Coming each Saturday, Hodler’s Digest will aid you observe each single necessary information story that occurred this week. One of the best (and worst) quotes, adoption and regulation highlights, main cash, predictions and way more — every week on Cointelegraph in a single hyperlink.

Prime Tales This Week

Invoice to make Bitcoin authorized tender passes in El Salvador

El Salvador has formally turn out to be the primary nation on the earth to undertake Bitcoin as authorized tender.

A regulation outlining the proposals, launched by President Nayib Bukele, handed with a “supermajority,” attracting 62 out of 84 votes.

Beneath the so-called Bitcoin Regulation, retailers should settle for Bitcoin in addition to U.S. {dollars} — and so they’ll be anticipated to current costs for items and providers in each currencies. The federal government goes to be releasing an official crypto pockets for shoppers to make use of, however they’ll depend on personal suppliers if they like.

Everlasting residency goes to be obtainable for individuals who make investments 3 BTC within the nation, and now, a 90-day implementation interval has begun.

Because the 90-day implementation interval begins, the president has requested a state-owned geothermal electrical firm to look at plans “to supply services for Bitcoin mining with very low cost, 100% clear, 100% renewable, zero-emissions power” — from its personal volcanoes.

Unsurprisingly, response from regulators hasn’t been overwhelmingly constructive. One government on the Financial institution for Worldwide Settlements has known as El Salvador’s transfer an “attention-grabbing experiment” — however warned that BTC hasn’t handed the take a look at of being a method of cost. The Worldwide Financial Fund has additionally warned the choice may have important authorized and monetary ramifications.

New report: El Salvador Bitcoin pump failed to draw good cash, for now

El Salvador’s plans have been first introduced throughout a keynote speech at Bitcoin 2021 in Miami, however the markets appeared to pay little discover.

Issues modified on Wednesday — the day Congress handed the laws. Bitcoin logged its finest every day efficiency since Feb. 8, the day Tesla introduced that it had added $1.5 billion price of BTC to its stability sheet.

Though there are causes to rejoice, Stack Funds’ head of analysis Lennard Neo has warned there was little in the way in which of bullish reactions from so-called “good” buyers.

Bringing the bulls again all the way down to Earth, he warned: “We should always not count on a major impression on Bitcoin for a rustic with a GDP per capita lower than 7% that of the U.S., with its economic system struggling the worst crash in many years final yr.”

Bitcoin’s seven-day excessive stands at $38,334.33. The sturdy transfer helped save the bulls throughout Friday’s choices expiry, as a result of any stage under $34,000 would have wiped 98% of name choices.

MicroStrategy will get $1.6 billion in orders in junk bond providing

MicroStrategy has attracted $1.6 billion price of orders in a latest junk bond providing — 4 occasions greater than what the enterprise intelligence agency initially sought.

Junk bonds are debt choices by firms with out investment-grade credit score scores and sometimes provide buyers increased returns whereas carrying increased threat.

It comes days after the publicly listed firm, which owns 92,079 BTC with a present market worth of $3.2 billion, introduced plans to spin off its crypto holdings into a brand new subsidiary known as MacroStrategy LLC.

Though this has been interpreted as bullish information, alarm bells began sounding after the junk bond providing was introduced — the newest in a sequence of debt raises to purchase extra Bitcoin. MSTR inventory fell after the information.

MicroStrategy closed the week at $516.44, a way off the year-to-date excessive of $1,315 that was seen in February.

In a latest article, analyst Juan de la Hoz mentioned MicroStrategy can be liable to chapter if Bitcoin costs fell, including: “MicroStrategy is a uncommon high-risk low-reward funding alternative, and a robust promote.”

Bitcoin 2021 attendees’ constructive COVID-19 exams are going viral

A few of those that attended Bitcoin 2021 in Miami have examined constructive for COVID-19, resulting in a wave of destructive media protection and hypothesis that it might have been a “superspreader occasion.”

Hundreds of individuals went to the two-day occasion, which didn’t require proof of vaccination or implement the carrying of face masks. There was little in the way in which of social distancing both as folks packed into crowded auditoriums.

