Margin buying and selling permits an investor to borrow cash or cryptocurrency to leverage their buying and selling place and enhance its dimension or the anticipated return. For instance, borrowing Tether (USDT) will permit one to purchase Bitcoin (BTC), thus growing the publicity. Though there’s an rate of interest concerned with borrowing, the dealer expects BTC’s worth appreciation to compensate for it.

Newer merchants is perhaps unaware of this, however buyers can borrow BTC to margin commerce a brief place, thus betting on worth draw back. For this reason some analysts monitor the full lending quantities of Bitcoin and Tether to realize perception into whether or not buyers are leaning bullish or bearish.

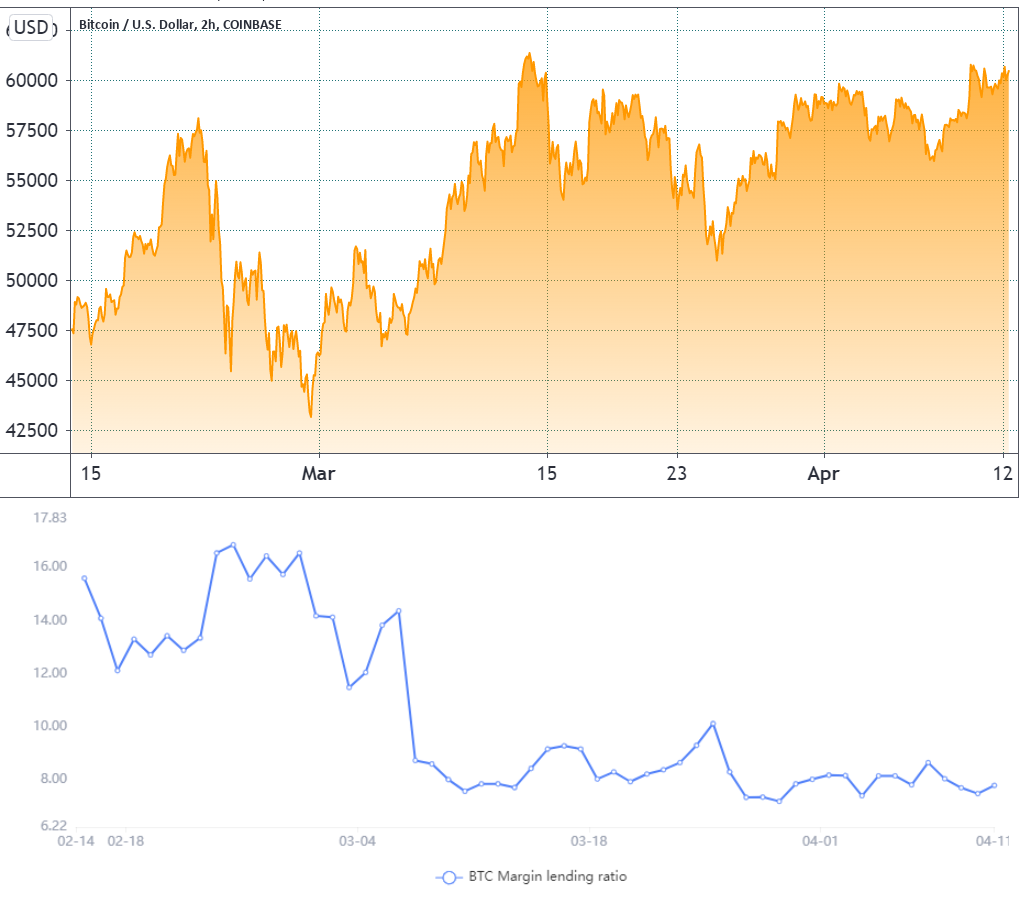

Apparently, information exhibits that at the same time as Bitcoin’s worth goals for a brand new all-time excessive, the BTC/USDT borrow ratio on OKEx has reached its lowest degree since Nov. 20, 2020. Whereas this determine nonetheless favors bulls, it raises questions on what catalysts are behind the transfer.

At any time when merchants borrow USDT or different stablecoins, they’re doubtless utilizing it to lengthy cryptocurrencies. Alternatively, BTC borrowing is especially used for brief positions.

Which means that theoretically, at any time when the USDT/BTC lending ratio goes up, the market is angled in a bullish method. The alternative motion signifies extra demand for Bitcoin shorts.

As proven within the chart above, USDT loans on OKEx have been holding at roughly eight instances bigger than Bitcoin-denominated loans. Albeit on the bullish aspect, that is close to the bottom degree since Nov. 17, 2020.

Borrowing charges for the bears have by no means been this low

Not like perpetual futures (inverse swaps), margin trades happen in common spot markets. To start out margin buying and selling, a dealer solely must switch collateral funds to a margin account. Most exchanges provide 3x to 10x leverage, relying on the asset’s volatility and market circumstances.

This indicator has halved since late February, regardless of BTC marking a brand new $61,800 all-time excessive and sustaining day by day candle closes above $55,000 for the previous 17 days. Nonetheless, a hike within the Bitcoin borrowing charge would undoubtedly trigger BTC shorts to scale back their leverage.

