The value of Bitcoin (BTC) has been underneath extreme promoting strain by whales for the previous two months, on-chain knowledge reveals.

Nonetheless, 5 key indicators counsel that main sellers are about to show into hodlers and even accumulators of Bitcoin once more, whereas institutional demand stays excessive. That is an explosive setup that will ship Bitcoin to new all-time highs within the close to time period.

Whales stopped promoting

The variety of whales, that are Bitcoin addresses with a steadiness equal to or greater than 1,000 Bitcoin, have declined by greater than 10% since Feb. 8, suggesting a big sell-off of Bitcoin.

Whereas the worth of Bitcoin managed to see two all-time highs through the two-month dumping interval, the general value rise has considerably slowed down, with BTC discovering sturdy resistance at round $60,000. Since March 31, nevertheless, giant holders of Bitcoin have stopped promoting.

Portfolio rebalancing as 1 / 4 ends is a typical time for sell-offs. As Bitcoin has seen a 104% value rise for the reason that starting of this yr, this was to be anticipated.

Grayscale, the biggest digital asset supervisor, introduced on April 6 that it had simply rebalanced its digital large-cap fund on the expense of promoting Bitcoin.

If rebalancing is the most important driver, and contemplating that the variety of addresses holding equal to or greater than 1,000 BTC is again at ranges final seen on the finish of 2020 — when the worth began rising — whales may very well be completed promoting for now.

Lengthy-term hodlers promoting Bitcoin are slowing down

When Bitcoin broke its earlier 2019 excessive in October 2020, this begn one of many quickest, most extended will increase in coin days destroyed (CDD).

The CDD on-chain metric expresses the “weight” at which long-term hodlers are promoting. It’s calculated by taking the variety of cash in a transaction and multiplying it by the variety of days it has been since these cash have been final spent. Which means the upper the CDD is, the extra quantity is offered.

Nonetheless, for the reason that starting of the yr, promoting by long-term hodlers is just not solely drastically slowing down however has virtually come again to the extent at which the sell-off was initially triggered in 2020.

This means that long-term hodlers have turn into more and more assured in a better Bitcoin value within the close to time period.

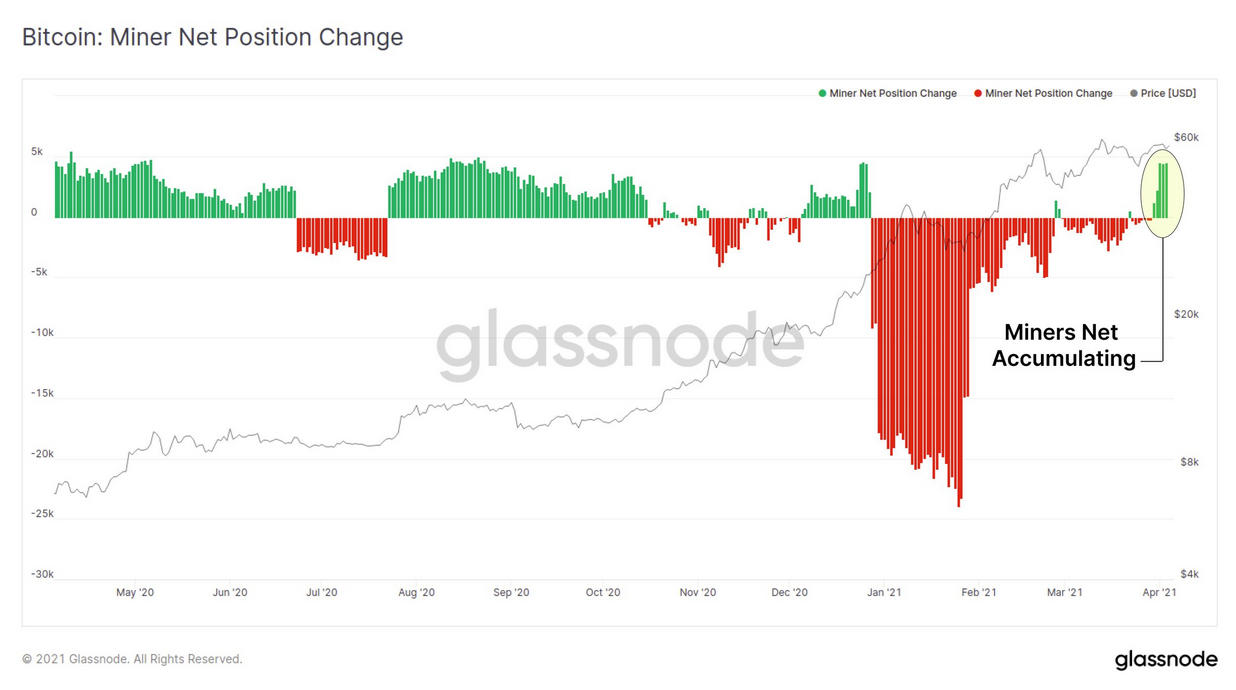

Miners have became Bitcoin accumulators once more

As a result of Bitcoin miners’ income stream is newly mined BTC, they usually must promote their mined BTC to pay for his or her operational bills corresponding to electrical energy prices. Nonetheless, some miners have a tendency to invest on the worth.

