On Saturday, cryptocurrency analysts and merchants have been discussing bitcoin’s current chart patterns and the notorious dying cross sample has been a topical dialog. Quite a lot of merchants imagine when bitcoin’s short-term transferring common (MA) dips beneath the long-term MA, the crypto asset might be bracing for a serious sell-off. In the meantime, others are certain the dying cross technical sample means the value is because of rebound and probably double-top to greater values than the earlier all-time excessive.

The Return of the Notorious Demise Cross

On June 19, quite a lot of Twitter conversations, discussion board posts, and even headlines mentioned the technical sample referred to as the dying cross in regard to bitcoin’s (BTC) chart. Bloomberg revealed an article regarding the dying cross on Saturday and the publication featured just a few statements from billionaire investor Mark Cuban. The definition of a dying cross stemming from Investopedia notes the sample suggests “the potential for a serious sell-off.” The web site’s definition provides:

The dying cross seems on a chart when a inventory’s short-term transferring common crosses beneath its long-term transferring common. Sometimes, the commonest transferring averages used on this sample are the 50-day and 200-day transferring averages.

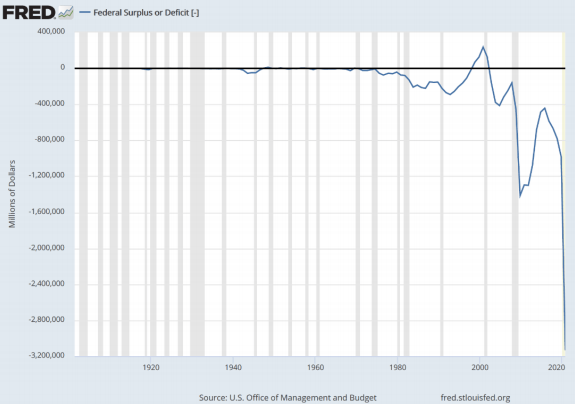

Nonetheless, the dying cross doesn’t essentially imply a bearish market is due. Investopedia particulars that dying cross occasions led to conventional inventory market crashes through the previous century together with 1929, 1938, 1974, and 2008. Demise crosses will not be uncommon and information from Canterbury Funding Administration signifies the Dow Jones Industrial Common has skilled 84 dying crosses since 1929. The favored economist and dealer Alex Krüger lately mentioned the state of affairs of a dying cross in relation to BTC/USD charts.

“The Demise Cross takes place when the 50 day transferring common crosses beneath the 200 day transferring common,” Krüger tweeted. “The Demise Cross takes place when the 50 day transferring common crosses beneath the 200 day transferring common. Journalists love writing about how a dying cross may carry forth a bear market. Nonetheless, one week historic returns following a bitcoin dying cross are POSITIVE. Loosen up,” Krüger burdened.

The favored creator of the bitcoin stock-to-flow mannequin, Plan B, additionally tweeted in regards to the notorious dying cross on Saturday. “Examine this chart to see what occurred [the] final two occasions the dying cross occurred, This fall 2019 and Q1 2020,” Plan B said to his 566,000 followers.

Nonetheless, a person named Mohit Sorout responded to Plan B’s tweet and famous that there’s been quite a lot of dying cross events all through bitcoin’s lifetime.

“There have been 6 previous dying crosses in bitcoin’s lifetime,” Sorout replied to Plan B. “4 have resulted in huge draw back. The 2 that didn’t result in a downtrend have been in direction of the tip of a bear market, not after a full blown bull run. Select your bias properly,” he added.

Bitcoin Merchants Hope a 2013 Double-Prime Sample Emerges

The creator and host of CNBC’s Crypto Dealer present Ran Neuner additionally wrote in regards to the dying cross on Saturday too. “Bitcoin shorts are being closed,” Neuner said. “That is affirmation that the shorts have been speculative and that it wasn’t miners hedging. We stated this could occur in anticipation of the ‘dying cross’ that ought to cross across the twenty fourth June. Anticipate extra FUD. I’m not promoting.”

A crypto fanatic referred to as Sultan mentioned the dying cross state of affairs together with his followers as effectively and stated that it might imply the worst is behind us. “Demise cross,” Sultan wrote. “Mockingly, dying crosses are sometimes an indication that the worst is already behind us. On the 2019 DC, Bitcoin had already went by a -47% dip earlier than the DC flashed, with a 52% restoration after. And a -64% dip earlier than the 2020 DC, with a fast 150% restoration,” he added. One other individual wrote to Plan B and stated:

An actual dying cross is when each MA’s are going through down. Good luck to anybody buying and selling the present cross on BTC.

Nobody actually is aware of what’s going to occur although quite a lot of merchants are assured their predictions will play out. Investor and market watcher John Hostetler additionally talked in regards to the dying cross state of affairs as effectively on Saturday. “Solely a idiot may deny that this Bitcoin DeathCross is extra like a bearish cross in crimson than a bullish one in inexperienced,” Hostetler said. “However I do like how the BTC value fell this week, as if to say ‘let’s get it over with, then we are able to rise’”

“In the long run, the cross modifications little,” Hostetler additional stressed. “Large query stays: has this halving cycle peaked? 2 weeks in the past I’d’ve assigned {that a} 1% chance, as a result of I hadn’t regarded on the now-dismal chart of Bitcoin S2F a number of shortly. Since then I’ve raised the percentages to ~20%. However that also leaves 80%. So I proceed with the Bitcoin double prime mannequin, drawing hope from the summer season of 2013, when $BTC got here inside a breath of a Demise Cross: gray arrow on the chart,” he concluded.

What do you concentrate on the bitcoin dying cross chart sample? Do you anticipate a bear market or a bull market going ahead? Tell us what you concentrate on this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Sultan, Plan B, Alex Krüger

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any harm or loss precipitated or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

Source link