Massive value jumps and 100x positive aspects get numerous consideration from pundits and influencers within the cryptocurrency group as a result of they provide the hope of in a single day riches.

In actuality, these alternatives are few and much between. To not point out, solely a handful of merchants really handle to catch these waves and money out in time to lock in life-changing cash.

Thankfully, catching a big value surge is much from being the one approach for crypto traders to make a buck, and the latest rise of decentralized finance (DeFi), nonfungible tokens (NFTs) and the gradual march of mainstream crypto adoption gives a close to limitless stream of funding alternatives.

Let’s take a look at 5 other ways crypto holders could make a straightforward buck with out really having to commerce.

Staking

Staking, which rewards customers for locking tokens on a protocol as collateral for transaction validation, is without doubt one of the greatest methods to earn a yield on belongings held in a crypto-based portfolio.

In August, the Ethereum community will swap from a proof-of-work (PoW) consensus mannequin to a proof-of-stake (POS) mannequin, and Ether (ETH) holders who stake within the Eth2 contract can earn as much as 5.83%.

Underneath this new PoS system, token holders actively take part in transaction validation by locking their cash in nodes on the community that then vie for an opportunity to confirm transactions, create new blocks and obtain the rewards that come together with it.

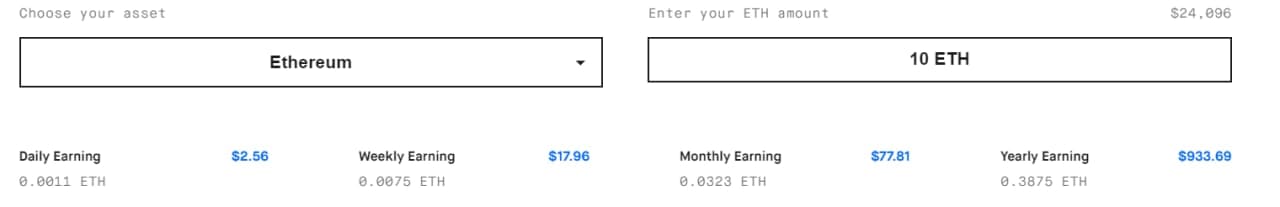

Knowledge from Staking Rewards reveals {that a} stake of 10 Ether at present ends in a weekly incomes of 0.0075 ETH, price $17.96 at present costs, and a yearly incomes of 0.3876 ETH which is at present price $933.69.

The share yield for Ether decreases as extra tokens are locked on the community so the ultimate earnings might change.

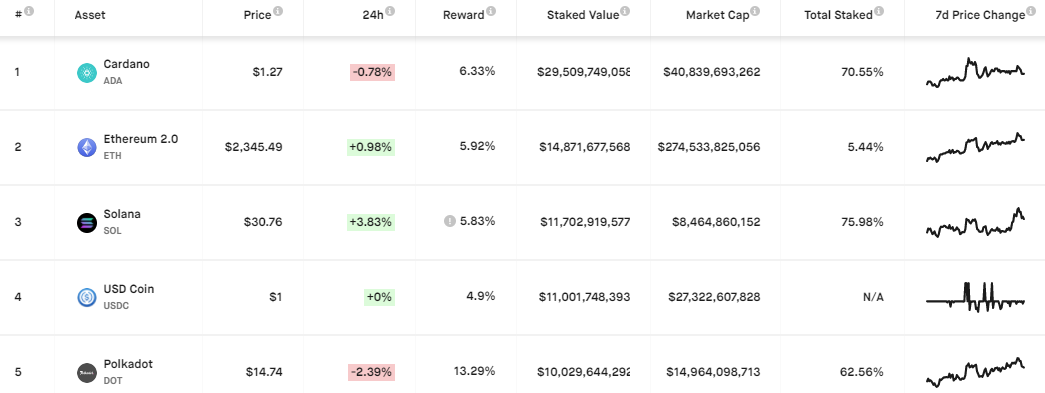

At present, the highest 5 crypto belongings by staked worth are Cardano’s ADA, Ether, Solana (SOL), USD Coin (USDC) and Polkadot (DOT).

