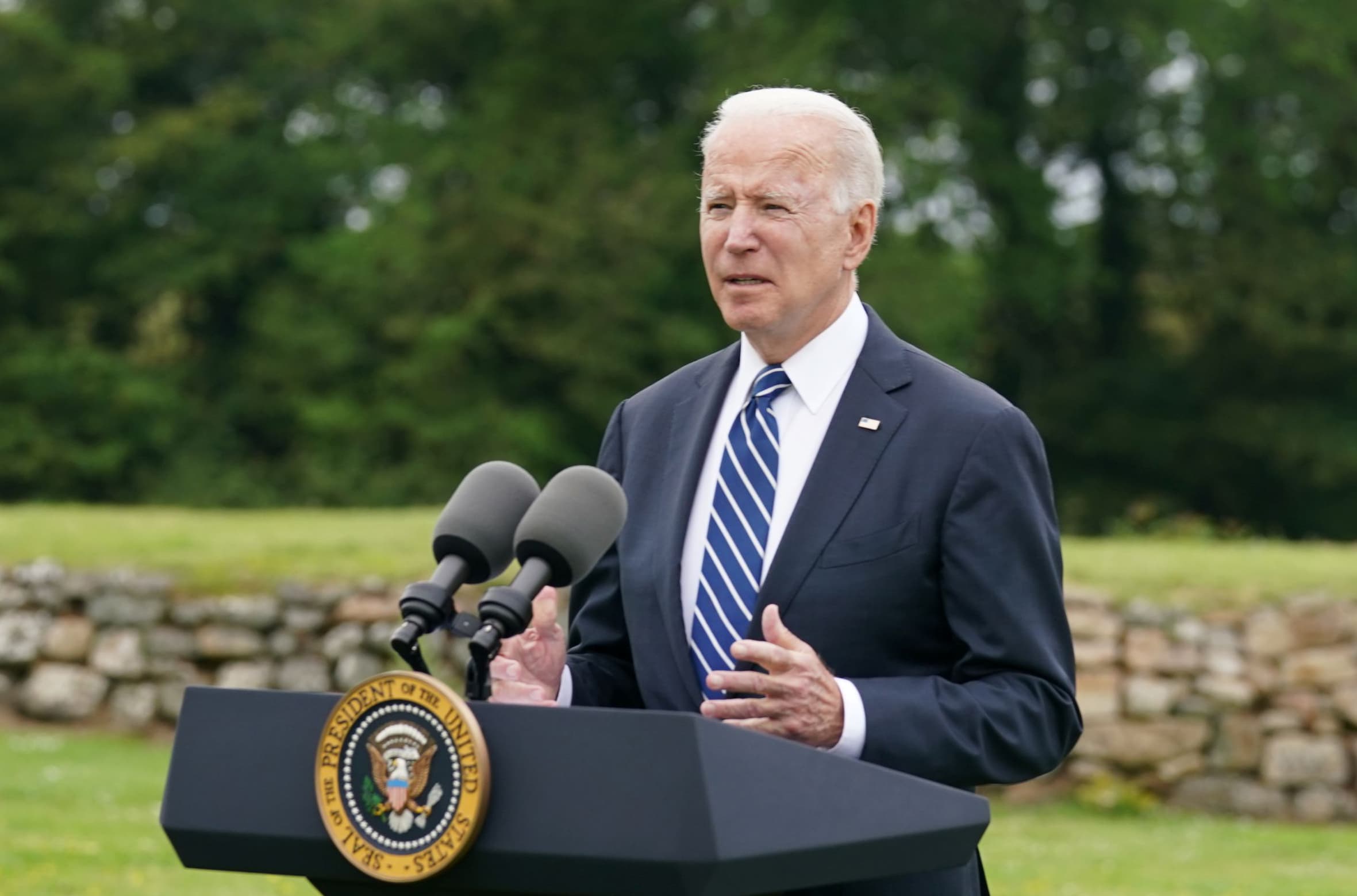

U.S. President Joe Biden speaks about his administration’s pledge to donate 500 million doses of the Pfizer (PFE.N) coronavirus vaccine to the world’s poorest nations, throughout a go to to St. Ives in Cornwall, Britain, June 10, 2021.

