Bitcoin (BTC) might need examined the $40,000 assist in mid-July, however in accordance with varied derivatives metrics, there has not been a major change in investor optimism.

This example both signifies that worth will not be what they’re in search of to mark the tip of the present bear market or that the majority merchants are nonetheless underwater at $40,000.

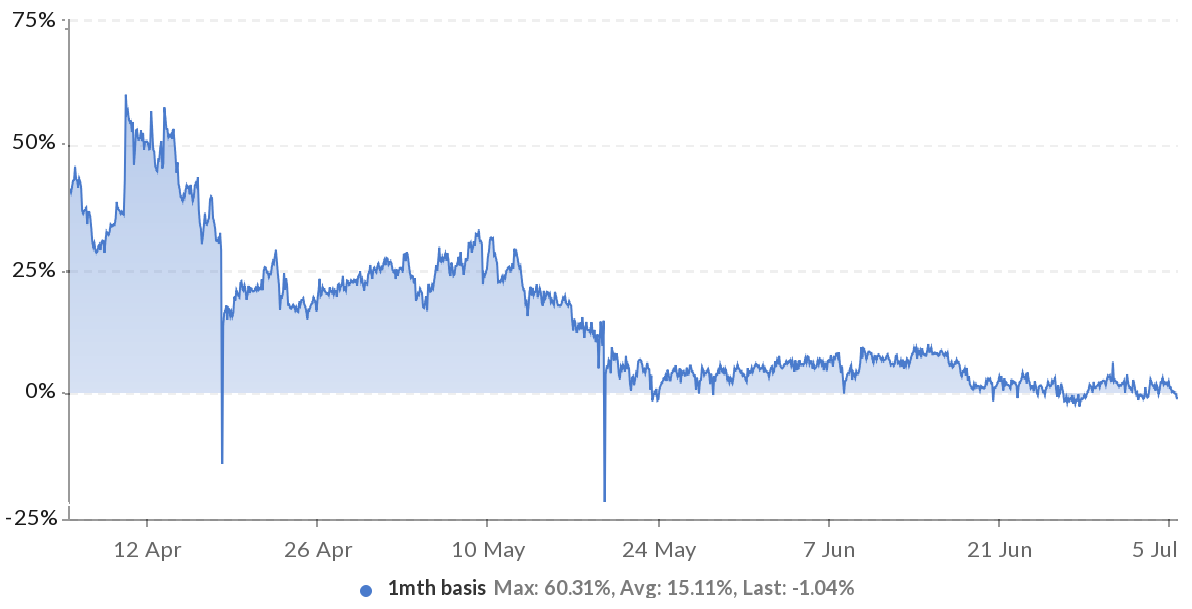

Top-of-the-line measures of optimism is the futures market premium, which measures the hole between longer-term contracts and the present spot market ranges. In wholesome markets, a 5% to fifteen% annualized premium is predicted. Nevertheless, throughout bearish markets, this indicator fades or turns destructive, a scenario often called “backwardation” — and an alarming pink flag.

In keeping with the chart above, the one-month futures contract has been unable to maintain an annualized premium above 5% since June 18. There have even been some intervals of backwardation, together with the newest one on July 5.

There’s, after all, the chance that derivatives markets may decouple from common spot markets. Perhaps traders are unwilling to take the change danger, as futures contracts require margin deposits.

May spot and derivatives markets diverge?

To grasp whether or not the bearish alerts seen in derivatives are explicitly tied to those devices, one ought to analyze spot market volumes. Sometimes, bearish markets will current decrease buying and selling exercise a few weeks after the value crash.

As predicted, the traded quantity peaked in late Might however decreased by greater than half a few weeks later. Though this can’t be deemed a bearish indicator by itself, it expresses a scarcity of curiosity in buying and selling on the present ranges.

This motion may occur when patrons are scared and, in consequence, place scaling bids beneath market ranges, or when sellers have been exhausted. Sadly, there is not any strategy to know till an honest quantity of quantity trades outdoors of the $650 billion market capitalization space.

Choices markets can help in confirming bearish sentiment

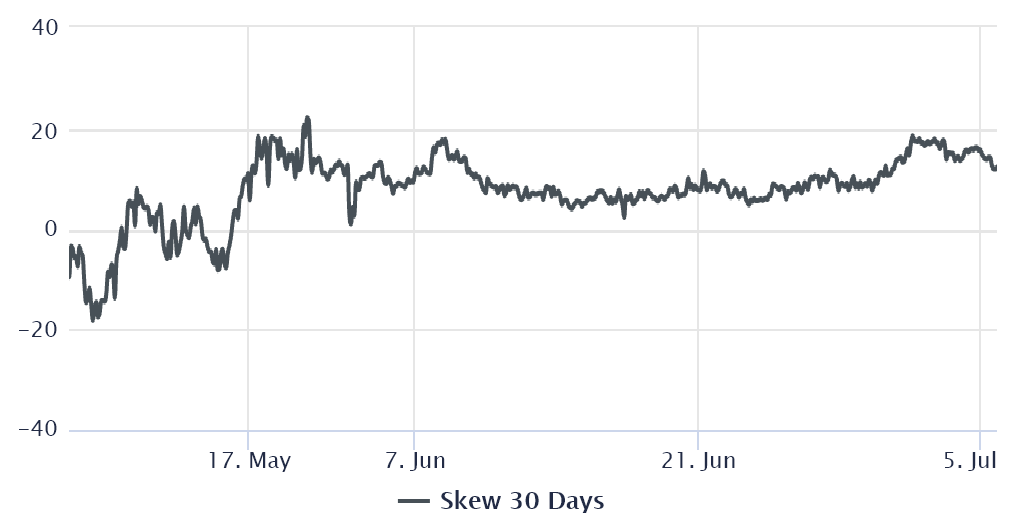

Nevertheless, there’s one other strategy to gauge skilled merchants’ optimism. The 25% delta skew compares comparable name (purchase) and put (promote) choices. When worry is prevalent, the metric will flip optimistic because the protecting put choices premium is larger than comparable danger name choices.

The alternative holds when market makers are bullish, inflicting the 25% delta skew indicator to shift to the destructive space.

A 25% delta skew starting from -10% to +10% is often deemed impartial. Nevertheless, the indicator has been above such a variety since June 30, indicating worry from arbitrage desks and market markets.

The final time this indicator confirmed a bullish sentiment was on April 14, the precise day of the $64,900 all-time excessive.

Contemplating that not one of the derivatives indicators confirmed indicators of bullishness whilst Bitcoin’s worth held above $40,000 on June 15, there’s cause to consider that traders are usually not comfy opening lengthy positions proper now. It stays to be seen what’s going to set off a sentiment change, however it can actually take greater than a single 10% rally.

The views and opinions expressed listed below are solely these of the author and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer entails danger. It is best to conduct your individual analysis when making a choice.

Source link