Bitcoin (BTC) is again with a vengeance this week as a brand new day’s buying and selling will get underway with a recent assault on $60,000.

After a weekend by which the biggest cryptocurrency averted a correction, Monday is wanting bullish — however what might form worth motion within the brief time period?

Cointelegraph presents 5 components to keep watch over for Bitcoin merchants because the market inches nearer to historic all-time highs.

Shares replicate coronavirus mayhem

The macro image is a story of two coronavirus moods this week.

With the UK exiting lockdown, sentiment amongst enterprise leaders has bounced to highs, indicative of pockets of optimism surfacing within the West nonetheless battered by coronavirus restrictions.

The image is muddied by eurozone essential gamers France and Germany, by which the image is far much less rosy, whereas america can also be a patchwork of coverage in the case of the virus.

As such, shares are broadly flat because the week begins, whereas elsewhere, a looming lockdown is sending sentiment plummeting in India, Monday’s essential downward mover.

The controversial measures from Delhi “are unnerving markets and nobody is bound whether or not lockdowns will assist deliver instances beneath management,” Deepak Jasani, head of retail analysis at HDFC Securities advised Bloomberg.

“The motivation to try to bottom-fish at this level is proscribed for merchants.”

Markets commentator Holger Zschaepitz, in the meantime, described a “busy” week for equities, noting new highs for mainstream threat belongings on Friday — one thing which more and more contains Bitcoin.

Breakout on the playing cards for Bitcoin

The sign of the second inside Bitcoin is lastly tied to the spot market.

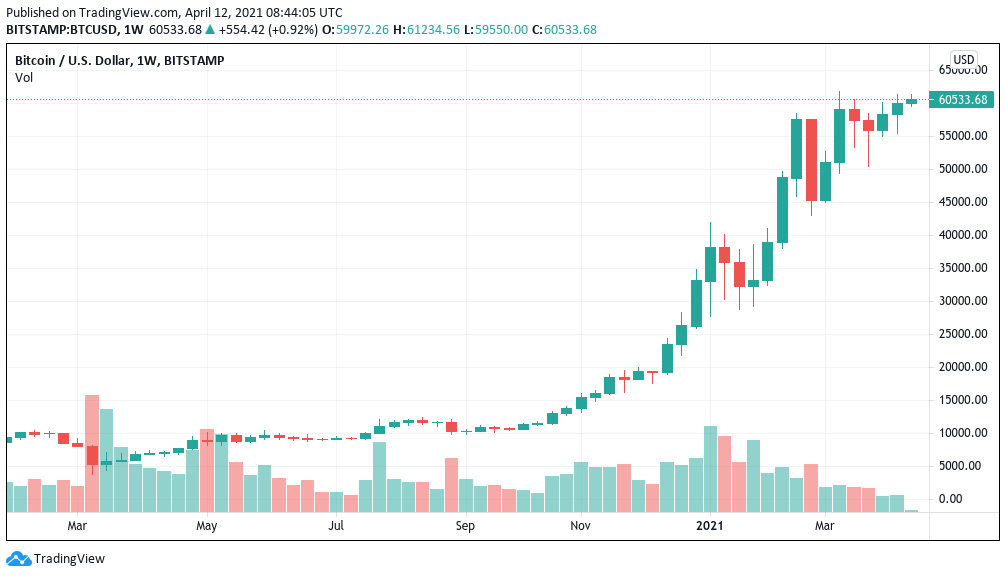

On Monday, $60,000 is again after BTC/USD final handed the numerous worth degree early on Saturday.

The weekend noticed the biggest weekly shut in Bitcoin’s historical past at round $60,000.

On the time of writing, the BTC/USD pair is focusing on $61,000 once more, lower than $1,000 from all-time highs. Amongst analysts, expectations of Bitcoin reentering uncharted territory are predictably excessive.

“One other breakout try,” on-chain analytics service Skew summarized.