One influencer on Crypto Twitter, Mr. Whale, estimated that there have been greater than 50,000 guests on the occasion. He famous that this was the primary main in-person convention for the reason that pandemic started, and mentioned dozens of individuals have examined constructive.

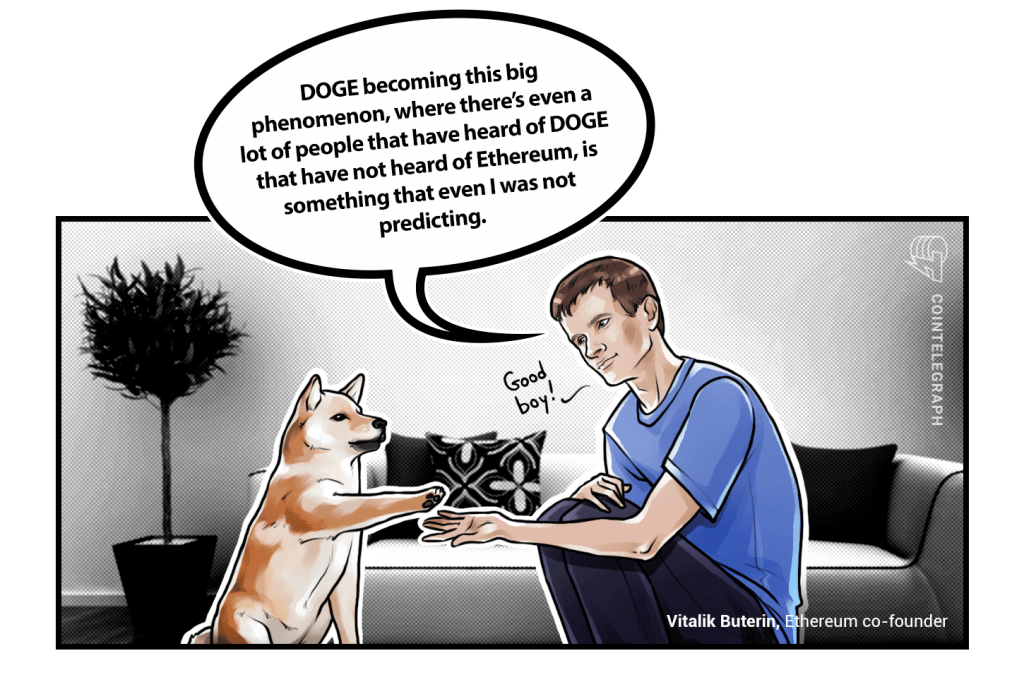

Vitalik Buterin has made $4.3 million from his $25,000 funding in Dogecoin… up to now

Ethereum co-founder Vitalik Buterin has revealed that he invested $25,000 into DOGE in 2016… and has made a reasonably penny consequently.

His first concern was how he would inform his mom — not least as a result of “the one attention-grabbing factor about this coin is a emblem of a canine someplace.”

Buterin instructed Lex Fridman’s podcast that he was caught off-guard by the speculative frenzy that resulted from Elon Musk’s fascination with the joke cryptocurrency.

He recalled being in lockdown in Singapore when the worth of DOGE shot up 775% from $0.008 to $0.07 over the course of a single day, pondering: “Oh my god, my DOGE is price, like, quite a bit!”

Buterin added: “I bought half of the DOGE, and I bought $4.3 million, donated the income to GiveDirectly, and some hours after I did this, the worth dropped again from round $0.07 to $0.04.”

Assuming he held on to the remaining 50% of his DOGE stash, he would now be sitting on tens of thousands and thousands of {dollars} in paper income.

