In the event you’re trying to decrease danger, defensive shares may be a great way to go. The businesses beneath have lengthy observe data and secure cashflows. It doesn’t matter what the market is doing, their prospects preserve paying.

This reliability has helped these firms pay regular dividends. By the thick and skinny, buyers preserve gathering earnings.

When there’s a market downturn, dividends may also help reduce the blow. In the event you spend money on a few of these defensive shares, you recognize a gradual stream of earnings retains flowing into your account. Some buyers think about it a “sleep nicely at night time” technique.

With out additional ado, right here’s the listing of defensive firms to contemplate…

Prime Defensive Shares

- Verizon (NYSE: VZ)

- Flower Meals (NYSE: FLO)

- CVS Well being (NYSE: CVS)

- Basic Mills (NYSE: GIS)

- Coca-Cola (NYSE: KO)

- Procter & Gamble (NYSE: PG)

This listing covers totally different sectors. And by investing throughout the board, you possibly can additional cut back your danger. For instance, if shares of 1 firm drop in any given month, others in your portfolio may preserve you within the inexperienced.

To see why these firms made the listing, let’s take a look at some firm highlights…

Verizon Inventory

Verizon is a family identify and the corporate has nicely over 100 million subscribers. It additionally serves 99% of the Fortune 500 firms. Verizon has constructed a strong model that reaches into greater than 150 nations.

Verizon is likely one of the high defensive shares as a consequence of its attain, together with its recurring income streams. Prospects have a tendency to chop these companies final after they fall on powerful monetary occasions. This has helped Verizon survive many downturns since its begin in 1983.

To take care of a number one place, Verizon invests billions every year. This 12 months, capex may come near $20 billion. And an excellent chunk of that may go in direction of 5G. To increase, Verizon has taken on near $180 billion in debt. That’s steep… though, Verizon can simply cowl these funds and has a lot to spare…

Verizon has paid a dividend for greater than 30 consecutive years. Its present yield is above 4% and that’s laborious to beat in our low rate of interest world. The current payout ratio additionally is available in beneath 60%. So, it seems to be fairly protected going ahead.

Flower Meals

Flower Meals sells bakery meals within the U.S. and has 46 bakeries in 18 states. You’ll find its merchandise underneath manufacturers comparable to Nature’s Personal, Dave’s Killer Bread, Canyon Bakehouse, Tastykake and Surprise.

The meals trade has skinny margins but additionally has a few of the finest defensive shares. Regardless of which method the market strikes, folks must eat. Going one step additional down the meals chain, you may additionally wish to think about these agriculture shares. They may be an effective way to counter inflation going ahead.

Flower Meals has an extended historical past of paying dividends. Its present dividend yield is available in above 3% and the payout ratio is simply above 70%. This offers somewhat wiggle room to proceed elevating the dividend.

CVS Well being

CVS Well being is one other family identify. It has greater than 9,900 retail places throughout 49 states, the District of Columbia and Puerto Rico. CVS has additionally had 50 million sufferers go to its MinuteClinic.

Because the U.S. inhabitants continues to develop and age, CVS Well being will revenue alongside the best way. The healthcare sector generally is a nice space to search out defensive shares. Though, it’s a aggressive trade with a lot of regulatory danger. Nonetheless, CVS has been navigating healthcare modifications and continues to reward shareholders…

CVS Well being has paid a continuing dividend over the previous few years. It hasn’t raised it, however the payout ratio is available in beneath 40%. The corporate has been specializing in paying down some debt to strengthen its stability sheet.

Basic Mills

Many shoppers know Basic Mills for its cereals, comparable to Cheerios. Though, it sells many various kinds of meals. This consists of snacks, baking merchandise, fruit, pizza and ice cream. This assortment of merchandise helped Basic Mills make our listing of defensive shares.

The diversification helps Basic Mills generate regular cashflows. If one model falls, the others may proceed upward. On high of its well-known meals, Basic Mills has branched into pet meals. The corporate purchased Blue Buffalo Pet Merchandise for $8 billion. It is a rising market and offers additional diversification.

In terms of rewarding shareholders, Basic Mills has an extended observe file. The corporate has paid dividends going all the best way again to 1898. It’s additionally raised its dividend 9 out of the previous 10 years. The dividend additionally seems to be protected with the current payout ratio coming in round 50%.

Coca-Cola

Coca-Cola’s has merchandise in additional than 200 nations and territories. Many shoppers are conversant in its comfortable drinks however it’s expanded past these. Coca-Cola sells espresso, waters, juices and teas. As client preferences change, Coca-Cola adapts to maintain money flowing.

