Buying and selling ought to simply be a easy course of of shopping for low and promoting excessive however for a lot of traders the method is extra akin to rocket science. One of the vital primary and easy-to-understand methods that may assist accomplish that is to determine an asset’s assist and resistance ranges.

As soon as merchants can spot the assist and resistance ranges, they’ll enhance their entry and exit timing available in the market. Help and resistances are additionally useful throughout bullish, bearish and range-bound markets.

Let’s take a second to grasp the fundamentals.

What are helps?

Help is shaped at a degree the place the demand from the patrons absorbs the provision from sellers, stopping the value from declining additional. At this degree, the bullish merchants are inclined to purchase as they consider the value is enticing sufficient and will not decline additional.

Alternatively, the bears cease promoting as a result of they consider the market has fallen sufficient and could also be due for a rebound. When each these conditions happen, a assist is shaped.

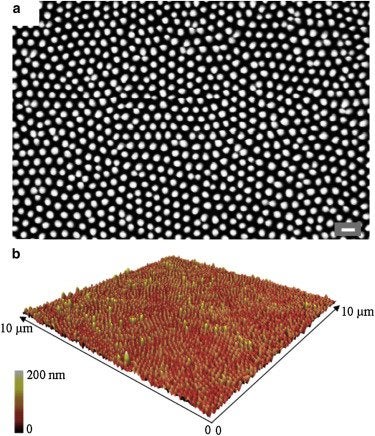

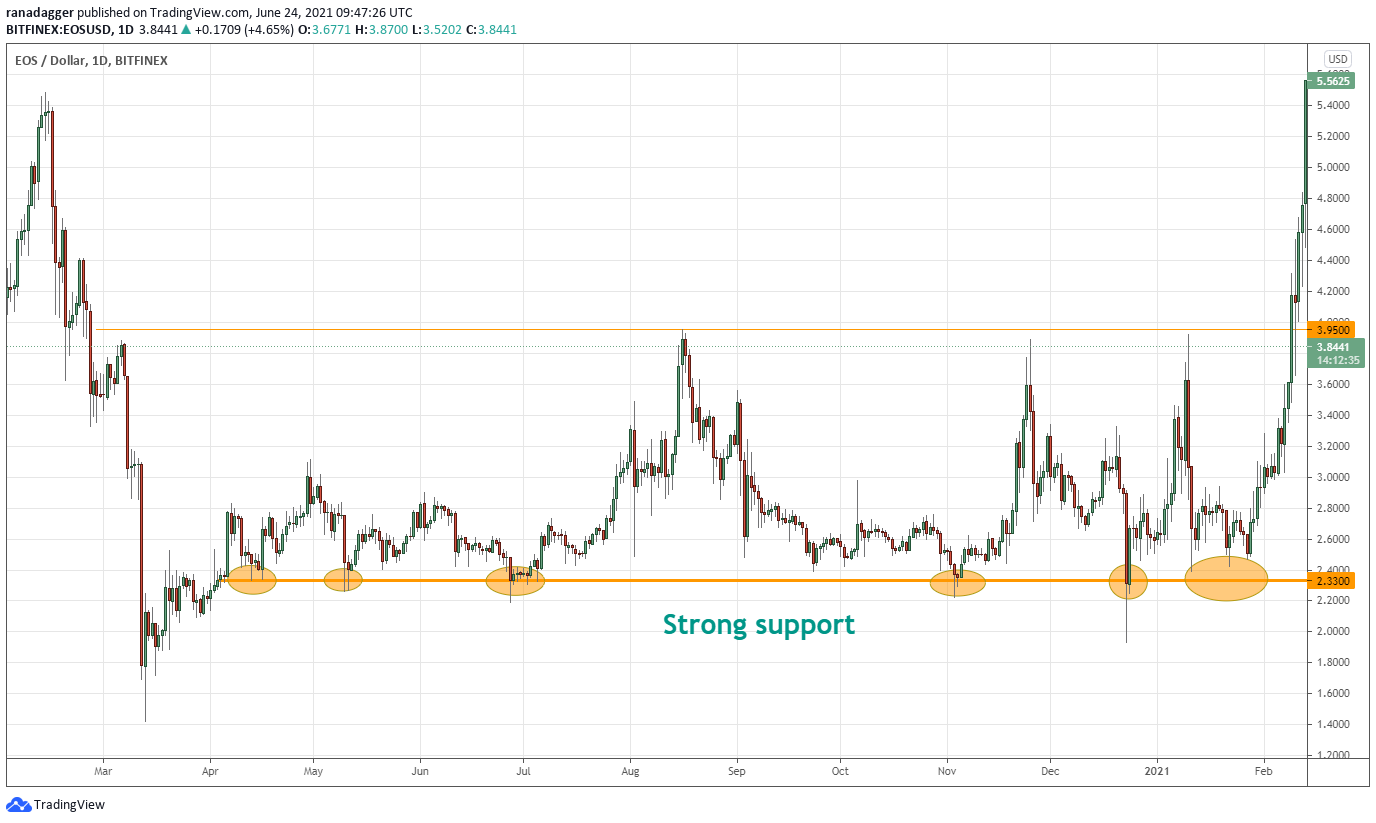

The above chart is an efficient instance of a robust assist. Each time EOS worth drops to the $2.33 degree, patrons emerge and the promoting reduces. This causes demand to exceed provide, leading to a rebound.

