Bitcoin (BTC) gained extra free publicity this week as inflation knowledge confirmed that costs are rising quicker than even specialists had anticipated.

The newest Client Value Index (CPI) report on June 10 from the US Bureau of Labor Statistics (BLS) additionally revealed that hourly common earnings for United States employees are at their lowest this century.

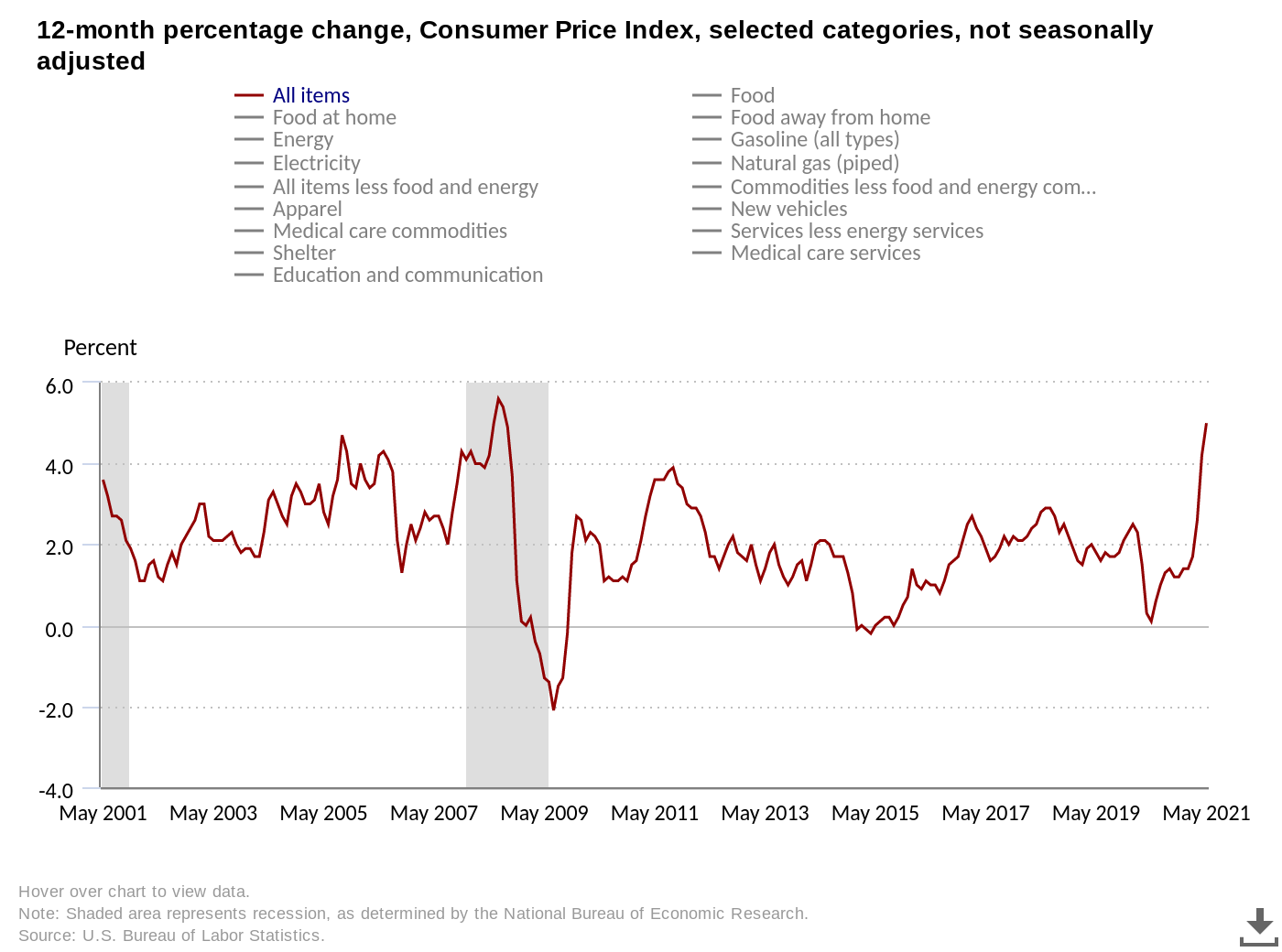

Inflation returns to 2008 ranges

One in every of Bitcoin’s greatest mates is inflation. Its inherently deflationary nature permits its customers to save lots of for the longer term with out worrying that inflation is eradicating the worth of these financial savings.

Because the COVID-19 pandemic started, central banks have launched unprecedented money-printing packages, and the implications are actually changing into worryingly clear.

In Could, 12 months after the coronavirus pandemic started to take maintain exterior of China, the U.S. CPI rose 0.6%.

That is 5% greater than the identical month final yr and signifies that U.S. inflation is now at its highest since 2008, the yr of the monetary disaster.

“The Could CPI report exhibits reopening-sensitive classes dominating worth pressures for a second straight month,” Bloomberg analysts stated in feedback accompanying the report.

Maybe unsurprisingly, Bitcoin proponents have been fast to lift the alarm.

“The US simply hit a 13 yr excessive inflation fee. This was sudden by policymakers and economists,” Dan Held, growth lead at crypto exchange Kraken said in a series of tweets.

“To a person of common intelligence, it was totally intuitive given the huge cash printing (stimulus) that occurred since COVID.”

Held famous that wages had didn’t sustain with any modifications, which means that U.S. employees have been incomes on common much less per hour than at any time within the twenty first century, when adjusted for inflation.

“Wages didn’t sustain with inflation, so employees obtained poorer. TL;DR wages are extra ‘sticky’ than costs which might be adjusted rather more simply,” he concluded, highlighting an identical interval within the Seventies.

The CPI hides true inflation rates

Other Bitcoin figures have seized on inflation in recent years as a prime example of how the fiat monetary system deceives those it forces to participate.

While the CPI still looks relatively low in percentage terms, a plethora of assets are not included in the gauge. Examples of these are products and services which provide a citizen with reassurance for the future, such as real estate and college tuition.

Related: Bitcoin is a ‘masterpiece of monetary engineering’ Michael Saylor tells Austin Davis

MicroStrategy CEO Michael Saylor and Saifedean Ammous, writer of The Bitcoin Customary, have been particularly vocal concerning the disparity.

“CPI is a deceptive measure of inflation,” Saylor argued in March.

“Volatility is a deceptive measure of threat. The previous distracts us from the issue, whereas the later distracts us from the answer.”

Source link