Up to date on June 2nd, 2021, by Nikolaos Sismanis

Appaloosa Administration was based in 1993 by David Tepper and Jack Walton.

The agency used to function as a junk bond funding firm within the Nineteen Nineties however advanced by the 2000s to develop into a extra diversified hedge fund.

It has been probably the most profitable hedge funds by specializing in public fairness and glued earnings markets all over the world, delivering jaw-dropping returns to its institutional traders throughout instances of misery.

As of its final 13F submitting, the fund had ~$6.9 billion in managed securities beneath administration, a 4.5% enhance from its earlier quarter amid larger capital allocation in its public-equity holdings, presumably resulting from buying extra shoppers.

Traders following the corporate’s 13F filings during the last 3 years (from mid-Could 2018 by mid-Could 2021) would have generated annualized complete returns of 10.0%. For comparability, the S&P 500 ETF (SPY) generated annualized complete returns of 18.6% over the identical time interval.

Word: 13F submitting efficiency is totally different than fund efficiency. See how we calculate 13F submitting efficiency right here.

Click on the hyperlink beneath to obtain an Excel spreadsheet with metrics that matter of Appaloosa Administration’s present 13F fairness holdings:

Preserve studying this text to be taught extra about Appaloosa Administration.

Desk Of Contents

David Tepper

Little might be mentioned about Appaloosa Administration with out mentioning its legendary supervisor David Tepper. Mr. Tepper has been certainly one of Wall Avenue’s highest-paid hedge fund managers of the previous decade, delivering market-beating returns throughout recessionary instances.

His web value is at present round $14.5 billion. His fortune was made by Appaloosa, having the vast majority of his belongings hooked up to the fund. Mr. Tepper has created most of his and Appaloosa’s worth by navigating the fund’s allocations throughout instances of misery.

In 2001, for instance, when the market was struggling large losses amid the dot com bubble, Mr. Tepper generated a 61% return by specializing in distressed bonds. In the course of the Nice Recession, he embraced the “purchase when there may be blood within the streets” mentality by buying distressed monetary shares.

Whereas everyone else was dumping their shares, Tepper was scooping up shares, together with his well-known play of shopping for Financial institution of America (BAC) shares for $3 every, in addition to AIG’s debt.

His daring bets paid off massively. From 2009 to 2010, the fund’s belongings beneath administration grew from $5 billion to $12 billion. Round $4 billion of those positive aspects have been added to Mr. Tepper’s web value, making him the very best earner of the recession and forming the vast majority of his wealth.

Final 12 months, Mr. Tepper introduced his retirement to pursue proudly owning the Carolina Panthers soccer crew, which he purchased in 2018 for a file $2.3 billion. A portion of Appaloosa’s belongings left the fund, which explains its present decreased AUM of $6.9 billion.

Appaloosa Administration’s New Buys & Sells

Throughout its newest 13F submitting, Appaloosa Administration executed the next notable portfolio changes:

New Buys:

- Chesapeake Vitality Corp (CHK)

- ViacomCBS Inc. (VIAC)

- D.R. Horton, Inc. (DHI)

- (The) Mosaic Firm (MOS)

- Antero Sources Corp (AR)

- iQIYI Inc (IQ)

- Apache Corp (APA)

- BP plc (BP)

- Discovery Inc Collection A (DISCA)

- Baidu Inc ADR (BIDU)

New Sells:

- Tenneco Inc. (TEN)

- Kinder Morgan Inc. (KMI)

- Sq. Inc (SQ)

- Magellan Midstream Companions LP (MMP)

- Allow Midstream Companions LP (ENBL)

- Wells Fargo & Co. (WFC)