Though horizontal helps are thought of to be extra dependable, they don’t seem to be the one method helps are shaped. Throughout uptrends, trendlines act as helps.

Litecoin (LTC) began its bull run in December of 2020. Thereafter, the value rebounded off the trendline on a number of events. This occurred as a result of when the value neared the trendline, the bulls bought, believing that the LTC/USDT pair had reached enticing ranges to purchase.

On the identical time, the counter-trend merchants stopped promoting, assuming that the near-term could also be oversold. Each these occurring on the identical time prompted the correction to finish and the uptrend to renew.

What are resistance ranges?

Resistance will be thought of as the alternative of assist as a result of it’s the degree the place provide exceeds demand, halting the up-move.

The resistance is shaped when patrons who’ve bought at decrease ranges begin to ebook earnings and the aggressive bears begin shorting as they consider the rally is prolonged and prepared for a pullback. When provide exceeds demand, the rally stalls and reverses.

The assist or resistance doesn’t should be a single degree. The above chart exhibits how the realm between $10,500 to $11,000 acted because the resistance zone. Every time the value reached this zone, short-term merchants booked earnings and aggressive bears shorted the BTC/USDT pair. Between August 2019 and July 2020, the pair turned down from the resistance zone on 5 events.

Much like assist, the resistance line or zone doesn’t must all the time be horizontal.

In the course of the decline from Could 6, 2018, to July 4, 2018, Ether (ETH) rallied to the resistance line, additionally known as the downtrend line, however turned down from there. It is because merchants who had a bearish outlook used the rallies to provoke recent brief positions as they anticipated decrease ranges.

On the identical time, aggressive bulls who bought on sharp dips closed their positions close to the resistance line. Therefore, the road acted as a wall and the value turned down from it.

Figuring out assist and resistance throughout consolidation phases

When the assist and resistance are clearly outlined as within the EOS/USD pair above, merchants can purchase on a rebound off the assist and look ahead to the value to rally close to the resistance to shut the place. The stop-loss for the commerce will be saved slightly below the assist of the vary.

A number of instances, skilled merchants could attempt to hunt these stops by pulling the value beneath the assist of the vary. Subsequently, merchants could purchase on the best way up and likewise look ahead to the value to shut decisively beneath the assist earlier than dumping their positions.

Buying and selling helps in an uptrend

When an asset takes assist on an uptrend line thrice, merchants could count on the road to carry. Therefore, lengthy positions will be taken on a bounce off the uptrend line. The stops for the commerce will be saved slightly below the trendline.

Nonetheless, in an uptrend, the break beneath the trendline doesn’t essentially imply that the pattern has reversed. Many instances, the pattern simply takes a break earlier than resuming once more.

As seen within the chart above, the ETH/USDT pair took assist on the uptrend line on a number of events. Nonetheless, when the pair broke beneath the uptrend line, it didn’t begin a brand new downtrend. The worth consolidated in a spread for a couple of days earlier than resuming the up-move.

Merchants could shut their lengthy positions if the value dips and sustains beneath the uptrend line however new brief positions ought to be averted. If the value resumes its uptrend after consolidation, merchants could once more search for shopping for alternatives.

Resistance flips to assist

When the value breaks out of a resistance, the bulls attempt to flip the earlier resistance into assist. If that occurs, a brand new uptrend begins or resumes. If this occurs a number of instances, it could supply a superb shopping for alternative.

Bitcoin was caught between the $10,500 to $11,000 zone from August 2019 to July 2020. After the breakout from the resistance zone, the value once more dropped beneath $10,500, however the bulls purchased the dip aggressively, flipping the extent into assist. This supplied a superb shopping for alternative to merchants as the brand new uptrend was simply getting began.

Help flips to resistance

Polkadot’s (DOT) chart above exhibits how the zone between $28.90 to $26.50 was performing as a assist zone from Feb. 14 to Could 18 of this yr. Nonetheless, as soon as the bears pulled the value beneath the assist zone, the zone flipped over into resistance and has not allowed the value to interrupt above it since then. That is an occasion the place a assist zone become a resistance.

Key takeaways

Whereas analyzing any coin, merchants should search for assist and resistance ranges as they’ll act pretty much as good entry and exit alternatives.

In an uptrend, merchants ought to look to purchase at assist ranges and in a downtrend, merchants ought to look to brief on the resistance line.

Help and resistance ranges are usually not set in stone {and professional} merchants will attempt to hunt for cease orders. Therefore, merchants ought to maintain the stops such that they don’t get run down by the market makers.

The views and opinions expressed listed here are solely these of the writer and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer includes threat, you must conduct your individual analysis when making a call.

Source link