A have a look at order ebook exercise on main alternate Binance reveals sellers lined up at $60,500, $61,500 and $62,000 earlier than orders start to dry up. On the purchase aspect, $59,000, $58,000 and $57,000 stay sturdy areas of curiosity.

The ensuing constriction of volatility, with Bitcoin sandwiched between main purchase and promote curiosity, is a basic sign for the ultimate phases of worth consolidation. At 50 days, Bitcoin has now been in such a consolidatory regime since hitting $58,300 for the primary time within the final week of February.

For common Twitter dealer Crypto Ed, the newest transfer is stunning, as simply final week, extra bearish alerts crammed the low-timeframe panorama. Sunday, as well as, was pointing to an incoming drop.

“Stunning PA this morning invalidating this concept,” he commented.

Coinbase punctuates booming on-chain indicators

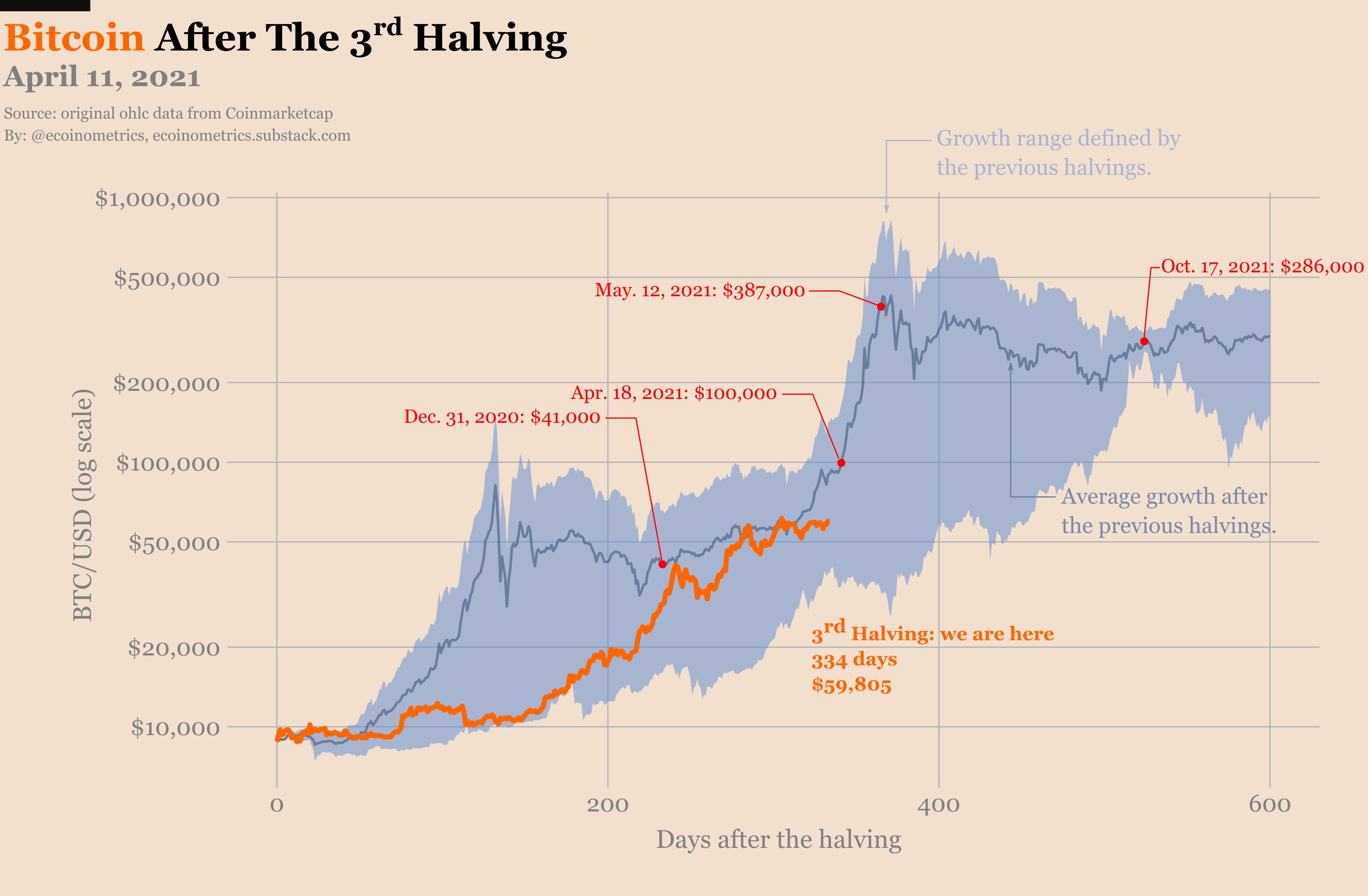

Cointelegraph has usually reported on the power of Bitcoin on-chain indicators this 12 months, these persistently demanding a continuation of the bull market all through 2021.

Regardless of the previous weeks’ consolidation, nothing has modified for fundamentals, which present that Bitcoin isn’t but close to the bull cycle peak, for instance like that of December 2017.

For Twitter account Byzantine Normal, which produced a comprehensive overview of indicator knowledge this weekend, there may be thus no cause to be bearish at $60,000.

“Abstract: - derivs a bit overheated - fixed sturdy spot bid - institutional pushed circulate - no peak retail euphoria but - mainstream adoption getting very actual - Coinbase IPO might be volatility catalyst,” it concluded.