Appaloosa Administration’s Present Main Investments

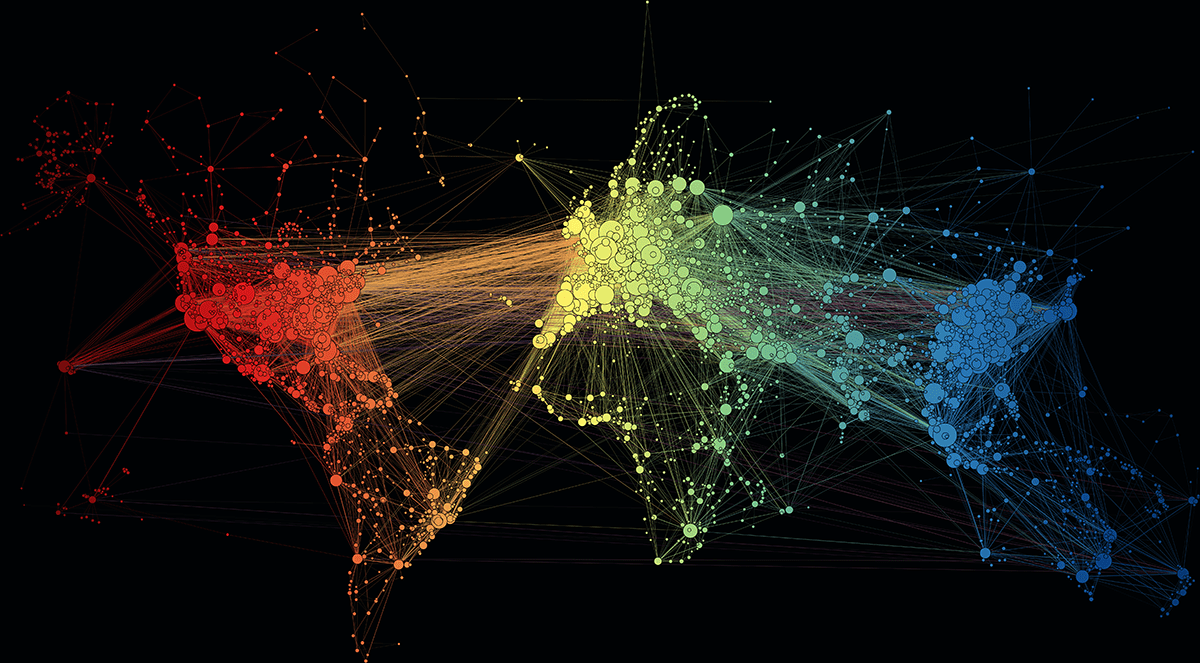

Appaloosa Administration’s long-term technique has targeted on concentrated funding positions with multi-bagger potential. This funding philosophy appears to be the case effectively after Mr. Tapper’s departure, because the fund’s practically $6.9 billion-worth public fairness portfolio consists of solely 40 shares, with the highest 5 accounting for round 46% of its complete holdings.

Supply: 13F Filings, Creator

The fund’s 10 largest investments are the next:

Amazon (AMZN)

Jeff Bezos’s e-commerce behemoth used to take up practically ⅓ of Appaloosa’s a few quarters earlier. With the fund’s conventional technique of focus, administration’s religion placement in Amazon has been typical amongst a number of funds as of late.

The corporate appears unstoppable each when it comes to its bodily and digital infrastructure capabilities. Nonetheless, with Appaloosa reserving some income out of its humongous stake, Amazon at present occupies round 9.7% of its complete portfolio. The fund trimmed its place by round 5% as of its newest submitting.

Amazon delivered one other spectacular quarter lately, with Q1 AWS web gross sales up 32% YoY to $13.5B, topping the 22.5% progress price consensus estimate. Income grew to $108.52 billion, a 43.7% enhance YoY, contributing to all-time excessive LTM (Final Twelve Month) gross sales of $419 billion.

Resulting from scaling its operations, the corporate’s web earnings margins have consistently been evolving, reaching 6.42% throughout this era, turning Amazon into an more and more worthwhile progress monster. The inventory is at present buying and selling at a ahead P/E of 58.5, however contemplating its EPS progress, it makes for a really cheap valuation a number of.

