In an interview with CNBC on June 14, legendary investor Paul Tudor Jones sounded the alarm over advancing inflation. After final week’s shopper value index (CPI) report confirmed that United States inflation had hit a 13-year excessive, the founding father of Tudor Funding advocated for a 5% Bitcoin (BTC) portfolio allocation.

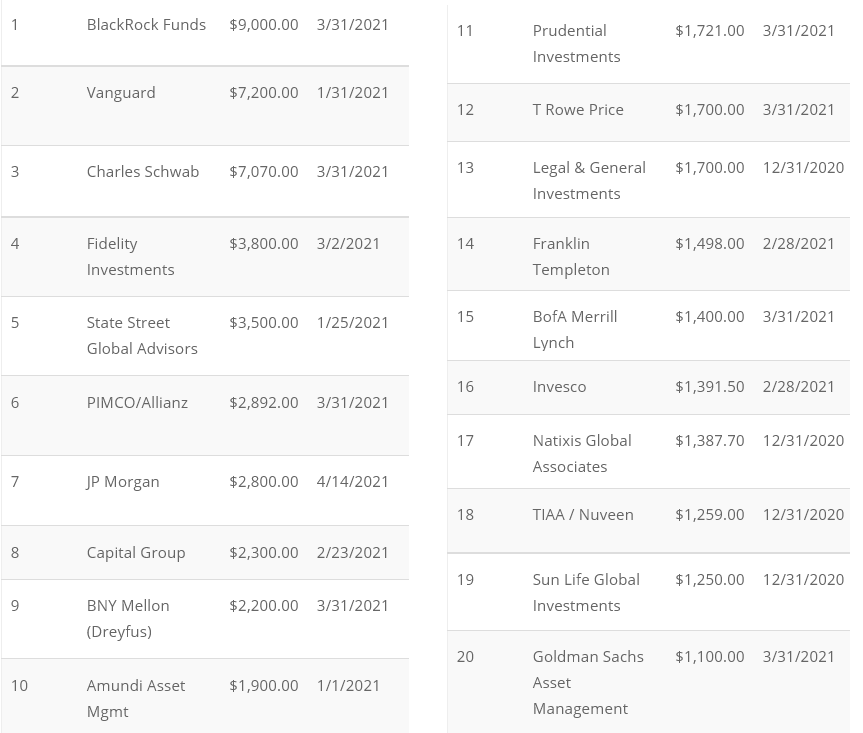

When mixed, the world’s 50 largest asset managers oversee $78.9 trillion in funds. A mere 1% funding in cryptocurrencies would quantity to $789 billion, which greater than Bitcoin’s total $723 billion market capitalization.

Nevertheless, there is a basic misunderstanding on how this business works, and that is what impedes a 1% allocation, not to mention a 5% one.

Let’s examine just a few main hurdles that the standard monetary sector should vault earlier than actually turning into Bitcoin apes.

Hurdle 1: Perceived threat

Investing in Bitcoin stays a major hurdle for giant mutual fund managers, particularly contemplating their perceived threat. On June 11, The U.S. Securities and Change Fee (SEC) warned buyers concerning the dangers of Bitcoin futures buying and selling — citing market volatility, a scarcity of regulation and fraud.

Though a number of shares and commodities have comparable and even larger 90-day volatility, by some means, the company’s focus stays on Bitcoin.

DoorDash (DASH), a $49 billion U.S. listed firm, holds a 96% volatility, versus Bitcoin’s 90%. In the meantime, Palantir Applied sciences (PLTR), a $44 billion U.S. tech inventory, has an 87% volatility.

Hurdle 2: Oblique publicity is sort of unimaginable for US-based firms

A lot of the mutual fund business, primarily the multi-billion greenback asset managers, can not purchase bodily Bitcoin. There may be nothing particular about this asset class, however most pension funds and 401k autos don’t enable direct investments in bodily gold, artwork, or farmland.

Nevertheless, it’s doable to bypass these limitations utilizing exchange-traded funds (ETFs), exchange-traded notes (ETN), and tradeable funding trusts. Cointelegraph beforehand defined the variations and dangers assigned to ETFs and trusts, however that solely scratches the floor as every fund has its personal laws and limits.

Hurdle 3: Fund regulation and directors could stop BTC purchases

Whereas the fund supervisor has full management over the funding choices, they need to comply with every particular car regulation and observe the chance controls imposed by the fund’s administrator. Including new devices similar to CME Bitcoin futures, for instance, may require SEC approval. Renaissance Capital’s Medallion funds confronted this challenge in April 2020.

These choosing CME Bitcoin futures, similar to Tudor Funding, must always roll over the place forward of month-to-month expiries. This challenge represents each liquidity threat and error monitoring from the underlying instrument. Futures weren’t designed for long-term carry, and their costs vastly differ from common spot exchanges.

Hurdle 4: The standard banking business stays a battle of curiosity

Banks are a related participant on this area as JPMorgan, Merrill Lynch, BNP Paribas, UBS, Goldman Sachs, and Citi determine among the many world’s largest mutual funds managers.

The connection with the remaining asset managers is tight as a result of banks are related buyers and distributors of those unbiased mutual funds. This entanglement goes even additional as a result of the identical monetary conglomerates dominate equities and debt choices, which means they in the end resolve on a mutual funds’ allocation in such offers.

Whereas Bitcoin is but to pose a direct risk to those business mammoths, the lack of awareness and threat aversion, together with the regulation uncertainties, trigger many of the world $100 trillion skilled fund managers to keep away from the stress of venturing into a brand new asset class.

The views and opinions expressed listed below are solely these of the author and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer includes threat. You must conduct your personal analysis when making a choice.

Source link