6 min learn

This story initially appeared on StockMarket

Ought to Traders Be Watching These Prime Semiconductor Shares In Might 2021?

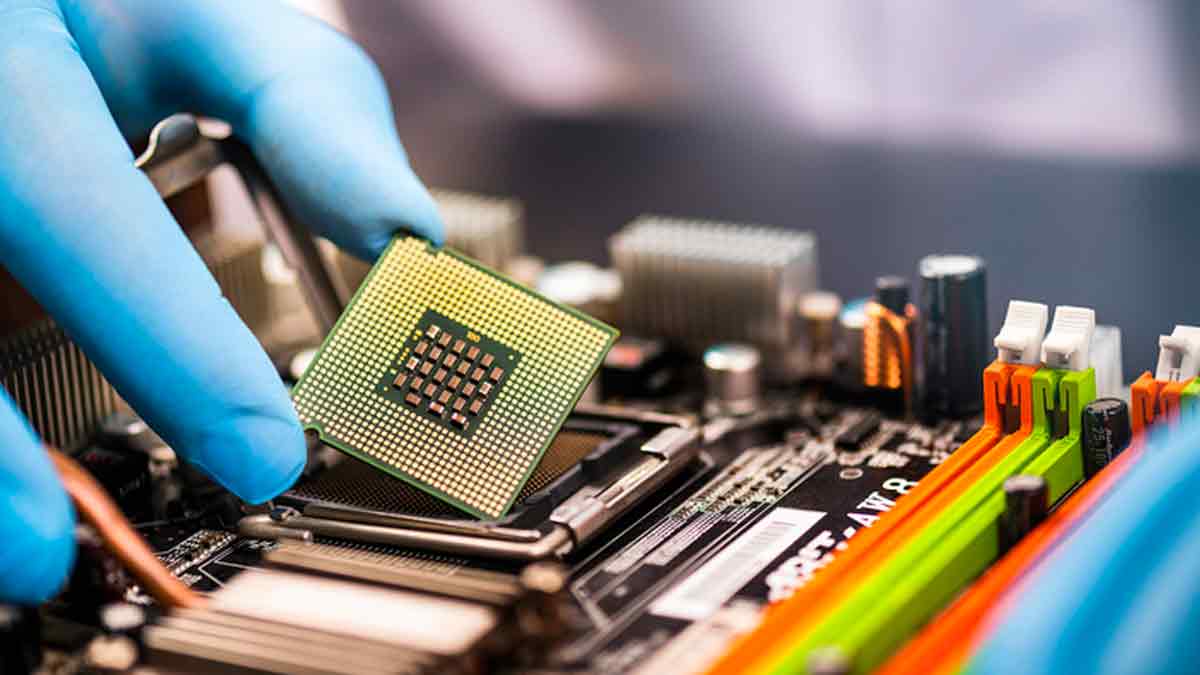

Semiconductor shares are an fascinating play within the inventory market at this time, to say the least. Why? For essentially the most half, it’s due to how essential semiconductor chips are in our world at this time. Protected to say, semiconductors are the brains behind a lot of the tech round us proper now. From our sensible units and residential home equipment, and even the vehicles we drive, semiconductors are current. Now, seasoned and new buyers alike would possible be acquainted with the present chip shortages all through the globe. With out going into an excessive amount of element, this scarcity stems from surges in chip demand throughout varied consumer-focused industries. Nonetheless, whereas the scarcity persists, calls for stay at an all-time excessive. May this be a shopping for alternative for buyers now?

Properly, Citigroup (NYSE: C) analyst Christopher Danely seems to consider so. Earlier this week, Danely argued that there could possibly be “extra upside” in semiconductor shares for now. Furthermore, the analyst additionally reiterated his purchase ranking on semiconductor producer Texas Devices (NASDAQ: TXN). Optimistic analyst notes apart, a number of the largest names within the trade proceed to make huge performs as properly. As of final month, the Taiwan Semiconductor Manufacturing Firm (NYSE: TSM) revealed plans to considerably increase its manufacturing capabilities. This plan would contain investments of $100 billion over three years. Evidently, the semiconductor trade isn’t resting on its laurels. Total, I can perceive if buyers are keen to leap on the highest semiconductor shares on the inventory market now. In mild of that, listed here are 4 names value paying attention to.

