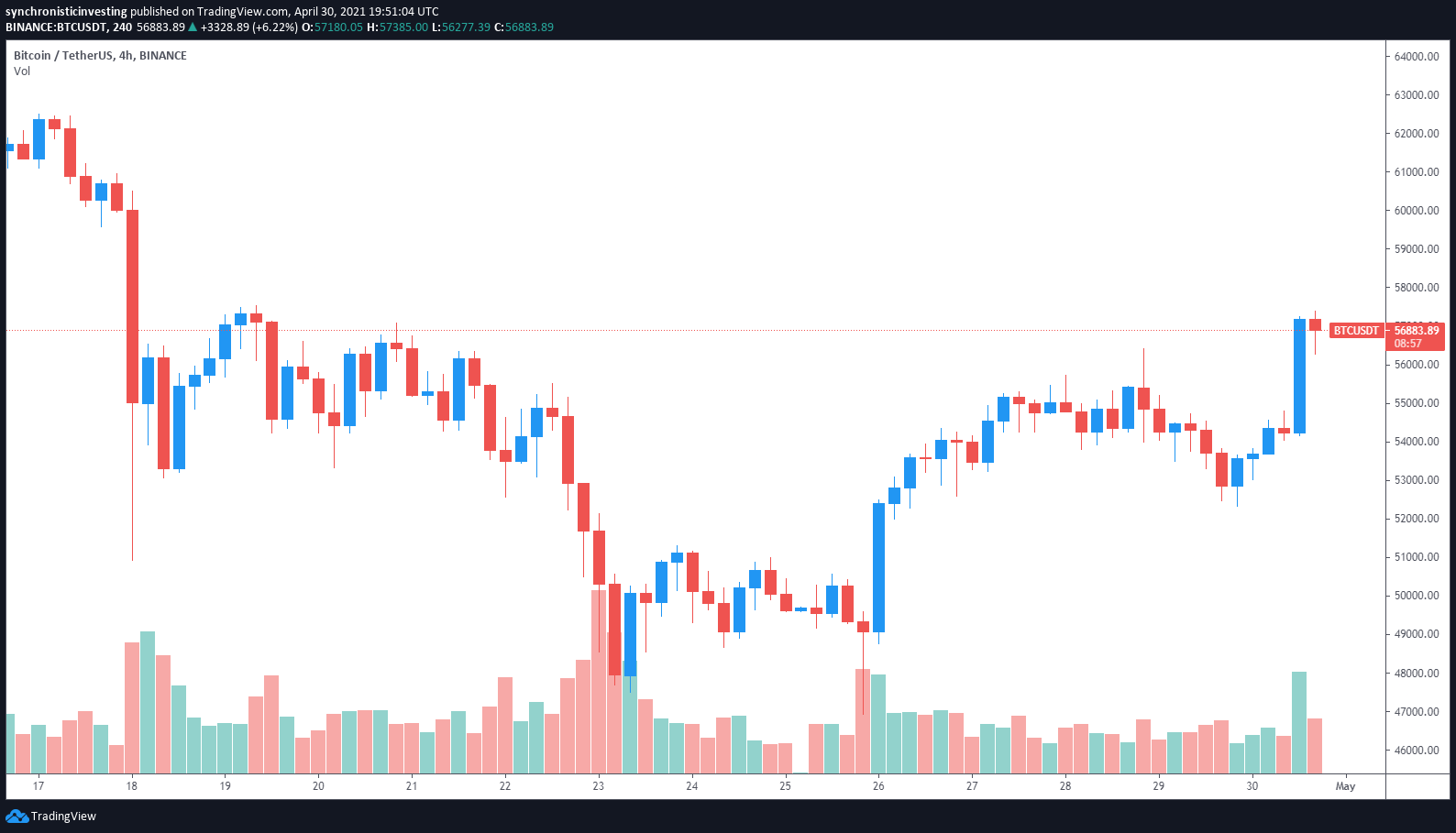

Bitcoin (BTC) and the general cryptocurrency market sprang to life on April 30 as an uneventful near this month’s $4.2 billion choices expiry occurred with none indicators of controversy.

Information from Cointelegraph Markets and TradingView exhibits that after a quick dip under the $53,000 assist degree on April 29, the worth of Bitcoin staged a ten% rally again above $57,400 by noon.

The revelation from MicroStrategy CEO Michael Saylor that the corporate noticed a 52% surge in income in comparison with the identical quarter final yr will probably strengthen the argument that organizations ought to maintain Bitcoin on their steadiness sheet as a method to fight inflation in addition to appeal to new buyers.

Central financial institution digital currencies (CBDC) are additionally gaining traction because the Financial institution of England revealed that it’s shifting forward with plans to launch a digital pound and the central financial institution of France made headlines on April 29 after settled a $100 million Euro bond utilizing a CBDC that was hosted on the Ethereum (ETH) community.

