After a 13% rise in two days, Bitcoin’s (BTC) market capitalization surpassed $800 billion to achieve its highest worth in 79 days. Throughout the identical timeframe, Ether (ETH) collected a forty five% acquire in two weeks, putting the community’s market capitalization at $340 billion.

Constructive expectations for the London arduous fork and its potential deflationary impact undoubtedly performed a task, however some buyers proceed to query how Ether’s valuation stacks towards Bitcoin. Some, together with Pantera Capital CEO Dan Morehead, count on Ether to outpace Bitcoin as the most important cryptocurrency.

Market members might have additionally been excited after Minneapolis Federal Reserve President Neel Kashkari steered that the Fed might stick to the asset-purchase program a bit longer. The rationale cited was the Delta variant’s unfold and its potential hurt to the labor market.

Kashkari mentioned:

“Delta may discourage individuals from returning to jobs that require in-person interplay and preserve children out of faculties.”

Extending the stimulus for longer raises the inflationary danger, which will increase the attractiveness of scarce property like actual property, commodities, shares, and cryptocurrencies. Nonetheless, the affect of those macroeconomic modifications ought to equally affect Bitcoin and Ether.

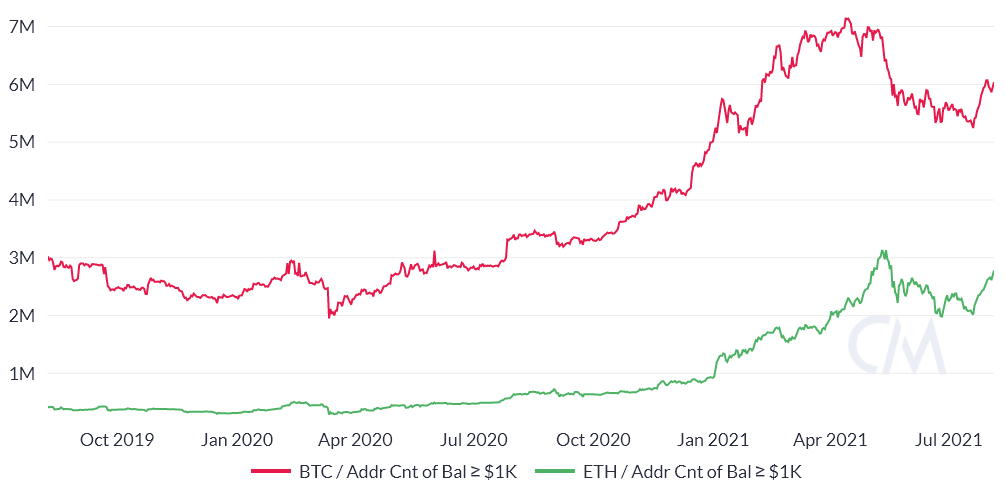

Lively addresses give Bitcoin a transparent lead

Evaluating a few of Ethereum’s metrics may shed some gentle on whether or not Ether’s 58% low cost is justified. Step one ought to be to measure the variety of energetic addresses, excluding low quantities.

As proven above, Bitcoin has 6 million addresses price $1,000 or increased, and three.67 million have been created since 2020. In the meantime, Ether has lower than half at 2.7 million addresses with $1,000. The altcoin’s development has additionally been slower, with 2.4 million of these created since 2020.

This metric is 55% decrease for Ether, and this corroborates the market capitalization hole. Nonetheless, this evaluation doesn’t embrace how a lot massive shoppers have invested. Though there isn’t any good approach to estimate this quantity, measuring cryptocurrency exchange-traded merchandise may very well be a great proxy.

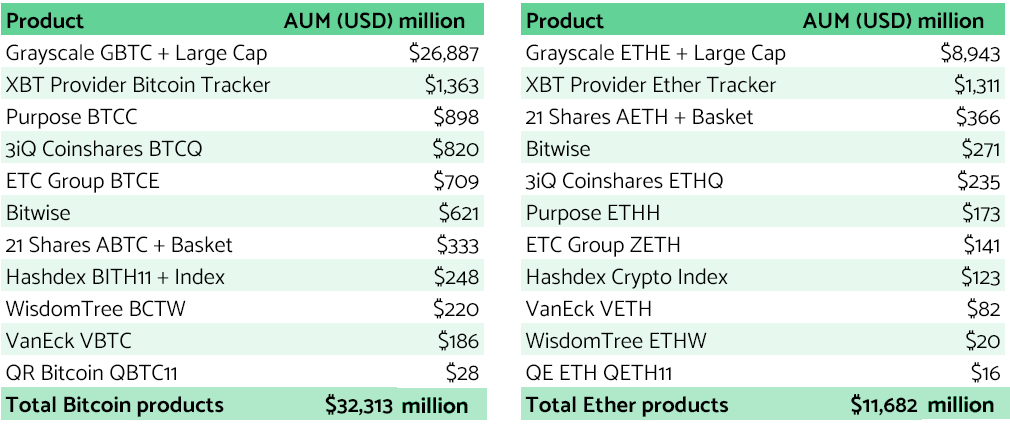

Ether lags on exchange-traded merchandise

After aggregating information from a number of exchange-traded devices, the result’s telling. Bitcoin dominates with $32.3 billion in property below administration, whereas Ether totals $11.7 billion. Grayscale GBTC performs a significant position on this discrepancy as a result of its product was launched in September 2013.

In the meantime, Ether’s first exchange-traded product got here in October 2017, when the XBT Supplier Ether Tracker was launched. This distinction partially explains why Ether’s complete is 64% decrease than Bitcoin’s.

