The double-digit rallies seen from many altcoins reveals merchants have gotten more and more bullish with the passing of every day, however sustaining this momentum will to some extent depend upon Bitcoin’s (BTC) short-term worth motion.

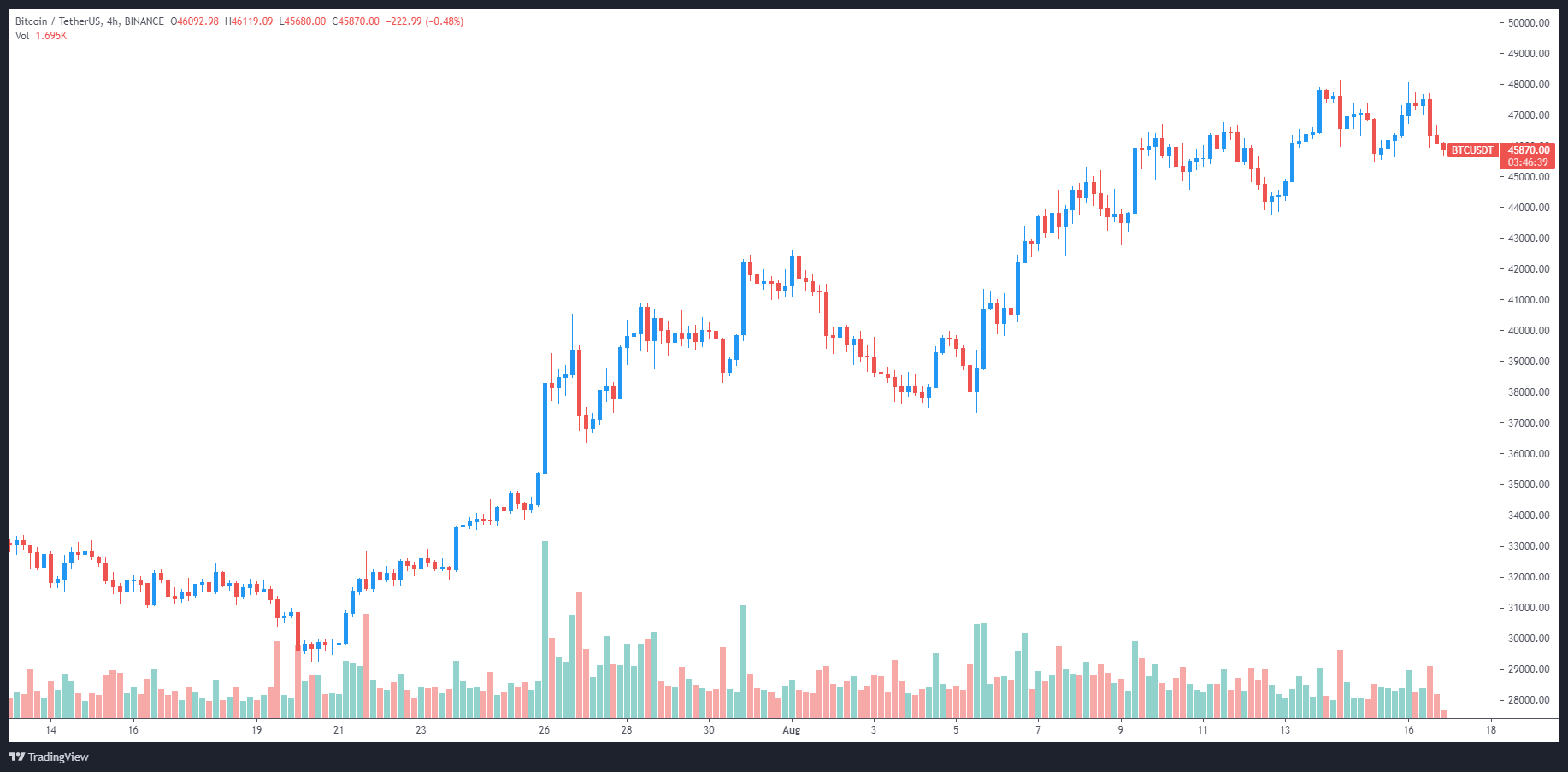

Knowledge from Cointelegraph Markets Professional and TradingView reveals that after touching the $48,000 worth degree in the course of the early morning buying and selling hours on Aug. 16 the value of BTC dipped beneath $45,800 as bulls scrambled to place a halt to the value slide.

