This text relies partly on materials drawn from “The Daybreak of a New Lively Fairness Period” by C. Thomas Howard and Return of the Lively Supervisor by C. Thomas Howard and Jason Voss, CFA.

In our 2019 ebook Return of the Lively Supervisor, we declared that energetic fairness administration was alive and effectively regardless of the current motion to index investing. We offered quite a few concepts on the way to enhance the analysis of funding alternatives in addition to handle fairness portfolios, from the attitude of behavioral finance.

Little did we all know {that a} new golden period of energetic fairness would begin shortly thereafter.

Earlier than we element the proof of this return to superior energetic efficiency, we first have to handle the problem of energetic vs. passive investing, because it dominates a lot of the present dialogue round fairness investing.

Lively vs. Passive

It’s effectively established that energetic fairness collectively underperformed its passive counterpart over a lot of the final 10 years. A few of this underperformance might be attributed to the various closet indexers which can be included within the “energetic” fairness universe.

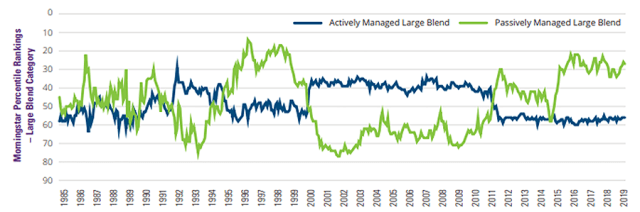

What just isn’t so well-known is that energetic funds have gone by prolonged durations of under- and outperformance. The graph beneath, derived from a current Hartford Funds examine, illustrates the cyclical nature of this sample. From 2011 by 2019, energetic funds lagged their passively managed friends, as measured by what is taken into account probably the most extremely environment friendly market phase, Morningstar’s massive mix funds

Nevertheless, for the ten years prior, energetic funds beat their passive counterparts. Furthermore, over the past 30 years, energetic eclipsed passive in 19 out of 26 corrections, that are outlined as 10% to twenty% market drops.

Rolling Month-to-month Three-12 months Durations, 1986 to 2019

The current coronavirus market crash was dramatic, leading to a drop of greater than 30% and the quickest descent right into a bear market ever. Does this market turmoil presage an prolonged interval of energetic fairness outperformance like we noticed after the dot-com bust and the Nice Recession? There may be good motive to imagine so.

The unprecedented 2020 worldwide financial shutdown and the next huge fiscal and financial stimulus have created extraordinary uncertainty round particular person inventory valuations. The divergent sample of fairness returns that has developed gives fertile floor for energetic fairness. It’s in simply such conditions that expert funding groups can thrive.

Lively Fairness Alternative (AEO)

Simply how favorable is the present atmosphere for inventory selecting? Three tutorial research make clear that query. They discover that each rising cross-sectional inventory dispersion, or the cross-sectional customary deviation of returns from both particular person shares or a portfolio of shares, and rising volatility, usually measured by VIX, are predictive of upper stock-picking returns. Moreover, a fourth examine demonstrates that top constructive skewness performs a serious position in portfolio and market efficiency.

The energetic fairness alternative (AEO) estimates the influence of market situations on stock-picking returns by measuring how buyers are driving particular person inventory return dispersion and skewness. Lively fairness managers favor a better AEO because it signifies their high-conviction picks usually tend to outperform. However, a low AEO implies that even probably the most gifted managers will wrestle to beat their benchmark.

AEO estimates are calculated utilizing 4 parts in descending order of significance:

Every element is measured as a six-month trailing common after which transformed to a regular regular deviate. These are then mixed utilizing common correlations with fund and inventory alphas and scaled to a 0–100 vary.