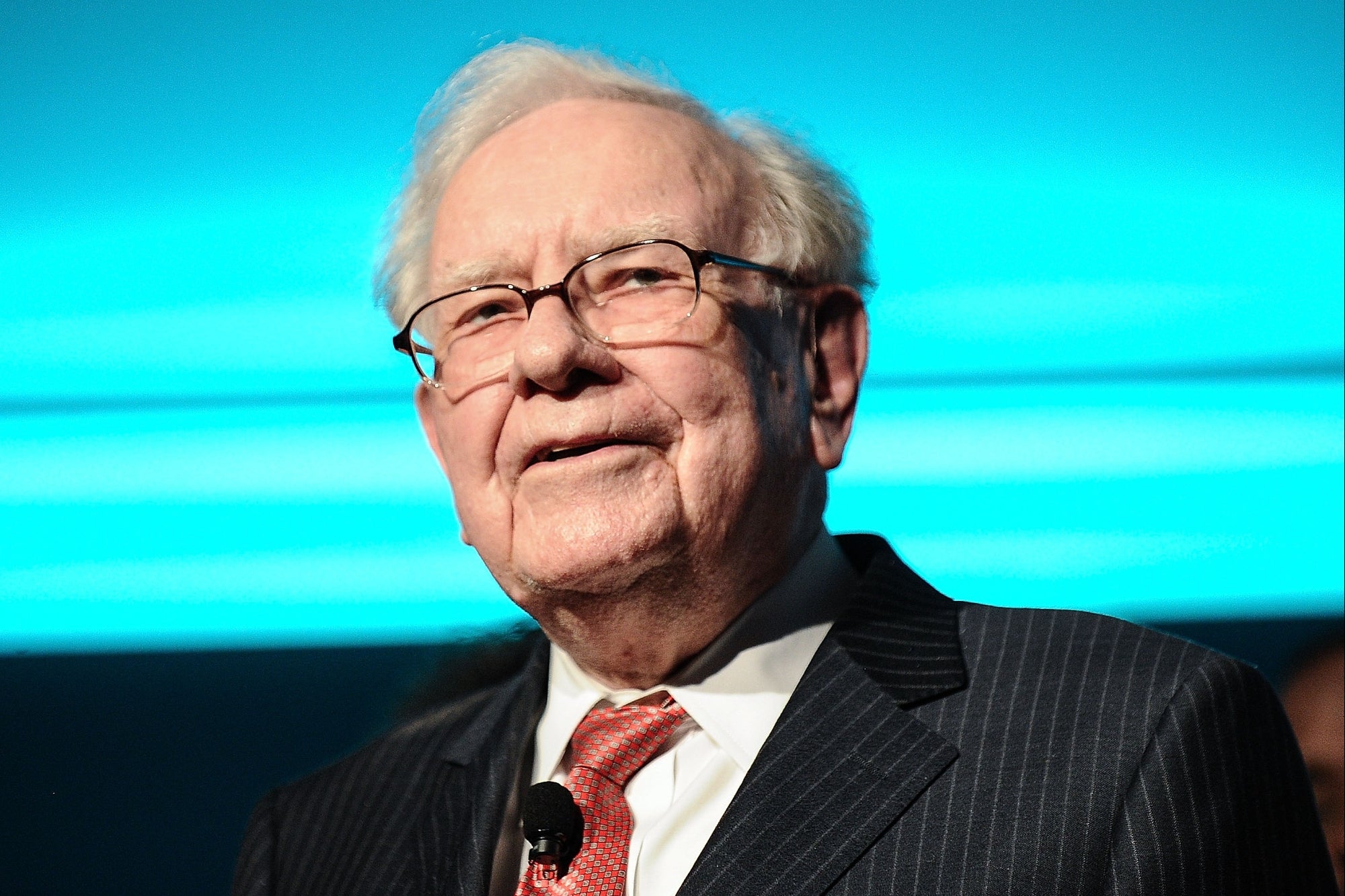

Coca-Cola has been certainly one of Warren Buffett’s favourite defensive shares. It’s additionally been an awesome development inventory as nicely. He purchased $1 billion value of the inventory again in 1998 and right this moment, it’s nonetheless certainly one of his largest holdings. Coca-Cola has survived and thrived by means of a number of market crashes.

With Warren Buffett’s stamp of approval, Coca-Cola is a superb inventory to contemplate. It has an extended historical past of rewarding shareholders and that appears like it should proceed. The dividend yield is available in round 3%.

Procter & Gamble

Procter & Gamble’s has a whole bunch of various merchandise. Its portfolio of manufacturers consists of Bounty, Tide, Downy, Gillette, Outdated Spice, Head & Shoulders, Natural Essence, Febreze, Mr. Clear, Swiffer and Crest… simply to call just a few.

Folks proceed to purchase these merchandise it doesn’t matter what the inventory market is doing. Consequently, Procter & Gamble is likely one of the finest defensive shares. It additionally has the power to move alongside inflation prices to prospects.

This pricing energy has helped Procter & Gamble paying larger dividends every year. It’s raised its dividend for greater than 60 years. Its present dividend yields is available in simply above 2.5% and appears protected going ahead.

Defensive Shares and Revenue Alternatives

The defensive shares above are strong alternatives. Additionally they overlap with these high client staples shares. So, be happy to verify these out as nicely. And an excellent reminder… it’s at all times essential to do your individual analysis earlier than investing.

In the event you’re in search of even higher investing alternatives, think about signing up for Wealth Retirement. It’s a free e-letter that’s filled with investing suggestions and methods. Revenue knowledgeable Marc Lichtenfeld shares lots of his finest investing concepts.

Source link