All issues thought of, staking gives the most effective low-risk alternatives in crypto to realize a much bigger stack no matter market sentiment or efficiency, whereas additionally serving to to assist the community via transaction validation.

Lend crypto for low-risk yields

The expansion of the DeFi sector led to the event of a various crypto lending ecosystem, the place customers can deposit their cryptocurrencies to numerous lending protocols in change for rewards within the underlying token or in several belongings like Bitcoin (BTC), Ether and varied altcoins.

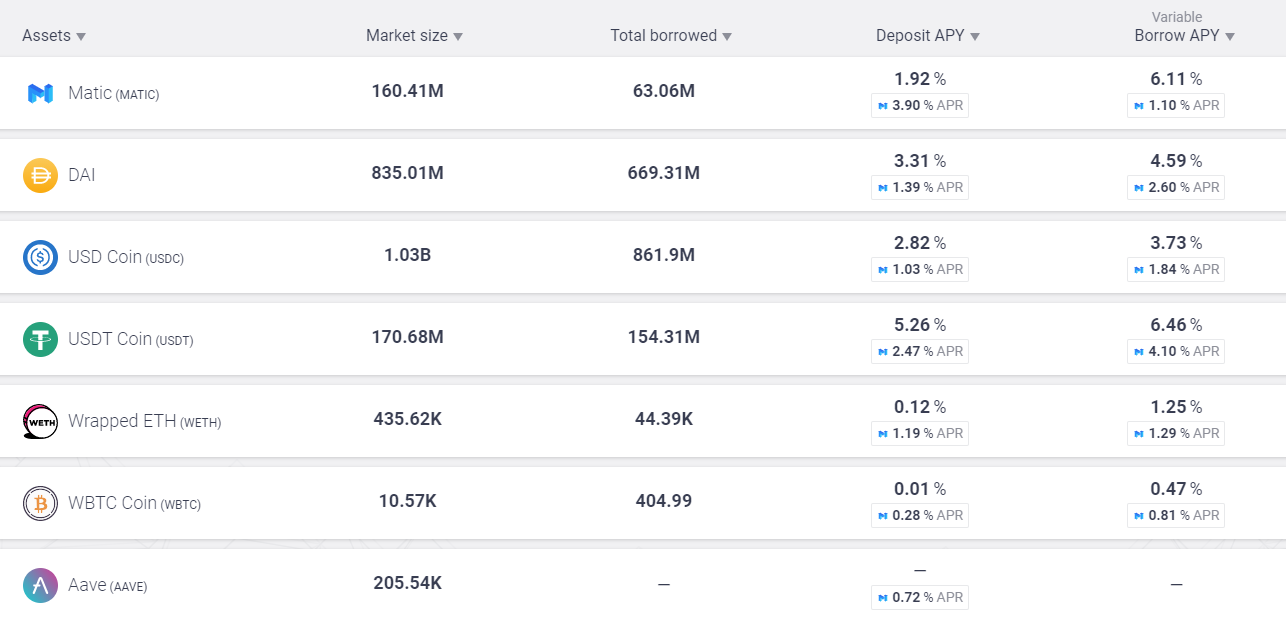

Aave is the highest lending protocol in the mean time and the platform gives yield alternatives for tokens on the Ethereum and Polygon community with its native coin MATIC.

The chart above reveals the highest seven lending swimming pools accessible via the AAVE protocol on Polygon and rewards are paid in Wrapped MATIC (WMATIC), with the present deposit annual share yield (APY) being 1.92% and a yearly estimated APY of 6.1%.

Different high lending protocols embrace Curve (CRV), Compound (COMP), MakerDAO (MKR) and Yearn.finance (YFI).

Lending gives one other low-risk option to earn an honest yield, in each bull and bear markets, on tokens that don’t provide user-controlled rewards like staking.

