As Bitcoin (BTC) examined the $43,000 assist for the third consecutive day, whales purchased the dip on derivatives exchanges. Whereas there was no important value change, the Bitcoin futures premium reached its lowest degree in six months. This indicator matches Dec. 11, 2020, when Bitcoin hit a $17,600 low simply 10 days after making an all-time excessive at $19,915.

In December 2020, derivatives motion triggered a 95% rally in 23 days, taking Bitcoin to a brand new excessive at $42,000. Along with the futures premium bottoming, rumors of probably dangerous United States regulation performed a central-stage function out there downturn in each situations.

Regulatory uncertainties are again to the highlight

This time round, U.S. Treasury Secretary Janet Yellen acknowledged on the Washington Sq. Journal CEO Council Summit on Might 4 that:

“There are points round cash laundering, Financial institution Secrecy Act, use of digital currencies for illicit funds, shopper safety and the like.”

On Might 6, U.S. Securities and Trade Fee chair Gary Gensler punted to Congress the concept of offering extra regulatory oversight to the crypto house. Gensler stated:

“Proper now, there’s not a market regulator round these crypto exchanges, and thus there’s actually no safety towards fraud or manipulation.”

Including to the regulatory haze, on Might 11, the U.S. Securities and Trade Fee issued an investor warning stating t dangers of mutual funds which have publicity to Bitcoin futures.

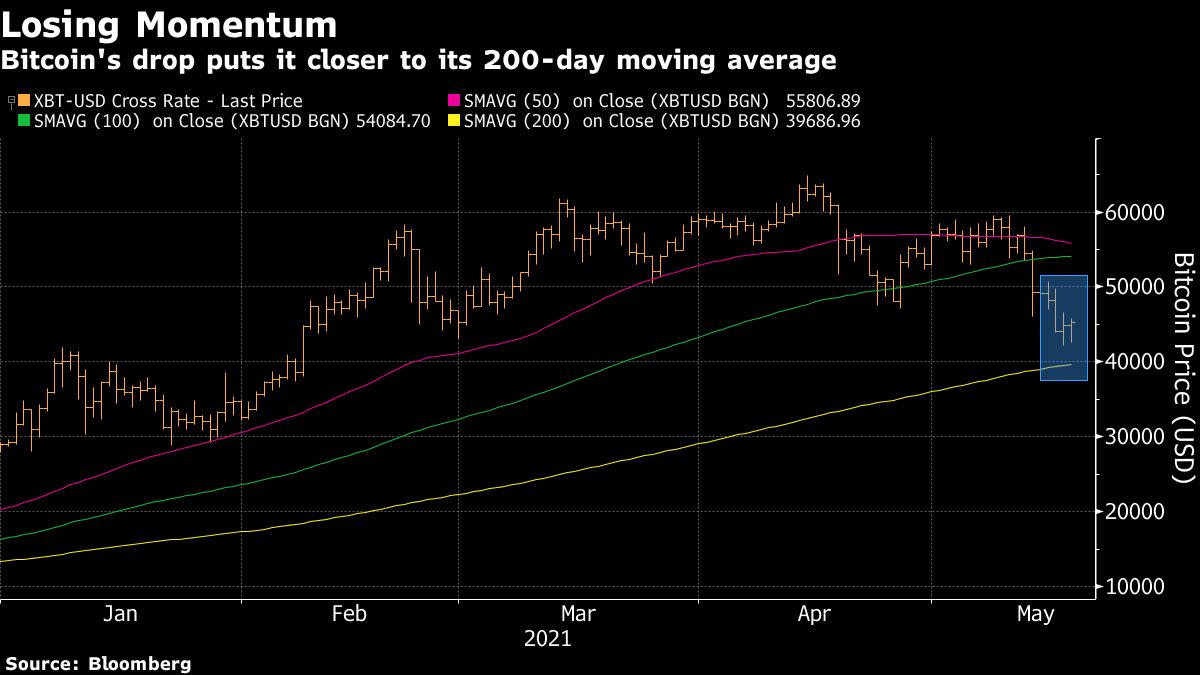

As Bitcoin reached a $19,915 all-time excessive on Dec. 1 and the futures premium spiked above 15%, the premium reacted to the value correction. Though the 8% low appears close to the earlier month’s common, it is vitally modest contemplating Bitcoin had rallied 90% in two months.

Discover that as quickly because the $17,600 degree proved its energy, the futures premium spiked to fifteen%, indicating optimism.

The present state of affairs started in another way, because the market has been excessively optimistic from the beginning. Nonetheless, the state of affairs drastically modified over the previous week as Bitcoin dropped 26%. This transfer precipitated the futures premium to achieve its lowest degree in six months at 8%.

Whales aggressively purchased under $43,000

Nonetheless, the bearish sentiment on Might 17 lasted for a really quick interval, as whales lastly determined it was time to purchase the dip.

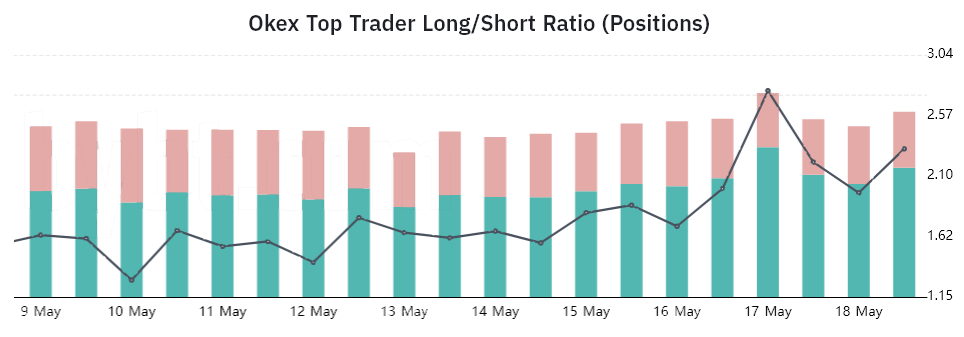

The highest merchants’ long-to-short indicator is calculated utilizing purchasers’ consolidated positions, together with margin, perpetual and futures contracts. This metric supplies a broader view of the skilled merchants’ efficient internet place by gathering knowledge from a number of markets.

Prime merchants on OKEx moved from a 1.62 long-to-short ratio on Might 16 to a 2.74 peak as Bitcoin examined the $43,000 assist within the early hours of Might 17. This knowledge signifies that whales and market makers had lengthy positions nearly thrice bigger than shorts, which may be very unusual.

Whereas their bullish guess stays, it alerts a whole sample from the earlier week. Enterprise intelligence agency MicroStrategy additionally scooped up one other $10 million price of Bitcoin at a median value of $43,663.

Though it is perhaps too quickly to declare that the correction section has ended, there appears to be sufficient proof relating to the futures premium bottoming and whales’ intense shopping for exercise under $43,000.

If historical past repeats and a 95% rally follows go well with, Bitcoin may attain $83,000 in mid-June.

The views and opinions expressed listed here are solely these of the author and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer entails threat. You need to conduct your individual analysis when making a call.

Source link

_width-1200-auto-webp-quality-75.jpg)