Semiconductor Shares To Watch Proper Now

QuickLogic Company

QuickLogic is the main supplier of open configurable computing options primarily based on 100% open-source software program and {hardware}. In essence, it’s a fabless semiconductor firm that develops low energy, multi-core MCU, FPGAs, and embedded FPGA mental property (IP), voice, and sensor processing. QUIK inventory at the moment trades at $6.22 as of Friday’s closing bell.

In February, the corporate reported its fourth-quarter financials. QuickLogic experiences that it has accelerated progress in remodeling its enterprise from primarily a product firm to a platform firm. It additionally handed the Amazon (NASDAQ: AMZN) AVS Certification for hearable reference design in order that OEMs can evaluable sensible hearable merchandise shortly and simply.

Whole income for the quarter was $2.5 million, a 40% enhance in comparison with the final quarter. A bit of this income got here from its mature product income, at $1.7 million, which is up by 46% in comparison with its earlier quarter. Given all of this, will you think about including QUIK inventory to your watchlist?

[Read More] Low cost Shares To Purchase? 4 Cloud Computing Shares To Know

Nvidia Company

Nvidia is a multinational tech firm that’s primarily based in Santa Clara, California. The corporate basically focuses on private laptop graphics, graphics processing items (GPU), and likewise on synthetic intelligence (AI). Its GPU product manufacturers are geared toward specialised markets. Particularly, GeForce for players and Quadro for designers. NVDA inventory at the moment trades at $592.49 as of 4:oo p.m. ET Friday. Just lately, Baird analyst Tristan Gerra lined the corporate.

Particularly, he positioned an outperform ranking and an $800 worth forecast on the corporate’s inventory. That may characterize a 38% enhance from the inventory’s present worth. Based on Gerra, Nvidia’s management in AI positions the tech titan for continued success. AI computing is ready to be one of the vital transformational applied sciences of our period in spite of everything in line with him.

Lastly, he additionally praised Nvidia’s aggressive edge that has obstacles to entry which can be among the many highest throughout the semiconductor trade. This might insulate Nvidia’s gross sales and earnings from the competitors. For these causes, will you think about watching NVDA inventory?

Learn Extra

Superior Micro Units Inc.

AMD is a multinational semiconductor firm that’s primarily based in Santa Clara, California. It develops laptop processors and associated applied sciences for each the enterprise and shopper markets. For greater than 50 years, the corporate has pushed innovation in high-performance computing, graphics, and visualization applied sciences. AMD inventory at the moment trades at $78.81 as of Friday’s shut. Final week, the corporate reported its first-quarter financials for 2021.

Intimately, it reported a income of $3.45 billion for the quarter, a 93% enhance year-over-year. AMD additionally posted a gross revenue of $1.58 billion, a rise of 94% year-over-year. Additionally, web revenue for the quarter was $555 million, up by 243% year-over-year or an earnings per share of $0.45.

Given these spectacular financials, the corporate continues to speed up its enterprise with the most effective product portfolio in its historical past. It additionally continues to get pleasure from robust execution and sturdy market demand for its merchandise. Notably, its knowledge middle income greater than doubled and it has elevated its full-year steerage. Given all of this, will you think about including AMD inventory to your portfolio?

[Read More] Greatest Shares To Purchase Now? 4 Shopper Discretionary Shares In Focus

ON Semiconductor Company

One other high semiconductor firm to know now can be ON Semiconductor (ON). Primarily, the corporate provides semiconductors that function energy, analog, sensor, and connectivity options. Its core finish markets embody the automotive, industrial, cloud, and Web of Issues sectors.

Notably, ON can do all of this by its international community of producing amenities and engineering facilities. For buyers, ON inventory can be among the many extra reasonably priced bets within the present pool of semiconductor shares. Because it stands, the corporate’s shares are taking a look at features of over 130% prior to now 12 months. Nonetheless, seeing because it has taken a breather from its all-time excessive seen final month, would it not be sensible to purchase on the dip right here?

Properly, in its current quarter fiscal posted earlier this week, ON reported stellar figures. To start with, the corporate noticed huge year-over-year surges of 742% in web revenue and 766% in earnings per share. Moreover, ON additionally ended the quarter with over $1 billion in money readily available. CEO Hassane El-Khoury cited good execution from his workforce and robust demand from ON’s key end-markets as key elements of this efficiency. Given ON’s function within the present electrical automobile market, would you think about including ON inventory to your Might watchlist?

Source link