Bitcoin (BTC) plunged 7.38% to hit its five-month low of $29,313 on Tuesday because the market stared on the prospect of one other sell-off, this time led by miners affected by a current crackdown in opposition to cryptocurrency entities in China.

The Folks’s Financial institution of China on Monday stated it had summoned a number of regional establishments, together with the Agricultural Financial institution of China, China Development Financial institution, and ICBC, in addition to Jack Ma’s fee platform Alipay, to “strictly implement” its current ordinances on curbing Bitcoin and different cryptocurrency-related actions, together with mining.

Sichuan, a hydropower-rich area in South-West China, ordered the 26 largest crypto mining farms to cease working, Chinese language Media report on Friday. The province was contributing 75% of the entire world hash energy to run the Bitcoin blockchain community.

The regulatory warnings adopted a decline within the Bitcoin market, which, in mid-April, traded close to $65,000, spurred by backings from high-profile advocates, together with Tesla CEO Elon Musk.

Miner capitulation FUD

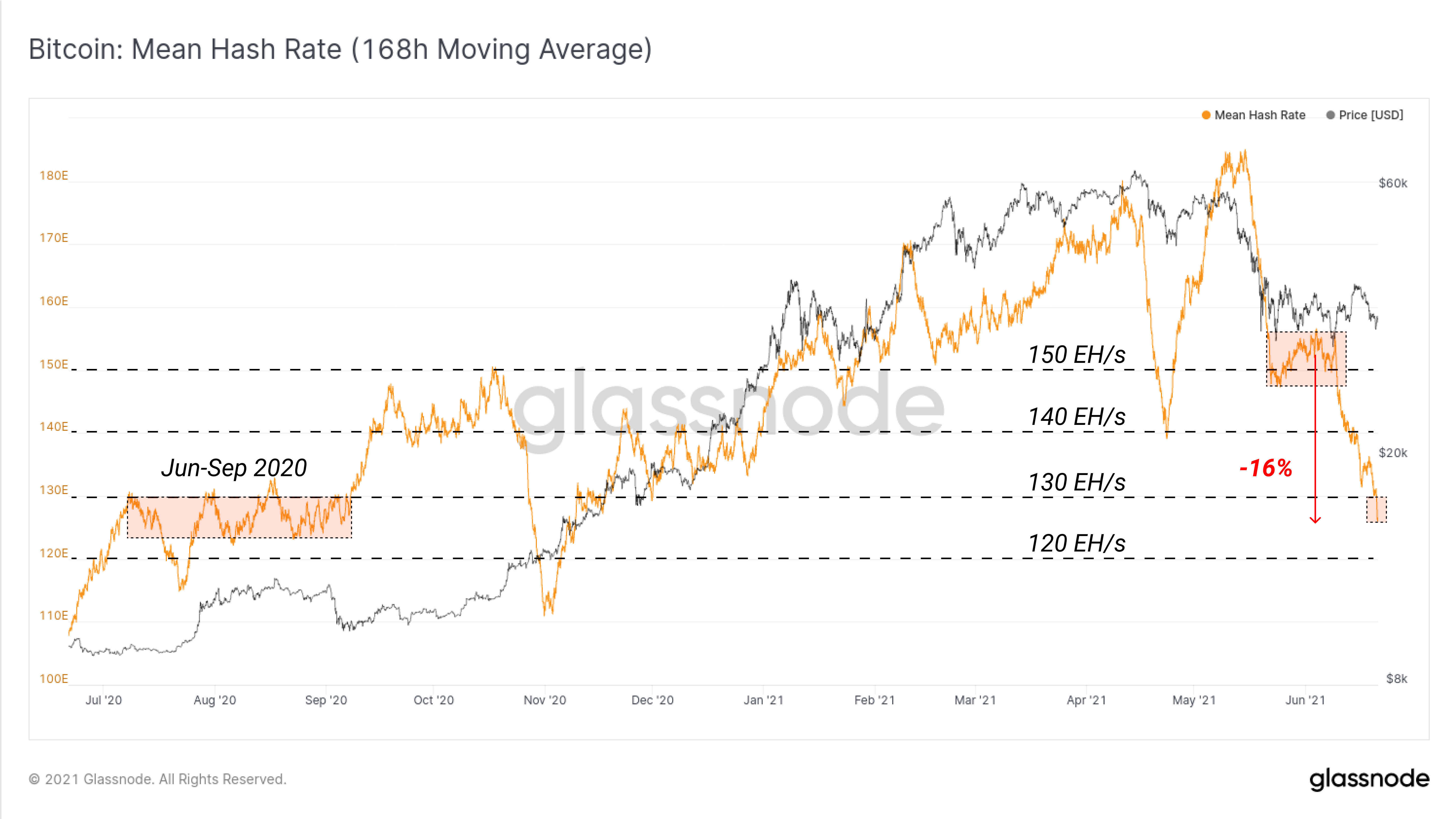

A report printed by Glassnode revealed a “seismic mining shift” going down in China. The info analytics platform famous that many miners are within the strategy of both shutting down or migrating their hash energy outdoors China to adjust to the mining ban.

