A current sell-off within the Bitcoin (BTC) market pushed its costs beneath the important thing psychological assist of $30,000.

Whereas the cryptocurrency’s transfer downhill prompted many analysts, together with Luno trade’s Vijay Nayyar and Kinetic Capital’s Jehan Chu, to foretell an extra depressive transfer beneath $25,000, Anthony Pompliano provided a contrasting bullish outlook.

The Morgan Creek Digital Property founder pitted risk-on markets in opposition to the fears of the fast-spreading Delta variant of COVID-19. He famous that governments, on the entire, would introduce “extra aggressive financial stimulus” applications ought to the brand new coronavirus pressure unfold on the scale of its Alpha model.

“Historical past just isn’t essentially an indicator of the longer term, however it’s laborious to think about a state of affairs the place if we had a second wave of lockdowns, we wouldn’t additionally get extra aggressive financial stimulus efforts,” Pompliano wrote in a publication.

“If that occurred, we’d seemingly see all belongings proceed to go greater and better.”

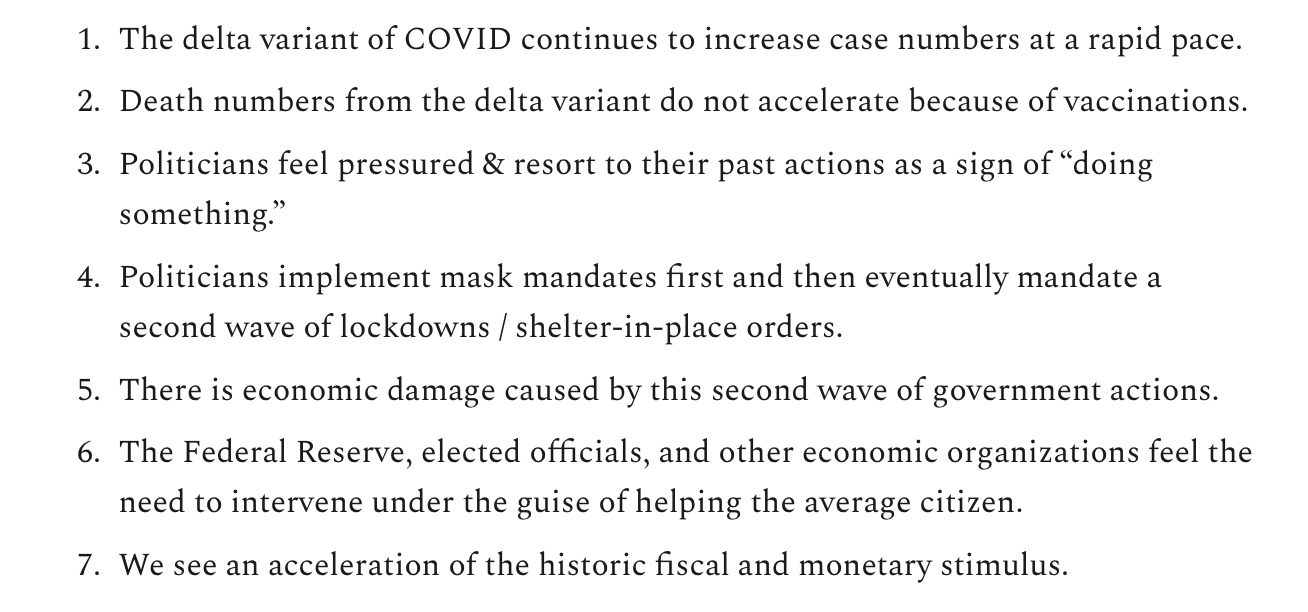

In saying so, Pompliano envisioned that the highway to extra greenback liquidity would really like are available in seven successive phases, as proven within the snapshot beneath:

