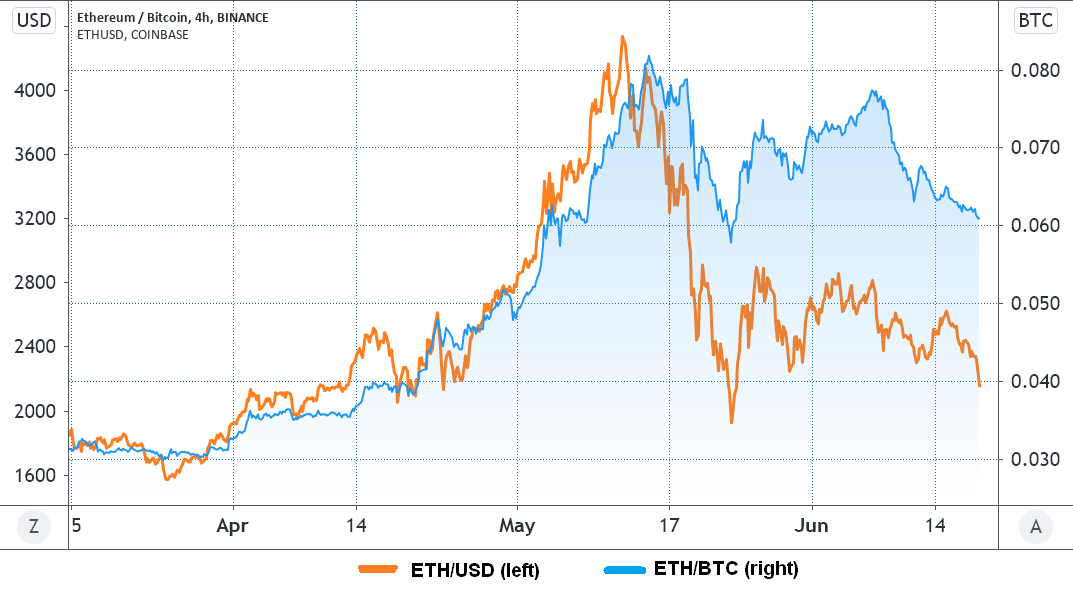

Ether (ETH) value outperformed Bitcoin (BTC) by 173% from March 28 to Might 15. The unbelievable bull induced the token to succeed in a $4,380 all-time excessive. Nonetheless, as cryptocurrency markets initiated a pointy drop on Might 12, the pattern began to reverse, and since then, Ether has underperformed by 25%.

Some may say it’s a technical adjustment after a robust rally. Whereas this partially explains the transfer, it excludes some crucial elements, together with the quick advance of smart-contract community rivals and Bitcoin being adopted as an official forex for the primary time.

Discover how the ETH/BTC ratio rallied once more on June 8, reaching 0.77 regardless of Ether’s value remaining 36% beneath its all-time excessive and ranging close to $2,800. To grasp what may have been driving the ratio, analysts want to investigate Ether and Bitcoin value drivers individually.

Mike Novogratz could have been misinterpreted in his interview

Ether’s bull run doubtlessly acquired an additional leg as a result of intense reward from institutional traders. Merchants may have picked up a way of urgency, often known as FOMO, and promptly shifted their Bitcoin publicity in direction of the main altcoin.

On Might 13, New Yorker journal printed an interview with Mike Novogratz, the founder, and CEO of Galaxy Digital. Within the dialog, Novogratz mentioned:

“Rapidly, you’ve got decentralized finance and NFTs each on Ethereum on the identical time roughly, with wild accelerating development.”

Novogratz was then questioned on how a lot greater Ether may attain, to which he answered:

“You understand, it is harmful to provide predictions on the highs. However may it get to $5,000? In fact it may.”

Whereas an Ethereum holder might need interpreted it as a prediction, others may have understood it as a wild guess, seemingly relying on normal crypto market circumstances.

Nonetheless, roughly per week later, a report from Goldman Sachs revealed the worldwide funding financial institution believed that Ether had a “excessive probability of overtaking Bitcoin as a dominant retailer of worth.” Curiously, one of many important quotes within the report was instantly from Novogratz’s interview with the New Yorker.