A lot of these factors discuss with materials already lined by Cointelegraph, whereas Coinbase’s upcoming direct itemizing on Nasdaq (Wednesday) might present a uncommon counterpoint narrative this week.

Particularly, itemizing day can usually see a sell-off for corporations going public, and this Wednesday might due to this fact see short-term volatility.

“Coinbase’ google searches recommend that normies haven’t caught on but,” Byzantine Normal added.

“It appears to be solely crypto nerds which can be conscious and even amongst us there’s disagreement on what this occasion entails.”

Ether sees recent historic peak in altcoin surge

It’s not simply Bitcoin capturing for the moon on Monday — altcoins are setting data, indicative of a broader leg up for cryptocurrency curiosity.

These are being led by Ether (ETH), the biggest altcoin by market cap, which has hit new all-time highs on the day, at present at $2,190.

Lengthy tipped to be focusing on $5,000 and even $10,000 this cycle, ETH/USD has gained 7% previously week, ceaselessly outperforming Bitcoin itself.

That efficiency nonetheless pales compared to different main cap altcoins, notably Binance Coin (BNB), which is up 70% in seven days and nearing $600.

“I believe $BNB is headed to $600. Pennant break. All time excessive break. Value discovery. So much to love. Seems insane on $BTC pair as effectively,” analyst Scott Melker commented on the motion final weekend in a well timed prediction.

As Cointelegraph reported, “alt season 2.0” is anticipated to hit its stride solely in summer season and reaching hitherto unknown proportions. Fellow analyst Filbfilb, co-founder of buying and selling suite DecenTrader, believes altcoins’ time is already right here.

