Environmental, social, and governance (ESG) elements have develop into central tenets within the capital allocation course of for each the suppliers of capital, or buyers, and the customers of capital, or firms. Whereas preliminary rounds of ESG funding have largely acquired undiscerning reward from stockholders and stakeholders alike, most organizations fail to articulate the worth proposition of ESG investments and assess if and the way such investments have created worth.

These shortcomings are perpetuated by the prevailing view that ESG concerns are non-financial in nature, and subsequently such a purpose can’t be met or shouldn’t even be tried.

However this view fails to acknowledge that ESG isn’t non-financial data, however moderately pre-financial data.

ESG represents elements that assess the long-term monetary resiliency of an enterprise. Given the character of ESG investments, evaluation must quickly put aside typical return metrics, equivalent to EBITDA, earnings, and money flows, and as an alternative focus first on how ESG impacts worth creation. That’s the key to creating the crucial connection between investments in ESG and return.

Within the brief time period, an emphasis on worth creation would deliver much-needed monetary self-discipline to ESG investments and improve the knowledge worth of sustainability studies and disclosures. Within the long-term, such a spotlight might help speed up the transition of ESG from a market-driven phenomenon towards a standardized principles-based framework.

The Hyperlink between ESG and Intangible Worth Creation

Because the world economic system continues to transition to at least one pushed by intangible worth, it has clarified the lack of “earnings” to seize worth creation through investments. For instance, in The Finish of Accounting and the Path Ahead for Traders and Managers, authors Baruch Lev and Feng Gu look at the explanatory energy of reported earnings and e-book worth for market worth between 1950 and 2013. They discover that the R2 declined from roughly 90% to 50% over the interval. Newer proof means that the worldwide pandemic has accelerated this development.

As ESG represents an effort to fill this worth creation hole in monetary reporting, it’s no shock that as worth creation continues to shift to intangibles, so continues the rise and adoption of ESG.

To evaluate ESG worth creation, we should first settle for that ESG is just not a one-size-fits-all method. Worth creation alternatives for ESG investments are largely a perform of the business wherein an enterprise operates. So as to generate financial worth from ESG investments, or any funding, an enterprise should generate returns above these required by the tangible property and monetary capital employed. ESG worth creation alternatives are increased for firms with a differentiated, value-added, and high-margin enterprise mannequin than for firms with a commoditized, tangible-asset intensive, low-margin enterprise mannequin.

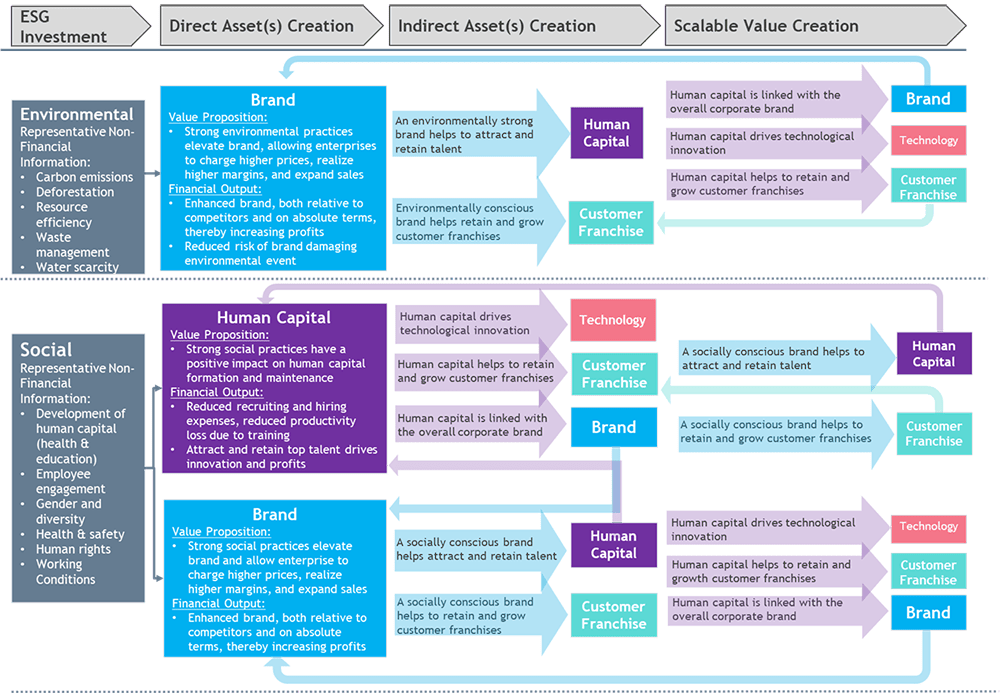

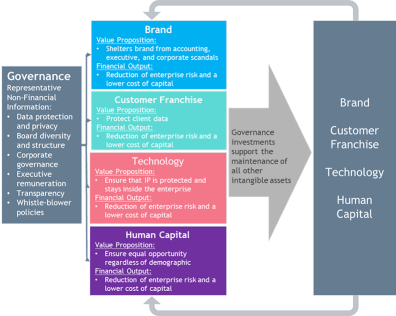

Given the above, it turns into clear that ESG worth creation manifests within the formation and upkeep of intangible property. However which of E, S, and G generate which intangible property? Answering this query is critical for enterprises to articulate the worth proposition of ESG investments. The next determine begins to offer a framework for answering this query by inspecting particular teams of intangible property, together with Manufacturers, Human Capital, Buyer Franchises, and Expertise. It examines the worth creation lifecycle by three separate levels:

- Direct Belongings: These intangible property which are immediately impacted by the E, S, or G funding.

