Good morning, and welcome to our rolling protection of the world economic system, the monetary markets, the eurozone and enterprise.

The Financial institution of England units UK rates of interest at midday right this moment, in opposition to the backdrop of an financial restoration because the nation slowly emerges from lockdown and extra individuals are vaccinated.

Non-public sector development is the quickest in years, mortgage lending is at a report, and economists are predicting the largest bounce in GDP for the reason that Nineteen Forties.

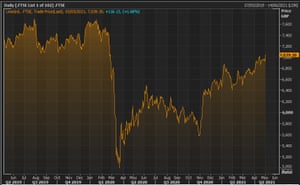

Traders are additionally upbeat. The FTSE 100 share index hit its highest degree in over a yr yesterday, with mining giants, oil corporations and banks among the many risers — all corporations who profit from a world rebound.

So with the financial image brightening, the BoE is anticipated to lift its development forecasts right this moment, in its newest Financial Coverage Report (additionally launched at midday).

Elsa Lignos of RBC predicts that the Financial institution will predict a smaller spike in unemployment this yr:

Considerably, the extension of the federal government’s furlough scheme, which was introduced on the funds, is prone to see the MPC decrease its estimate of the place it expects unemployment to peak as soon as help is withdraw.

This optimism definitely isn’t anticipated to set off an rate of interest rise from their present report low of 0.1%.

However…the Financial Coverage Committee will likely be pondering when it ought to sluggish, or taper, its £895bn asset buy stimulus programme, which is shopping for up round £4.4bn of presidency bonds every week.

Any hawkish indicators about that would additionally despatched the pound larger (it’s presently buying and selling at $1.39).

Joumanna Bercetche 🇱🇧

(@CNBCJou)Financial institution of England right this moment. Reminder {that a} mechanical tapering is *already* what the MPC have guided in direction of

See beneath from the Feb MPR the place Ramsden says “we do have to sluggish the tempo considerably in some unspecified time in the future” in order that they don’t go over the £150bn envelope pic.twitter.com/CAbvsxnJjo

Shamik Dhar, chief economist at BNY Mellon Funding Administration, says the prospects for the UK economic system “look vibrant”.

Due to a formidable vaccine rollout, the economic system appears to be like set to bounce again strongly within the second half, in all probability at double digit annualized development charges, returning total exercise to pre-crisis ranges this yr. Inflationary pressures may construct, however will in all probability be contained by a powerful provide response in these industries which have been locked down. The Financial institution of England (BoE) stays a great distance off tightening financial coverage, however might be one of many first central banks to sign it’s interested by it, presumably in early 2022.

This mentioned, the BoE is considering switching the normal sequencing of the coverage tightening, with hikes within the coverage fee presumably coming earlier than a shrinkage within the stability sheet, and is anticipated to supply steering on this concern within the subsequent coverage conferences. We anticipate that a lot of the fiscal deficit will right robotically as personal sector financial exercise picks up strongly, however the Chancellor may have to lift taxes modestly farther from right here. Long term, the general public debt burden will fall as long as the yield on gilts stays decrease than the nominal development fee of the economic system.

However the economic system received’t return to its pre-Covid state, after all, Dhar provides:

“The economic system will return to pre-crisis ranges of financial exercise rapidly, and presumably get well the pre-crisis pattern degree subsequent yr. However the composition of the UK economic system has in all probability modified completely because of the pandemic. Whereas we are going to see a powerful bounce again in ‘shut contact’ industries, resembling hospitality and journey, this yr and subsequent, they could by no means get well their pre-crisis share of the economic system. ‘Remotely-consumed’ items and companies will stay a bigger proportion of the economic system than they had been pre-pandemic.

European shares are anticipated to open somewhat larger, with new eurozone building information, the ultimate UK companies PMI for April, and the weekly US jobless report additionally arising.

IGSquawk

(@IGSquawk)European Opening Calls:#FTSE 7057 +0.24%#DAX 15176 +0.04%#CAC 6346 +0.10%#AEX 715 +0.10%#MIB 24515 +0.21%#IBEX 8964 -0.05%#OMX 2255 -0.01%#STOXX 3999 -0.09%#IGOpeningCall

The agenda

- 7am BST: German manufacturing facility orders for March

- 8.30am BST: Eurozone building PMI for April

- 9.30am BST: UK companies PMI for April

- Midday BST: Financial institution of England rate of interest determination

- Midday BST: Financial institution of England publishes Financial Coverage report

- 1.30pm BST: US weekly jobless claims figures

Source link