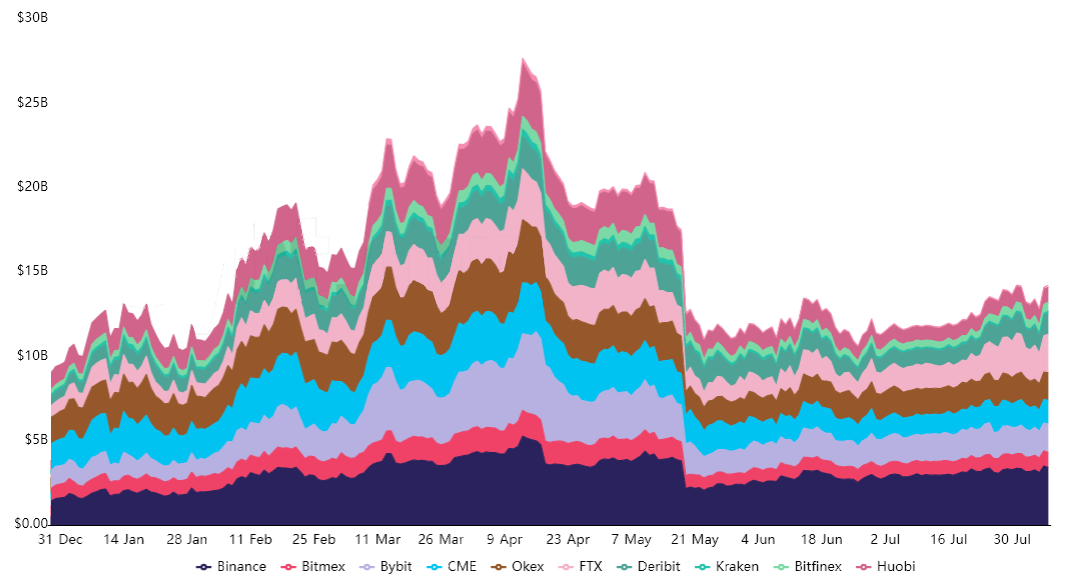

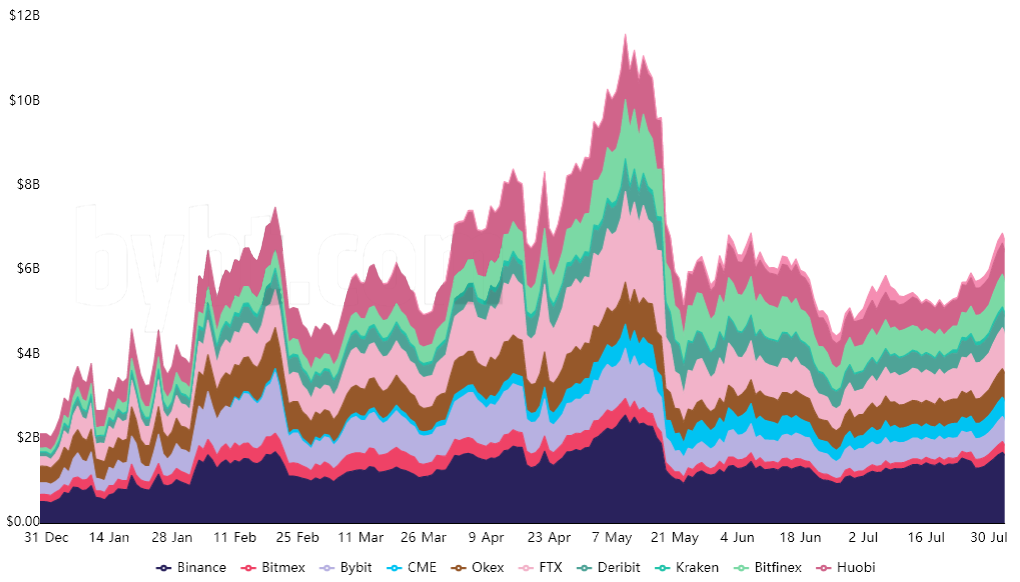

Futures open curiosity justifies the worth hole

Lastly, one ought to evaluate the futures markets information. Open curiosity is the perfect metric {of professional} buyers’ precise positions as a result of it measures market members’ complete variety of contracts.

An investor may have purchased $50 million price of futures and offered your entire place a few days later. This $100 million in traded quantity doesn’t presently characterize any market publicity; due to this fact, it ought to be disregarded.

Bitcoin futures open curiosity presently quantities to $14.2 billion, down from a $27.7 billion peak on April 13. Binance change leads with $3.4 billion, adopted by FTX with one other $2.3 billion.

However, the open curiosity on Ether futures peaked a couple of month later at $10.8 billion, and the indicator presently stands at $7.6 billion. Due to this fact, it’s 46% decrease than Bitcoin’s, which additional explains the valuation low cost.

Associated: Ethereum market cap hits $337 billion, surpassing Nestle, P&G, and Roche

Different metrics like on-chain information and miner revenues present a extra balanced scenario, however each cryptocurrencies have completely different use instances. For instance, 54% of the Bitcoin provide has remained untouched for longer than one yr.

The reality is that any indicator has a draw back, and there’s no definitive valuation metric to find out whether or not a cryptocurrency is above or under its honest worth. Nonetheless, the three metrics analyzed counsel that Ether’s upside, when priced in Bitcoin, doesn’t sign a “flippening” anytime quickly.

The views and opinions expressed listed here are solely these of the author and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer includes danger. You must conduct your personal analysis when making a choice.

Source link