- Oblique Belongings: These intangible property that profit from the worth accretion of the direct intangible asset(s) which was focused with the E, S, or G funding.

- Scalable Worth Creation: The ultimate section of the lifecycle acknowledges that intangible asset worth creation through ESG investments is scalable on account of the interconnection with different intangible property. Such attributes are why the worth created from ESG investments might have little correlation with the funding quantity.

Provided that intangible asset worth drivers are nicely documented and understood, and now armed with a greater understanding of how E, S, and G investments lead to intangible worth creation, we will determine sure traits to evaluate anticipated relative worth creation of ESG investments between enterprises. Listed below are six such traits, together with temporary descriptions:

- Reliance on Model/Model Power: The better the reliance on model and popularity for an enterprise, the better the anticipated return on ESG investments.

- Reliance on Human Capital: The better the reliance on human capital for an enterprise, the better the anticipated return on ESG investments.

- Worth-Added Enterprise Mannequin: The better the enterprise valuation premium over tangible property and capital, or the flexibility to generate enterprise valuation premium, the better the anticipated return on ESG investments.

- Nature of Buyer Relationships: The better the connection or publicity to the top buyer, the better the anticipated return on ESG investments.

- Tangible Asset Depth: The extra a enterprise mannequin depends on tangible property, the much less the potential worth to be created by ESG investments.

- Market-Dominant Expertise: Propriety expertise can create shopper demand that’s much less elastic to the worth of different intangible property, subsequently the extra a enterprise mannequin depends on proprietary expertise, the much less the potential worth to be created by ESG investments.

The next chart analyzes these six standards for 5 enterprises from totally different industries. The better the realm lined, the better the anticipated worth creation of ESG investments.

Whereas the above are actually six key standards for ESG worth creation, such a framework is just not restricted to simply six standards, nor does it require the utilization of those particular standards.

What’s the Path Forward for ESG?

Within the brief time period, a give attention to intangible worth creation can deliver extra monetary self-discipline to ESG investments and bolster sustainability studies to transcend limitless lists of statistics and overtly qualitative narratives.

Long term, a give attention to intangible worth creation can facilitate a transfer towards a monetary reporting system that captures intangible worth creation. The first purpose in growing a standardized principles-based framework is to make sure the usefulness and relevancy of economic statements. Nonetheless, the present accounting framework is just not solely failing to offer related data on worth creation, however additionally it is actively constraining efforts to completely implement value-creating ESG priorities.

In a latest article, “Constrained by Accounting: Inspecting How Present Accounting Follow is Constraining the Internet Zero Transition,” the authors analyze BP’s dedication to develop into carbon impartial by 2050 within the context of ESG and the present accounting mannequin for intangible property and liabilities. They argue that the present accounting mannequin unduly penalizes and demotivates firms as they try to make such investments. This want isn’t any extra succinctly articulated than within the authors’ evaluation of each expertise and model intangibles, the latter of which is mentioned beneath:

“We postulate that whereas a corporation doesn’t management the setting, its workers, or different stakeholders, it has management of its relationship with these entities, intertwined with its popularity, by the alignment of its choices with social norms. It follows that the definition of an asset needs to be utilized to an entity’s popularity or its social license to function, leading to capitalization and honest valuation of those property. This remedy balances the requirement to acknowledge social obligations as liabilities and reduces the punishing remedy of prices associated to complying with social norms. Such prices may very well be seen as funding in popularity and the potential profit to the group from such funding can be capitalized.”

These constraints aren’t restricted to model and expertise, but in addition exist for human capital. In “Two Sigma Affect: Discovering Untapped Worth within the Workforce,” the authors observe how present accounting drives conduct that limits the worth creation alternatives for human capital. The authors state:

“Non-public fairness has tended to view labor as a line-item to be lowered moderately than a spot to take a position, leading to a big blind spot for the business. What if there have been one other, extra fruitful method of workforce points?”

These examples spotlight the inextricable hyperlink between ESG and the efforts of accounting commonplace setters exploring alternatives to systematically deal with intangible worth creation. The limitation of accounting frameworks to systematically deal with intangible property is just not on account of their lack of acknowledgement concerning the significance of intangibles, however moderately the dearth of a viable framework that’s sensible, goal, and universally relevant.

A give attention to worth creation will permit the perfect concepts, ideas, and frameworks that emanate from ESG to tell the continuing debate on higher convey worth creation by accounting and monetary reporting processes. Constructing on the initiative proven with ESG, buyers might help information the best way towards an answer.

If you happen to appreciated this publish, don’t overlook to subscribe to the Enterprising Investor.

All posts are the opinion of the creator. As such, they shouldn’t be construed as funding recommendation, nor do the opinions expressed essentially mirror the views of CFA Institute or the creator’s employer.

Picture credit score: ©Getty Pictures / SimplyCreativePhotography

Skilled Studying for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report skilled studying (PL) credit earned, together with content material on Enterprising Investor. Members can file credit simply utilizing their on-line PL tracker.

Source link