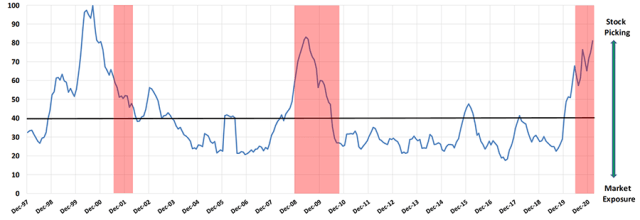

The next graphic presents the beginning-of-the-month AEO scores from December 1998 by February 2021. The typical AEO over this time was 40, with values larger than 40 indicating a greater stock-picking atmosphere.

Lively Fairness Alternative, Dec. 1997 to Feb. 2020

In the course of the almost 25 years beneath evaluate, the 1998–2006 and 2008–2010 durations favored inventory selecting. The 2011–2019 interval was unhealthy for energetic fairness. AEO was principally beneath common and declined to a low of 18 in mid-2017.

Anna Helen von Reibnitz studied cross-sectional dispersion going again almost 50 years and finds that the mid-2017 AEOs had been among the many lowest in a half century. For a lot of the earlier 10 years, inventory pickers confronted sturdy headwinds, which partly explains passive’s current development at energetic’s expense.

Since late 2019, nonetheless, AEO has spiked and is now at twice its common. The pink shaded areas signify Nationwide Bureau of Financial Analysis (NBER) recessions. Based mostly on a 1972–2013 fund pattern, von Reibnitz concludes: “General, these outcomes recommend that durations of elevated dispersion have a constructive impact on alpha for the fund pattern as an entire, past that coming from recessions.”

We’re at the moment in a recession, till NBER says in any other case, that’s accompanied by increased AEOs. This needs to be ultimate terrain for inventory pickers.

Passive Development’s Shocking Impression on Lively Efficiency

In 2019, passive fairness mutual fund property beneath administration (AUM) exceeded energetic fairness AUM for the primary time ever. How lengthy will this transition from energetic to passive final? Will passive funds be the one ones left standing on the finish of the day? We don’t imagine so. Why? for the straightforward motive that as uninformed passive AUM grows, the inventory market will develop into extra informationally inefficient.

Data-gathering energetic funds have a wonderful alternative to outperform as passive AUM expands. Sanford J. Grossman and Joseph E. Stiglitz argued 40 years in the past that some data inefficiency should stay to incentivize energetic buyers to pursue the expensive data-gathering course of required to make worthwhile funding selections. The present passive revolution is thus sowing the seeds for an energetic fairness renaissance.

The extra shares are held by passive buyers, Russ Wermers demonstrates, the extra informationally inefficient markets develop into and the larger the alternatives for energetic managers. Passive fund trades add little market effectivity, Wermers and Tong Yao keep, since they’re pushed by investor flows, whereas information-gathering energetic funds commerce in shares that aren’t effectively priced.

Of their examine of indexing and energetic administration within the world mutual fund sector, Martijn Cremers and different researchers clarify the diploma of specific versus closet indexing as largely the perform of a nation’s monetary market and regulatory situations. Additionally they conclude that the extra aggressive stress from listed funds, the extra energetic energetic funds develop into and the decrease their charges.

Furthermore, the common energetic alpha generated is increased in nations with extra specific indexing and decrease in these with extra closet indexing. General, the proof means that specific indexing improves competitors within the mutual fund trade. The present move of funds out of closet indexing could imply smaller energetic vs. passive AUM, but it surely bodes effectively for these fairness managers who pursue narrowly outlined methods whereas specializing in high-conviction positions.

As massive passive inflows proceed, inventory mispricing will enhance. From the present 50/50 break up, the forces driving flows into passive funds will ultimately be neutralized by the offsetting enhance in inventory selecting’s attraction. This might end in a roughly 70% passive to 30% really energetic break up. That’s a beautiful equilibrium for energetic fairness methods.

Current Lively Fairness Efficiency

Whereas energetic fairness funds underperformed from 2011 by a lot of 2019, how have they fared since Return of the Lively Supervisor was revealed in October 2019?