By holding again on promoting Bitcoin, they turn into web accumulators. That is expressed within the miner web place change metric, which reveals the 30-day change of the provision held in miner addresses.

The final time miners have been hesitant to promote their Bitcoin was proper earlier than a serious value enhance virtually three months in the past. This optimistic change means that miners count on larger costs within the close to future.

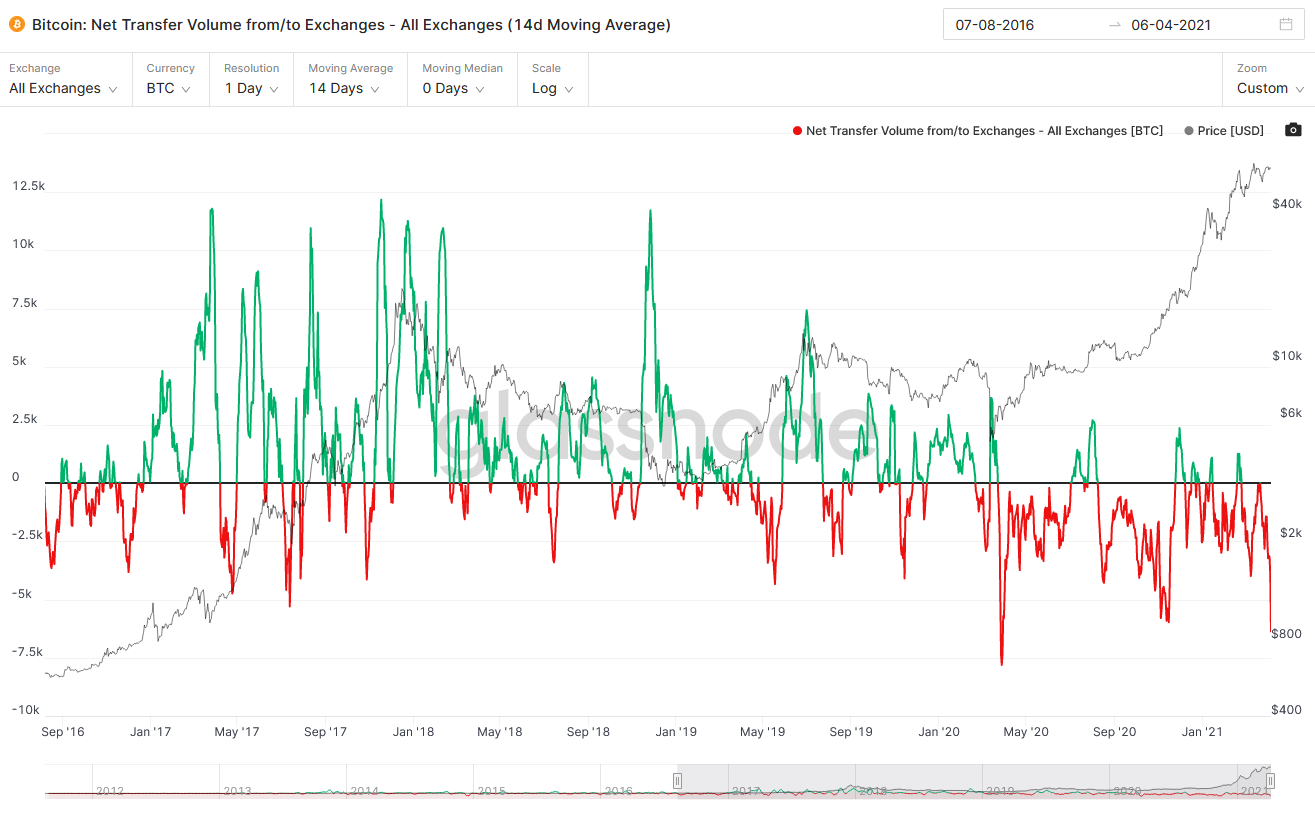

Institutional demand stays excessive

Regardless of materials promoting strain from whales, institutional demand for Bitcoin has not slowed down. The web switch quantity of Bitcoin from/to exchanges is deep within the crimson, virtually at a historic low, which means that extra Bitcoin is at the moment being withdrawn from exchanges than deposited.

This can be a signal that these cash are transferring to chilly storage. That is typical for establishments, as they have an inclination to make long-term investments and like safer custody options fairly than leaving them on an alternate.

