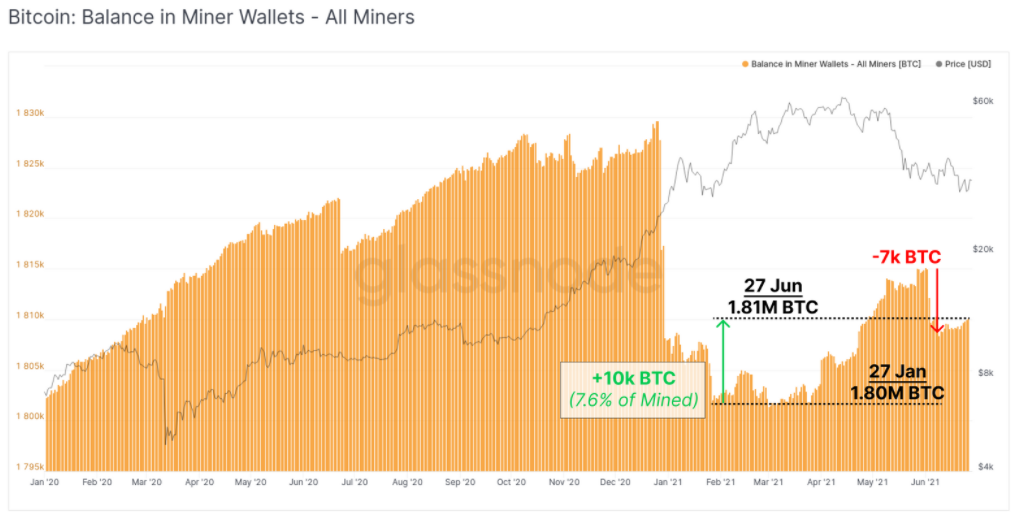

Bitcoin (BTC) miners are “unlikely” to stress BTC worth by promoting cash within the coming weeks, new information says.

As a part of its newest weekly report, The Week On-chain, analytics useful resource Glassnode sought to allay fears of one other massive miner sell-off.

Issue drop a present to remaining miners

Amid the continuing switch of mining gear — and subsequently Bitcoin hash price — out of China, fears have emerged over miners promoting BTC to cowl prices and liquidations.

Given the magnitude of the geographical adjustments — the China rout marks the biggest hash price shake-up in historical past — miners may compound promoting stress by disposing of cash which can not in any other case have moved in a very long time.

The mixed affect of promoting and decreased hash price provides a “double whammy” for Bitcoin worth motion, lowering the potential for features and even sustaining important assist ranges.

For Glassnode, nonetheless, the scenario seems to be already beneath management. Miners are in transit, it notes, and people nonetheless on-line face an enormous windfall.

It is because later this week, Bitcoin’s problem will drop by nearly 25% — once more the largest transfer down ever — that means will probably be extra worthwhile to mine Bitcoin for the remaining miners.

As such, there must be much less incentive to promote, as community members can be in an upward spiral of profitability till the lacking hash price returns and problem will increase.

“The Bitcoin mining puzzle is 23.6% tougher regardless of revenues being up 154% on a 7-day common foundation,” the report explains.

“Since a really massive proportion of hash-power is presently offline and in transit, and the subsequent problem adjustment is estimated to be -25%. As such, miners who stay operational are more likely to grow to be much more worthwhile over the approaching weeks, until worth corrects additional or migrating hash-power comes again on-line.”

Glassnode added that miners usually tend to be liquidating cash amassed over time as a part of the transfer.

“This largely signifies that miners who’re in operation are unlikely to exert extreme obligatory promoting… and thus it’s extra possible that Chinese language miners liquidating treasuries is the dominant sell-side supply,” it concluded.

Costing alternatives

A separate supply in the meantime highlighted simply how worthwhile mining may very well be beneath present circumstances.

Associated: World’s first Bitcoin ETF provides $3M per day all through BTC worth dip

Utilizing information that places Bitcoin’s power utilization at round 2,520-gigawatt hours per two-week problem interval, author Hass McCook underscored the 75% revenue alternative open to miners with particular working and capital expenditure.

If it prices on the most $20,000 to mine 1 BTC, the distinction between that expenditure and spot worth, which was $34,500 on the time of writing, is obvious.

“So if the price to mine a coin is about $20k within the absolute worst of instances (in all probability nearer to $13-14k for the skilled retailers now), how laborious would you’re employed proper now to seize the 75%+ revenue out there to you…?” McCook concluded.

Source link