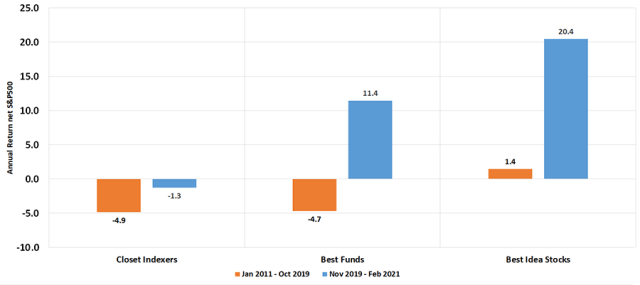

The annual returns, web of S&P 500 returns, for closet indexers and greatest energetic fairness funds, together with the returns for greatest thought or high-conviction shares are introduced beneath. One of the best energetic fairness mutual funds pursued a narrowly outlined fairness technique and centered on their greatest thought shares. AthenaInvest, C. Thomas Howard’s agency, assigns a fund to one in all 10 technique groupings based mostly on its self-declared technique. One of the best funds in every technique are decided every month based mostly on goal measures of technique consistency and high-conviction fairness holdings. (These measures aren’t performance- based mostly however are gauges of fund supervisor conduct.)

The reported annual returns are derived from a easy common of the 220 or so greatest fund subsequent month web returns for every month through the time interval into consideration. Closet index returns are calculated in an analogous method. Greatest thought shares are these most held by the perfect funds. Every month options between 250 and 300 greatest thought shares. Annual returns are calculated utilizing a easy common of the next month-to-month inventory returns in every month through the interval into consideration. Because of this a small variety of large-cap shares — the FAANGS, for instance — don’t disproportionately affect reported returns. In truth, small shares dominate the perfect thought universe.

Lively Fairness Mutual Fund and Greatest Thought Shares, Web Annual Returns

Because the previous determine exhibits, each closet indexers and greatest funds underperformed the S&P 500 by almost 5% from early 2011 to late 2019. Greatest thought shares barely outperform, but when their charges are deducted, they generate returns similar to the S&P 500’s. So, if an energetic fairness fund had centered completely on greatest thought shares throughout this era, it might have matched the market return. Thus, even the perfect funds should maintain various low-conviction shares together with their high-conviction counterparts.

This ancient times, throughout which AEO was effectively beneath its common worth, exhibits how troublesome it’s for energetic fairness funds to outperform in such markets. A excessive AEO atmosphere, nonetheless, wherein emotional investing crowds are pushing shares away from their elementary worth, units the stage for stock-picking success.

The later November 2019 to February 2021 interval, when AEO was effectively above common, demonstrates this. Once more, closet indexers underperformed the market roughly by their charges. But each greatest funds and best-idea shares eclipsed the S&P 500 on an annual foundation by 11.4% and 20.4%, respectively, as AEO reached ranges not seen because the late Nineteen Nineties. Greatest thought shares outperformed greatest funds by a whopping 9% yearly, which provides additional proof that greatest funds maintain many low-conviction shares.

This current efficiency shines a light-weight on the extraordinary ability of energetic fairness managers when market situations favor inventory selecting.

Thriving within the Golden Period

So how can skilled managers optimize their efficiency in at present’s excessive AEO and emotionally charged market atmosphere?

Limiting frequent cognitive errors will likely be essential to success. Funding managers might be single-minded and hardnosed when making shopping for selections. In spite of everything, they’ve rigorously thought-about dozens of candidates and invested solely of their greatest thought shares. However as soon as a inventory enters the portfolio, an emotional transformation takes place. It turns into a part of the “household.” Heaven forbid it ever goes down. “How may you do that to me!” the supervisor thinks. “I examined you rigorously, even assembly with firm administration, and that is what you do to me!”