Kevin Lemarque | Reuters

WASHINGTON — President Joe Biden and leaders of the G-7 group of countries will publicly endorse a worldwide minimal company tax of at the least 15% on Friday, one piece of a broader settlement to replace worldwide tax legal guidelines for a globalized, digital financial system.

The leaders will even announce a plan to interchange Digital Companies Taxes, which focused the largest American tech corporations, with a brand new tax plan linked to the locations the place multinationals are literally doing enterprise, somewhat than the place they’re headquartered.

For the Biden administration, the World Minimal Tax plan represents a concrete step in direction of its purpose of making what it calls a “international coverage for the center class.”

This technique goals to make sure that globalization and commerce are harnessed for the advantage of working People, and never merely for billionaires and multinational companies.

For the remainder of the world, the GMT is meant to finish the tax slicing arms race that has led some nations to chop their company taxes a lot decrease than others, with a view to entice multinational corporations.

If extensively enacted, the GMT would successfully finish the observe of world companies in search of out low-tax jurisdictions like Eire and the British Virgin Islands to maneuver their headquarters to, although their prospects, operations and executives are positioned elsewhere.

The second main initiative Biden and G-7 leaders will announce Friday is a plan they’re “actively contemplating” to broaden the Worldwide Financial Fund’s provide of Particular Drawing Rights, an inner IMF foreign money, which are out there to low-income nations.

This plan is geared toward increasing worldwide growth financing to poor nations and serving to them to buy Covid vaccines and recuperate extra shortly from the pandemic’s results, in accordance with a White Home reality sheet.

The White Home additionally stated G-7 leaders will conform to “proceed offering coverage assist to the worldwide financial system for so long as essential to create a powerful, balanced, and inclusive financial restoration.”

However it’s the GMT plan that has the best potential to affect company backside traces and affect investor selections.

The G-7 tax settlement “will function a springboard to getting broader settlement on the G-20,” stated a senior administration official, who spoke to reporters on background with a view to talk about ongoing talks.

A joint assertion issued Thursday by Biden and British Prime Minister Boris Johnson presents a preview of what to anticipate from the worldwide tax settlement between the G-7 companion nations.

Britain’s Prime Minister Boris Johnson speaks with U.S. President Joe Biden throughout their assembly, forward of the G7 summit, at Carbis Bay, Cornwall, Britain June 10, 2021.

Toby Melville | Reuters

“We decide to reaching an equitable answer on the allocation of taxing rights, with market nations awarded taxing rights on at the least 20% of revenue exceeding a ten% margin for the most important and most worthwhile multinational enterprises,” the assertion says.

“We additionally decide to a worldwide minimal tax of at the least 15% on a rustic by nation foundation.”

As a part of this settlement, “we’ll present for … the elimination of all Digital Companies Taxes, and different related related measures, on all corporations.”

The elimination of Digital Companies Taxes, a patchwork of country-by-country taxes that particularly goal the largest American tech corporations, represents an actual victory for america.

Analysts say the elimination of those taxes — and an finish to the looming menace of latest DSTs — would add a stage of certainty to the worldwide tax system that might in the end profit Massive Tech corporations in the long run, even when a brand new World Minimal Tax raised prices within the close to time period.

As soon as the G-7 leaders undertake the GMT proposal, the following step will likely be to win assist for it among the many G-20 nations, a various group of economies that features China, India, Brazil and Russia.

G-20 finance ministers and central financial institution governors are scheduled to fulfill in Venice, Italy, in July. The IMF funding proposal and the worldwide tax plan are each anticipated to be excessive on the agenda.

It is unclear at this level whether or not the GMT plan will win the assist of the 19 member nations and the European Union.

Particulars of the plan have but to be hammered out, and a few of the G-20 nations preserve company tax charges comparatively low in an effort to lure companies.

A lot of the groundwork for adopting a GMT has already been laid by the Group for Financial Cooperation and Growth, or OECD, which launched a blueprint final fall outlining the two-pillar strategy to worldwide taxation.

The OECD Inclusive Framework on Base Erosion and Revenue Shifting, often known as BEPS, is the product of negotiations with 137 member nations and jurisdictions.

One pillar is the plan for nations to gather taxes from multinational companies based mostly on the share of that firm’s earnings derived from a selected nation’s customers.

The second pillar is the worldwide minimal company tax, a set charge of at the least 15% that might apply even when tax charges in a selected nation are decrease than that.

Source link