Altcoins present important power

Whereas a lot of the mainstream information and focus from analysts revolves round Bitcoin and Ethereum, a handful of altcoins caught the eye of merchants on Friday as their costs noticed double-digit positive factors

One of many strongest performers of the day was IoTeX which surged 75% to a brand new all-time excessive at $0.085. The blockchain challenge is concentrated on fixing the problems of scalability, privateness and excessive working prices that are limiting the mass adoption of the Web of Issues (IoT) ecosystem.

VORTECS™ knowledge from Cointelegraph Markets Professional started to detect a bullish outlook for IOTX on April 27, previous to the current value rise.

The VORTECS™ Rating, unique to Cointelegraph, is an algorithmic comparability of historic and present market circumstances derived from a mixture of information factors together with market sentiment, buying and selling quantity, current value actions and Twitter exercise.

As seen within the chart above, the VORTECS™ Rating started to climb on April 26 and reached a excessive of 76 on April 27 earlier than spiking to 73 once more on April 29. It is value noting that the VORTECS™ Rating hit 73 roughly 10 hours earlier than the worth spiked 75% to a brand new all-time excessive at $0.0857.

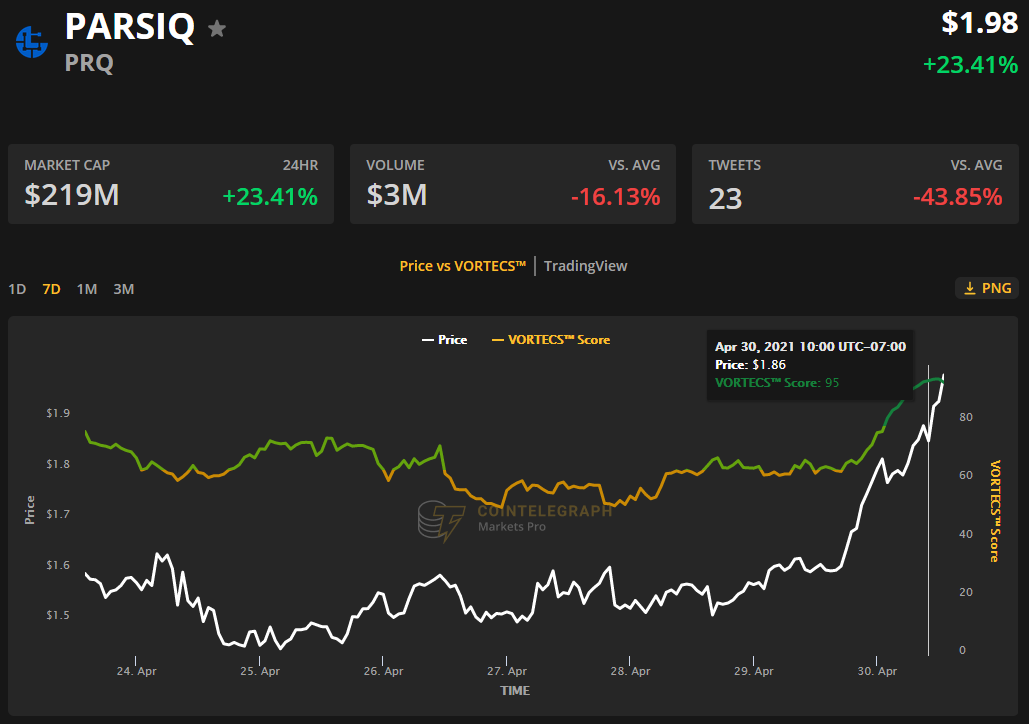

A second coin that has been performing effectively over the previous couple of days and is now registering a VORTECS™ Rating of 95 is PARSIQ (PRQ), an analytics platform that gives cutting-edge instruments for the evaluation of blockchain know-how throughout quite a lot of industries.

Bullishness for PRQ was first detected on April 28 when the VORTECS™ Rating reached the inexperienced zone. The rating stayed close to that degree (67) over the subsequent day after which quickly climbed to a excessive of 95 on April 30 as the worth of PRQ rallied increased.

A rating of 95 is without doubt one of the highest scores ever registered on the VORTECS™ system, and former situations of scores within the mid to excessive 90’s have been proven to precede additional value appreciation, as was not too long ago demonstrated by Polygon (MATIC) this week.

Usually, altcoins rallied throughout the board, boosting the entire market capitalization to $2.177 trillion whereas Bitcoin’s dominance price slipped to 48.8%.

The views and opinions expressed listed below are solely these of the creator and don’t essentially replicate the views of Cointelegraph.com. Each funding and buying and selling transfer entails danger, it is best to conduct your individual analysis when making a choice.

Source link