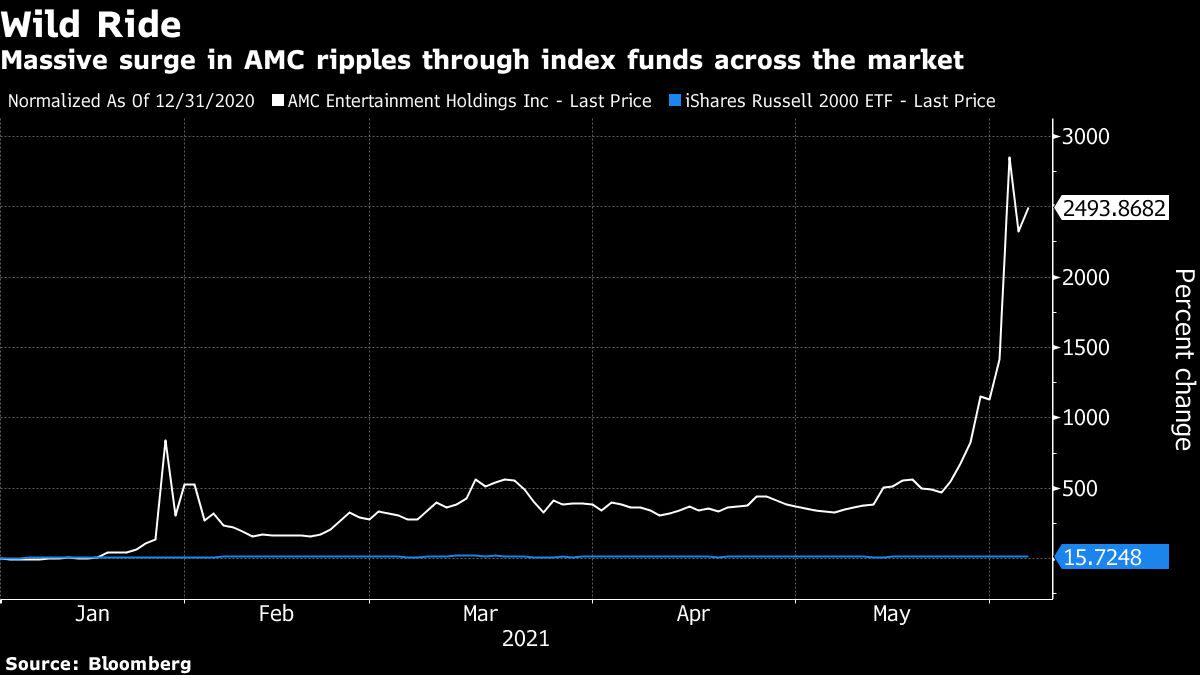

(Bloomberg) — Index funds are supposed to chop out the human-driven craziness that periodically infects markets, however the latest meme-stock fever proved the $11 trillion business is much from immune.

The exceptional surge in shares of AMC Leisure Holdings Inc. and a handful of different shares is exhibiting up in a number of exchange-traded funds, skewing portfolios, altering threat profiles and exerting outsized affect on costs.

Take the $68 billion iShares Russell 2000 ETF (ticker IWM). Up to now week via Thursday, AMC powered 70% of the product’s advance. The inventory was answerable for lower than a tenth of the fund’s return within the earlier week.

It’s a well timed reminder that even diversified funds on autopilot stay topic to the whims and eccentricities that incessantly lash markets out of nowhere.

“For index investing, the enchantment is that human decision-making, human feelings are taken out of it,” stated Tom Essaye, a former Merrill Lynch dealer who based “the Sevens Report” e-newsletter. “That works all effectively and good till a inventory that’s speculated to be 50 foundation factors of the fund now turns into 6%.”

The AMC impact might be seen throughout a spread of funds. Alongside IWM, the $17.5 billion iShares Russell 2000 Worth ETF (IWN) and $72 billion iShares Core S&P Small-Cap ETF (IJR) have additionally seen the inventory’s affect climb.

An identical phenomenon happened in January, when GameStop Corp. at one level surged greater than 1,600%. Shares of the video-game retailer additionally rallied alongside AMC up to now week. The 2 corporations are amongst a handful of shares dubbed meme shares which can be having fun with speedy, social-media fueled good points.

“As soon as the foundations have been drawn up within the land of indexing, as soon as the play has been referred to as within the huddle, you don’t have that discretion,” stated Ben Johnson, Morningstar’s world director of ETF analysis. “You are taking regardless of the market goes to offer you and execute the performs.”