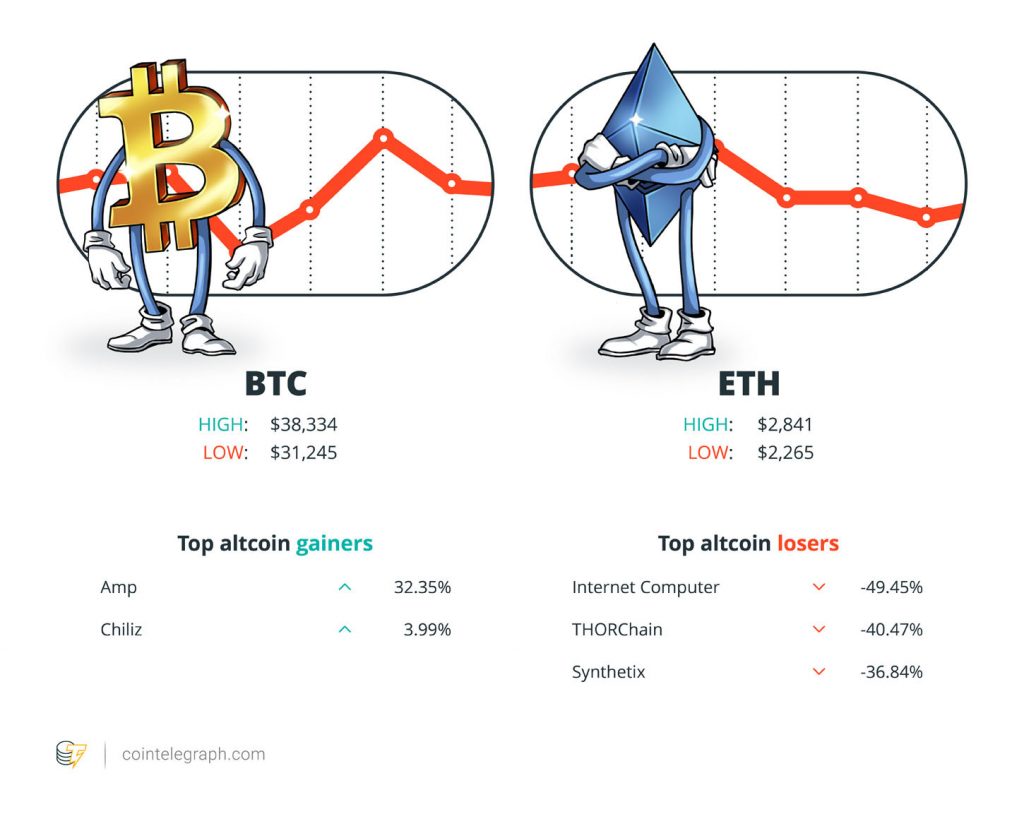

Winners and Losers

On the finish of the week, Bitcoin is at $35,211.65, Ether at $2,318.90 and XRP at $0.81. The overall market cap is at $1,493,755,186,500.

Among the many greatest 100 cryptocurrencies, the one two altcoin gainers of the week are Amp and Chiliz. The highest three altcoin losers of the week are Web Pc, THORChain and Synthetix.

For more information on crypto costs, be sure to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“Regulatory readability permits firms like BlockFi to proceed innovating. It permits shoppers and buyers to take part on this sector with the utmost confidence.”

Zac Prince, BlockFi CEO

“The ~$38,000 space for BTC is the one to look at proper now.”

Rekt Capital

“Cryptocurrencies show all of the hallmarks of ‘dangerous cash’: unclear origin, unsure valuation, shady buying and selling practices.”

Pieter Hasekamp, Netherlands Bureau for Financial Evaluation

“Buyers ought to take into account the volatility of Bitcoin and the Bitcoin futures market, in addition to the dearth of regulation and potential for fraud or manipulation within the underlying Bitcoin market.”

U.S. Securities and Trade Fee

“@davidguetta is aware of what’s up. His Miami pad is on the market. Should purchase with #Bitcoin or #Ethereum. Normally, not a good suggestion to half w/ disinflationary #crypto that persistently outperforms actual property… however good people like Guetta like to take it from you.”

@ShaokyCinemaBTC

“Adoption of Bitcoin as authorized tender raises plenty of macroeconomic, monetary and authorized points that require very cautious evaluation. We’re following developments carefully, and we’ll proceed our consultations with the authorities.”