At its peak, Binance Chain managed 40% of DEX quantity

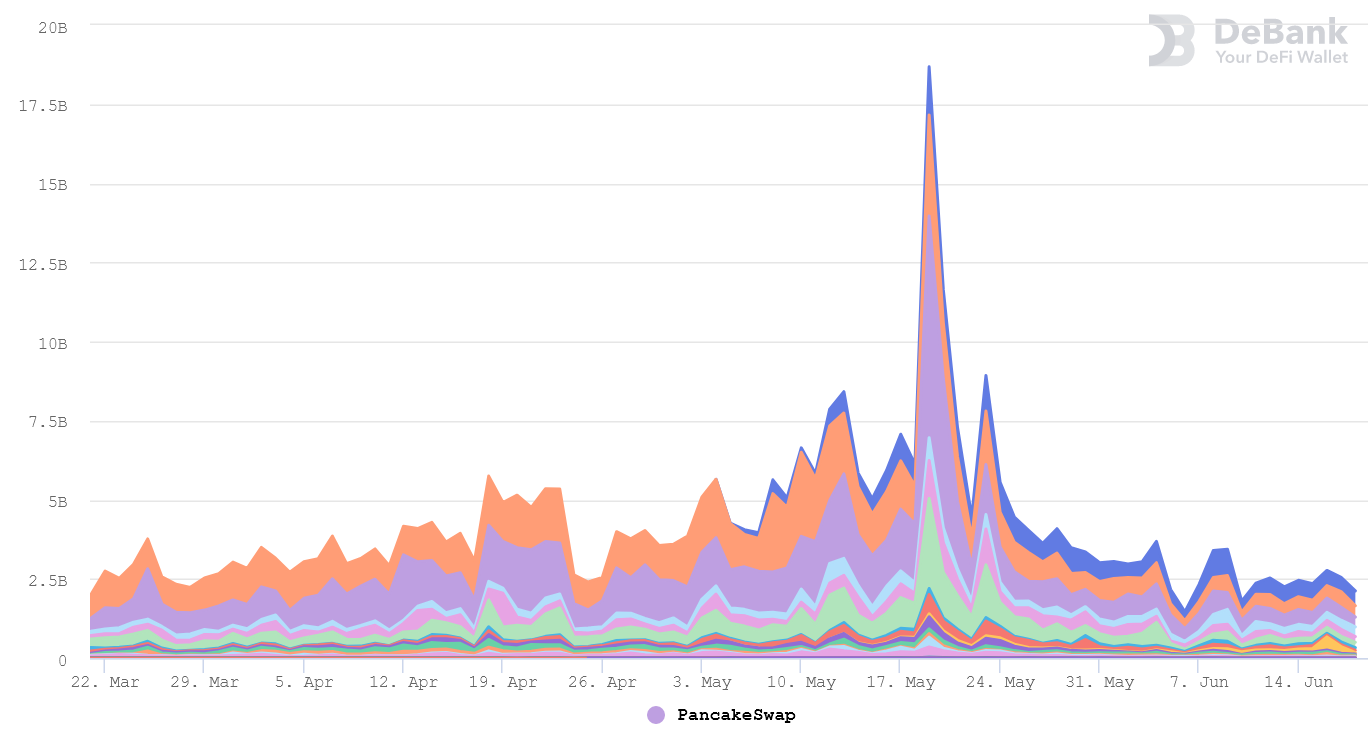

Whereas Ethereum has saved its 80% dominance on internet worth locked in decentralized finance (DeFi) purposes, Binance Sensible Chain (BSC) has reached a 40% market share on DEX exchanges.

The profitable development of the DeFi business and non fungible token (NFT) markets induced intense congestion on the Ethereum community, elevating median charges to $37 in mid-Might. That bottleneck triggered an exercise exodus to competing networks, and PancakeSwap was finest positioned to seize that circulation.

Associated: This is why one analyst says Bitcoin will outperform Ethereum within the brief time period

To make issues worse, vital DeFi tasks expanded to Binance Sensible Chain, together with yield aggregator Harvest Finance and decentralized trade aggregator 1inch. Traders rapidly realized that the pattern may proceed because the competing smart-contract community offered a simple resolution for dApps on the lookout for cheaper alternate options.

No nation is adopting the ‘Ethereum commonplace’

Bitcoin might need had a subpar efficiency over the previous 30 days as a result of it has failed to interrupt the $42,000 resistance a number of instances. Nonetheless, a serious milestone was achieved when El Salvador turned the primary nation to make Bitcoin authorized tender on June 12.

After the Central American nation made the choice regulation, a handful of different Central and South American international locations started discussing some great benefits of taking the same path.

Ethereum is enterprise a redesign that may change the issuing charge and the way entities receives a commission to safe the community by shifting away from the Proof of Work mannequin. In the meantime, Bitcoin is ensuring that each improve is backward-compatible and sustaining its strict financial coverage.

That’s the important purpose why Ether is not going to outperform Bitcoin over the following 12 months, or at the least till there’s a greater understanding of how Ethereum community dominance of good contracts can be.

Skilled traders keep away from uncertainties in any respect prices, and cryptocurrency markets already current loads of that. There’s simply no purpose for institutional traders to disregard the dangers whereas competing networks eat Ethereum’s lunch.

The views and opinions expressed listed here are solely these of the author and don’t essentially mirror the views of Cointelegraph. Each funding and buying and selling transfer includes danger. You must conduct your personal analysis when making a call.

Source link