“One of many largest migrations of Bitcoin hash-power in historical past seems to be underway,” wrote Glassnode, including that the estimated imply hash-rate (7DMA) has declined from circa 155 EH/s to round 125 EH/s in simply two weeks after the China FUD (a backronym for Worry, Uncertainty, and Doubt).

Glassnode anticipated that the Chinese language mining trade would doubtless liquidate a portion of their Bitcoin holdings when coming to grip with relocating their farms overseas or promoting their {hardware}. These sell-offs would possibly mirror “miners hedging danger” and “acquiring capital to facilitate and fund logistics.”

In the meantime, for some miners, it could be a normal exit from the trade solely, the report added.

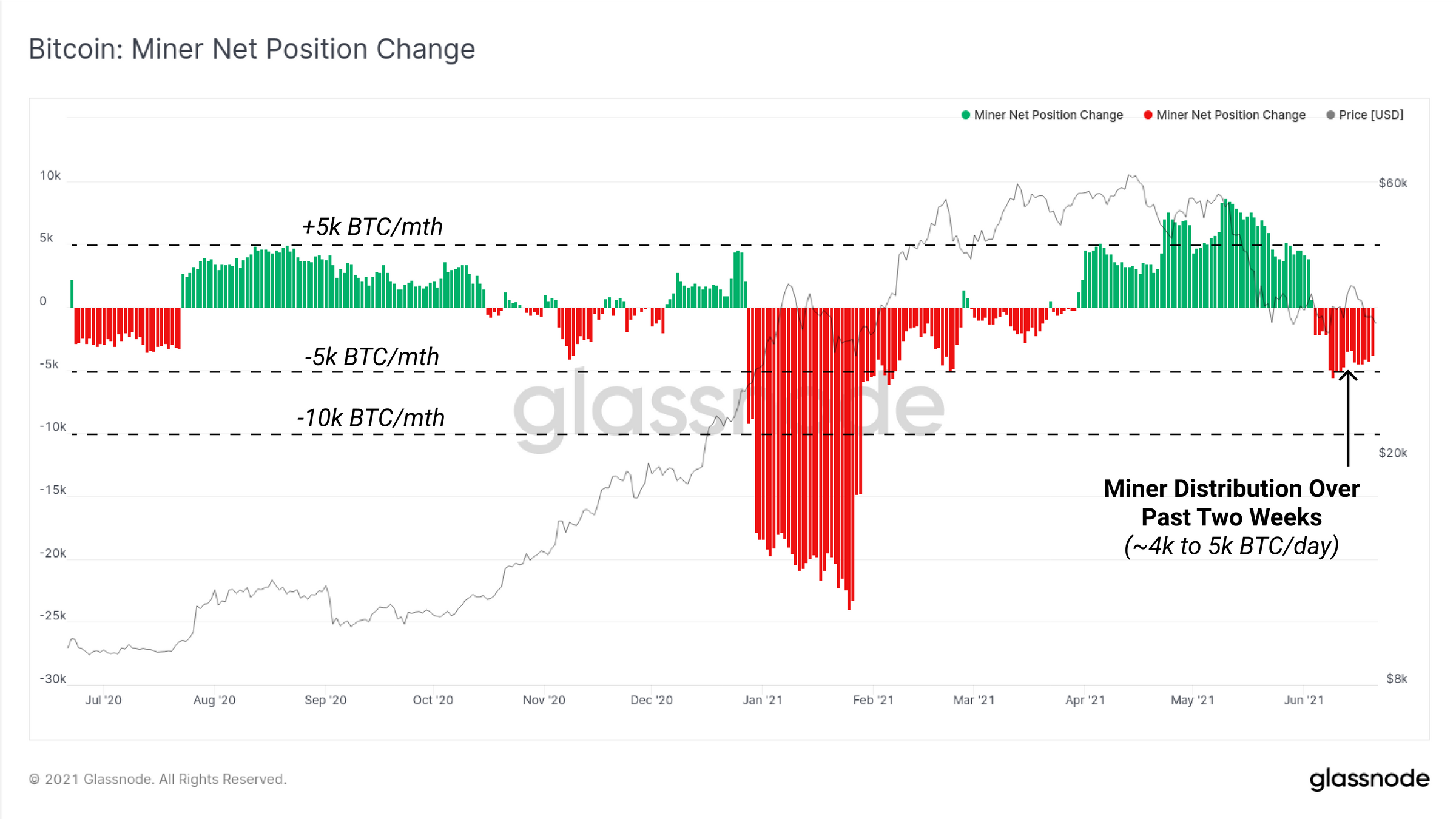

Current on-chain traits have proven a spike in miners’ BTC distribution and a decline in accumulation.

For instance, the Miner internet place change metric, which tracks the transactional movement of Bitcoin mining swimming pools, confirmed miners distributing BTC at a price of 4K to 5K per thirty days over the interval by which the hash price fell 16%.

“This has reversed the development of internet accumulation which was energetic since April.”