Right here’s what analysts are saying could possibly be the subsequent steps for Bitcoin worth.

Bitcoin wanted to retest help after a 50% rally

Bitcoin’s surge from $29,500 on July 20 to $48,000 on Aug. 14 has resulted within the worth settling in a buying and selling vary between $44,000 and $48,000, as proven within the following tweet from pseudonymous Twitter analyst Nunya Bizniz.

BTC 1hr:

Bounce at EQ? pic.twitter.com/LjCdQf8yXF

— Nunya Bizniz (@Pladizow) August 16, 2021

The equilibrium level recognized within the above tweet is discovered close to $46,123 and the analyst could possibly be hinting that after BTC exams the help, purchase volumes may improve as a result of short-term merchants would view the present pullback as nothing greater than a help/resistance retest.

However, pseudonymous dealer, Gasoline Fring, suggested {that a} bounce may additionally occur on the backside of a rising channel would provoke the identical consequence but it surely’s value noting that each analysts are utilizing 1-hour charts so these options merely seek advice from the potential worth motion outcomes of right this moment.

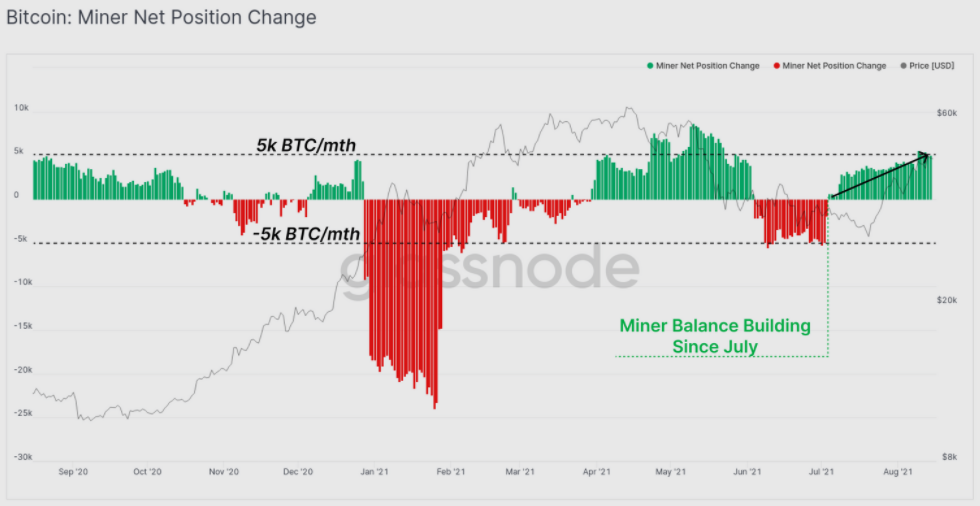

Miners are accumulating once more

A latest report from Glassnode highlighted miner accumulation as one other probably bullish indicator for Bitcoin. The on-chain analytics supplier noticed “a web discount in obligatory sell-side strain sourced from miners.”

China’s crackdown on mining operations which started in Might took a heavy toll on the Bitcoin hash charge, main miners to shut up store and transfer to completely different cou with a extra pleasant stance in direction of crypto mining.

Glassnode mentioned,

“We have now seen the online stability place of miners proceed to extend during the last two months. The web development of miner balances has now hit +5k BTC/month which demonstrates a web discount in obligatory sell-side strain sourced from miners.”

Associated: BTC eyes $50K breakout regardless of most ‘greed’ since all-time highs: 5 issues to look at in Bitcoin this week

A each day shut above $46,500 is the subsequent hurdle

In response to crypto Twitter analyst Rekt Capital, $46,500 is a vital degree for BTC within the short-term.

As seen above, the value motion for BTC has resulted within the formation of an ascending triangle on the each day chart and the value wants to shut above the $46,500 degree to be able to affirm a profitable check of the triangle resistance.

A each day shut above $46,500 would help the continuation of the uptrend whereas an ascending triangle breakdown may see Bitcoin worth slide into the low $40,000 zone.

The general cryptocurrency market cap now stands at $2.007 trillion and Bitcoin’s dominance charge is 43.5%.

The views and opinions expressed listed here are solely these of the writer and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer entails danger, it is best to conduct your personal analysis when making a choice.

Source link