Threat-on FOMO anticipated

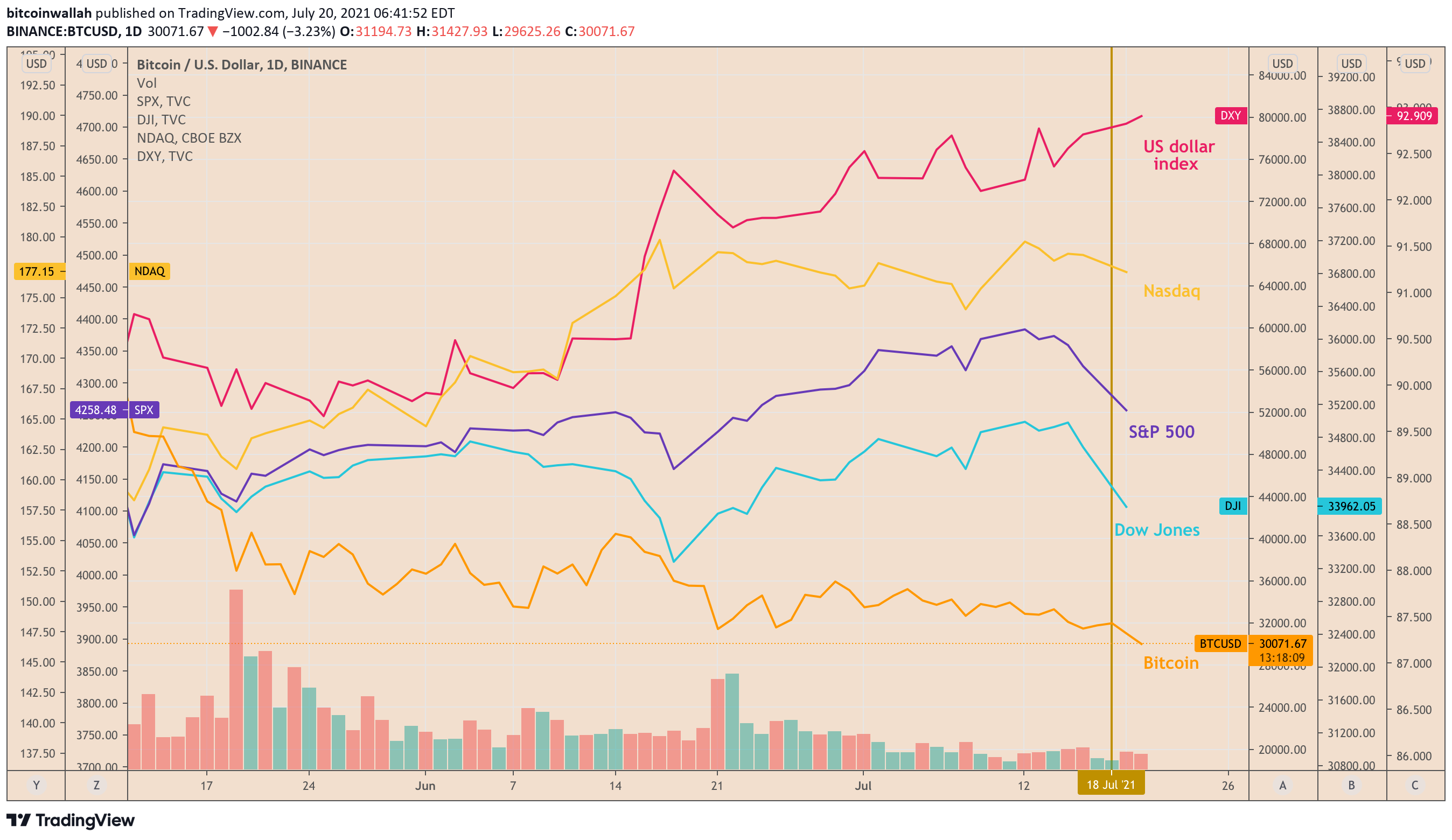

Pompliano’s statements appeared because the Bitcoin market fell in sync with different risk-on belongings throughout the globe on July 2.

As an illustration, all three Wall Avenue indexes — the S&P 500, the Nasdaq Composite and the Dow Jones Industrial Common — logged their steepest declines in weeks. Additionally, gold fell to as little as $1,795.12 an oz however later recovered to $1,812.145 an oz.

In the meantime, United States authorities bonds rallied alongside the greenback, displaying that traders are heading for safe-havens amid the worldwide market turmoil.

Behind the rout, world media shops reported, was a rising listing of worries about financial restoration. The Delta variant of COVID-19 has unfold quickly, reigniting the dialogue in a number of international locations about whether or not authorities ought to reimpose lockdown and curb financial exercise.

“The hope was that [COVID-19] vaccines would offer us with the endgame,” Mohammed Kazmi, a portfolio supervisor at Union Bancaire Privee, instructed the Monetary Instances. “Now traders are wanting on the UK and there’s a little bit of concern as regards to reopening so aggressively when circumstances are nonetheless so excessive.”

Kazmi added that markets are actually stepping again from hopes of a V-shaped restoration and are feeling unsure about the way forward for their economies.

Associated: Inventory-to-flow mannequin presumably invalidated as Bitcoin worth loses $30K

Pompliano’s feedback additionally appeared because the Federal Reserve flirted with the thought of mountaineering its near-zero lending charges by the tip of 2023 to curb rising inflation.

Moreover, a number of central financial institution officers additionally favored the thought of tapering their aggressive $120 billion per 30 days asset buy program, though Fed Chairman Jerome Powell clarified that the Fed intends to run the quantitative easing coverage scorching till the U.S. financial system recovers fully.

James Wo, founder and chief government officer of world blockchain and digital asset funding agency Digital Finance Group additionally famous that although the Bitcoin trade has encountered draw back volatility throughout this present market cycle, the basics which have pushed the worth of its and different markets greater all throughout 2020 proceed unaffected. He added:

“Any mixture of narratives which have introduced digital belongings to this discounted worth might be checked off of lists of FUD that might have finally affected the worth of the entire market.”

The views and opinions expressed listed below are solely these of the creator and don’t essentially replicate the views of Cointelegraph.com. Each funding and buying and selling transfer entails danger, it’s best to conduct your personal analysis when making a call.

Source link