T-Cellular (TMUS)

Appaloosa trimmed its TMUS stake by 14% after ditching its AT&T stake fully within the earlier quarter.

With T-Cellular buying Dash final 12 months, the corporate ought to be capable of actively compete with AT&T and Verizon. Because of the synergies to be unlocked, the corporate ought to endure a progress section over the subsequent few quarters. Revenues rose by 78% to $19.8 billion in the newest quarter, with service revenues rising to $14.2 billion.

Administration raised its merger synergy forecasts following the continuing integration progress (round 50% of Dash’s buyer visitors is now carried on the T-Cellular community, whereas roughly 20% of Dash clients have been moved over). It now expects merger synergies of $2.8-$3.1 billion for FY2021 (up from $2.7-$3 billion), which quantities to double final 12 months’s synergies.

The inventory at present occupies round 9.4% of Appaloosa’s portfolio.

Micron Know-how (MU)

Regardless of Appaloosa trimming its Micron Know-how stake by 9%, the corporate is at present the fund’s third-largest holding, accounting for round 9.3% of its public fairness investments. The inventory has skilled a spectacular rally over the previous 4 years, because the demand for its semiconductors has been explosive.

Whereas the inventory is taken into account speculative, its strong profitability during the last a number of years has confirmed bears and short-sellers unsuitable. Many had predicted that the corporate’s high & backside line would endure because of the pandemic.

Nonetheless, Micron posted a strong FY2020 web earnings of $2.69 billion. The corporate is anticipated to supply FY2021 EPS of $9.02, implying a ahead P/E of ~9, which certainly implies a comparatively truthful a number of for an organization within the semiconductor trade.

Nonetheless, the trade stays wildly cyclical, which might translate to risky future efficiency for MU’s shareholders.

Fb (FB)

Appaloosa decreased its Fb stake by round 9%, retaining the inventory in its fourth-largest place. Shares account for round 9.2% of the fund’s holdings. With sturdy progress, a wholesome steadiness sheet, and the perfect platform for advertisers to make the most of, Fb stays a lovely decide at an affordable valuation.

The corporate’s MAU progress price has been sustained over time, by no means falling beneath the double-digits, which is a unbelievable feat contemplating that 2.8 billion individuals use its household of apps already.

The corporate at present shows all-time excessive LTM revenues and web earnings of $94.4 billion and $34.7 billion, respectively, whereas the inventory trades at 25.4 instances its underlying earnings, which makes for an inexpensive a number of at its ongoing progress charges.

With its ARPU (common income per consumer) rising, we’re assured that Fb’s financials will proceed increasing quickly, and the inventory will finally replicate the corporate’s underlying qualities, sending shares considerably larger.

Alphabet (GOOGL)

Appaloosa additionally trimmed its place in Alphabet by round 9%, doubtless in efforts to diversify its portfolio towards the corporate’s year-long rally. The corporate is one other instance of showcasing world-class financials and strong progress.

Additional, the inventory trades at a lovely valuation of round 28 instances the corporate’s ahead earnings, which makes it one of many extra cheap expertise shares.

Alphabet’s progress appears to be re-accelerating as effectively, with its newest outcomes posting income progress of 23.5%. Q1 revenues elevated 34% year-over-year to $55.3B, whereas working margin rose to 30% in comparison with final 12 months’s 19%, additional boosting the corporate’s future profitability.

It’s at present Appaloosa’s fifth-largest holding or round 8.6% of its public-equity holdings.

PG&E Company (PGE)

PG&E was Appaloosa’s largest holding at one level. The hedge fund slashed its place by an extra 32% throughout this quarter, netting Appaloosa respectable income from the inventory’s restoration from final 12 months’s ranges. With the remainder of its stake in PG&E, Appaloosa doubtless goals to learn from the corporate’s at present depressed state of affairs.