Learn extra: Robinhood, Meme Shares and Investing as a Recreation: QuickTake

The distinction now could be that buyers have poured billions of {dollars} into merchandise monitoring smaller and cheaper shares up to now six months, a part of a broad rotation into extra growth-sensitive corporations to trip an financial restoration from Covid-19.

On the identical time, meme mania is larger than ever. Alongside AMC and GameStop, corporations together with BlackBerry Ltd., Koss Corp. and Mattress Bathtub & Past Inc. additionally noticed enormous strikes up to now week.

“Even in a basket of two,000 shares you’re getting some systemic threat round this idea of retail meme shares as a result of they’re sufficiently small to push round,” stated Nick Colas, co-founder of DataTrek Analysis.

Balancing Act

The money and chaos exposes a glitch within the plumbing of many funds, which is that they’re typically tied to the rebalancing schedule of the index they comply with.

Given the pace of the rallies within the likes of AMC and GameStop, even monitoring an index that rebalances quarterly — a comparatively frequent schedule, by business requirements — leaves a fund prone to distortion.

One of the crucial-dramatic examples occurred in Could, although it was unrelated to the meme-fueled drama. Round 68% of the $14.5 billion iShares MSCI USA Momentum Issue ETF (MTUM) needed to be modified due to the massive market rotation that occurred since its final semiannual rebalance.

For quants who prefer to slice and cube shares by traits like how costly they seem or how a lot their costs swing round — referred to as elements — it’s all referred to as model drift. The fund is drifting away from its technique, or investing model.

Not too way back, AMC shares appeared low-cost and crushed down, which means it certified for a lot of worth issue methods. However the wild surge of latest weeks makes it among the many most-expensive shares within the Russell 3000.

AMC shares at present stand at nearly 10 instances the extent analysts see it buying and selling a 12 months from now: $5.25. The premium tops all Russell 3000 shares which have sufficient of an analyst following to generate a worth goal, in response to Bloomberg knowledge, and greater than double that of GameStop — the subsequent over-valued inventory.

AMC will doubtless stay in lots of worth funds till their rebalancing comes round.

“Analysis tells premiums akin to these related to small cap and worth shares are usually delivered by a subset of the asset class,” stated Wes Crill at Dimensional Fund Advisors, a pioneer of quant investing which has $637 billion underneath administration. “Model drift can cut back the percentages of capturing the premiums once they seem.”

The plain resolution could be to rebalance extra typically. However that may carry extra transactional prices to funds, which generally is a large drawback for passive automobiles charging rock-bottom charges.

For some, the timing works out, merely by happenstance. AMC made up 21% of the $1.8 billion Invesco Dynamic Leisure and Leisure ETF (PEJ) at one level on Wednesday. Due to its repeatedly scheduled rebalancing, it had zero shares of AMC by Friday.

Pickers’ Delight

Indexes are created utilizing all kinds of strategies, however the commonest are cap-weighted and equal-weighted. And neither is proof against meme-stock distortion.

IWM is predicated on a cap-weighted index, which means it allocates in response to an organization’s market cap. Whereas meaning it will probably maintain tempo with AMC’s rally, it’s routinely extra uncovered to probably unstable investments. The fund now holds 1.75% of AMC, Bloomberg knowledge present.

On the different finish of the spectrum, the $21 million SoFi 50 ETF (SFYF) is predicated on an equal-weight gauge, which means it goals to carry roughly the identical worth of shares in every of its constituents. However with a semiannual rebalancing schedule, AMC now accounts for 20% of the fund. It must be within the low single digits.

Learn extra: AMC Is Hijacking a Tiny Meme ETF as Weighting Grows 4% an Hour

Finally, all of this could add as much as excellent news for lively cash managers.

Whereas lumbering index funds are on the mercy of meme-mania and the rebalancing schedule, inventory pickers can transfer quick to take advantage of excessive market motion.

“If there are elements of the market which were hijacked and pushed increased by retail buyers, maybe simply avoiding these will present lively managers the power to outperform within the coming years,” stated Brent Schutte, chief funding strategist at Northwestern Mutual Wealth Administration Firm.

Extra tales like this can be found on bloomberg.com

Subscribe now to remain forward with essentially the most trusted enterprise information supply.

©2021 Bloomberg L.P.

Source link