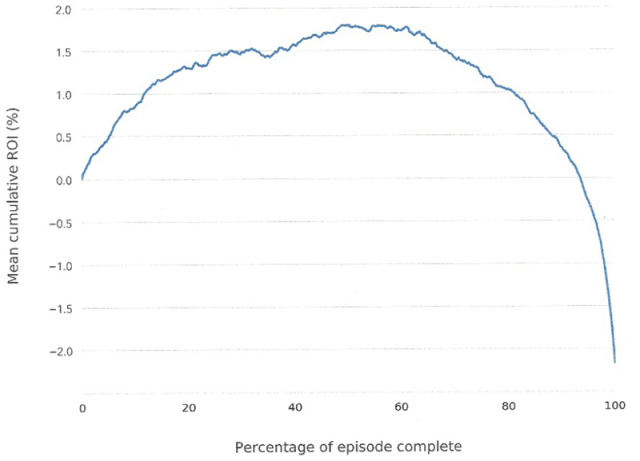

Emotional promoting selections are an issue for skilled buyers. A 2019 Essentia Analytics paper, “The Alpha Lifecyle,” exhibits that managers are likely to fall in love with their shares and find yourself hurting returns by holding on too lengthy and promoting too late. The graph beneath illustrates the paper’s principal outcomes.

Grand Imply of Cumulative Return on ROI over All Inventory Time Episodes

The determine’s preliminary upward slope exhibits how the everyday supervisor’s stock-picking expertise will increase alpha for about 50% to 60% of the holding interval. After that, alpha begins to say no after which plummets to unfavourable territory through the holding interval’s closing 5%. That’s, on common, managers develop hooked up to their shares and cling to them to the purpose of smothering the preliminary hard-earned alpha. Managers ought to study to promote earlier than reaching this closing damaging stage.

Which means creating a circumstances-based promoting rule. This is among the most vital emotional changes a supervisor could make to an funding course of. Take the feelings out of promoting by creating an goal promoting rule, ideally earlier than the inventory is even bought. This reduces the potential for cognitive errors across the promoting choice and may enhance fund efficiency. Managers ought to develop into as deliberate about promoting as they’re about shopping for.

One other vital consideration is the reliability of the monetary knowledge on which fairness evaluation relies. In “Fraud and Deception Detection: Textual content-Based mostly Evaluation,” Jason presents a novel strategy. He invented Deception And Reality Evaluation (D.A.T.A.), a computer-based evaluation, to review the psycholinguistic/behavioral cues revealed within the 86.5% of economic knowledge that’s text-based. In checks of scandal-plagued corporations, D.A.T.A. recognized indications of deception in all such corporations and with a mean lead time of 6.6 years. How is that this attainable?

We’ve got lengthy maintained that behaviors — as revealed in firm paperwork — drive selections, and, in flip, selections drive outcomes and inventory efficiency. It takes 6.6 years on common for unhealthy behaviors to be priced precisely by the market and solely after a major lag do they present up within the numbers. That is why it’s so vital for buyers to give attention to conduct.

The golden period is right here.

Since late 2019, market situations have turned favorable for energetic fairness funds. Particular person inventory dispersion and constructive skewness, market volatility, and the small agency premium all have elevated in current months. The stage is ready for inventory pickers to exhibit their ability.

Given the dimensions of current financial and market disruptions, we will count on heightened uncertainty for a while. This makes figuring out a inventory’s elementary worth a problem that favors professional, closely resourced skilled fairness groups.

The present excessive AEO interval additionally alerts elevated buying and selling exercise by emotional crowds that push inventory costs away from elementary worth. The current GameStop brief squeeze frenzy is barely probably the most seen instance of those market-roiling trades. This new golden period of inventory selecting may stretch many months into the longer term. Skilled managers and buyers alike ought to embrace this chance for so long as it lasts.

When you preferred this submit, don’t neglect to subscribe to the Enterprising Investor.

All posts are the opinion of the writer. As such, they shouldn’t be construed as funding recommendation, nor do the opinions expressed essentially mirror the views of CFA Institute or the writer’s employer.

Picture credit score: ©Getty Photos / Randy Faris

Skilled Studying for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report skilled studying (PL) credit earned, together with content material on Enterprising Investor. Members can file credit simply utilizing their on-line PL tracker.

Source link