Chinese language authorities have slapped Alibaba with a $2.8 billion nice after ending an anti—belief investigation that seemed into alleged monopolistic practices. The State Administration for Market Regulation launched a probe into the e-commerce large’s “suspected monopolistic conduct” in December, notably its coverage that forces retailers to promote on its platforms solely and prevents them from promoting on rival e-commerce web sites. In a launch posted on the watchdog’s web site, it mentioned its investigation proved that the coverage eradicated and restricted competitors within the nation and hindered innovation within the on-line retail platform sector.

On account of that conclusion, the regulator penalized the corporate in accordance with China’s antimonopoly regulation, ordering it to cease its unlawful actions and to pay a nice equal to 4 % of its home gross sales within the nation. As The New York Instances notes, the $2.8 billion nice will not put Alibaba’s funds at risk, however it exceeds the $975 million penalty the Chinese language authorities imposed on Qualcomm again in 2015 for violating the antimonopoly regulation. In an announcement despatched to NYT, Alibaba mentioned it will settle for the penalty and would make sure that “to higher perform its social duties.”

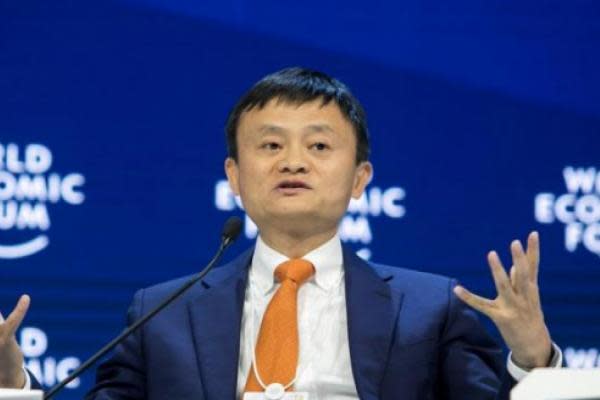

China began maintaining a better eye on tech giants final yr, with lawmakers proposing an replace to the antimonopoly regulation so as to add guidelines particularly for them. Jack Ma’s companies, specifically, appear have grow to be a goal in his dwelling nation after he known as Chinese language banks “state-owned pawnshops” for giving pointless loans throughout a finance summit. His executives even needed to kind a job drive to take care of regulators every day.

Except for the antimonopoly probe into Alibaba, Shanghai Inventory Alternate blocked the deliberate IPO for Ant Group, the monetary providers firm he based, again in November. Earlier than the yr ended, regulators ordered the corporate to “return to its origins” as a fee supplier and to close down the investments, lending, insurance coverage and wealth administration providers it launched through the years.

Source link