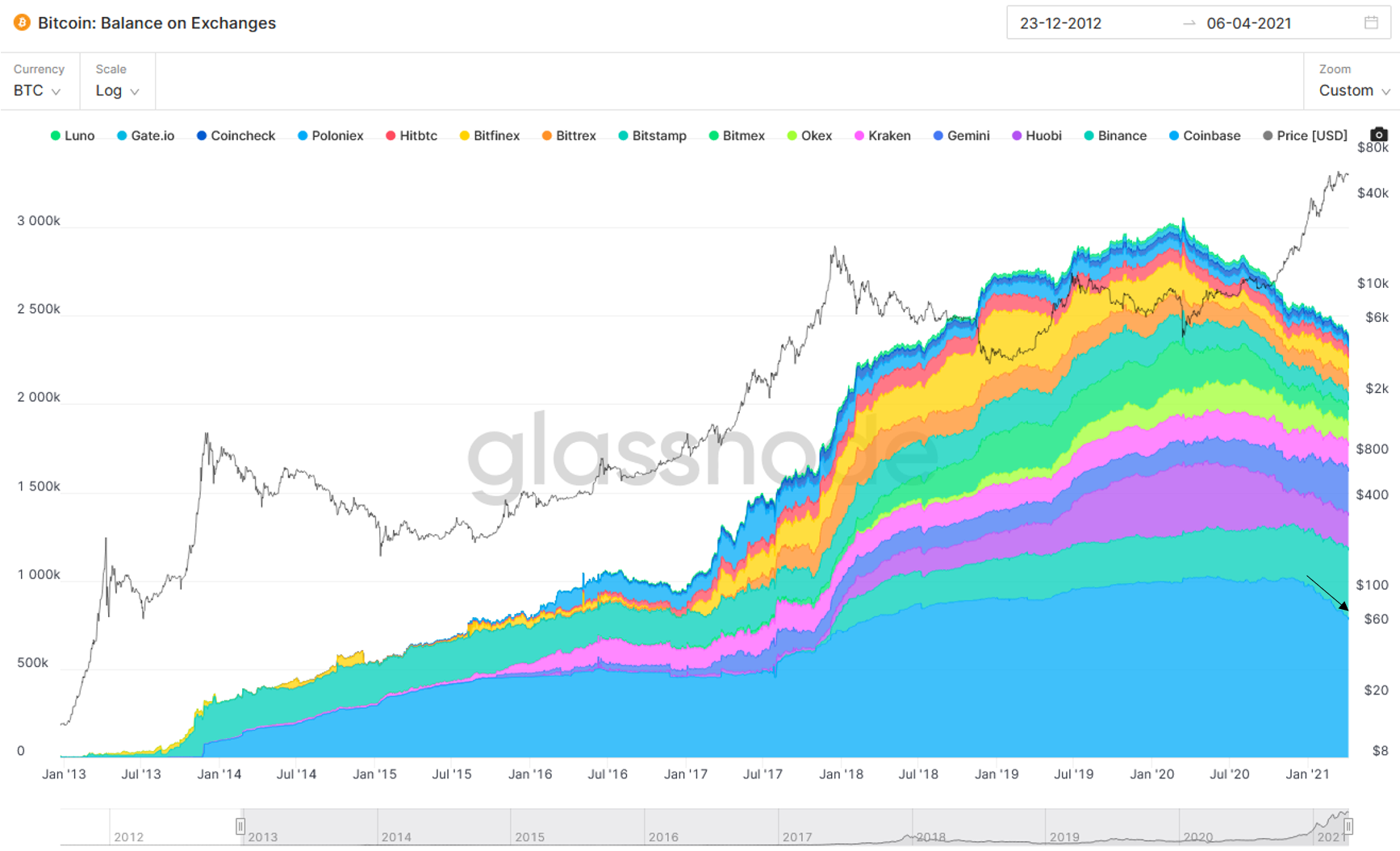

For the reason that pandemic, there was a historic provide crunch of alternate Bitcoin balances. It has turn into much more materials as establishments have began to build up in larger portions since November 2020.

That is made clear by the big steady drop in Bitcoin balances on exchanges over the previous few months, notably Coinbase, which is a frequent selection for establishments.

In the meantime, Coinbase launched its quarter one earnings and outlook yesterday, by which it states:

“Property on Platform of $223 billion, representing 11.3% crypto asset market share, consists of $122 billion of Property on Platform from Establishments. … We count on significant progress in 2021 pushed by transaction and custody income given the elevated institutional curiosity within the crypto asset class.”

Not solely is it sure that establishments have materially added to their income, however this knowledge additionally reveals Coinbase’s confidence that this development of shopping for is probably going not going to cease quickly.

Weekly ascending triangle near a break

For the reason that starting of February, a weekly ascending triangle has fashioned. Statistically, this chart sample offers a better chance of breaking to the upside than to the draw back.

If the worth have been to interrupt to the upside, the scale of the triangle suggests a possible breakout goal towards $79,000. Whereas neither the break to the upside nor the worth goal is a certainty, it’s a chart value keeping track of alongside main on-chain indicators.

Sturdy forces out there — whether or not they’re long-term hodlers, miners or whales — are all displaying indicators of confidence in an growing value of Bitcoin.

The ascending triangle offers much more motive to consider that this transfer may very well be imminent and to the upside. Whereas nobody would thoughts a $79,000 Bitcoin value within the close to future, a breakdown of the triangle can be a chance that needs to be considered as not all key on-chain indicators have absolutely aligned simply but.

The views and opinions expressed listed below are solely these of the writer and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer entails threat. You need to conduct your personal analysis when making a call.

Source link

![What Is a Breakout Session? [+ How To Plan Your Own]](../hubfs/breakout-session.jpg)