Huge buyers absorbing miners’ OTC distribution

Miner capitulation is just not essentially a foul factor so long as the market absorbs the promoting strain. Throughout the first quarter of 2021, bids for BTC/USD rose from as little as $28,700 to $61,788 at the same time as miners offered their Bitcoin holdings en masse.

Jonathan Ovadia, chief government at OVEX — a South Africa-based cryptocurrency alternate, credited institutional buyers behind the newest sell-off absorption as he drew proof from MicroStrategy’s ongoing Bitcoin accumulation spree. He stated:

“The continual accumulation of Bitcoin by institutional buyers, significantly MicroStrategy, is predicated on a really deep conviction of the potential future upside past this present correction.”

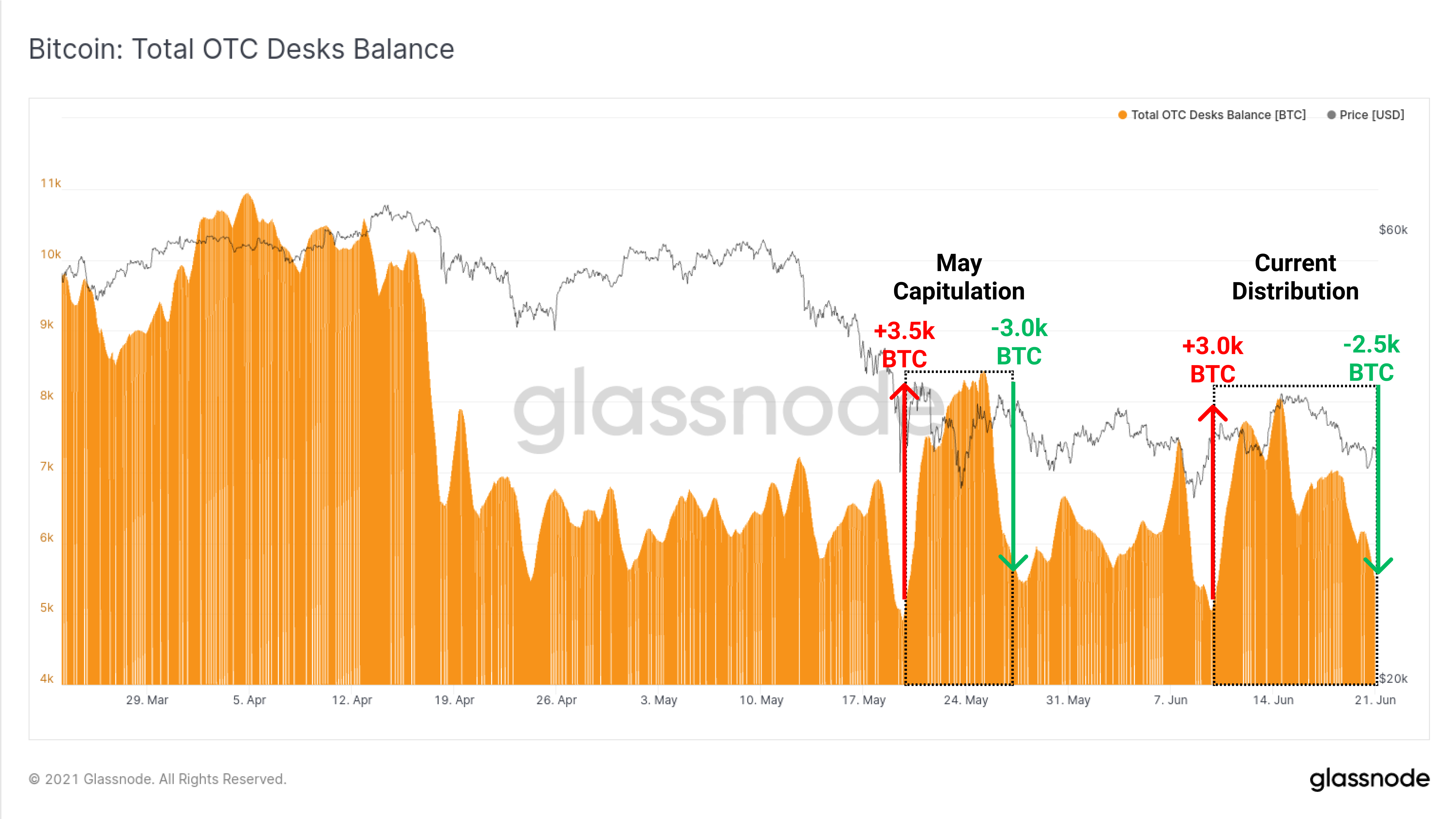

In the meantime, having a look at over-the-counter (OTC) desks, which miners make the most of to match their giant dimension distributions with institutional consumers, additionally confirmed demand amongst giant quantity consumers.

“Throughout each the Could Promote-off and during the last two weeks, between 3.0k and three.5k BTC in internet inflows have been noticed,” Glassnode noticed. “Nonetheless in each cases, virtually the total influx dimension was absorbed by consumers over only a few weeks.

In consequence, OTC’s Bitcoin balances had been comparatively flat since April.

Source link