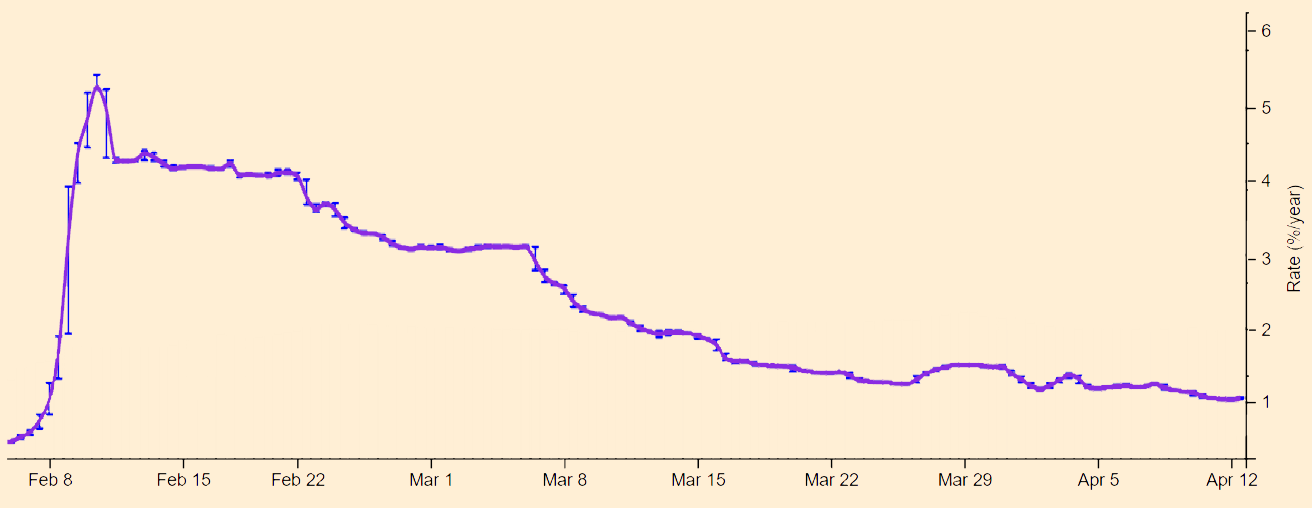

In response to information from Bitfinex, BTC’s short-term lending has charge plummeted to 1% per 12 months. Subsequently, excessive prices are positively not behind the a lot smaller BTC borrowing exercise. Though OKEx doesn’t present a chart, each the Poloniex and Quoine exchanges displayed the same development, in keeping with information from Coinlend.

Bulls saved their lengthy positions regardless of the charge enhance

Merchants betting on a unfavorable worth swing should borrow BTC to margin commerce a brief place. Even on this state of affairs, they may nonetheless must pay curiosity and commerce it to U.S. {dollars} or stablecoin. To shut the transaction, the client should repurchase the BTC whereas hoping for a lower cost and return it to the lender with the extra curiosity.

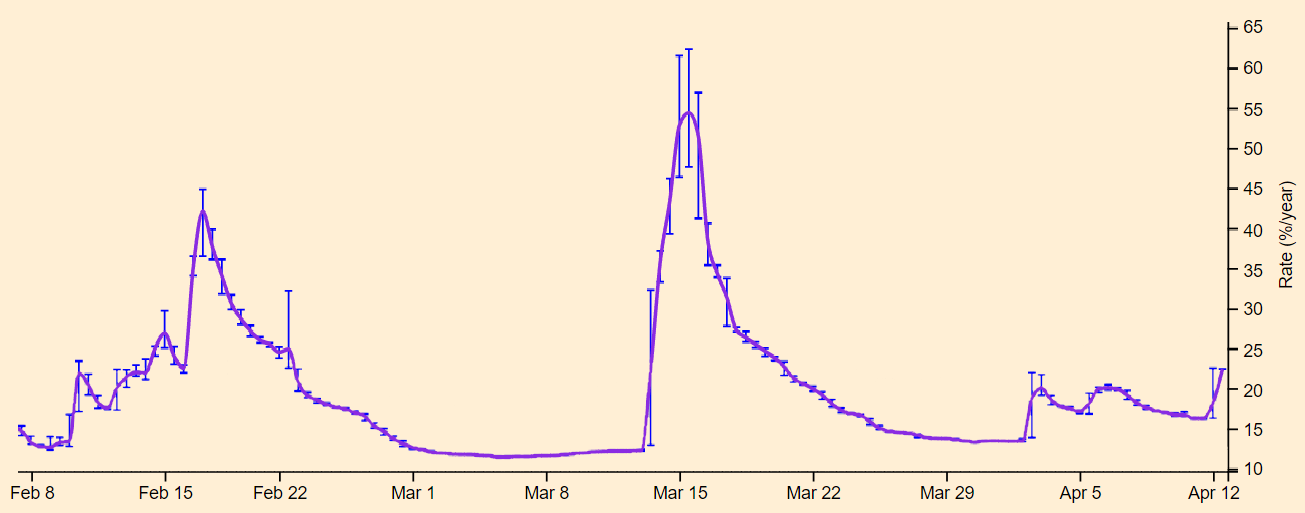

This time round, there was a large spike within the USD lending charge in mid-March as Bitcoin surpassed $60,000. The leveraged lengthy frenzy rapidly reverted as BTC dropped 13% over the next days, and this prompted fiat and stablecoin borrowing charges to normalize.

Merchants trying to borrow USD or stablecoins to purchase Bitcoin have been paying from 15% to 23% per 12 months over the past couple of weeks. This charge is probably going why the OKEx USDT and BTC borrow ratio fails to extend regardless of Bitcoin’s worth energy.

Proper now, the lending ratio favors bulls

A meager 1% annualized charge was not sufficient to entice debtors to quick Bitcoin, which is a optimistic indicator. Had there been any demand for it, the borrowing charge would have gone up.

Consequently, merchants mustn’t understand that the OKEx margin lending ratio being at its lowest degree in 5 months as a bearish sign.

Although a 23% margin charge for longs is significantly costly, there’s room for additional leverage. Therefore, $60,000 changing into a assist degree for Bitcoin ought to come as no shock.

The views and opinions expressed listed below are solely these of the author and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer entails threat, and you need to conduct your individual analysis when making a call.

Source link