Earn charges and tokens from offering liquidity

Liquidity provision is without doubt one of the main parts of a DeFi platform, and traders who select to offer funds to rising platforms are sometimes rewarded with excessive share returns on the quantity staked, in addition to a share of the charges generated by transactions throughout the pool.

As seen within the picture above, offering liquidity to an Ether/USDC pool on QuickSwap will entitle an investor with a share of the $23,098 in complete every day distributed rewards and a payment APY of 33.81%.

Ideally, long run traders could be clever to analysis the accessible swimming pools in the marketplace, and if a liquidity pair comprised of strong tasks or perhaps a stablecoin pair akin to USDC/Tether (USDT) seems to be interesting, it has the potential to be the blockchain model of a financial savings account that gives much better yields than can at present be present in any financial institution or legacy monetary establishment.

Maximize returns by yield farming

Yield farming is the idea of placing crypto belongings to work in a approach that generates the very best yield attainable whereas minimizing threat.

As new platforms and protocols emerge, they provide excessive incentives to depositors as a approach of mining for liquidity and growing the overall worth locked (TVL) on the protocol.

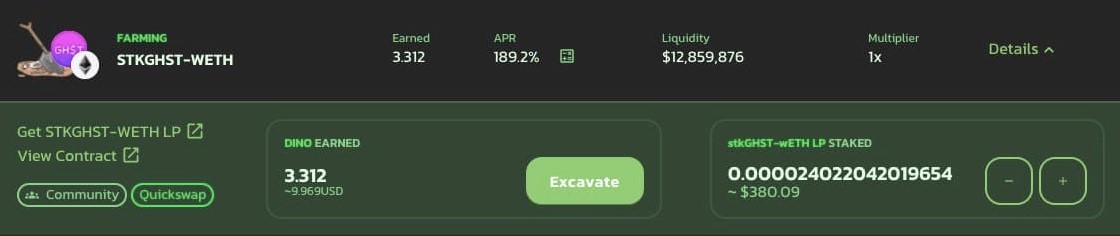

Rewards for STKGHST-WETH LP deposits on DinoSwap. Supply: DinoSwap

The excessive yields provided are usually paid out within the native token of the platform as seen above, the place a consumer has deposited a liquidity pool token for an STKGHS-WETH pair which has an APR of 189.2% and has to date generated a reward of three.312 DINO.

For lengthy traders who maintain a portfolio full of an assortment of tokens, yield farming is a option to achieve publicity to new tasks and procure new tokens with out having to spend new funds

Associated: Right here’s why DinoSwap’s (DINO) TVL rose above $330M per week after launch

NFT and blockchain gaming make ‘play-to-earn’ a actuality

Blockchain gaming and NFT gathering is one other option to produce a return on a crypto portfolio with out spending new funds.

Axie Infinity is the most well-liked instance in the mean time, and the in-game play includes buying and selling, battling, gathering and breeding NFT-based creatures referred to as Axies.

Enjoying Axie Infinity generates rewards within the type of Clean Love Potion (SLP), an in-game token that’s used within the Axie breeding course of and in addition trades on main cryptocurrency exchanges. Customers can swap SLP for dollar-based stablecoins or different large-cap cryptocurrencies.

Based on knowledge from Your Crypto Library, “Right this moment, the common participant earns between 150 to 200 SLP per day,” which, at present market worth, is price between $40 and $53.50.

In some components of the world, that quantities to the revenue offered by a full-time job. For that reason, Axie Infinity has seen a large uptick in consumer exercise and new accounts in international locations like Venezuela and Malaysia.

Crypto investing, lending, staking and play-to-earn blockchain video games present a a lot larger return on funding than conventional banks provide on financial savings and checking accounts. Because the blockchain sector grows, it’s doubtless that traders will proceed to flock to platforms that supply excessive yields for partaking with the protocol.

Need extra details about buying and selling and investing in crypto markets?

The views and opinions expressed listed here are solely these of the creator and don’t essentially replicate the views of Cointelegraph.com. Each funding and buying and selling transfer includes threat, you need to conduct your personal analysis when making a call.

Source link