Ought to the corporate recuperate from its present headwinds, Appaloosa is prone to have made certainly one of its most profitable distressed fairness investments, shopping for shares close to their 50-year lows. Nonetheless, the corporate stays very dangerous, and has suspended dividends. Subsequently, retail traders needs to be very conscious of the underlying considerations earlier than allocating capital to the corporate.

PG&E stays unprofitable, although the inventory is that if one considers its ahead web earnings estimates. Analysts count on profitability to renew subsequent 12 months.

Alibaba Group (BABA)

Alibaba’s stake was slashed by 40% throughout this previous quarter. Shares have remained depressed over the previous 12 months, regardless of the corporate posting file revenues and income. This is because of Chinese language equities dealing with growing scrutiny, and Alibaba itself lately ordered to pay $2.75B in fines by the Chinese language regulators.

Nonetheless, what the market appears to see as “excessive danger” on the subject of Alibaba is probably going largely a psychological phenomenon. The corporate continues to be a progress juggernaut, with no indicators of slowing down. So far as the latest advantageous, the $2.75B equates to round 3.8% of Alibaba’s money place, or what the corporate makes each couple of weeks or so.

With a mean estimated shopping for value beneath $200, Appaloosa has profited properly off of its Alibaba stake. The inventory is at present buying and selling at a really cheap valuation of round 20 instances its ahead earnings.

Nonetheless, we are able to’t ignore the opposite main danger revolving round Chinese language equities, which is the potential for a NASDAQ de-listing.

Vitality Switch LP (ET)

Appaloosa trimmed its Vitality Switch stake by 5% throughout this previous quarter, but the inventory ascended to its high 10 largest holdings amid the remainder of its portfolio changes. Lately, Vitality Switch recaptured the higher hand following the District Courtroom’s choice to refuse to close down the Dakota Entry Pipeline.

The corporate ought to due to this fact face decreased money move dangers going ahead. The Grasp Restricted Partnership is at present yielding 7.7%, regardless of slashing its distribution in half final October resulting from COVID-19’s results within the power sector.

Vitality Switch is Appaloosa’s eighth-largest holding, accounting for round 3.8% of its complete portfolio.

Occidental Petroleum Company (OXY) & HCA Healthcare, Inc. (HCA)

Final however not least, Appaloosa’s ninth and tenth largest holdings are each comparatively new entries on this checklist (made it to its high 10-largest holdings final quarter), accounting for round 3.5% and three.2% of its portfolio, respectively. Occidental, together with the opposite new stakes that the fund initiated in the course of the quarter like Chesapeake Vitality Corp and BP, doubtless point out that the Appaloosa is changing into bullish on the power sector.

The corporate has primarily suspended its dividend at this level, paying solely a penny per quarter, because it recovers from the antagonistic results of the pandemic. It’s unlikely that traders will see any vital capital returns again at this level, with all 4 of its earlier quarters leading to web losses.

Lastly, the fund trimmed its place in HCA by 5% to a $199 million stake. Appaloosa owns solely two shares working within the healthcare sector, with HCA being the most important one. The medical care services supplier posted resilient outcomes throughout FY2020, and whereas it did lower its dividend in the course of the 12 months to stay prudent, it reinstated as of the previous couple of quarters.

The inventory at present trades at simply over 15 instances its ahead earnings, being fairly pretty priced contemplating its long-term progress prospects.

Remaining Ideas

Appaloosa Administration has had a affluent previous, with a number of achievements beneath Mr. Tepper’s management. The agency has spoiled its traders with jaw-dropping returns throughout antagonistic financial instances. Mr. Tepper’s departure marks a brand new period for the fund.

Whereas the agency’s public holdings have barely lagged the market over the previous three years, it’s nonetheless early to evaluate, because the agency might as soon as once more shine throughout a possible future recession.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

Source link