Coinbase outflows reinforce institutional buy-in narrative

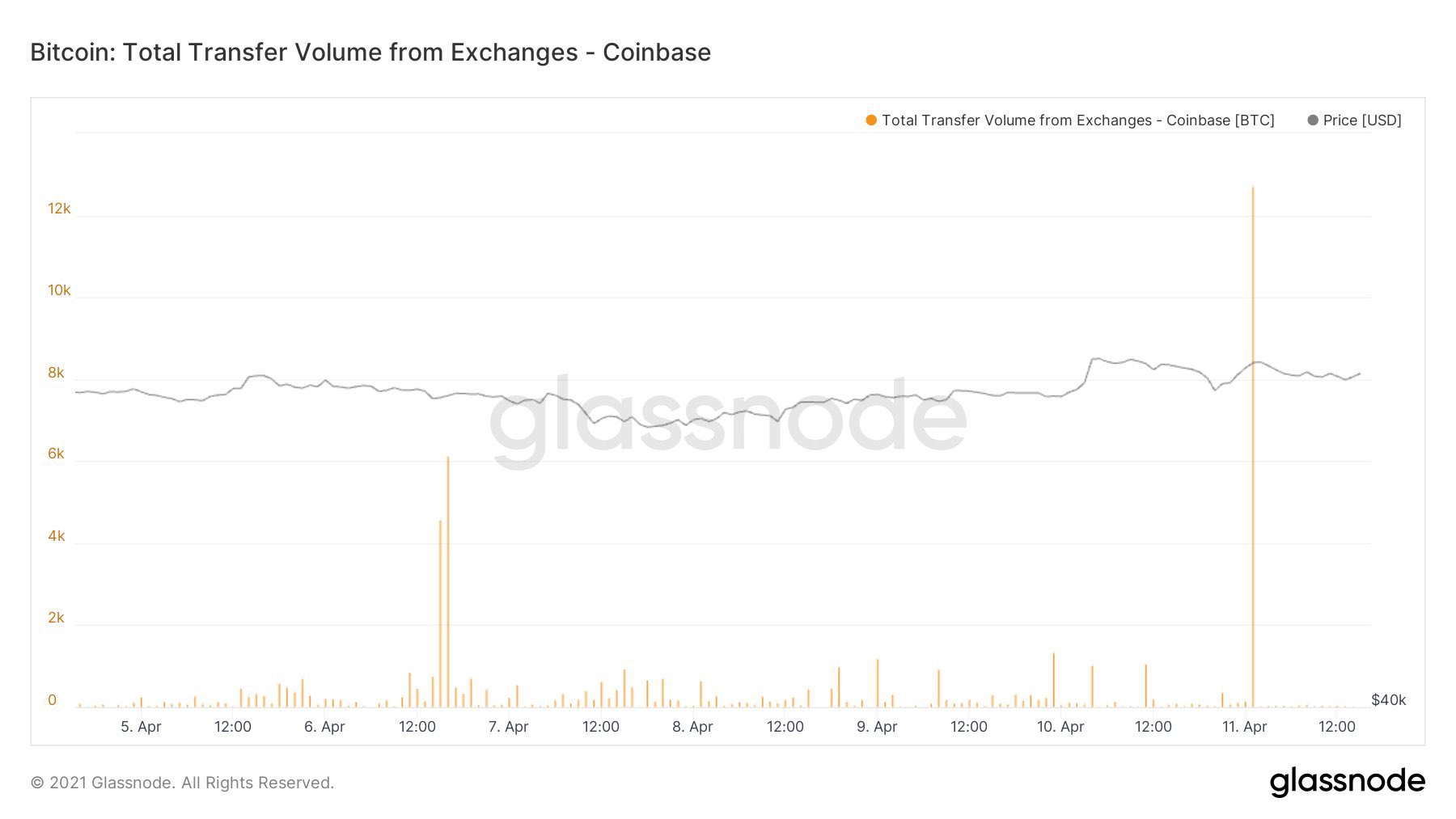

Lastly, one other occasion that forged the highlight on Coinbase, this time, involving customers quite than the corporate itself.

In accordance with on-chain monitoring useful resource Glassnode, Sunday noticed a sudden spike of $750 million in outflows from Coinbase’s books.

Whereas not unequivocally indicative of a serious buy-in, such an occasion wouldn’t be unparalleled within the present atmosphere, however can be important by way of measurement.

Institutional buyers proceed to each purchase and champion Bitcoin as an funding, whereas rumors swirl of extra well-known names reportedly eyeing an allocation.

Source link