Gerry Rice, IMF spokesman

“Moments in the past in our #London saleroom, a particularly uncommon “Alien” CryptoPunk #7523 from the gathering of @sillytuna bought for $11.8M as a part of our #NativelyDigital NFT public sale – setting a brand new world public sale file for a single CryptoPunk.”

Sotheby’s

“Stablecoins usually are not launching us off into some courageous new world […] The important thing right here is to make sure that simply because one thing is packaged in shiny expertise we don’t by some means deal with the dangers it poses in another way.”

Christina Segal-Knowles, Financial institution of England

“Digital foreign money from central banks has nice promise. Official digital public cash may assist drive out bogus digital personal cash.”

Elizabeth Warren, Democratic Senator

“I don’t assume @michael_saylor is conversant in Murphy’s Regulation. What if #Bitcoin crashes under $20K? Will #MicroStrategy promote inventory at depressed costs to shore up its stability sheet? Will it promote Bitcoin to lift money? If MicroStrategy goes bankrupt will collectors HODL its Bitcoin?”

Peter Schiff, economist and crypto skeptic

“I ought to have purchased much more — that was my mistake.”

Marc Lasry, Avenue Capital Group CEO

FUD of the Week

U.S. officers get well $2.3 million in crypto from Colonial Pipeline ransom

Officers with a U.S. authorities taskforce have seized greater than $2 million in crypto paid in ransom following an assault on the Colonial Pipeline system, which prompted gas shortages for many individuals within the U.S.

The Bitcoin in query was linked to Russia-based DarkSide hackers, and about 63.7 BTC has been clawed again.

Though there’s little doubt that it is a good factor, Bitcoin’s value really ended up falling due to issues over how the FBI really managed to grab the cryptocurrency. Coinbase has refuted options that it was concerned.

Mati Greenspan, the founding father of Quantum Economics, has mentioned that the recovered ransom is definitely bullish for Bitcoin, as many had anticipated U.S. politicians to make use of crypto as a scapegoat for the assault and implement some heavy-handed rules.

Proposed New York Bitcoin mining ban watered down to permit inexperienced tasks

A proposed crypto mining ban calling for a compelled three-year hiatus on all mining operations in New York has been watered down — and can now permit inexperienced tasks.

The invoice handed within the senate on June 8, and has now been referred to the state meeting. If the invoice is handed there, it will likely be delivered to Governor Andrew Cuomo to both approve or veto the proposed laws.

The preliminary New York Senate Invoice 6486A sought to halt all crypto mining for 3 years in an effort to conduct environmental impression opinions on mining operations within the tri-state space.

Nonetheless, the invoice was amended within the senate to get it over the road, and the revised 6486B invoice is now centered solely on any agency that makes use of carbon-based gas sources to energy proof-of-work crypto mining.

Alleged $3.6 billion crypto Ponzi’s victims nonetheless consider the change is legit

Victims of an alleged $3.6 billion crypto Ponzi scheme in South Korea are reportedly hampering the progress of a police investigation and a joint lawsuit — as they nonetheless consider within the venture and maintain out hopes of getting a return on their investments.

V World is accused of defrauding about 69,000 folks out of 4 trillion gained ($3.6 billion), all whereas promising buyers they might triple their investments.

A discover on the corporate’s web site says that it strongly denies the “false” claims and has filed a criticism with police “for defamation and obstruction of enterprise.”

If V World is discovered responsible, it will doubtlessly be one of many greatest crypto-related Ponzi schemes on file, in a similar way to the notorious multi-billion Ponzi scheme from OneCoin in 2015.

Greatest Cointelegraph Options

Pronouncements from the G-7 permit inexperienced fintech to flourish

Sustainability and the necessity to reduce local weather change amid the COVID-19 pandemic have turn out to be the worldwide financial agenda.

Miami stakes the declare to turn out to be the world’s Bitcoin and crypto capital

Miami has a dynamic mayor, numerous VC cash and is coming off the largest-ever crypto extravaganza, however is that sufficient with out authorized readability?

Extra IRS crypto reporting, extra hazard

The U.S. authorities have gotten critically concerned about crypto, making unreported crypto extra harmful.

Source link