Repeatedly all through my profession I’ve ranted in regards to the nonsense of benchmarking in all its kinds. By now I’ve given up on the hope that enterprise and investing will ever go away the observe behind, so I don’t count on this publish to vary something besides to make me really feel higher.

So, indulge me for a minute or come again tomorrow . . .

I spoke lately with a pal about a company that we’re each intimately aware of and that has modified considerably over the past couple of years. For my part, one mistake the group made was to rent a strategic consulting agency to benchmark the group to its friends.

Alas, the result of that train was the dedication that the group needed to be extra like its friends to achieve success. In consequence, the group engaged in a cost-cutting and streamlining train in an effort to extend “effectivity.”

And guess what? Because of these measures, many individuals now assume that what made that group particular has been misplaced and are enthusiastic about now not being its buyer.

The issue with benchmarking an organization towards its friends is that it tends to be the quickest path to mediocrity. Technique consultants evaluate firms with distinctive cultures and enterprise fashions to their friends and inform them to undertake the identical strategies and processes that made their friends profitable previously.

However benchmarking an organization that’s about to vary the world is outright foolishness. In 2001 and 2002, Amazon’s share value dropped 80% or so. If Jeff Bezos had requested the Massive Three consultants what he ought to do, they might have advised him to be extra like Barnes & Noble.

Identify a single firm that went from loser to star performer and even modified its trade based mostly on the recommendation of strategic consultants . . .

Or as Howard Marks put it so clearly: “You’ll be able to’t do the identical factor as others do and count on to outperform.”

Which brings me to investing, the place pension fund consultants and different firms have launched benchmarking as a key methodology to evaluate the standard of a fund’s efficiency.

In fact, fund supervisor efficiency needs to be evaluated by some means. However why does it need to be towards a benchmark set by a selected market index?

Once they’re benchmarked towards a selected index, fund managers cease considering independently. A portfolio that strays too removed from the composition of the reference benchmark creates profession danger for the fund supervisor. If the portfolio underperforms by an excessive amount of or for too lengthy, the supervisor will get fired. So over time, fund managers spend money on an increasing number of of the identical shares and grow to be much less and fewer energetic. And that creates herding, notably within the largest shares in an index. Why? As a result of fund managers can now not afford to not be invested in these shares.

Mockingly, the entire benchmarking pattern has turned round. Benchmarks are actually designed to trace different benchmarks as carefully as potential. In different phrases, benchmarks are actually benchmarked towards different benchmarks.

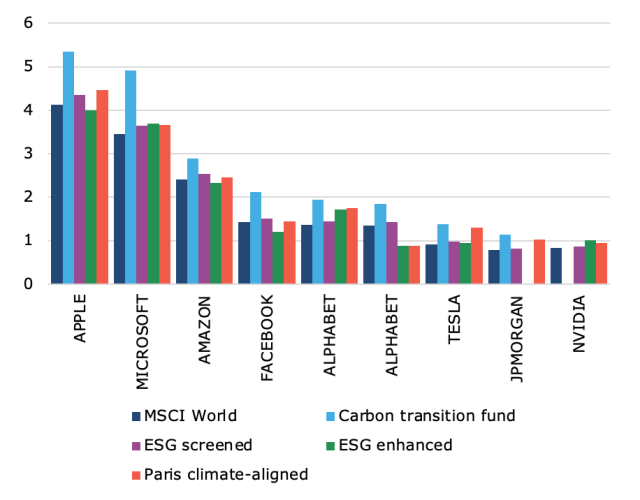

Take as an illustration the world of environmental, social, and governance (ESG) investing. Theoretically, ESG buyers ought to be pushed not simply by monetary targets but in addition by ESG-specific targets. So their portfolios ought to look materially completely different from a conventional index just like the MSCI World. In truth, in a really perfect world, ESG buyers would allocate capital otherwise than conventional buyers and thus assist steer capital to extra sustainable makes use of.

So, I went to the web site of a significant exchange-traded-fund (ETF) supplier and in contrast the portfolio weights of the businesses in its MSCI World ETF with the weights in its completely different ESG ETFs. The chart under exhibits that there’s basically no distinction between these ETFs, sustainable or not.

Portfolio Weights of the Largest Firms: Sustainable vs. Standard ETFs

The benefit of that is that buyers can simply swap from a traditional benchmark to an ESG benchmark with out a lot concern about dropping efficiency. That helps persuade institutional buyers to make the transfer.

However the draw back is that there’s little distinction between conventional and sustainable investments. If each firm qualifies for inclusion in an ESG benchmark after which has roughly the identical weight in that benchmark as in a traditional one, then what’s the purpose of the ESG benchmark? The place is the profit for the investor? Why ought to firms change their enterprise practices when they are going to be included in an ESG benchmark with minimal effort anyway and gained’t danger dropping any of their buyers?

Benchmarking ESG benchmarks towards typical benchmarks is like benchmarking Amazon towards different retail firms. It can kill Amazon’s progress and switch it into one other Barnes & Noble.

For extra from Joachim Klement, CFA, don’t miss 7 Errors Each Investor Makes (And Methods to Keep away from Them), and Threat Profiling and Tolerance, and join his Klement on Investing commentary.

For those who preferred this publish, don’t overlook to subscribe to the Enterprising Investor.

All posts are the opinion of the writer. As such, they shouldn’t be construed as funding recommendation, nor do the opinions expressed essentially replicate the views of CFA Institute or the writer’s employer.

Picture credit score: ©Getty Pictures / Mike Watson Pictures

Skilled Studying for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report skilled studying (PL) credit earned, together with content material on Enterprising Investor. Members can report credit simply utilizing their on-line PL tracker.

Source link